Metro Profile: A Tale of Four Cities: Widespread Growth in Northwest Arkansas

When Sam Walton opened in 1950 the dime store in Bentonville, Ark., that would evolve into the giant retailer Walmart, to say the area was sparsely populated would be an understatement. Even 20 years later, when the first Walmart distribution center was opened in Bentonville, the city had just over 5,000 people. Today, these environs have grown so much that they comprise their own metropolitan statistical area (MSA).

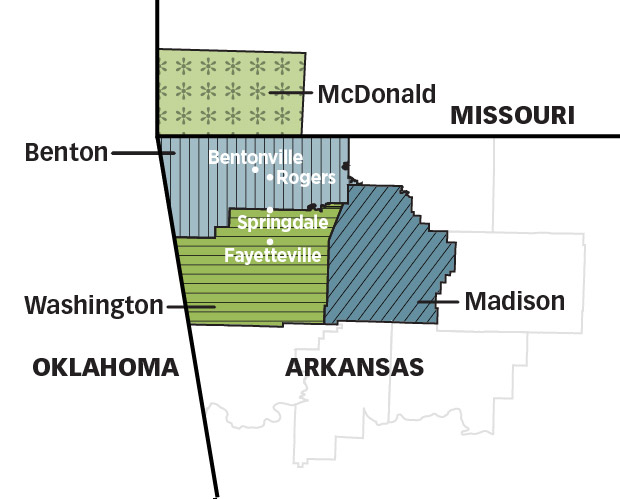

The Fayetteville-Springdale-Rogers MSA (which includes Bentonville) is home to almost a half-million people. A region more often referred to as Northwest Arkansas, this MSA covers four counties, one of which is across the border in Missouri.

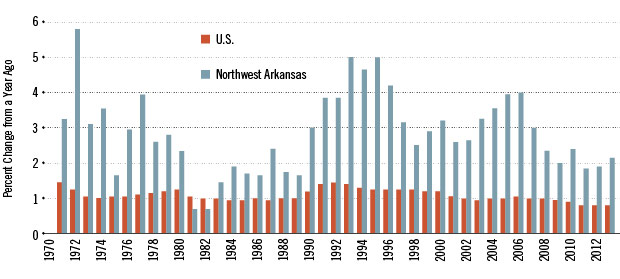

This strong growth is relatively dispersed among the MSA's counties. Although the core counties of Benton and Washington have been leading the way with an average population growth of at least 2.4 percent, every county in the region has experienced average growth faster than that of the nation since 1971. Thus, not only has Northwest Arkansas experienced the fastest population growth of any MSA located in Arkansas, but it is also the only MSA in Arkansas (with at least two counties in the state) that has experienced an average population growth above the national average in all counties.

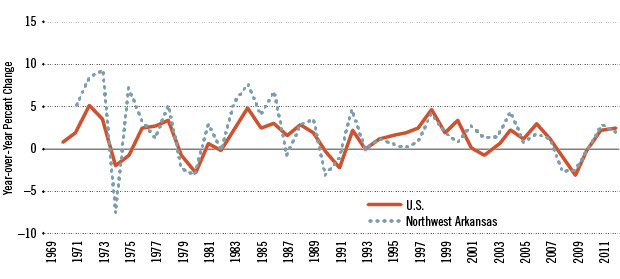

Strong growth in real income per capita has gone hand-in-hand with the growth in population. Per capita income in Northwest Arkansas has grown about 2 percent annually since 1970, compared with 1.4 percent in the U.S. as a whole. (See Figure 1.) At these rates, Northwest Arkansas doubles its income every 35 years, while the U.S. needs 50 years to do the same.

As a result, per capita income in Northwest Arkansas has converged with the national average. As of 2012, income per capita in Northwest Arkansas was about $36,000, about $6,000 below the national average. After adjusting for the lower cost of living in the region, per capita income in Northwest Arkansas was at that time, in effect, $40,000, just $2,000 shy of the national average.

Annual, inflation-adjusted income growth has been relatively uniform across all counties since 1971, although Benton (2 percent per year) and Washington (1.8 percent) exhibited greater growth than Madison (1.3 percent) and the Missouri county of McDonald (1.5 percent).

Multiple City Centers

Although the growth rates alone are noteworthy, arguably more impressive is how this growth has occurred across multiple cities in the region. Economic activity in most metro areas typically revolves around one city center. The economic growth in Northwest Arkansas is supported by four cities: Fayetteville, Springdale, Rogers and Bentonville.

More than half the metro area's residents reside in these four cities, each of which brings prosperity to the region in its own way. Fayetteville, where the University of Arkansas is located, is a source of skilled labor. Of its residents age 25 and older, 44.8 percent have a bachelor's degree or higher, placing it between the cities of Boston (43.9 percent) and Austin, Texas (45.6 percent).

A few miles north of Fayetteville are the cities of Springdale and Rogers. This area is home to two of the region's major employers: Tyson Foods, a multinational food corporation, and J.B. Hunt, a trucking and transportation company. Both cities also have strong manufacturing and construction sectors. In Springdale, 34 percent of the workforce is employed in one or the other sector; in Rogers, 22 percent. As a result of widespread growth in the region and opportunities for employment, many families have moved to this part of the state and now call Springdale and Rogers home. About 20 percent of the population in this area is foreign-born, and nearly 30 percent of residents in Springdale and in Rogers are Hispanic or Latino, about twice the national rate. More than 10 percent of the firms in each of these cities are Hispanic-owned.

