Jefferson City, Mo., Facing Same Struggles As Other State Capitals

The skyline of Jefferson City is dominated by the massive dome atop the Missouri state Capitol, a reminder of the central role the state of Missouri plays in the city’s economy. What is now the seat of power for the Missouri legislature was just a trading post between St. Louis and Kansas City a hundred or so years ago; the city’s central location in Missouri, however, enabled Jefferson City to undergo expansive population growth in the late 19th and early 20th centuries.

Today, with a population of 43,132, Jefferson City is the 15th largest city in the state. The city stands as the hub of a four-county region of about 150,000 people. The four counties—Callaway and Cole, along with the more rural Moniteau and Osage—comprise the Jefferson City metropolitan statistical area (MSA). The MSA has experienced gradual population growth over the past 10 years, rising by 6.4 percent since 2004; over the same period, Missouri’s population grew by 5.5 percent and the nation’s by 8.9 percent.

Government’s Shrinking Role

Prior to the financial crisis and last recession, government activities directly accounted for almost 29 percent of the region’s output, as measured by real gross metropolitan product (GMP). This percentage was much greater than that in other nearby state capitals—in Little Rock, Ark., it was 16.1 percent, and in Springfield, Ill., it was 21.7 percent, for example. The Jefferson City MSA’s share was also three times greater than that in nearby Joplin, Mo., which is roughly the same size.

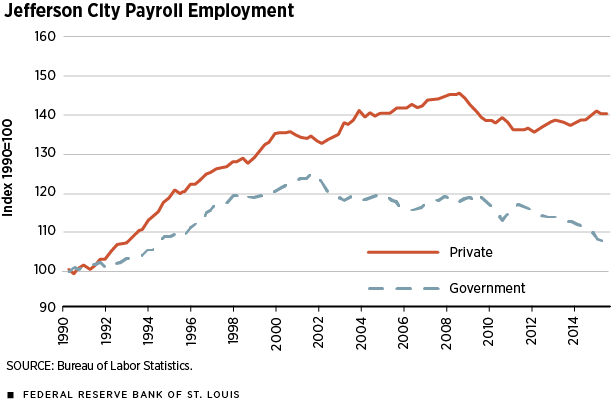

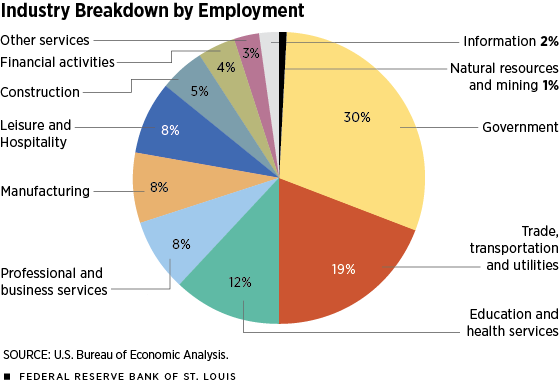

The state of Missouri is also the largest employer in the metro area, accounting for 26 percent of the region’s jobs in 2014. As the largest employer in the region, the government makes decisions about hiring and changes in wages that can ripple out to the private sector: Private-sector businesses compete for the same workers, and government agencies (and their employees) purchase goods and services from the private sector. As a consequence, the general stability of the large public sector helped mitigate the recessionary effects during the depth of the financial crisis. The pullback by government during the recovery, however, has restrained growth in the region in recent years.

Health Care

Two of the region’s largest employers are hospitals, Capital Region Medical Center and SSM Health St. Mary’s Hospital. More broadly, the industry accounts for 10 percent of the region’s employment and 7 percent of total output. Like government, the sector is less sensitive to changes in the overall economy. Health care has steadily added jobs throughout the recession, making this sector a critical source of growth.

Recession in Jefferson City

From 2007 to 2009 (the span of the Great Recession), federal, state and local governments were able to net positive job growth, and the region suffered only minimal declines in output. This helped to cushion the loss of over 2,000 jobs in the private sector. During these recession years, the Jefferson City MSA saw a much less dramatic decline in real output relative to the national average. Real GMP in Jefferson City contracted each year from 2007 to 2009, but never declined more than 0.3 percent in a single year. The recession was much sharper nationwide and in the state of Missouri. For example, in 2009, real GDP shrank 2.8 percent nationally and 2.7 percent in Missouri.

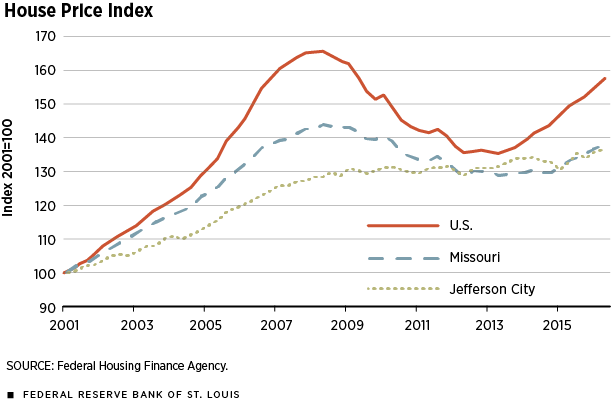

Another key contributor to the resilience of the MSA’s economy has been its stable housing market. During the housing boom from 2004 to 2007, house prices rose by 12.6 percent in the MSA. In contrast, the national index surged 26.6 percent. After national prices collapsed during the recession, they rebounded by 16 percent in 2013. Meanwhile, house prices in Jefferson City were much less turbulent, climbing steadily by 1.5 percent each year, even during the national housing collapse.

