National Overview: The Economy Should Be Able To Avoid a Recession in 2012

Despite some persistent headwinds, the U.S. economy has strengthened modestly over the past three months and looks increasingly likely to strengthen further in 2012. Key developments in this regard have been a healthy rebound in business capital spending, strong corporate earnings, robust exports and a steady increase in private-sector employment. But the economy still faces some significant challenges. These include an unexpected increase in inflation over the first half of 2011, strains in global financial markets stemming from developments in Europe, a stubbornly high unemployment rate, and a housing market strained by high foreclosures and a large volume of unsold homes.

In short, while the late-summer recession scare appears to have been a false alarm, it may take awhile before the economy returns to full employment.

Better Data but Skittish Markets

The U.S. economy was extraordinarily weak over the first half of 2011. Part of this weakness stemmed from the lingering effects of the financial crisis and housing bust. However, some unexpected disturbances exacerbated the economy's lackluster growth and further eroded business and consumer confidence. These included higher oil and commodity prices and disruptions in the global automotive supply chain triggered by the Japanese earthquake in March. Just as these effects were beginning to wane, Europe's sovereign debt and banking crisis reignited in July. In response, stock prices fell sharply, and financial market volatility and stresses began to rise. By September, many economists were predicting a double-dip recession.

Despite the building storm clouds, key data were beginning to indicate a noticeable improvement in economic conditions over the second half of 2011. This improvement was confirmed when the Bureau of Economic Analysis reported that real GDP increased by 2.5 percent in the third quarter; this estimate was a little more than forecasters had expected. Although revised data subsequently lowered this estimate to 2 percent, the available data in October and November suggested that real GDP growth in the fourth quarter could exceed 3 percent. Importantly, first-time claims for unemployment insurance benefits continued to trend lower in early December, and nonfarm employment continued to rise. Through November 2011, private payrolls rose by about 160,000 per month, the largest average gain since 2006.

FOMC Economic Projections for 2012

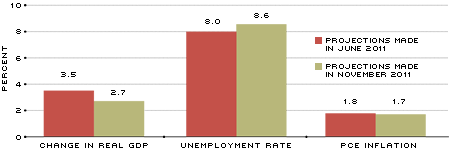

NOTE: Projections are the midpoints of the central tendencies. The forecast for the unemployment rate is for the average of the three months in the fourth quarter of 2012. The other variables are the forecasted change from the fourth quarter of 2011 to the fourth quarter of 2012. PCE is personal consumption expenditures.

SOURCE: Federal Open Market Committee.

The expenditure and output data have also been solid, as retail sales, new automotive sales and industrial production were relatively strong in October. Bank lending is also picking up, as commercial and industrial loans have risen by 9.5 percent over the past year (through November). Overall, as suggested by robust gains in the Index of Leading Economic Indicators, the economy was exhibiting a healthy degree of forward momentum in the fourth quarter of 2011. According to the November projections of FOMC participants, most expect GDP to increase by about 2.7 percent in 2012, about one percentage point more than what the FOMC projected for 2011.

But there remain some areas of concern. First, growth of real after-tax income has weakened measurably over the past year. Consumers have reduced their saving to maintain their desired level of spending. At some point, though, real incomes will need to rebound or consumer spending will weaken. Second, financial stresses remain elevated and market volatility has increased. Such an environment tends to breed uncertainty, causing firms and investors to become extra cautious about making longer-term commitments. Finally, house prices remain under downward pressure. Until house prices stabilize, buyers and builders will remain exceedingly cautious, even though key measures of housing affordability remain near record-high levels. For these reasons and more, the FOMC projects that the unemployment rate will remain about 8.5 percent at the end of 2012.

Some Good Inflation News

After measuring about 5.25 percent in the first quarter of 2011, the inflation rate (as measured by the annual rate of change in the consumer price index, or CPI) has steadily retreated. By the third quarter, the CPI inflation rate had declined to about 3 percent. Price pressures eased further in October because of falling energy prices and a sharply slower rate of increase in food prices.

As yet, neither forecasters nor financial markets seem too worried about inflation getting out of hand. At the end of November, market-based measures of inflation expectations over the next five and 10 years remained below 2 percent—roughly the same levels as a year earlier. For 2012, the FOMC expects that inflation, as measured by the change in the personal consumption expenditures (PCE) price index, will be between 1.5 percent and 2 percent.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us