I Want My MTV...and My CNN... The Cable TV Industry and Regulation

As if editing a movie once again because the last cut was not just right, the U.S. Congress is considering deregulating the cable television industry after re-regulating it just three years ago. This follows the initial deregulation of the cable TV industry 10 years ago. Much of the regulatory volatility since 1984 arose because of great leaps in technology and changing opinions about what other industries or forms of entertainment compete with cable TV. Regardless of the reasons, however, the on-and-off nature of regulation in this industry makes it a case study of the economics of regulation, with particular attention to the concepts of barriers to entry, rate regulation and natural monopoly, all of which play an important role in this industry.

A Cable Retrospective

Cable television began in the 1940s as a way to bring broadcast television signals to remote areas with poor reception. By the 1960s, cable operators started importing signals from stations in distant cities in the hope of attracting customers with greater variety. Perceiving these imported signals as a threat to their market shares, local broadcast stations petitioned the Federal Communications Commission (FCC) to intervene on their behalf. The FCC, favoring the local broadcast signals, restricted the cable operators' ability to import distant signals. At the same time, it instituted its "must-carry" rules (see glossary for definitions of cable terms).

The FCC's control over cable systems greatly increased in 1972 when it adopted a new set of comprehensive rules specifying minimum technical standards and franchise requirements. At the same time, the FCC pre-empted state and local regulation of pay cable services, established ceilings for franchise fees and relaxed the restrictions on importing distant signals, as long as they were taken from the closest Top-25 market. By the late 1970s, a series of adverse court rulings and the commission's more pro-competitive stance led to the removal of many of these restrictions.

The FCC was not the only agency with which these cable companies had to deal, however. A myriad of state and local regulations covering basic cable services created a complex working environment for any company operating in multiple communities across the country. This environment made cable TV deregulation a natural and extremely important part of a larger telecommunications deregulation package in the 1980s.1 This move to allow the market to allocate resources in this sector of the economy culminated with the Cable Franchise and Communications Policy Act of 1984 (Cable Act of 1984), which effectively deregulated cable TV.

Regulation Off...and On Again

The Cable Act of 1984 had three main provisions: It 1) removed the rate restrictions for basic cable TV service in communities where operators faced "effective competition" from other media; 2) restricted the ability of local franchise authorities to deny renewals to firms when their contracts expired; and 3) permitted local franchise authorities to require that some channel capacity be devoted to public, educational and governmental use. The FCC defined "effective competition" as the availability of three or more, unduplicated, over-the-air television channels—for example, ABC, CBS and NBC—in the cable system's market area. Based on this definition, about 97 percent of all cable systems were free from rate regulation by Dec. 29, 1986, the effective date of deregulation.

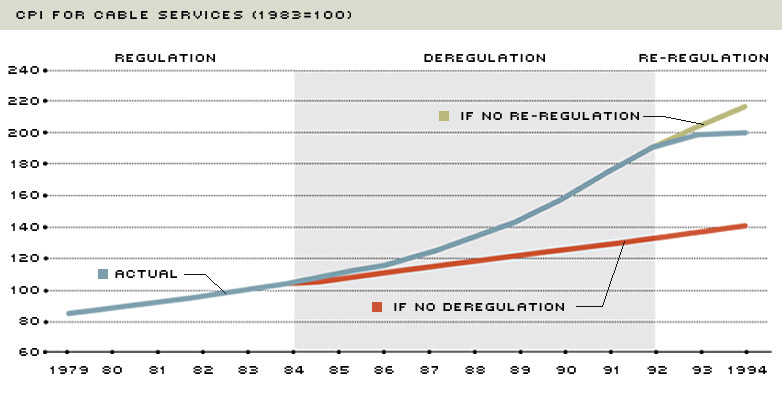

Cable Prices and Regulation

NOTE: As the chart above illustrates, cable prices increased dramatically during the period of deregulation, then moderated somewhat under re-regulation. The moderation

was not as striking as anticipated, though.