Recovery

While steady government employment was able to keep the MSA’s economy afloat during the recession as the private sector contracted, the dynamics have reversed during the recovery as state governments around the nation have looked for ways to reduce their costs amid lower tax revenue. In Missouri, inflation-adjusted state tax revenue peaked in 2007 and fell 13 percent to a low point in 2011. While revenue has started to increase in recent years, growth has been slow; revenue in 2014 was still 7 percent below its peak.

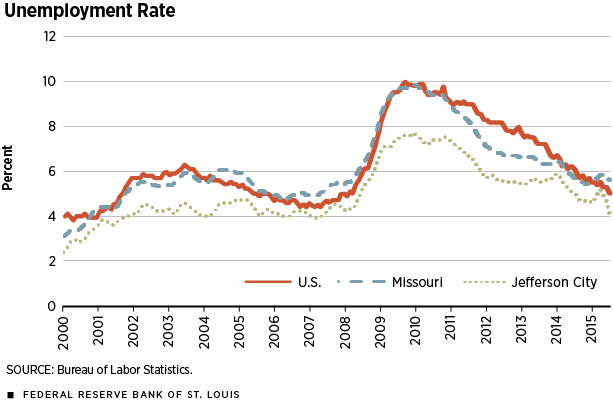

As a result, government layoffs at the state level picked up following the recession, offsetting the modest expansion in the private sector. The result was a period of flat growth after 2009. Still, the unemployment rate in Jefferson City dropped quickly, starting in 2010. From 2010 to 2011, the rate fell from 7.7 to 6 percent, largely due to a shrinking labor force. Real gains in overall employment were minimal, with payrolls rising by a mere 200 jobs in 24 months.

By 2012, economic activity in the private sector had begun to accelerate. Employment at private firms in the MSA rose 2 percent from 2012 to 2013, while real GMP grew at an annual average rate of 1.5 percent. From 2012 to 2014, the health care and education sector generated more employment gains than any other sector, accounting for over 25 percent of the area’s growth in jobs. Growth in the health care sector has also provided critical improvements in wages, which rose 2 percent from 2013 to 2014 and 13.6 percent since 2005.

Despite these windfalls in Jefferson City’s private industries, persistent contraction in the public sector, particularly at the state level, has prevented substantial overall economic gains. The government has progressively been shrinking employment since 2005, shedding nearly 10 percent of its workforce over the past 10 years.

Current Economic Conditions

Most key economic indicators provide signs that the economy still is in the process of adjusting to a new normal following the recession and sectoral shift. The Jefferson City MSA experienced steady job growth in 2014 and through most of 2015, resulting in about an additional 1,000 jobs. The unemployment rate in the MSA was 4 percent in November, the lowest in nearly a decade. However, total employment in the region is still below prerecession levels, and job growth is only marginally stronger than a year ago.

The regional housing market has begun to pick up in the past couple of years after a period of stagnancy from 2009 to 2013. Since 2014, house prices are up 6 percent, which represents a larger increase in home prices than in the previous eight years combined.

Outlook

Local businesses in Jefferson City indicate that business activity is gradually increasing. About half of the contacts surveyed in November for this article reported higher sales from a year earlier. Levels of sales since Jan. 1, 2015, met expectations for 53 percent of firms and exceeded expectations for 11 percent.

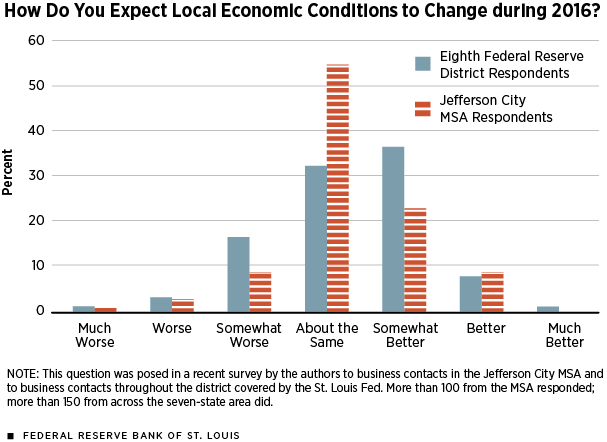

Looking ahead, the majority of business contacts anticipate economic conditions to remain the same in 2016. Sixty-four percent of firms do not expect their employment levels to change in the year to come. These findings were only slightly less optimistic than those for the businesses surveyed across the St. Louis Fed’s entire Eighth Federal Reserve District.

One of the main challenges that the Jefferson City MSA faces is in attracting young, educated professionals. Many business contacts in the MSA reported that a lack of skilled labor limits firms’ abilities to grow and innovate. Several contacts also noted that the area falls short in education overall. Businesses reported that schools and universities in the region could increase their emphasis on the teaching of technical skills required for the jobs in highest demand in today’s economy. Currently, Jefferson City lags behind the U.S. in higher-level educational attainment. Twenty-five percent of the local population 25 and older has a bachelor’s degree, compared with 29 percent nationwide.

Another way of attracting labor would be to offer higher wages; however, of over 100 business contacts surveyed, only 18 percent are increasing wages in order to attract new, skilled employees.

As in many other state capital regions, state government finances are likely to play

a significant role in the economy of the Jefferson City MSA. An improving economy with more jobs as well as higher incomes and spending, should boost tax revenue, and there are signs that state government layoffs have slowed. This combination should alleviate some of the economic strain on the region. Nonetheless, there are no indications that the public sector will drive growth as it has in the past; so, private firms will have to continue to grow in order for the regional economy to maintain its current level of output growth.

Research assistance was provided by Evan Karson, an intern at the Bank.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us