Going Interstate: A New Dawn For U.S. Banking

The day interstate branching proponents have hoped for—and opponents have dreaded—is about to dawn. After years of debate, Congress appears to be ready to pass legislation that paves the way for nationwide interstate branching in the United States beginning in 1997.

This legislation could have far-reaching effects for the banking industry, as well as for U.S. consumers and businesses that depend on banks for their credit and depository needs. The removal of geographic restrictions on how and where a bank can operate is sure to change the structure of the U.S. banking industry—the number of banks, their size and the type of products they offer.

Roadblocks at the Border

The banking industry is one of the most heavily regulated industries in the United States and is arguably the most heavily regulated banking system in the world. Because the United States has a dual banking system—banks can be chartered and supervised by the states or the federal government—many banks are subject to a vast number of state and federal regulations. There are regulations related to safety and soundness, such as minimum capital requirements; consumer protection, such as the Truth in Lending Act; credit availability, such as the Community Reinvestment Act (CRA); and geographic restrictions on bank operations, such as limits on branching. Many regulations are aimed at protecting the federal deposit insurance fund.

Geographic restrictions on banking (establishing bank subsidiaries) and branching (establishing bank branches) have ebbed and flowed since the Civil War. In this century, most changes have occurred at the state rather than the federal level.1 While concerns about dismantling geographic restrictions on banking are many, the two major fears are that economic power will become too concentrated and local economies will be harmed if local banks are not protected from competition.

Throughout most of the 20th century, local banks in the United States have been protected from both interstate and intrastate competition. Since the late 1920s, state legislatures have held most of the cards, in effect determining whether a bank could establish subsidiaries and branches, even if it had a national charter. That's because current federal laws governing expansion powers for state and national banks have a "states' rights" bent to them, generally allowing states to preempt federal laws by passing more or less restrictive legislation.2

Two major pieces of federal legislation currently govern interstate banking and branching: the Bank Holding Company Act of 1956 and the McFadden Act of 1927 (amended 1933). The Bank Holding Company Act, or more specifically the Douglas Amendment to the Act, prohibits a bank holding company (BHC) from acquiring an out-of state bank subsidiary unless the home state of the acquired bank has a statute authorizing such an acquisition.3 Except for a few grandfathered institutions, multistate multibank BHCs, that is BHCs that operate bank subsidiaries in more than one state, were virtually nonexistent until the late 1970s and early 1980s when a number of states, starting with Maine, passed legislation permitting out-of-state acquisitions. Many states opened their borders simply to attract more capital for economic development.

Every state but Hawaii has since adopted some form of interstate banking. Most feature regional or national reciprocity: Out-of-state acquisitions of home state banks are permitted only if home state banks are permitted to acquire banks in the other state. De novo entry—entry through the establishment of a new bank—is generally prohibited; many states permit acquisition only if a bank has already been operating for some fixed period of time, typically three to eight years. In addition, many states place caps on the portion of a state's deposits that can be controlled by an out-of-state organization.

Restrictions on branching have followed a much more convoluted path.4 Most of the activity regarding branching restrictions occurred before the 1920s. The McFadden Act and its subsequent amendments essentially prevented interstate branching, permitting national banks to branch only to the same extent as state banks, thus giving the states ultimate authority. As with interstate banking laws, state laws on branching generally did not change between the McFadden Act and the 1980s. Since then, many states have relaxed branching laws, for much the same reasons they relaxed interstate banking laws. Today, all states allow at least limited branching within the state, and most states permit statewide branching. The vast majority of states (42), however, still do not permit interstate branching. The pending legislation will change all that, allowing interstate branching unless a state expressly passes a law prohibiting out-of-state branches—that is, unless the state opts out (see below).

These laws have had profound effects on the structure of the U.S. banking system. Between 1976 and 1992, the proportion of banks affiliated with holding companies increased from 26 percent to 73 percent. While 42 percent of all banks are now affiliated with one-bank (one-state) BHCs, about 31 percent of all banks are now part of multibank BHCs (MBHCs), many of which cross state borders.

In seven states, out-of-state organizations account for more than 60 percent of banking assets; in other states, out-of-state organizations are virtually nonexistent. Although the number of U.S. banks declined throughout the 1980s, the number of branches increased, as a result of relaxed branching restrictions. Table 1, which gives a snapshot of Eighth District states, is a good illustration of the wide variety of banking and branching laws currently in effect and the corresponding differences in banking structure that result.

Bypassing Barriers: The Benefits for Consumers...

