Labor Indicators: Some of Today's Trends Pre-Date the Great Recession

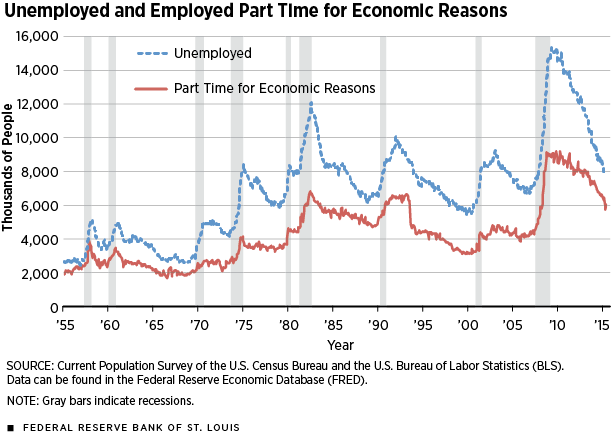

More than six years after the Great Recession reached its trough, policymakers and researchers are still debating whether a full-blown, robust recovery in the labor market is under way. Although the unemployment rate declined from 10 percent in October 2009 to 5 percent in October 2015, some policymakers and researchers are concerned that other labor statistics are lagging the levels typically expected in the mature stages of an economic expansion. For example, several point to the number of workers who report working part time but would like to work full time. This number has been declining more slowly than the level of unemployment. (See Figure 1.)

We argue that some cyclical factors are being confused in this debate with secular, or long-term, trends in the labor markets—trends that started many years before the latest recession. We cite evidence to support the idea that the current apparent weakness in the labor market may be related to the long-term negative trends in labor force participation, real wage growth, job reallocation and business creation. In this context, many labor indicators are actually stronger today than they have been in years, and even many of the "weak" ones have rebounded from Great Recession levels.

Long-run Trends in Quantities and Prices

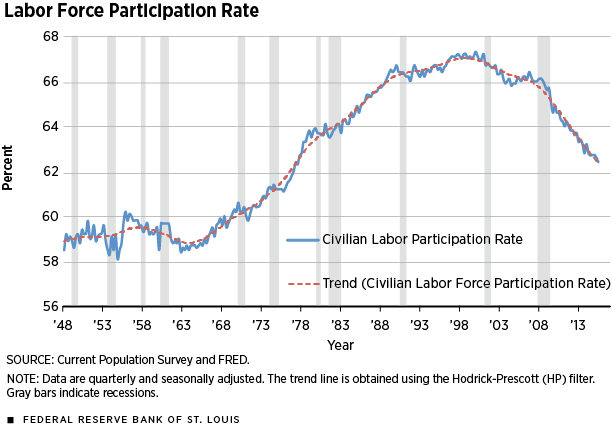

The potential concerns about the labor market pertain to quantities and prices. On the quantities side, the labor force participation rate (i.e., the share of the population that is employed or actively looking for a job) has continued its plunge, which started in 2000 and accelerated after 2007, as seen in Figure 2. While part of this decline can be attributed to an aging population,1 there is a concern that the individuals who are currently out of the labor force might join the labor force later, thereby slowing down the improvement in the unemployment rate.

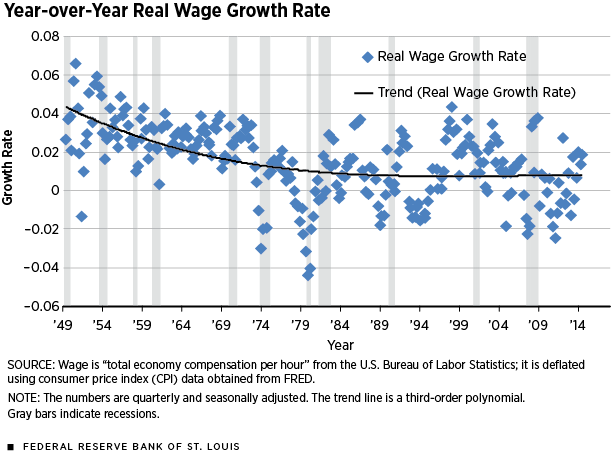

On the price side in the labor market, real wage growth has remained relatively flat since the recession trough, as seen in Figure 3.