SOURCE: Bureau of Labor Statistics and Federal Communications Commission

Market Forces Take Over

After deregulation, many changes occurred in the cable industry, not the least of which were price hikes. As then-Sen. Albert Gore Jr. put it: "Precipitous rate hikes of 100 percent or more in one year have not been unusual since cable was given total freedom to charge whatever the market will bear.... Since cable was deregulated, we have also witnessed an extraordinary concentration of control and integration by cable operators and program services, manifesting itself in blatantly anticompetitive behavior toward those who would compete with existing cable operators for the right to distribute services" (Congressional Record, May 18, 1989). Gore's sentiments were later supported by findings in both government and academic studies.

According to a 1990 General Accounting Office (GAO) report, the average rate for the lowest tier of basic service increased 43 percent—from $11.14 to $15.95 per month—between Nov. 30, 1986, and Dec. 31,1989. For this higher rate, the subscriber received an average of seven additional channels (from 24 to 31). During the same period, the average rate for the most popular level of service increased 39 percent—from $11.71 to $16.33 per month. This subscriber also received an average of seven additional channels (from 27 to 34). In comparison, the Consumer Price Index rose about 14 percent between December 1986 and April 1991.

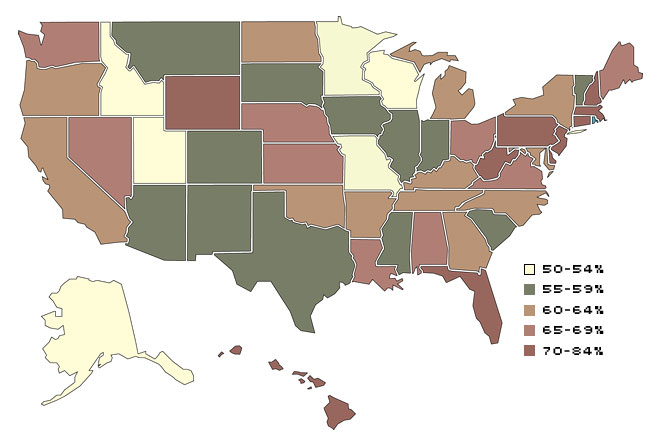

As cable prices increased rapidly, cable TV, during these first three years of deregulation, became available to 14 percent more homes than previously. Just a small number of the newly accessible homes chose to subscribe, however, and cable penetration rates increased by only 2 percentage points to 58 percent. (See the accompanying map for current cable penetration rates by state.)

In a follow-up report in 1991, the GAO reported that the average rate for the lowest tier of basic service increased another 9 percent—to $17.34 per month—between Dec. 1, 1989, and April 1, 1991. With this higher rate, the subscriber actually lost one channel previously received, making the average number of channels received 30. During the same period, the average rate for the most popular level of service increased another 15 percent—to $18.84 per month. This rate gave the subscriber one additional channel, making the average number of channels received 35. In comparison, the Consumer Price Index rose about 7 percent between December 1989 and April 1991.

The GAO also noted that, during this year and a half, the number of cable companies offering more than one tier of basic service increased sharply—from 17 percent to 41 percent. Typically, cable companies began offering a basic package—just the major networks and one or two distant channels—and an "expanded" tier that included the rest of the commonly viewed cable channels, like CNN or ESPN. This change was a reaction to proposed legislation in the early 1990s that would have re-regulated only the lowest-priced tier of basic service. In fact, the final legislation that was passed and signed in 1992 did just that.

In response to the rate hikes experienced after deregulation, the FCC in June 1991 actually beat Congress to the punch and redefined "effective competition" to try to increase the number of cable systems that would be subject to rate regulation. It did so very simply by increasing the required number of unduplicated, over-the-air broadcast signals in the system's area from three to six. It also decreed that effective competition would exist if another multichannel service—a cable system or home satellite dish, for example—available to at least 50 percent of the homes accessible to cable TV, had at least 10 percent of these homes subscribing. This redefinition, though, would only affect about 41 percent of the cable systems, which serve about 20 percent of the nation's subscribers, according to the GAO's 1991 report.