After all this time, why is the gridlock on interstate banking and branching legislation finally breaking up? Because its perceived benefits—to consumers, businesses and the banking industry—now outweigh its perceived costs. In addition, policymakers have recognized that the financial services market is now more competitive than it was 20 years ago, giving consumers and businesses a wider variety of options. Moreover, awareness has grown that banks are at a competitive disadvantage in many markets and product areas because nonbank competitors are not subject to the same regulations and restrictions. In other words, Congress is about to act, if only cautiously, on the banking industry's frequent cry to level the playing field.

Finally, as with most industries that are artificially restrained, the banking industry figured out a way to get around the restrictions: As states passed interstate banking laws, out-of-state organizations entered a state via the holding company route, setting up a bank subsidiary which could then, depending on state law, branch statewide or into adjacent counties or cities. Thus, de facto interstate branching has already occurred, though not, as many have argued, in an efficient way.

Consumers and small businesses are expected to benefit from the new legislation in several ways.5 One set of benefits is generally lumped under the title of "increased convenience." Eliminating barriers to interstate branching will be especially helpful to the 53.4 million Americans who live or operate small businesses in the 37 metropolitan areas that cross state borders.6

We can use the District's largest bank—Boatmen's—to illustrate. Under current legislation, a Boatmen's bank customer who lives in Illinois, across the river from St. Louis, but works on the Missouri side of the metro area cannot go to any branch of Boatmen's to conduct his banking business, even though Boatmen's operates in both states. Boatmen's branches on the Missouri side of St. Louis are affiliated with the Boatmen's National Bank of St. Louis; branches on the Illinois side are affiliated with the Boatmen's National Bank of Belleville. Although both are owned by the same bank holding company, Boatmen's Bancshares, they operate as independent companies. An account holder at the Illinois bank can cash a check at a Boatmen's branch in Missouri, but cannot make a deposit.

Under interstate branching, Boatmen's will be able to consolidate its subsidiaries in Missouri and Illinois and make each branch office a part of the same organization. Memphis (Tennessee-Arkansas-Mississippi), Evansville (Indiana-Kentucky), Ft. Smith (Arkansas-Oklahoma), Louisville (Kentucky-Indiana) and Texarkana (Arkansas-Texas) are the other Eighth District metro areas in the same boat.

Cross-state metropolitan areas are not the only likely beneficiaries. People who move frequently, like military personnel, or travel frequently, whether for business or pleasure, could benefit if their banks are able to operate branches across the country.7 And business owners who operate in several states may find added convenience as well as reduced costs if they could consolidate their banking accounts with one provider.

Another expected benefit for consumers is an increase in the products available in local markets as large banking companies—those most likely to take advantage of the new law—expand across state lines. Large banks usually offer a wider array of products and services than smaller community banks because they have the volume necessary to make certain products, like credit cards, profitable.

Still another expected benefit is the effect increased local competition will have on the prices of bank products and services. New owners in a market may well lower their prices in an attempt to maintain or increase market share. Prices could also decline if banks pass on to consumers the reduction in costs that many analysts expect to come with interstate banking and branching.

...And for Banks

The banking industry will also benefit from this legislation. As we have seen, banking organizations have been able to get around restrictive state branching practices via the holding company route; unfortunately, it can be a very expensive and inefficient detour. Each subsidiary of a holding company must establish a separate board of directors, file separate regulatory reports, provide audited financial statements, and maintain support functions such as personnel, audit and accounting. Each bank within an organization must meet minimum capital requirements as well as subject itself to regulatory exams and, depending on the chartering situation, multiple examining authorities. Duplicate costs like these are not incurred in a branch system. Some analysts estimate the industry could save millions of dollars annually by eliminating the separate subsidiary requirement. Of course, MBHCs could choose to keep their existing structure under the new law because it confers certain benefits to them that may exceed the costs: One such benefit is a local board of directors that is an excellent referral source for lending opportunities.8

A less obvious, but potentially more important, benefit expected to accrue to the banking industry—and to local communities—comes from geographic diversification. By allowing banks to operate in more than one region, the risks associated with a local economic downturn can be reduced. Many of the loan problems suffered by banks in the Southwest in the mid-1980s and in New England in the early 1990s could have been mitigated had these banks had profitable loans in other parts of the country when their regional economies took a nose dive. Local communities could benefit because geographic diversification should make banks financially stronger and better able to withstand loan losses that could deplete capital and curtail lending activities or, in a worst-case scenario, lead to a failure, which would reduce the banking options in a community.

