National Overview: Pace of Growth Is Expected To Quicken

Despite an early stumble in 2014, the U.S. economy has performed well over the past year. Job growth has been strong, inflation expectations remain low and financial market stresses are lower than average. Prevailing economic conditions at the end of 2014 suggest that the probability of faster real GDP growth and continued low inflation in 2015 outweighs the probability of slower growth and higher inflation.

A Look Back

Forecasters and policymakers were optimistic in late 2013 about the U.S. economy's prospects for 2014. Over the second half of 2013, growth of real gross domestic product (GDP) had increased at a 4 percent annual rate. In addition, the unemployment rate had fallen to 6.7 percent in December 2013, and inflation remained unusually low (1.2 percent). The consensus of private forecasters and the majority of the Federal Open Market Committee (FOMC) was that real GDP would increase by about 3 percent in 2014 and that inflation would remain below the FOMC's target of 2 percent.

However, the economy stumbled coming out of the gate, as real GDP fell at a 2.1 percent annual rate in the first quarter of 2014. Although some were alarmed by this development, most viewed the unexpected decline in economic activity as a temporary setback, influenced in part by adverse weather. Indeed, over the remainder of the year, the stock market would reach record highs, measures of business and consumer confidence would reach multiyear highs, and the unemployment rate would fall below 6 percent—much faster than most forecasters had anticipated. Importantly, inflation and interest rates would remain quite low and stable.

In short, following the first-quarter hiccup, the economy began developing some significant forward momentum in the spring: Growth of real GDP measured 4.6 percent in the second quarter and 5 percent in the third quarter. The pace of economic activity is expected to slow modestly in the fourth quarter to about 2.75 percent. Overall, real GDP growth is expected to be about 2.5 percent in 2014 and accelerate to about 3 percent this year.

A Look Ahead

When forecasting the macroeconomy, it is important to consider how developments in 2014 could affect the U.S. economy's performance in 2015. Some of these developments have been positive, and some have been negative. Two potential negative developments stand out: concerns about the economic health of the global economy and an increase in the trade-weighted value of the dollar.

At the conclusion of the European Central Bank's meeting Dec. 4, bank President Mario Draghi reported that the staff's forecast for European real GDP growth in 2015 had been revised "substantially downward" to 1 percent. But Europe's slow growth is not an outlier. Following a tax hike in the first quarter of 2014, Japan slipped into a recession; the country is expected to grow by less than 1 percent in 2015. Growth in Asia's other large economy, China, is also expected to be lower in 2015 than it has been in years.

The corrosive effect of slower global growth on the U.S. economy is likely to be magnified by a substantial appreciation of the U.S. dollar since late July 2011. During December 2014, the real value of the dollar rose to its highest level since June 2009. Although Canada and Mexico are the United States' two largest trading partners, and their economies show few obvious strains, slow global growth and a stronger dollar could lead to weaker growth of U.S. exports in 2015. If so, manufacturers may slow their planned capital expenditures.

Three positive developments stand out. First, and perhaps most important, is the aforementioned forward momentum, which is being manifested by strong employment growth and a larger-than-expected decline in the unemployment rate. Second, crude oil prices have fallen substantially since mid-June. Historically, falling energy prices have helped to boost the real purchasing power of consumers, spurring faster growth of consumer expenditures. As an example, car and light-truck sales in 2014 were at their highest since 2006. Falling oil prices also tend to lower headline inflation and—for a time at least—inflation expectations and nominal interest rates. However, some policymakers are worried that inflation will drift too far below the FOMC's target of 2 percent.

Macroeconomic policy is the third positive development. On the fiscal side, government expenditures are no longer a negative contribution to real GDP growth, as they were from 2011 to 2013. Of note, state and local government finances have improved. Regarding monetary policy, financial markets expect the stance of monetary policy to remain extraordinarily accommodative in 2015 even if, as some Federal Reserve policymakers have suggested, the Fed's target for short-term interest rates rises slightly.

Overall, then, key economic and financial market indicators at the end of 2014 suggest that the U.S. economy is likely to strengthen further in 2015.

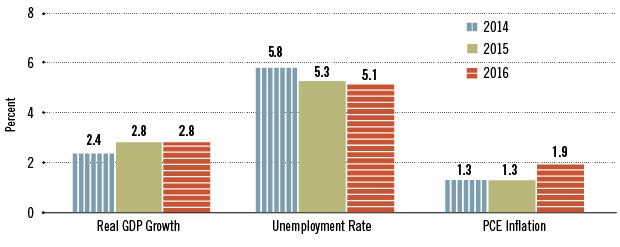

The FOMC's December 2014 Economic Projections for 2014-2016

NOTE: Projections are the mid-points of the central tendencies. The projections for real GDP growth and inflation are the percentage change from the fourth quarter of the previous year to the fourth quarter of the indicated year. Inflation is measured by the personal consumption expenditures (PCE) chain-price index. The projection for the unemployment rate is the average for the fourth quarter of the year indicated.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us