How Low Can You Go? Negative Interest Rates and Investors' Flight to Safety

Negative interest rates fascinate both professional economists and the public. Conventional wisdom is that interest rates earned on investments are never less than zero because investors could alternatively hold currency. Yet currency is not costless to hold: It is subject to theft and physical destruction, is expensive to safeguard in large amounts, is difficult to use for large and remote transactions, and, in large quantities, may be monitored by governments. Currency does not provide even a logical zero floor for market interest rates.

Interest rates come in two flavors. Nominal rates (or yields) refer to a periodic payment received by an investor relative to either the asset's principal (face) amount or its market price.1 Real rates refer to nominal rates minus the anticipated inflation rate. Each rate, at certain times and for certain securities, can be negative. Consider, for example, nominal Treasury notes and bonds, that is, securities not indexed for inflation. The yield to maturity on the 5-year Treasury note has been below 2 percent since July 2010, and the yield to maturity on the 10-year Treasury note has been below 2 percent since May 2012. Yet, looking forward, the Federal Open Market Committee in January 2012 announced an inflation target of 2 percent—implying an anticipated negative real yield over the life of the securities. Investors, facing uncertainty, appear willing to pay the U.S. government—when measured in real, ex post inflation-adjusted dollars—for the privilege of owning Treasury securities.

Nominal interest rates also, at times, are negative. Generally, each occurrence of a negative rate has its own special story. Most stories involve fear or uncertainty, with investors fleeing to perceived safer assets.

Our first example is very simple: negative interest rates on certain deposits in U.S. banks. These negative rates have been observed on large noninterest-bearing demand deposits insured by the Federal Deposit Insurance Corp. (FDIC) under its Transaction Account Guarantee (TAG) program. This program, authorized by the Wall Street Reform (Dodd-Frank) Act through year-end 2012, insures noninterest-bearing demand deposits without limit. Because banks perceive few investment opportunities for these deposits, they charge customers the cost of the FDIC insurance. Overall, customers receive a negative interest rate on their deposit—but also the safety of FDIC insurance. Anecdotal evidence suggests that many such deposits previously were held as shares in money market mutual funds, which have very low risk but are not federally insured.

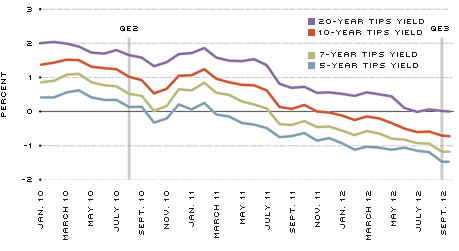

Our second example is U.S. Treasury inflation-protected securities (TIPS).2 The yield on the 5-year TIPS has been negative since March 2011, and yields on 7-year and 10-year TIPS have been negative since August and December 2011, respectively. The yield on the 20-year bond hovers near zero. (See Figure 1.)

U.S. Treasury Inflation-Protected Securities (TIPS) Yields

SOURCE: U.S. Treasury Department/Haver Analytics.

NOTE: QE=quantitative easing.

An illustration is helpful. Owners of Treasury notes and bonds of all types, including TIPS, receive every six months a fixed coupon payment—these coupons are always positive, never negative. A negative yield to maturity appears when a bond's price rises to lofty heights. Consider the TIPS bond issued Sept. 28, 2012, maturing on July 15, 2022, with a coupon rate of 0.125 percent (that is, investors receive semiannual coupon payments from the Treasury of 6.25 cents for each $100 invested). The price at auction was $108.52. If the bond were to repay $100 at maturity, the calculated yield to maturity would be –0.750 percent. Why would investors pay such a high price for the bond? One explanation is that they anticipate high inflation during the life of the bond: At maturity, the TIPS investor receives not $100 but $100 plus the accumulated inflation (measured by the all-items CPI). What expected inflation rate might justify the bond's price? As a benchmark for comparison, consider the nominal (not indexed) bond issued Sept. 17, 2012, maturing Aug. 15, 2022. At issue, its price was $98.74, implying a yield to maturity of 1.76 percent. The difference between the two yields is a measure of expected average annual inflation during the bonds' lifetimes, approximately 2.5 percent. The negative yield on the TIPS bond also reflects, in part, strong worldwide demand for the nominal Treasury bond. (The high price of the nominal bond pulls up the price of the TIPS bond.)