Will the Toll Be Too High?

The greatest fear about interstate banking and branching is the fear of concentration. Some consumer groups and supporters of small community banks believe that a few large banking companies will end up dominating the U.S. banking system. They also argue that these larger, interstate organizations will siphon off deposits from their communities to lend elsewhere, depriving them of economic resources for growth and development.

The evidence does not appear to support these arguments. First, despite the significant declines in interstate banking barriers that occurred in the 1980s through regional compacts and nationwide reciprocal agreements, many measures of industry concentration increased little, if at all. According to the General Accounting Office (GAO), banks with assets of less than $1 billion—those that opponents fear will be harmed most—were able to maintain their national market share during the 1980s, despite the growth of large banking companies.

Concentration ratios (usually defined as the combined market share of the three dominant organizations in a market) did increase in many markets and in many states during the 1980s, but that does not mean these markets are now less competitive.9 Each merger is reviewed by state or federal bank regulators, as well as the Justice Department, for antitrust violations, so even with interstate banking and branching in place, a mechanism still exists to mitigate anti-competitive effects.10 There's also the evidence from states that have long permitted statewide branching, such as California and North Carolina, to suggest that small community banks can continue to thrive in a less restrictive branching environment.

Holes can also be punched in the argument that large, out-of-state organizations will drain resources from local communities. Banks do not need interstate banking and branching legislation to move deposits out of an area; that possibility already exists through correspondent banking relationships and the fed funds market. Banks with funds they cannot invest at a profit locally can lend these funds to out-of-market or out-of-state institutions through one of these routes or by purchasing loans originated elsewhere. Banks can also purchase investment securities, such as government bonds, if local lending opportunities do not appear profitable.

If markets work efficiently, funds will flow to their most profitable uses; that process should be encouraged, not discouraged. Besides, geographic barriers are not needed to ensure that banks meet their local development responsibilities. The Community Reinvestment Act, which is enforced by bank regulators, directs banks to make funds available to the entire community they serve, including low- and moderate-income neighborhoods. Ultimately, though regulations like CRA may be compelling reasons for banks to reinvest in their communities, the competitive market mechanism provides an even greater stick: Banks that ignore profitable local investment opportunities do so at their peril because competitors would be only too happy to take the business away.

Redrawing the Road Map

What will happen to U.S. banking markets once the legislation passes? No one, of course, knows the answer to that question, but speculation abounds. In markets located in states with already liberalized banking and branching laws, little will change. In states like Arkansas and Missouri—with limited branching and regional reciprocal interstate banking laws on the books—a lot could change, assuming the states do not opt out of interstate branching. A mini-industry of predicting which banks are ripe for takeover and which will go on an acquisition spree has already cropped up. Whatever the outcome in individual markets, the banking industry should emerge leaner and meaner from this road trip.

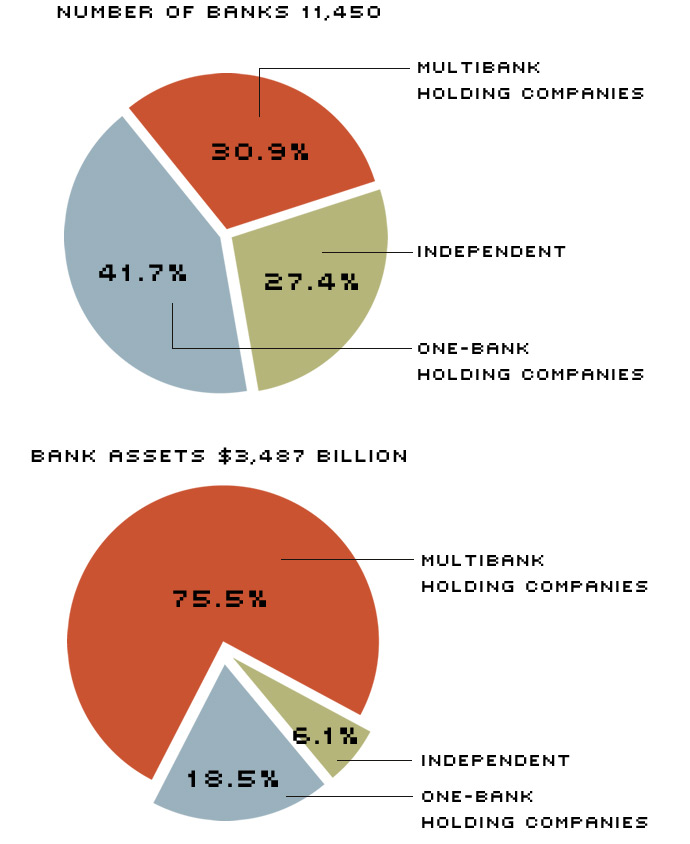

Bank Holding Companies Have Changed the Industry Landscape

Though independent banking companies are still highly represented in numbers, comprising about a third of U.S. banks, their share of industry assets is much smaller. Banks associated with one-bank or multibank holding companies hold about 94 percent of the industry's assets.

