Starting a Business During a Recovery: This Time, It's Different

The opening of new businesses is fundamental for U.S. employment growth. Businesses, small and large and of different ages, are constantly creating and destroying jobs. Profitable businesses stay in the market and expand, while the less-successful ones must consider downsizing or closing. These decisions, in turn, have a direct impact on the labor market. Amidst this job churn, it's important to remember that new businesses are the key to net job creation.

To illustrate the importance of startups, it is useful to consider a 2009 study that used data from the Business Dynamics Statistics (BDS), an annual series of data from the U.S. Census Bureau. The researchers found that, on average in 1980-2005, private-sector startup employment accounted for 3 percent of the overall employment every year.1 This may seem like a small fraction, but it becomes substantial when compared with the 1.8 percent average annual net employment growth during the same period.2 Similarly, researchers showed in another 2009 study that the youngest firms (less than 5 years old) accounted for almost the entire net job creation in 1980-2005.3

Examining the behavior of current business openings seems important to understanding the progress of employment recovery after the Great Recession. This will be the focus of this article.

Startups and the Business Cycle

Smaller firms—which are most likely younger as well4—are found to be less sensitive than large ones to business cycle conditions. A recent study found that in recessions prior to 2007, small businesses contracted slower during recessions and expanded faster during recoveries compared with large businesses, thus leading employment out of the recession. However, the same paper, using more-recent Business Employment Dynamics (BED) data, shows the opposite behaviors during the Great Recession. Small firms were more affected than large firms in terms of job creation and destruction.5

The last recession and the current recovery, thus, present special episodes to examine. Startup formation experienced a substantial decline up to the third quarter of 2009, according to BED data, which are published quarterly by the Bureau of Labor Statistics. By the beginning of 2010, the number of businesses exiting the market returned to prerecession levels, but the entry of new businesses still lagged behind.

The experience of business births and deaths varied across the U.S. Some regions faced little recovery, while other areas experienced growth in startups. The availability of state-level data on job creation and destruction allows for a regional examination of the current recovery.

Nation and District

BED data measure establishment births and deaths, as well as the subsequent creation and destruction of jobs.6 Births and deaths of businesses do not include temporary shutdowns or seasonal reopenings. Thus, a business must be closed for a year to be considered as a death and not a temporary shutdown. This, in turn, restricts the availability of business death data up to the beginning of 2010. Historically, the level of business births has been greater than deaths during economic recoveries. After the Great Recession, however, this process has been delayed by the slower growth of startups.

Business Deaths and Births

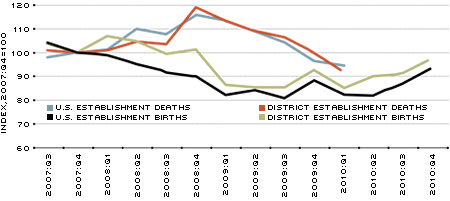

SOURCE: Business Employment Dynamics (BED), Bureau of Labor Statistics (BLS). Last observation: 2010:Q4 for establishment births and 2010:Q1 for establishment deaths.

Figure 1 shows establishment births and deaths normalized so that 2007:Q4=100. The Eighth District data reflect totals for the entire seven states in the District, even though parts of some states are actually in other Federal Reserve districts.

Figure 1 displays business births and deaths for the nation and the Eighth District.7 They are normalized so that the peak previous to the Great Recession is equal to 100. The main message to take away is that the Eighth District behaves similarly to the nation, with startup growth in the District being slightly higher. This is reasonable since the District's states account for a substantial amount of national business births—about 11.6 percent—and deaths—11.9 percent.

By 2010:Q1, business deaths fell to prerecession levels for both the nation and the District. Slow business formation, however, has delayed the closing of the gap between establishments' exit and entry levels. In 2010:Q4, for the nation and the District, startup levels were still 6.2 percent and 2.4 percent below the prerecession peak, respectively.

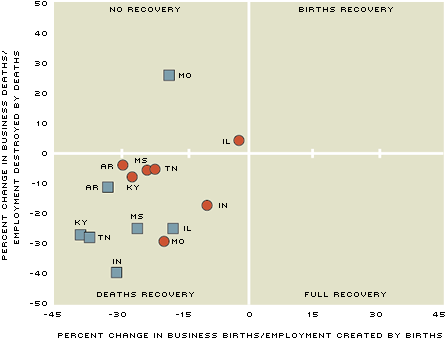

Job creation and destruction have varied across states. Figure 2 displays the relative degrees of recovery of each state in the Eighth District as measured by establishment creation and destruction (represented by red circles), as well as job creation by new businesses and job destruction by businesses that have shut down (represented by blue squares). The horizontal axis shows the percent change from 2007:Q4 to 2010:Q1 of business formation and the employment generated by those startups.

