National Overview: Fiscal Uncertainty Clouds Outlook for Growth

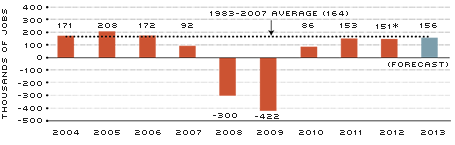

The U.S. economy continues to expand at a modest pace. By and large, businesses and consumers remain cautious spenders, although the housing sector is experiencing relatively strong growth. Average monthly job gains through the first 11 months of 2012 (151,000) were running about the same as the gains for all of 2011 (153,000). Still, the unemployment rate remains well above its natural rate. Despite last summer's drought, which caused some commodity prices to skyrocket, inflation pressures are generally in check. A wild card for the economy remains the near-term outlook for fiscal policy. Should the economy plunge over the so-called fiscal cliff, many forecasters expect a recession to follow shortly thereafter.

Nonfarm Employment Gains/Losses Per Month, 2004 to 2013

SOURCES: Bureau of Labor Statistics and Federal Reserve Bank of Philadelphia. *Through November.

Sluggish Growth ... Still

The economy is on track for the third consecutive year of real GDP growth of about 2 percent. After growing at a 1.6 percent annual rate over the first half of 2012, the U.S. economy grew at a healthy 3.1 percent annual rate in the third quarter. Heading into the fourth quarter of 2012, though, forecasts and key data flows pointed to a significant slowing in the pace of growth—perhaps to about 1.25 percent or less.

Early in the recovery, the economy benefited from a vigorous manufacturing sector, which was powered by strong growth of business capital spending and goods exports. These gains, however, were tempered by a moribund construction sector, which was reeling from the residential and commercial real estate bust.

But the tables have turned. Now, the residential housing sector is exhibiting strong growth, and the manufacturing sector is sputtering. Bolstered by low mortgage rates and relatively low prices, housing starts and home sales strengthened appreciably in 2012. With the inventory of new and previously-sold (existing) homes on the market dropping to levels last seen in late 2001, house prices are expected to continue rising, though at a modest pace.

Normally, rising house prices and a resurgence in homebuilding trigger a rapid rise in consumer expenditures on durable goods. And, indeed, consumer outlays for durable goods such as automobiles and appliances remained strong in the third quarter. Meanwhile, spending on services—the largest part of consumer spending—and nondurable goods remained rather tepid. Rising levels of consumer confidence and extremely low interest rates usually point to solid gains in household spending, but a continuation of modest after-tax real income growth will likely keep total consumer spending growing at a moderate pace.

Exports and business spending on capital goods (equipment, machinery and structures), which were sources of strength during much of this business expansion, slowed markedly in 2012. The downshift in business capital spending is especially significant because firms, being forward-looking, adjust their planned outlays in response to changing business conditions. With profit margins still relatively wide, much of the weakness in capital spending probably stems from relatively high levels of uncertainty about the fiscal cliff and its effects on the economy. A second concern is the soft global economy. Europe is in a recession, and several key Asian economies, which are important markets for U.S. manufacturers, have experienced weaker growth.

Going into 2013, uncertainty about the near-term outlook is, thus, higher than normal. Nevertheless, equity prices in 2012 were up by about 13 percent through the fourth week of December, financial stresses remained below average and commercial bank loan growth, while moderate, was on pace to post its largest increase in four years. In short, if the impediments that are restraining business capital spending and exports wane, then the economy could grow by more than expected in 2013. However, an extremely large federal budget deficit probably means that fiscal policy will contribute little, if any, to the economy's near-term growth.

Inflation

Inflation was relatively subdued in 2012. Through November, the headline Consumer Price Index (CPI) was on pace to rise by about 2 percent in 2012 after rising by 3 percent in 2011. This slowing occurred primarily because of smaller increases in food and energy prices. The slowing in food price inflation could be only temporary, thanks to last summer's drought. Faster global growth in 2013 and a further strengthening in the housing sector could also put upward pressure on inflation in the new year—the former because of rising energy and commodity prices, the latter because of upward pressure on rents (via rising home prices). Together, food, energy and the implicit rental cost facing households comprise slightly less than 50 percent of the CPI basket. For the present, the near-term inflation outlook remains fairly stable, and inflation expectations appear quiescent.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us