Data are as of December 1992.

Awaiting Interstate Branching: Where District Banks Stand Today

| State | Interstate banking law | In-state branching law | Percentage of assets held by out-of-state banking companies |

|---|---|---|---|

| Arkansas | RR | L | 2.1% |

| Illinois | NR | S | 21.7 |

| Indiana | NW | S | 52.9 |

| Kentucky | NR | L | 40.4 |

| Mississippi | RR | S | 2.1 |

| Missouri | RR | S | 1.9 |

| Tennessee | NR | S | 29.3 |

| State | Concentration ratio of the three largest banking companies | Percentage of national banking assets held in state | Number of banking companies | Number of five largest banking companies with headquarters out of state |

|---|---|---|---|---|

| Arkansas | 25.6% | 0.7% | 190 | 0 |

| Illinois | 37.3 | 5.8 | 714 | 2 |

| Indiana | 41.3 | 1.7 | 181 | 4 |

| Kentucky | 38.2 | 1.3 | 236 | 3 |

| Mississippi | 42.2 | 0.7 | 120 | 0 |

| Missouri | 46.7 | 1.9 | 362 | 0 |

| Tennessee | 39.6 | 1.5 | 203 | 2 |

NW = Nationwide banking

NR = Nationwide reciprocal banking

RR= Regional reciprocal banking

S = Statewide branching permitted

L = Limited area branching only

NOTE: Banking/branching status as of July 1994; data are for the period ending December 31, 1992.

SOURCES: Conference of State Bank Supervisors and FFIEC Reports of Condition and Income.

Endnotes

- See Mengle (1990) and Wheelock (1993) for details on the history of interstate banking and branching restrictions. [back to text]

- "Generally" is an important qualifier because there are some notable exceptions. In the early 1980s, for example, Congress gave bank holding companies the authority to acquire large failing out-of-state banks, regardless of state interstate banking restrictions. See Savage (1993). [back to text]

- A bank holding company is a corporation that controls at least one bank, frequently referred to as a bank subsidiary. [back to text]

- See Mengle (1990) for a detailed historical account of branching restrictions in the United States. [back to text]

- For an excellent discussion of the expected benefits for consumers and small businesses from interstate banking/branching legislation, see Calem (1993). [back to text]

- According to the U.S. Census Bureau, there were 30 metropolitan statistical areas (MSAs) and seven primary MSAs (PMSAs) that crossed state borders as of December 31, 1992. [back to text]

- Though the existence of huge ATM networks has filled part of this void, there are still many transactions that are not possible or are quite costly (in terms of fees) with ATMs. [back to text]

- See Rhoades and Savage (1993) for a discussion of the costs and benefits of the various organizational structures in banking. [back to text]

- See Savage (1993) and U.S. GAO (1993) for a review of concentration measures. [back to text]

- For information on how a merger is reviewed for competitive effects, see U.S. GAO (1993), pp. 129-40. [back to text]

References

Calem, Paul S. "The Proconsumer Argument for Interstate Branching," Federal Reserve Bank of Philadelphia Business Review (May/June 1993), pp. 15-29.

Crockett, Barton. "Cost Savings from Branching May Fall Short," American Banker (March 25, 1994).

Mengle, David L. "The Case for Interstate Branch Banking," Federal Reserve Bank of Richmond Economic Review (November/December 1990), pp. 3-17.

Rhoades, Stephen A., and Donald T. Savage. "Interstate Branching: A Cost-Saving Alternative?", The Bankers Magazine (July/August 1993), pp. 34-40.

Savage, Donald T. "Interstate Banking: A Status Report," Federal Reserve Bulletin (December 1993), pp. 1075-89.

United States General Accounting Office. Interstate Banking: Benefits and Risks of Removing Regulatory Restrictions (November 1993).

Wheelock, David C. "Is the Banking Industry in Decline? Recent Trends and Future Prospects from a Historical Perspective," Federal Reserve Bank of St. Louis Review (September/October 1993), pp. 3-22.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us