Is Re-Regulation the Answer?

Sometimes lost among the bits of information about price hikes and channel availability is the fact that people willingly chose to pay higher prices for cable TV. One of the original arguments supporting deregulation was that enough substitutes existed to foster competition in the market without any government intervention. To try to quantify the effects of these options on the industry, researchers looked at demand patterns and elasticities—measures of how the demand for a productor service responds to changes in prices—for cable TV and its substitutes and complements.

Mayo and Otsuka undertook such a study to compare consumer demand for cable TV both before and after deregulation. One of their findings was that at the prevailing price levels in the early 1980s (before deregulation), the demand for basic cable service was generally in elastic—not very responsive to price changes—while the demand for pay services was generally elastic—quite responsive to price changes. This suggests that prices for basic cable service could increase without much loss in demand, while similar price increases for pay services would lead to sharp declines in demand. This conclusion is further supported by Rubinovitz, who found that there was no change in the demand elasticity for either basic or pay cable services between regulation and deregulation. This means that even though the environment in which cable systems operate had changed, the fundamental demand structure of the market had not.

Cable Penetration Rates | September 1994

Eighth District Penetration Rates

| Designated Market Area | Rate |

|---|---|

| Bowling Green, KY | 53 |

| Columbia-Jefferson City, MO | 56 |

| Evansville, IN | 58 |

| Fort Smith, AR | 62 |

| Jackson,TN | 59 |

| Jonesboro, AR | 67 |

| Little Rock-Pine Bluff, AR | 58 |

| Louisville, KY | 60 |

| Memphis, TN | 58 |

| Paducah, KY/Cape Girardeau, MO/Harrisburg-Mt. Vernon, IL | 55 |

| Quincy, IL/Hannibal, MO/Keokuk, IA | 56 |

| Springfield, MO | 47 |

| St. Louis, MO | 50 |

SOURCE: A.C. Nielsen Company

Mayo and Otsuka also found that the demand for basic service in rural areas was generally inelastic, while the demand in urban areas was generally elastic. This makes intuitive sense: Consumers are better able to receive over-the-air broadcast signals in urban areas than in rural areas, which, in turn, suggests that the demand for cable services in urban areas should be more sensitive to price changes. Finally, the authors showed that the regulation of basic cable rates in the early 1980s led to prices that were above marginal cost, but below the levels that would have prevailed had the regulation been either absent or completely nonbinding. This last finding is evidence of a natural monopoly (see below).

Carroll and Lamdin also found that the cable industry is a natural monopoly and argued that this finding is consistent with statements from cable industry executives, who generally lobby against rate regulation. The authors inferred from these statements that the executives either believe that their industry faces effective competition, so that no rate regulation is needed, or know that their industry has monopoly power, so that no regulation is desired. To further support the natural monopoly conclusion, Carroll and Lamdin also discovered that the prices of cable company stock declined in response to announcements of lower entry barriers, which further suggests elements of natural monopoly and supports the notion that regulation would promote efficiency in the industry.

Deregulation in the Offing, Again?

Just three years since cable television's re-regulation in 1992, debate to deregulate has already begun, fueled by great advances in technology and the desire of the seven regional telephone companies (or Baby Bells) to enter the market. The proposed Telecommunications Competition and Deregulation Act of 1995 (Senate bill) and Communication Act of 1995 (House bill) would not only remove the current rate regulation, but also allow other industries to offer consumers the type of video services currently available only from cable companies. The Baby Bells have already sought court approval for entrance into the cable market, buoyed by the merging of voice and video into a single system, which is close to becoming a technological reality. The National Cable Television Association, pointing to the arrival of new TV signals via satellite dish, telephone line and wireless technology, supports deregulation because, "Consumers have a choice for TV that didn't exist before."2

These bills would remove barriers to entry in the cable industry, allow cable operators to provide telecommunications services, and allow cross-ownership between providers of common carrier video programming (like telephone companies) and cable companies. The Baby Bells acknowledge, however, that even if they were allowed to enter the cable market today, they are still two to three years away from offering widespread video services. Thus, the most threatening competition to the cable industry will probably not appear for at least 24 months.

