Faster Real GDP Growth during Recoveries Tends To Be Associated with Growth of Jobs in ''Low-Paying'' Industries

Typically, deep recessions are followed by rapid growth. However, since the second quarter of 2009, when the latest recession officially ended, real (inflation-adjusted) gross domestic product (GDP) has increased at only a 2.3 percent annual rate.1 Prior to the latest recession, the economy's long-term growth rate of real potential GDP was about 3 percent per year.2 Thus, the current business expansion could not only be the weakest on record—although that conclusion will ultimately depend on its length and future growth—but it could signal a worrisome downshift in the economy's long-term growth rate of real potential GDP.

A common refrain among many economic pundits and analysts is that the bulk of the job gains during this recovery have been in "low-wage jobs," a term that is rarely defined. This essay will explicitly define "low-wage" jobs in order to assess the validity of this claim. (This essay will not delve into the numerous hypotheses that have been put forward to explain why the economy fell into a deep recession and why the current expansion's growth rate has been so anemic. Interested readers should refer to those articles listed in the reference section.)

To preview our conclusion, we found that the percentage change in job losses during the latest recession was higher in "high-paying" private-sector industries—which we define as industries with above-average hourly earnings—than in low-paying sectors. Likewise, the percentage change in job gains during the recovery was also proportionately larger in high-paying industries. It should be pointed out, though, that the total number of jobs in low-paying industries exceeds the number of jobs in high-paying industries by nearly 70 percent. Thus, an equal percentage increase in jobs in both industries would generate much larger job gains in low-paying industries than in high-paying industries. We also found that the percentage change in job gains in low-paying industries was much stronger following the 1981-82 and 1990-91 recessions, which also happened to be periods of much stronger real GDP growth.

Top- and Bottom-Paying Industries

Since the peak of the previous business expansion (the fourth quarter of 2007), the U.S. economy has grown at a compounded annual rate of 1.2 percent per quarter, as measured by real GDP. Such a prolonged period of weak growth is rare in U.S. economic history. This period, though, encompasses two distinct periods: a deep and prolonged recession followed by a relatively weak expansion.

The history of U.S. business cycles shows that recessions are caused by several different factors, and they affect some industries more than others. For example, from the first quarter of 2008 to the first quarter of 2009, the real value of services output increased by 0.3 percent, but the real value of goods produced fell by 8.2 percent and the real value of structures put in place fell by 13.3 percent.

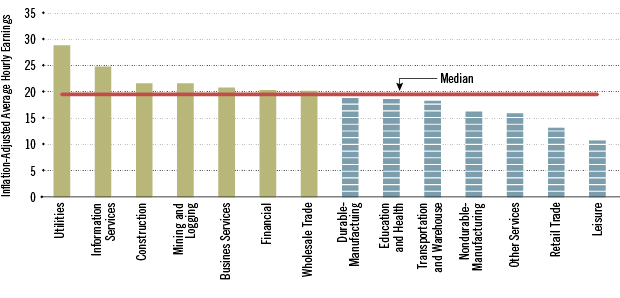

The chart shows the distribution of real hourly earnings (wages) in 2007 for the 14 private-sector industries.3 The industries are ranked by their average real wage per worker in that industry, with the highest wages on the left and the lowest on the right. In 2007, the highest average real wage rates were in the utilities industry ($28.71 per hour). The lowest average real wage rates were in the leisure industry ($10.72 per hour). The median real wage rate of all 14 industries in 2007 was $19.45 per hour. Industries with jobs above the real median wage in 2007 are those with the solid green bars, while those industries with jobs below the real median wage are represented by blue, broken bars.4 Throughout the remainder of the article, we will refer to industries with average real wages above the industry median as "high-paying industries" and industries with average real wages below the industry median as "low-paying industries."5

The chart shows that the highest- and lowest-paying jobs are service-sector jobs. This should not be too surprising given that roughly 84 percent of all private-sector jobs are in the service-providing industries. In terms of employment, the distribution of private-sector jobs was skewed toward lower-paying industries. In 2007, industries with an average real wage above the median comprised only 38.2 percent of total private payroll employment. What might surprise some people is that both durable and nondurable manufacturing jobs were in the lower-paying end of the distribution (below the median) in 2007.

Industry "Winners" and "Losers"

Because some industries are affected more than others during a recession, the distribution of employment losses also differs across industries. For example, during the latest recession, private-sector payrolls declined by a little more than 7.6 million.6 Of those job losses, a little more than 56 percent, or 4.3 million, were in the high-paying industries. In particular, the construction and business services industries collectively accounted for close to 41 percent, or 3.1 million, of total job losses. The financial industry, which was also hard hit during the recession, accounted for 6.1 percent of the job losses during the recession. Thus, the past recession hit the high-paying industries especially hard.

Since June 2009, private-sector employment has increased by about 10 million, more than offsetting the decline that occurred during the recession. However, unlike in the recession, the majority of job gains were in the low-paying industries. Of the 10-million increase in private nonfarm jobs during the current expansion, about 61 percent, 6.1 million, were in low-paying industries—consistent with the narrative mentioned above. In particular, job growth in the retail trade, education and health services, and leisure and hospitality industries was responsible for almost half of total job growth during the recovery. In high-paying industries, job growth was especially strong in business services, which has accounted for about a third of the private-sector job gains during the recovery.