The smallest of the four cities in the MSA is Bentonville, but as home to Walmart, it has experienced some of the fastest growth in the region. The population of the city increased about 14 percent from April 2010 to July 2013, nearly twice the growth rate of the other three cities and almost six times the national rate. Bentonville is also the wealthiest of the four cities; its median household income tops $60,000—nearly 20 percent higher than each of the other three aforementioned cities.

Economic Outlook

The region has been growing at a remarkable pace for nearly 50 years. However, such robust growth was not immune to the financial crisis of 2008 and subsequent recession. Since 2007, Northwest Arkansas has been experiencing population growth that is below average for the area, with Madison County losing population in 2011 and 2012, and McDonald County doing the same in 2010 and 2011. It is too early to tell if this is a cyclical phenomenon or if the MSA is experiencing a permanent slowdown in population growth. Long-term trends indicate that the region's population growth is positively correlated with the U.S. business cycle. As the national economy gains momentum, population growth in the region may pick up again.

While population growth has slowed, income growth has returned to the long-run average rate after being hit by the Great Recession. Real income per capita in the region declined during the first two years of the recession, but incomes rebounded in 2011 and 2012 (the latest year data are available). All the Arkansas counties are doing particularly well with all three experiencing above-average income growth (relative to the long-run trend) at some point after the end of the Great Recession; however, McDonald County (Missouri) is showing the effects of the downturn, with a decline in income in both 2011 and 2012.

This recovery in the MSA is particularly notable considering the significant impact of the recession on the local housing market. From 2006 to 2013, new permits for private housing fell 60 percent, worse than both national and state declines of 45 percent. The ability of Northwest Arkansas to weather such a downturn in housing is a good sign of stable growth in the MSA.

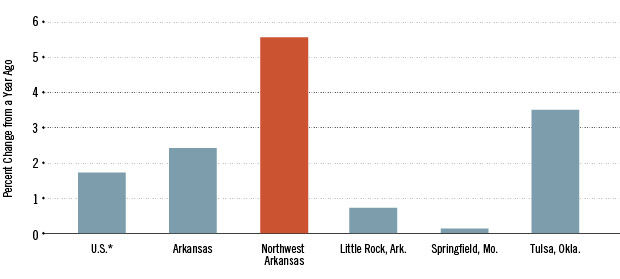

Despite the uncertainty surrounding recent population growth, which is most likely a reflection of economic growth in the MSA, comparing the region to the nation as a whole paints an optimistic outlook. In 2013, the region's economy (measured by real gross metropolitan product) grew by 5.6 percent, three times the national rate and much faster than the nearby MSAs of Little Rock, Ark.; Tulsa, Okla.; and Springfield, Mo. In fact, only 25 of the nation's 381 MSAs experienced faster growth in 2013, placing Northwest Arkansas firmly in the top 10 percent of the fastest-growing MSAs in the nation. (See Figure 3.)

Per Capita Personal Income Growth

SOURCES: Census Bureau/Federal Reserve Economic Data (FRED) and Haver.

NOTE: Data are presented at an annual frequency, and the range is 1971-2012. In 2012, per capita income growth was 2.33 percent in the U.S. and 1.96 percent in Northwest Arkansas.

Population Growth: U.S. vs. Northwest Arkansas

SOURCES: Census Bureau and Haver.

NOTE: Data are presented at an annual frequency, and the range is 1971-2013. In 2013, population growth was 0.7 percent in the U.S. and 2.08 percent in Northwest Arkansas.

Real GDP Growth 2013

*U.S. is average of all metro areas.

MSA Snapshot

Northwest Arkansas

| Population |

491,966

|

| Personal Income (Per Capita) |

$35,980

|

| Cost of Living |

–13.8%

|

| Employment |

219,300

|

| Unemployment Rate | 4.5% |

| Pop. (Age 25+) w/Bachelor's Degree or Higher | 27.3% |

NOTES: Population is from the Bureau of Economic Analysis (BEA), as of 2013. Per capita income is the 2012 annual figure from the BEA and was created averaging county income data using population weights. Cost of living figure is from Sperling's Best Places and is an annual figure for 2013; it is shown above as relative to the national average. The unemployment rate and employment figure are from the November 2014 release from the Bureau of Labor Statistics. The percentage of the population with a bachelor's degree or higher is from the U.S. Census Bureau; it is a five-year estimate from 2008-2012.

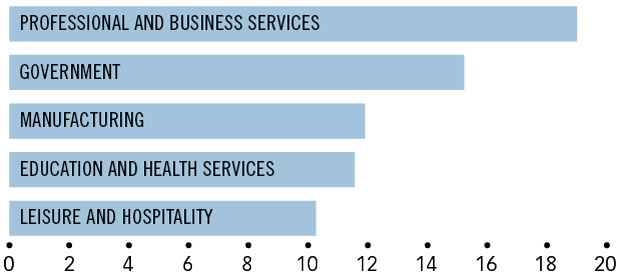

Largest Sectors by Employment

(Percent of Nonfarm Employment as of October 2014)

Largest Local Employers

| Walmart |

28,000

|

| Tyson Foods Inc. |

12,000

|

| University of Arkansas |

4,000

|

| J.B. Hunt |

2,600

|

NOTE: Totals are from the U.S. Department of Housing and Urban Development, as of January 2012.

Northwest Arkansas

NOTES: The colors do not correspond to any specific values; they are used solely to identify the outline of the metro area. McDonald County is in Missouri but is included as part of the metropolitan statistical area.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us