Ask an Economist

Carlos Garriga has been an economist in the Research division of the Federal Reserve Bank of St. Louis since 2007. His main areas of interest are macroeconomics, public finance and financial economics. Garriga has studied the effects of mortgage innovations in the housing boom and the role of the housing market in the financial crisis. In his free time, he enjoys spending time with his family and any outdoor activity. See http://research.stlouisfed.org/econ/garriga for more on his work.

Q. What were some of the lasting effects caused by the recent

housing crisis?

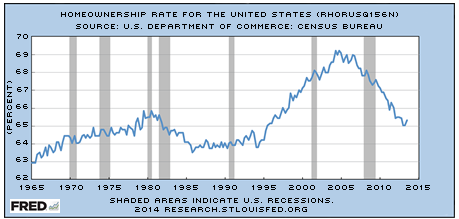

A.There are changes in regard to how people view the purchase of a home. In the past, people had this idea that you should try to buy a house as soon as possible. People had this idea that the price of a house could only go up. Today, people don't want to rush such an important decision, perhaps because of the fear of a decline in prices. Young households, in particular, are more reluctant to get into housing. In general, homeownership might not be a value for young people in the long run; if so, its reputation as a safe investment may be dramatically changing. Indeed, the rate of homeownership in the U.S. fell in 2013 to a level not seen since the 1990s. (See top chart.)

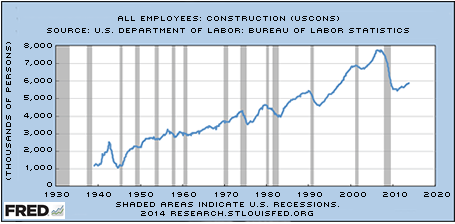

Another important effect is that the contribution of the construction sector to the rest of the economy is being reduced. This is more likely a short-term or medium-term effect. Construction is not employing as many people as in the past 10 years (see bottom chart), and that has a broader impact on the economy than many people realize. People in the construction sector buy a lot of resources from other sectors. When construction is down, other sectors suffer, and the effects can be quite sizable and enduring.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us