To Boldly Go Where We Have Gone Before: Repeating the Interest Rate Mistakes of the Past

Last year, despite repeated reductions in short-term interest rates, long-term rates remained stubbornly stuck at relatively high levels. Some lawmakers therefore called on the Federal Reserve to attempt to reduce these recalcitrant long-term rates by trading in long-term securities when performing open market operations. Such appeals have deep and distant echoes, reaching back more than 30 years.

A New Frontier Confronts a New Challenge

When the Kennedy administration assumed office in January 1961, the United States was facing two serious economic problems: It had been in recession since April 1960, and it had a persistent international balance-of-payments deficit. In fact, the U.S. balance of payments had been in deficit since 1951. Under the Bretton Woods agreements of 1944, the currencies of the industrialized world were pegged to the U.S. dollar, and the U.S. dollar was fixed in its value to gold. Essentially, the world was on a dollar standard, while the United States was on a gold standard. Thus any country that ran a balance-of-payments deficit with the United States could pay off the debt in U.S. dollars. The United States, on the other hand, had to exchange dollars for gold, if requested, to pay off a creditor country. Central banks in creditor countries began converting accruals of dollars into gold and threatened to convert their reserve balances as well. As a result, gold was leaving the United States at what was considered an alarming rate, with even greater losses foreseen.

Under this fixed exchange rate regime, policymakers believed that managing the recession and the balance-of-payments deficit required two, very different, governmental actions: an expansionary policy aimed at increasing aggregate demand for the recession; and a contractionary policy aimed at reducing aggregate demand (thereby reducing the demand for imports) for the balance-of-payments deficit. The Fed, having control of monetary policy, had to choose which need—the recession or the balance-of-payments deficit—was more pressing. After all, it could not correct both at the same time. Or could it?

Which Front to Attack, the Domestic or the International?

The Fed decided to attack on both fronts by engaging in a swapping operation—purchasing long-term bonds while simultaneously selling short-term bills. This operation was intended to fight the recession by lowering long-term interest rates to stimulate domestic investment, and the balance-of-payments deficit by raising short-term interest rates to attract foreign investment to the United States through a relatively higher rate of return. This swapping policy became known as Operation Twist because the Fed attempted to artificially flatten or twist the typically upward-sloping yield curve.

The policy, begun in February 1961, moved the Fed away from its March 1953 "bills only" policy that restricted open market operations to the short end of the market, especially Treasury bills. The February 20 directive of the Federal Open Market Committee (FOMC), the Fed's main policy arm, authorized the Federal Reserve Bank of New York to purchase intermediate or long-term U.S. government securities of up to 10 years in maturity, in an amount not to exceed $500 million. The plan initially limited acquisitions to securities in the range of one to five and one-half years, allowing the market time to adjust to the new policy. Afterwards, securities in the range of five and one-half to 10 years would be purchased. These purchases were to occur before the March 7 meeting of the FOMC.

This directive also included a clause requiring that purchases of intermediate- or long-term securities be offset by sales of short-term securities, thereby having the effect of altering the maturity pattern but not the dollar holdings of the Fed's portfolio. The purchases were thus "designed primarily to affect the rate structure rather than to provide reserves," according to the Minutes of Federal Open Market Committee.

In March 1961, the FOMC renewed this special authority to buy longer-term securities and permitted purchases of bonds with more than 10 years until maturity. Also being the month for annual review of the "bills only" policy, it tabled considerations for possible changes and decided to return to the question of reaffirmation later. In December 1961, the FOMC formally rescinded "bills only" after more than eight years in practice.

A True Panacea, or Just Some More Snake Oil?

Operation Twist was in effect, but to a gradually lesser degree each year, until 1965 when it was officially abandoned. For the first year, 1961, the Annual Report of the Federal Reserve Board reports that the Fed bought $1.3 billion in Treasury bonds (more than five years in maturity) and $7.5 billion in Treasury notes (between one and five years in maturity), but only $293 million of Treasury bills. Compared with its 1960 levels, the Fed increased its bond holdings 51 percent, its note holdings 60 percent, and its bill holdings 10 percent. This resulted in a dramatic restructuring of the Fed's 1961 portfolio. As a percent of total U.S. government securities holdings, bonds increased from 9 percent in 1960 to 13 percent in 1961, and notes jumped from 46 percent to 69 percent. Treasury bills, on the other hand, changed only marginally, from 10.6 percent to 11.1 percent, while certificates (short-term securities with coupons) declined noticeably from 33 percent to 6 percent. After these initial shifts, the structure of the portfolio through 1965 changed little by comparison.