For instance, average yearly growth from 1995 to 2005 was 1.77 percent, while it was only 0.14 percent from 2010 to 2015. The evolution of the curved line shows that the recent dynamics of real wage growth may be also affected by a trend that started in the 1980s.

How does one square these developments with the rapidly declining unemployment rate, the low number of unemployed per vacancy (a number that is back to prerecession levels) and anecdotal evidence that firms are having a hard time finding workers to fill open positions? Is the labor market recovery still in its fragile stage? Or is this how the mature stage looks?

Undoubtedly, the 2007-09 recession represented a large shock to the economy. Given the magnitude of the shock, the recession might have caused some changes in the economy that can be dubbed as "structural"; these cannot be easily changed back with monetary policy tools. It is important, however, to consider the post-Great Recession developments in the labor market in the context of secular trends that originated long before the 2007-09 recession. In the rest of this article, we argue that the findings mentioned above are indeed connected and, in fact, are part of a less-known group of secular trends in the U.S. labor market that started before the Great Recession. Together, our findings indicate that there may be a new normal in the U.S. labor market.

A Decline in Business Dynamism

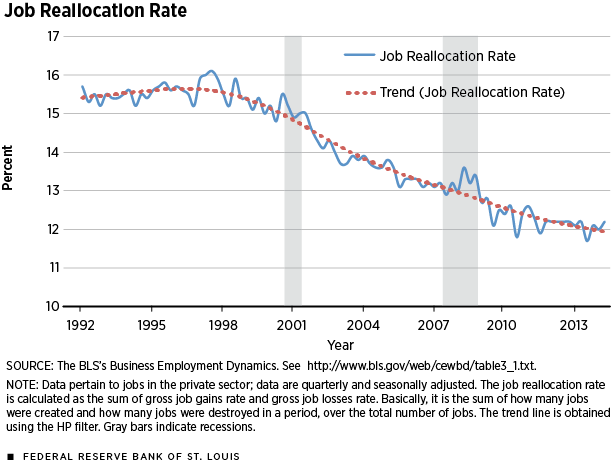

The evidence on longer-run trends in the U.S. labor market also includes research on what economists Steven Davis and John Haltiwanger have referred to as the "decline in business dynamism." These two documented the decline in several measures of job reallocation (i.e., job creation plus job destruction).2 Figure 4 shows the decline of job reallocation from 15.5 percent in the early 1990s to about 12 percent in 2014. In addition, evidence shows similar trends in other measures of business dynamism, such as worker reallocation, worker churn, worker turnover and an increase in job tenure.3

These trends are related to recent evidence that points toward the "collapse" of the job ladder. The job ladder is a theory that is useful to understanding employment dynamics over the business cycle. In particular, it explains how during advanced stages of the recovery, large employers poach workers from smaller employers. The decline in labor turnover after the recession affected this transition of workers from smaller to larger employers, which, in turn, slowed down hiring from the nonemployment sector.4

Another important trend in the labor market is job polarization, whereby occupations in the middle of the skill distribution (routine cognitive and routine manual) are disappearing, while occupations at the lower and higher ends of the distribution are growing.5

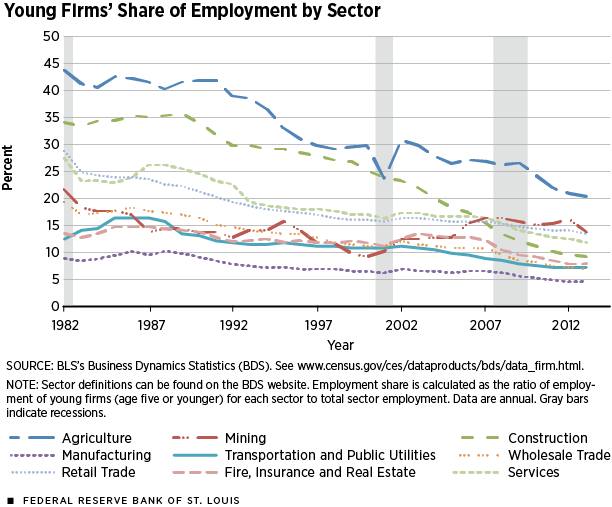

One way to understand the dynamics of the labor market is to examine the behavior of firms and what's going on in regard to the creation of new firms. Economists Benjamin Pugsley and Aysegul Sahin, among others, convincingly documented in 2015 two trends in the demographics of U.S. firms. First, they reported a dramatic decline in the creation of firms, a decline often referred to as the "startup deficit." Second, and very related, they documented a gradual shift of employment toward older firms.