Effective deregulation could occur before passage of this legislation, though, if the FCC chooses to redefine "effective competition" again. Such a move would potentially reduce the number of cable systems that are subject to rate regulation. Currently, effective competition exists if less than 30 percent of the households in the system's area subscribe, or if another multichannel service, available to at least 50 percent of the cable-ready homes, has at least 15 percent subscribing.3 Whether the legislation passes or not, the FCC will still have a role in determining if a cable system's rate for service is reasonable. Essentially, if a rate "substantially exceeds" the national average for comparable cable service, the FCC can intervene.

More for Less, That's What We All Want

With or without regulation, the cable industry will be very different five or 10 years from now. The Baby Bells will probably be allowed to enter the cable market and will probably offer video services that even cable companies will not because of the interactive and switching technologies currently available in the telecommunications industry. Until this type of competition arrives, though, the question of whether cable television should remain a regulated industry is difficult to answer.

Recent studies have shown that elements of natural monopoly do exist in the industry, supporting the notion that regulation might still be justified. Cable companies, on the other hand, point out that during deregulation the industry experienced great advances in technology and offerings. Were these advances worth the cost to achieve them? In other words, were the higher rates paid during deregulation worth the outcome? Many would say yes. And many actually did say yes by continuing their cable subscriptions. Opponents of deregulation argue that even though regulation is not ideal, true competition does not yet exist; thus, why give the industry the best of both worlds: no competition and no rate restrictions? Subscribers paid the higher rates, they argue, because there were no viable alternatives.

Which is the best outcome for the market? There is no simple answer. But it looks as if we may have to wait and see if other industries, like telephone companies, enter the cable market with comparable video services. If they do, we will probably see great improvements in service and offerings without the gouging price hikes many fear.

Endnotes

- Recall that in the early 1980s, AT&T was still the only company in the country offering local and long-distance telephone service. Deregulation was also occurring in many other industries—for example, trucking, airlines and banking—during this period. [back to text]

- See Robichaux (1995). [back to text]

- This latest revision of the definition occurred in April 1994. [back to text]

- To understand this idea, think of a student's report card. The grade point average is analogous to average cost, while the grade in any particular class is analogous to marginal cost. If the student has a "B" grade point average, and then receives a "C" in a class, the grade point average will fall. In other words, whether the marginal grade is greater or less than the average determines how the average will move. The same is true for marginal and average costs. [back to text]

- See, for example, Carroll and Lamdin (1993), Rubinovitz (1993) and Mayo and Otsuka (1991) for findings that cable TV companies acted as monopolists after deregulation. [back to text]

References

Carroll, Kathleen A., and Douglas J. Lamdin. "Measuring Market Response to Regulation of the Cable TV Industry." Journal of Regulatory Economics (1993), pp. 385-99.

Fournier, Gary M., and Ellen S. Campbell. "Shifts in Broadcast Policy and the Value of Television Licenses." Information Economics and Policy (1993), pp. 87-104.

Mayo, John W., and Yasuji Otsuka. "Demand, Pricing, and Regulation: Evidence from the Cable TV Industry." RAND Journal of Economics (Autumn 1991), pp. 396-410.

Prager, Robin A. "The Effects of Deregulating Cable Television: Evidence from the Financial Markets." Journal of Regulatory Economics (1992), pp. 347-63.

Robichaux, Mark. "Cable Industry Says New Rivals Obviate Rules." Wall Street Journal (April 3, 1995).

Rubinovitz, Robert N. "Market Power and Price Increases for Basic Cable Service Since Deregulation." RAND Journal of Economics (Spring 1993), pp. 1-18.

U.S. General Accounting Office. Telecommunications. Follow-Up National Survey of Cable Television Rates and Services, GAO/RCED-90-199 (June 1990).

_________. Telecommunications. 1991 Survey of Cable Television Rates and Services, GAO/RCED-91-195 (July 1991).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us