Figure 2

Percent Change since Start of Recession

Figure 2 displays the relative recovery of Eighth District states in terms of establishment births and deaths (red circles) and their subsequent employment creation and destruction (blue squares). Percent change was calculated since the peak of the recession, 2007:Q4, to 2010:Q1.

SOURCES: Business Employment Dynamics, Bureau of Labor Statistics.

Thus, a state with positive business openings and positive employment creation will have recovered in startup creation activity. The vertical axis shows the percent change of business deaths and the subsequent employment destruction during the same period. With this structure in mind, states located in the lower-right quadrant experienced full recovery, while states in the upper-left quadrant displayed no signs of recovery. States in the other two quadrants exhibited partial recovery in either business births or deaths.

Based on these measures, the main finding is that the great majority of states in the District have been in a partial recovery stage. In these states, business deaths are back to prerecession levels, but there is still little startup growth. Similarly, jobs destroyed by shutdowns are back to prerecession levels, but there is still weak employment creation from startups. Among these states, Kentucky, Tennessee, Arkansas, Mississippi and Indiana are experiencing a slower recovery in terms of employment creation than in terms of startup creation.

Meanwhile, Missouri experienced a decrease of 18.4 percent in employment created by startup openings and an increase of 25.6 percent in employment destroyed by business deaths. This means that this state was actually worse off in 2010:Q1 than at the beginning of the recession in employment creation and destruction.

Illinois displays partial recovery for employment dynamics but no recovery in terms of business entry and exit. Although there was a decrease in employment destruction, there still was a slow recovery of business exit levels in this state. Up until 2010:Q1, no state in the Eighth District had reached full recovery.

Is the asymmetric behavior of entry and exit of businesses described above a symptom of credit frictions? Maybe. If credit were scarce, new businesses and potential entrants would suffer more than existing firms. While older establishments have had time to accumulate enough retained earnings, the startups rely more heavily on external finance (home equity lines, credit cards, etc.). Another factor that may be affecting business entry levels is uncertainty. Incumbent establishments facing uncertainty may stay in the market and reduce investment. Instead, potential entrepreneurs may decide to postpone their decision of starting new businesses.

Whatever the reason for the slow recovery of establishments' births, the strong link between this variable and employment growth in previous recoveries suggests that the progress of startup entry must be closely followed to characterize the ongoing economic recovery of the District and the nation.

Endnotes

- See Haltiwanger et al. 2009 [back to text]

- This analysis considers just the U.S. private sector. [back to text]

- See Stangler and Litan. [back to text]

- Evidence of this can be found in Business Dynamics Statistics data, U.S. Census Bureau. [back to text]

- The authors of the paper defined small firms as those with fewer than 50 employees and large firms as those with more than 1,000 employees. [back to text]

- Births are establishments either with positive employment for the first time in the current quarter and with no links to the previous quarter or with positive employment in the current quarter following zero employment in the previous four consecutive quarters. Deaths are defined as establishments with no employment or zero employment reported for four consecutive quarters following the last quarter with positive employment. Births are a subset of openings, and deaths are a subset of closings. They do not include reopenings of seasonal businesses or temporary shutdowns. [back to text]

- District is defined as the sum of the Eighth District states. Throughout this analysis, states are considered as a whole. Thus, some regions analyzed here are part of neighboring Federal Reserve districts since district borders don't always coincide with state borders. See District map. [back to text]

References

Haltiwanger, John C.; Jarmin, Ron S.; and Miranda, Javier. "Who Creates Jobs? Small vs. Large vs. Young." National Bureau of Economic Research Working Paper No. 16300, August 2010. See www.nber.org/papers/w16300

Haltiwanger, John C.; Jarmin, Ron S.; and Miranda, Javier. "Jobs Created from Business Startups in the United States." Kauffman Foundation Research Series, January 2009. See www.kauffman.org/what-we-do/research/business-dynamics-statistics/business-dynamics-statistics-briefing-jobs-created-from-business-startups-in-the-united-states

Kane, Tim. "The Importance of Startups in Job Creation and Destruction," Kauffman Foundation Research Series. July 2010. See www.kauffman.org/what-we-do/research/firm-formation-and-growth-series/the-importance-of-startups-in-job-creation-and-job-destruction

Moscarini, Giuseppe; and Postel-Vinay, Fabien. "Large Employers Are More Cyclically Sensitive." National Bureau of Economic Research Working Paper No. 14740, February 2009. See www.nber.org/papers/w14740

Stangler, Dane; and Litan, Robert. "Where Will the Jobs Come From?" Kauffman Foundation Research Series, November 2009. See www.kauffman.org/what-we-do/research/firm-formation-and-growth-series/where-will-the-jobs-come-from

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us