The startup deficit is widespread across industries, most agree. Figure 5 shows that this shift affects most of the sectors in the economy and started in the early 1990s. The decline in the startup rate is even more dramatic if one takes into consideration that the industry composition of employment has been shifting toward retail and services, industries that typically have a relatively high share of young firms.

Pugsley and Sahin suggested that the startup deficit has contributed to changing how employment fluctuates over the business cycle. In particular, during contractions, there are two opposite effects: While the decline in startups amplifies the decline of employment, the larger share of employment in more-mature firms dampens the contraction of employment. (Large firms are less likely than small firms to fire people.) In contrast, during recoveries, both effects act in the same direction: Both the decline in firm entry and the larger share of employment in more-mature firms dampen employment growth. (Large firms are less likely than small firms to hire people.) The result is the emergence of jobless recoveries.

Acceleration of Negative Trends

All of these facts indicate that the U.S. labor market is less dynamic than it once was. While these trends originated at the beginning of the 1980s, they accelerated after 2000, according to the literature. The acceleration in the past 10 years might have been masked by the 2005-2007 expansion.

This acceleration coincided with what was happening with aggregate labor force participation, which peaked in 2000 and then started to decline. In fact, male labor force participation has been declining for decades. Women's labor force participation rose until 2000, after which it started to fall.

A closer look at the industry composition of startups and the timing of their decline reveals that the startups most closely associated with employment growth had been growing prior to 2000 but declining afterward. Startups can be broken down into "subsistence" and "transformational" entrepreneurships.6 The former group is associated with mostly creating employment for the entrepreneurs themselves and their family members, while those in the latter group are known for being the "engines of employment growth."

While, ex ante, it might be challenging to distinguish which startups will eventually grow, economist Ryan Decker and his co-authors attempted to do just that in 2014 when they looked at startups by industry. The positive news for productivity is found in the retail sector, in which there has been a shift since the 1980s, when there were many startups, many of which were small "Mom and Pop" stores, to today's fewer startups, many of which are branches of large, stable national chains in retail trade.7 The negative news for future productivity is that high-tech startups, which are a critical sector for innovation and productivity growth, were rising before 2000 and have been sharply declining since.

In general, more research is needed to understand whether the results on the startup deficit reflect changes in the dynamics of employment growth relative to other possible explanations. Further investigation is also needed into how much of the startup deficit is an efficient response to technological shifts (e.g., newer information and communication technologies giving an advantage to large incumbent firms relative to entrants) versus the result of distortions that are affecting the efficient allocation of workers to firms (e.g., regulations that are affecting workers' mobility across states and jobs, and regulations that are increasing the costs of starting a business). Although the literature has not yet achieved a consensus on what the drivers of the decline in business dynamism are, among the possible explanations are the lower growth in the supply of labor8 and less willingness to take on the risks inherent in a highly entrepreneurial economy.9

Conclusions

Although there is no clear answer yet on how to connect all these facts, viewing the postrecession developments in the context of the long-term trends seems relevant. In particular, distinguishing cyclical phenomena from long-term trends might be helpful to guide policy.

Questions for future research are plentiful. For example, what is behind the decline in the labor force participation rate? How much of the decline in that rate is due to the disappearance of middle-skill occupations and the resulting cut in wages, both of which have led some people to think they are better off not working than working? How much of the decline represents increased schooling (possibly in response to growing job requirements)?

The U.S. labor market has always been characterized by a high degree of fluidity, which allows workers to switch jobs in searching for the best match. Typically, workers who switch jobs enjoy significant wage growth. Thus, if there are barriers to switching, the aggregate job growth might be hampered, simply because wage growth is reduced. However, one needs to understand the nature of such barriers. Are these barriers due to some inefficient regulatory changes, or are they a response to some technological advances that lead to higher specificity of job-specific human capital that discourages reallocation?

