National Overview: A Spring-Loaded Economy?

2014 could be a watershed year for the U.S. economy. If the headwinds that have plagued the economy the past few years finally begin to wane, as many forecasters and financial market participants expect, then the economy could grow somewhere close to 3 percent. If so, real GDP growth in 2014 would be the best since 2005—and it would also likely generate continued improvement in labor market conditions. This outcome, though, depends crucially on the Fed's ability to keep inflation and inflation expectations stable at a time when the growth of the monetary base was on pace to increase by between 40 and 50 percent in 2013.

A Look Back at 2013

A year ago, the consensus of Blue Chip forecasters was that U.S. real gross domestic product (GDP) would increase by 2.2 percent in 2013, that headline consumer price index (CPI) inflation would be 1.9 percent and that the unemployment rate would average 7.5 percent during the fourth quarter of 2013.[1] Although fourth-quarter GDP data will not be published until late January 2014, some data in December has surprised to the upside. For example, the unemployment rate dropped below 7 percent in December, and some forecasters have raised their estimate of real GDP growth in the fourth quarter above 3 percent. However, forecasters did not foresee the sharp slowing in CPI inflation, which may end up about 1.25 percent in 2013.

After several years of forecasts that were generally too optimistic, the economy's actual performance was pretty close to expectations. Still, the economy faced several headwinds last year that have imparted a drag on growth.

Key Headwinds in 2013

Despite an extremely accommodative monetary policy and robust gains in housing construction and home sales, the economy struggled to build consistent momentum in 2013. Although the relatively weak growth of real GDP reflected many factors, three stood out. First, the pace of real personal consumption expenditures (PCE) steadily downshifted throughout the year. Although consumer outlays on durable goods like autos and household furnishings have been strong, expenditures on nondurables and services—together comprising nearly 90 percent of household expenditures—have been especially weak. This outcome is perhaps more puzzling considering the huge increase in household wealth during this business expansion. The slowdown in consumer spending in 2013 could have partly reflected the payroll tax increase in January 2013, which helped to reduce real after-tax income.

A second key reason for the economy's weaker-than-expected performance in 2013 was the exceedingly weak growth of real nonresidential (business) fixed investment. Through the first three quarters of 2013, real business fixed investment (BFI) in equipment and structures had only increased at a 1.5 percent annual rate. That puts it on track to be the weakest since 1986, excluding recession years. This development is all the more confusing given the backdrop of healthy profit margins and relatively low levels of financial market stress. Anecdotal evidence regularly reported in the minutes of the Federal Open Market Committee (FOMC) meetings suggests that many firms have been reluctant to commit to large capital outlays in the face of higher-than-usual amounts of uncertainty about economic policy or the growth of the economy.

A third reason for the relatively weak growth in real GDP has been the retrenchment in real federal government expenditures; those cutbacks reduced real GDP growth by an average of 0.3 percentage points per quarter for the first three quarters of 2013.

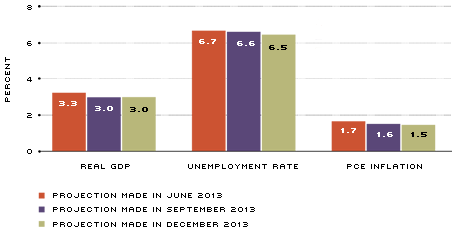

A Timeline of the FOMC's Economic Projections for 2014

NOTE: Projections are the midpoints of the central tendencies. The projections for real GDP and inflation are for the percentage change from the fourth quarter of 2013 to the fourth quarter of 2014. Inflation is measured by the personal consumption expenditures chain-price index. The projection for the unemployment rate in 2014 is for the average of the monthly rates in the fourth quarter of 2014.

The Outlook for 2014

FOMC participants see in the coming year faster growth of real GDP, further declines in the unemployment rate and continued modest inflation. (See chart.) This outcome seems reasonable given the following developments. First, real after-tax wages and salaries have started to increase from year-earlier levels. Further gains, bolstered by continued solid employment growth and stable gasoline prices, will help boost consumer spending, which appears to have been strong in the fourth quarter. Second, state and local finances have improved, and their expenditures are on pace to increase in 2013 for the first time in four years. Third, commercial and industrial construction activity is beginning to pick up, and the housing recovery shows few signs of faltering. Fourth, an improving global economy, continued healthy profit margins and waning levels of uncertainty should begin to boost business capital spending. Finally, continued confidence in the Fed's ability to manage its exit from unconventional policies will help to keep financial markets stable and, more importantly, inflation and inflation expectations in check. This outcome will be a further boost to business and household confidence.

Endnotes

- The forecasts for real GDP growth and CPI inflation are for the period from the fourth quarter of 2012 to the fourth quarter of 2013. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us