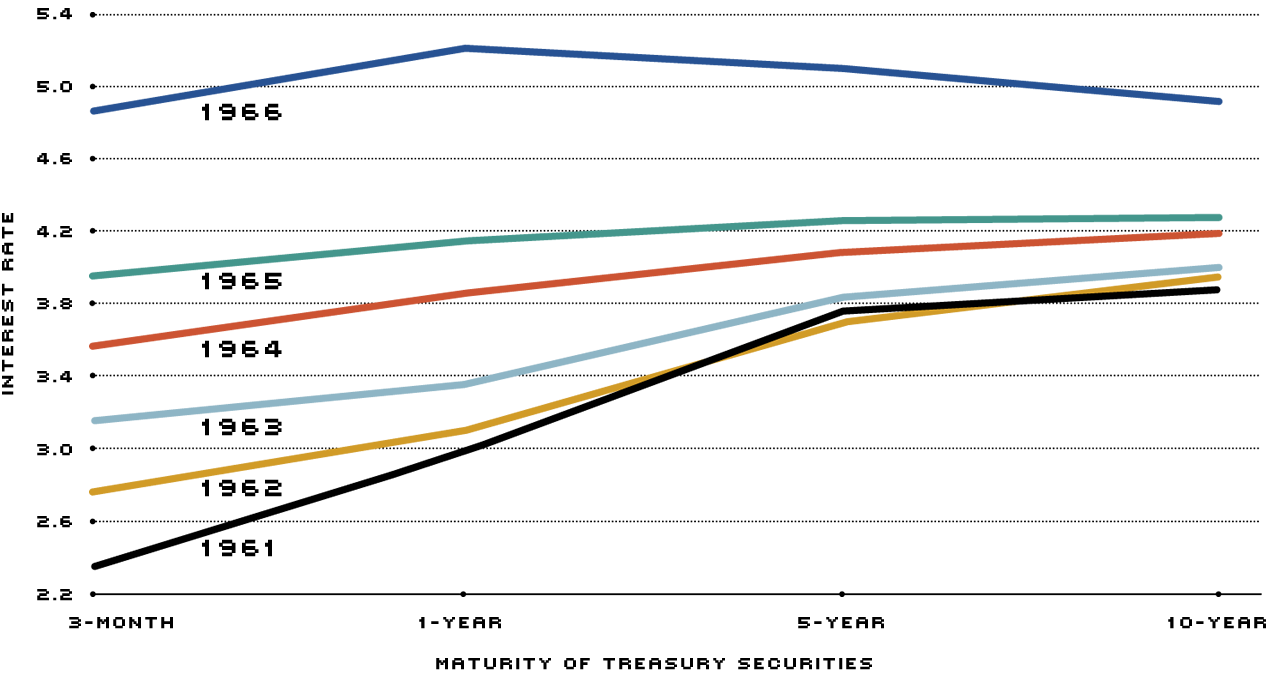

Regardless of this portfolio restructuring, the policy's success should be measured by its effect on the rate structure of the yield curve. As the chart illustrates, the gradual flattening in the yield curve between 1961 and 1966 might, at first glance, suggest the policy was successful. Looking behind the scenes, however, one uncovers a different picture.

Did the Fed Flatten the Yield Curve in the 1960s?

Looking at the chart above, it appears so. The spread between the three-month Treasury bill and the 10-year Treasury bond declined steadily from 1.53 percentage points in 1961 to 0.06 percentage points in 1966. Increases in the short-term interest rate were primarily responsible for closing the gap. Closer examination, however, reveals that factors other than Operation Twist were responsible for this narrowing interest rate spread.

Franco Modigliani and Richard Sutch, as well as Michael E. Levy, found upon closer examination that the narrowing in the spread between these interest rates occurred overwhelmingly because of increases in the interest rate ceiling on deposit accounts (Regulation Q) and the introduction in 1961 of negotiable time certificates of deposit, both of which allowed commercial banks, because of the greater availability of deposits, to take advantage of the arbitrage opportunities present in the market. Modigliani and Sutch argued that, if Operation Twist did contribute to a narrowing in the spread, it was unlikely to have exceeded 0.1 or 0.2 percentage points—a modest reduction at best. As they also pointed out, it is common for the spread to narrow as the economy recovers. (The trough of the business cycle was in February 1961; its subsequent peak was in December 1969.)

From this episode, many policymakers and analysts should have recognized, according to Benjamin H. Beckhart, that "long-term interest rates cannot be substantially reduced by money market gimmicks." It is doubtful, therefore, that the Fed would be more successful today than it was 30 years ago in attempting to twist the yield curve. Indeed, now that interest rate ceilings on deposit accounts are no longer in effect, there are no artificial forces holding these rates at any particular level. What's more, if expectations have a role in determining long-term interest rates, then the interest rate spread includes an inflation component that will not disappear simply because fewer long-term bonds are circulating in the market. As long as the swapping operation leaves inflationary expectations unchanged, no lasting narrowing of the interest rates spread can occur. In Beckhart's words, "A lasting decline will be achieved only if people gain confidence in the long-term purchasing power of the dollar."

Endnotes

Beckhart, Benjamin H. Federal Reserve System, American Institute of Banking and Columbia University Press, 1972.

Levy, Michael E. Cycles in Government Securities, 2 vols., New York: National Industrial Conference Board, 1962 and 1965.

Modigliani, Franco and Richard Sutch. "Innovations in Interest Rate Policy," American Economic Review (May 1966), pp. 178-97.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us