Declining business dynamism and other trends (like job polarization) matter because they might lower labor productivity and, in turn, wages and labor force participation. These negative trends might have interacted with cyclical effects during the economic recovery phase. Are these trends likely to be reversed with more expansionary monetary policy? To answer that, we need to understand the underlying forces behind the decline in business dynamism: Maybe it's an optimal response to new technological shocks, or maybe the decline is due to some bad regulatory changes.

Endnotes

- See Kudlyak, and see Aaronson et al. [back to text]

- See Davis and Haltiwanger, and see Haltiwanger. [back to text]

- See Davis et al., Hyatt and McEntarfer, and Hyatt and Spletzer. [back to text]

- See Moscarini and Postel-Vinay. [back to text]

- See Autor et al. [back to text]

- See Schoar, and see Decker et al. [back to text]

- See Foster et al. [back to text]

- See Karahan et al. [back to text]

- See Haltiwanger. [back to text]

References

Aaronson, Stephanie; Cajner, Tomaz; Fallick, Bruce; Galbis-Reig, Felix; Smith, Christopher; and Wascher, William. "Labor Force Participation: Recent Developments and Future Prospects." Brookings Papers on Economic Activity: Fall 2014, No. 2, pp. 197-275.

Autor, David H.; Katz, Lawrence F.; and Kearney Melissa S. "The Polarization of the U.S. Labor Market." The American Economic Review, 2006, Vol. 96, No. 2, pp. 189-194.

Davis, Steven J.; Faberman, R. Jason; and Haltiwanger, John. "Labor Market Flows in the Cross Section and over Time." Journal of Monetary Economics, 2012, Vol. 59, No. 1, pp. 1-18.

Davis, Steven J.; and Haltiwanger, John. "Labor Market Fluidity and Economic Performance." Working Paper No. w20479. National Bureau of Economic Research (NBER), 2014.

Decker, Ryan; Haltiwanger, John; Jarmin, Ron; and Miranda, Javier. "The Role of Entrepreneurship in U.S. Job Creation and Economic Dynamism." The Journal of Economic Perspectives, 2014, Vol. 28, No. 3, pp. 3-24.

Foster, Lucia; Haltiwanger, John; and Krizan, Cornell J. "Market Selection, Reallocation, and Restructuring in the U.S. Retail Trade Sector in the 1990s." The Review of Economics and Statistics, November 2006, Vol. 88, No. 4, pp. 748-58.

Haltiwanger, John. "Top Ten Signs of Declining Business Dynamism and Entrepreneurship in the U.S." Kauffman Foundation New Entrepreneurial Growth Conference, 2015.

Hyatt, Henry R.; and McEntarfer, Erika. "Job-to-Job Flows and the Business Cycle." Working Paper CES-WP-12-04, U.S. Census Bureau Center for Economic Studies, 2012.

Hyatt, Henry R.; and Spletzer, James R. "The Recent Decline in Employment Dynamics." IZA Journal of Labor Economics, 2013, Vol. 2, No. 1, pp. 1-21.

Karahan, Fatih; Pugsley, Benjamin; and Sahin, Aysegul. "Understanding the 30-Year Decline in the Startup Rate: A General Equilibrium Approach." Unpublished manuscript, May 2015.

Kudlyak, Marianna. "A Cohort Model of Labor Force Participation." Economic Quarterly, 2013, Vol. 99, No. 1, pp. 25-43.

Moscarini, Giuseppe; and Postel-Vinay, Fabien. "Did the Job Ladder Fail after the Great Recession?" Forthcoming, Journal of Labor Economics.

Pugsley, Benjamin W.; and Sahin, Aysegul. "Grown-up Business Cycles." In 2015 Meeting Papers, No. 655. Society for Economic Dynamics, 2015.

Schoar, Antoinette. "The Divide between Subsistence and Transformational Entrepreneurship," a chapter in the NBER book Innovation Policy and the Economy, 2010, Vol. 10, pp. 57-81.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us