One problem with the above analysis is that it ignores base effects, that is, the distribution of employment by high- and low-paying industries is not equal. In June 2009, employment totaled 39.9 million in high-paying industries but 68.5 million in low-paying industries. Thus, an equal percentage increase in job growth would mean a much larger gain in the number of jobs in low-paying industries. To put the analysis on a common footing, we will report changes in jobs during past recessions and recoveries in percentage terms rather than in level terms. We will also focus on high- and low-paying industries in the aggregate, rather than on an industry-by-industry basis.7

Current vs. Previous Episodes

It is possible that the trends in employment noted above were similar in previous recessions and expansions. If so, then the patterns we have highlighted may just be par for the course. To assess whether this is true, look at the table, which shows the job losses and job gains for comparable periods in the previous three recessions and recoveries. These are the periods following the 1981-82, 1990-91 and 2001 recessions. Since the data available in the current recovery are 66 months in length, we looked at job gains over the first 66 months of these previous three recoveries.

In the 1981-82 recession, the high-paying industries lost 9.2 percent of their jobs and the low-paying industries lost 0.1 percent. In the recovery following this deep recession, job growth in the high-paying industries was 13.1 percent. However, it was much stronger, 23.9 percent, in the low-paying industries. A similar pattern occurred in the 1990-91 recession and recovery: Low-paying industries experienced extremely modest job losses during the recession, but much stronger job gains during the recovery (compared with high-paying industries). The pattern changed beginning with the 2001 recession and recovery. Indeed, in the latest recession, the low-paying industries lost 4.6 percent of their jobs, much more than in the previous three recessions. Moreover, just as in the 2001 recession, the percentage growth in jobs in high-paying industries during the current recovery has exceeded the percentage change in job growth in the low-paying industries.

Thus, in contrast with the economic recoveries in the 1980s and 1990s, job growth in the past two recoveries has been characterized by faster job growth in high-paying industries and slower job growth in low-paying industries. Although more research will be needed to ascertain why this development has persisted for the past 14 years, one key difference is that real GDP growth during the 1980s and 1990s expansions was much stronger than the latter two episodes.

The Distribution of Average Real Wages in 2007 by Two-Digit NAICS Private Industries

SOURCES: Bureau of Labor Statistics, Bureau of Economic Analysis/Haver Analytics and authors' calculations.

NOTE: Industries with jobs above the real median wage in 2007 ("high-paying" jobs) are those with solid green bars, while those industries with jobs below the real median wage ("low-paying") are represented by blue, broken bars. NAICS stands for North American Industry Classification System.

Job Losses/Gains During Previous Recessions and Recoveries

Current Employment Statistics (CES) Data

| Percent Changes | ||

|---|---|---|

| Episode | "High-Paying" | "Low-Paying" |

| 1981-82 Recession and Recovery | ||

| Recession (Peak to Trough) | –9.2 | –0.1 |

| Recovery (Trough to t+66 months) | 13.1 | 23.9 |

| 1990-91 Recession and Recovery | ||

| Recession (Peak to Trough) | –3.3 | –0.4 |

| Recovery (Trough to t+66 months) | 6.6 | 14.4 |

| 2001 Recession and Recovery | ||

| Recession (Peak to Trough) | –2.3 | –1.4 |

| Recovery (Trough to t+66 months) | 7.3 | 4.2 |

| 2007-09 Recession and Recovery | ||

| Recession (Peak to Trough) | –9.7 | –4.6 |

| Recovery (Trough to t+66 months) | 9.9 | 8.9 |

| Averages, Recessions | –6.1 | –1.6 |

| Averages, Recoveries | 9.2 | 12.9 |

SOURCE: Authors' calculations.

Endnotes

- Annual rates of growth are compounded percentage changes for the period indicated. Thus, a 2.3 percent annual rate of growth from the second quarter of 2009 to the third quarter of 2014 is a more precise measure of growth than simply taking the percentage change over this period (12.9), divided by the number of quarters (21), and then multiplying by 4 to get an annual percent change. Such a calculation equals 2.5 percent per quarter (annualized). [back to text]

- Measured as the annualized growth of real potential GDP from 1982 to 2007. Real potential GDP is calculated by the Congressional Budget Office and is viewed as the level of real GDP that would prevail if all firms in the economy were producing at their normal capacity. [back to text]

- Average hourly earnings are for production and nonsupervisory employees in private-sector industries only. Hourly earnings also exclude many types of benefits, such as employer-paid health insurance premiums and employer contributions toward 401(k) retirement plans. [back to text]

- We chose 2007 under the assumption that the distribution of real wages within an industry was that which prevailed when the economy slowed and subsequently fell into a recession. In analysis not reported here, we looked at the distribution of average real wages for these 14 industries in 1981, 1990 and 2000. The distribution of high- to low real-wage industries changes very little across time. [back to text]

- Admittedly, using the industry average wage ignores the potentially large intra-industry distribution of wages. Another potential complication is that average hourly earnings series excludes supervisory employees, which could conceivably change the distribution reported in the figure. [back to text]

- The official National Bureau of Economic Research peak and trough dates do not exactly match the peak and trough dates of private nonfarm employment (jobs). Private-sector employment peaked at 115.977 million jobs in January 2008 and continued to fall until reaching its low point of 107.187 million in February 2010. [back to text]

- This will be part of our future research on this issue. [back to text]

References

Fernald, John; and Jones, Charles I. "The Future of Economic Growth," American Economic Review: Papers and Proceedings, May 2014, Vol. 104, No. 5, pp. 44-49.

Reinhart, Carmen; and Rogoff, Kenneth. "Recovery from Financial Crises: Evidence from 100 Episodes," American Economic Review: Papers and Proceedings, May 2014, Vol. 104, No. 5, pp. 50-55.

Baily, Martin Neil; and Taylor, John B. (eds.). Across the Divide: New Perspectives on the Financial Crisis. Hoover Institution Press, November 2014. PDFs of individual chapters available at www.hoover.org/research/across-great-divide-new-perspectives-financial-crisis-0.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us