Negative rates also have been seen in Europe. First, consider the widely discussed negative policy rates set by two central banks: the Riksbank (Sweden) and the Danmarks Nationalbank (Denmark). Both banks set three policy rates (a term deposit rate, an overnight repo rate and a lending rate) and offer overnight and term deposits to commercial banks. The repo rate is the banks' "primary" policy tool; it has been consistently positive. At times, both banks have set their less-important term deposit rate at negative values. The Riksbank between July 8, 2009, and Sept. 7, 2010, set a rate for 7-day deposits at –0.25 percent. Although the rate attracted media attention, it meant nothing because banks historically have placed only very small amounts in term deposits. The Danmarks Nationalbank (DNB) in July 2012 set its 14-day deposit rate at –0.2 percent, seeking to repel currency inflows from the euro area. (Its repo rate is set at 0.20 percent.)

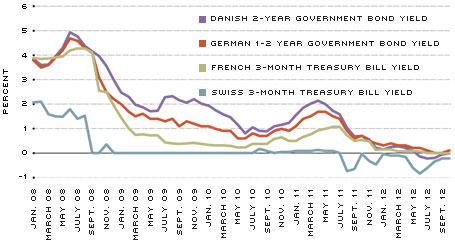

European Government Securities Yields

SOURCES: Danmarks Nationalbank, Deutsche Bundesbank, Bank of France, Swiss National Bank/Haver Analytics.

Second, consider yields on certain French, German, Danish and Swiss government securities. (See Figure 2.) Investors in the euro area seek safety—and appear willing to pay for it. Yields on Swiss 3-month treasury bills slipped negative in mid-2011, and yields on French 3-month treasury bills turned negative (albeit by only one basis point) in August 2012. Danish government bonds with two years to maturity have displayed negative yields to maturity since June 2012; yields on longer maturities are positive. Yields on German bonds with between one and two years to maturity fell to zero in August 2012 but have resisted going negative. In times of turmoil, investors accept zero or negative nominal yields as a fee for safety.

The above examples of negative central bank policy rates are newsworthy because they are unusual. Some analysts have argued that such examples suggest that central banks should consider setting negative policy rates, including negative rates on deposits held at the central bank. Such proposals are foolish for a number of reasons. First, a policy rate likely would be set to a negative value only when economic conditions are so weak that the central bank has previously reduced its policy rate to zero. Identifying creditworthy borrowers during such periods is unusually challenging. How strongly should banks during such a period be encouraged to expand lending? Second, negative central bank interest rates may be interpreted as a tax on banks—a tax that is highest during periods of quantitative easing (QE).3 Central banks typically implement QE policies via large-scale asset purchases. Sellers of these assets are paid in newly created central bank deposits, which, in due course, arrive in the accounts of commercial banks at the central bank. It is an axiom of central banking that the banking system itself cannot reduce the aggregate amount of its central bank deposits no matter how many loans are made because the funds loaned by one bank eventually are redeposited at another. Is it reasonable for the central bank to impose a tax on deposits held at the central bank when the central bank itself determines the amount of such deposits held by banks and the banking system? Perhaps these and other considerations caused European Central Bank President Mario Draghi in a recent press conference to label negative deposit rates "uncharted waters" and dismiss any possibility that the ECB would consider it.

In summary, in normal economic times, both nominal and real interest rates are positive. But in unusual times, negative nominal and real yields are not unusual. Both often reflect investors' flight to safety. The existence of negative yields, however, provides no support for the argument that central banks should consider negative policy rates as a monetary policy tool.

Endnotes

- Formulas for exact yield calculations are beyond the scope of this article. [back to text]

- Additional information regarding prices and yields on Treasury bonds is available at www.treasurydirect.gov [back to text]

- See Anderson et al. (2010) and Anderson (2012). [back to text]

References

Anderson, Richard; Gascon, Charles; and Liu, Yang. "Doubling Your Monetary Base and Surviving: Some International Experience." Federal Reserve Bank of St. Louis Review. November/December 2010. Vol. 92, No. 6, pp. 481-505.

Anderson, Richard G. "Quantitative Easing the Swedish Way." Federal Reserve Bank of St. Louis Economic Synopses. Nov. 16, 2012, No. 33. See http://research.stlouisfed.org/publications/es/article/9550

Draghi, Mario. Introductory statement at the press conference. Aug. 2, 2012. See www.ecb.int/press/pressconf/2012/html/is120802.en.html

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us