Emerging Markets: A Source of and Destination for Capital

Emerging markets are increasingly becoming a source of growth in the complex global economy. Brazil, Russia, India, Indonesia, China and South Korea are projected to account for approximately 45 percent of the global output by the year 2025, up from 37 percent in 2011, according to a report from the International Monetary Fund.1

Although there are varying definitions of what precisely is an emerging market, in general, countries that experience significant growth in GDP and infrastructure are given this distinction.2 Emerging markets typically have lower per capita GDP and have enacted structural economic reforms in an effort to grow rapidly and to catch up with more-developed nations. A natural consequence of this has been the growth of capital markets and the increasing capital flows to and from these countries.

In what follows, we make a very preliminary study of the trends in capital flows to and from emerging markets over the past couple of decades.

Half the World's People

The countries on our list of emerging markets make up a sizable portion of the world's population. They had roughly 3.6 billion inhabitants as of 2010, most of whom reside in China or India, according to population estimates from the U.N. Department of Economic and Social Affairs. This total represents about 52 percent of the global population and is expected to grow.

Before the financial crisis of 2007-2009, emerging markets had significantly higher growth rates compared with the rates in countries that belong to the Organisation for Economic Co-operation and Development (OECD), whose members are usually considered to be more developed. However, the financial crisis had a large impact on both OECD countries and emerging markets. Although emerging markets as a whole witnessed slower growth during the downturn, they did not see a wholesale contraction in economic activity as their OECD counterparts witnessed.

Types of Capital Flows

An engine of growth for emerging markets, capital flows are typically broken into two principal categories: foreign portfolio investment (FPI) and foreign direct investment (FDI). In spirit, FPI is investment that is made without gaining a controlling interest in the entity receiving the funds. It is an investment in an asset for the purpose of earning a return (e.g., the purchase of corporate or government securities or bonds). FDI entails some sort of ownership or controlling stake (e.g., investing in a factory or land). In general, the benchmark for FDI is if an investor takes at least a 10 percent controlling stake in the target entity. This essay focuses more attention on FDI because of its stronger links to growth and employment.

FDI cultivates development because, in addition to the resources that it provides developing economies, it gives them the opportunity to "learn by doing," which leads to growth-enhancing innovation and spillovers. Over the past couple of decades, the share of FDI in total foreign equity flows has been larger for developing countries than for developed countries.3 Arguably, the causality runs both ways: Those engaging in FDI are more likely to target countries with greater growth potential.

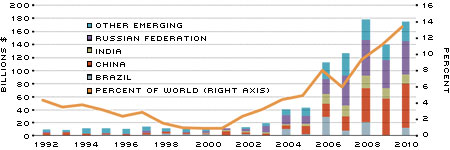

Emerging Markets' Outward Flows of Foreign Direct Investment

SOURCE: United Nations Conference on Trade and Development.

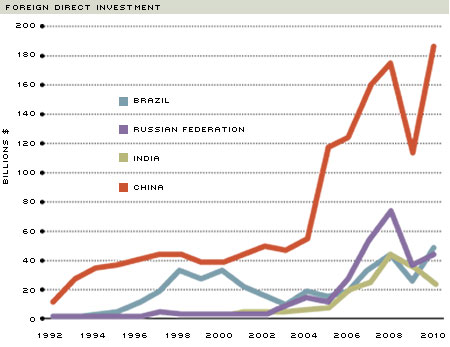

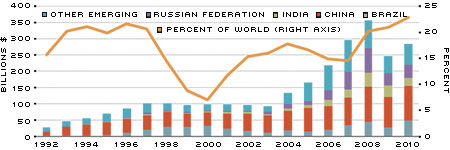

Emerging Markets' Inward Flows of Foreign Direct Investment

SOURCE: United Nations Conference on Trade and Development.

Figures 1 and 2 highlight the important trends in emerging markets' inflows and outflows of FDI. First, the absolute values of FDI into and out of emerging markets have shown a phenomenal increase since 2000. This is just another piece of evidence of the importance of emerging markets in an increasingly globalized world. Second, within emerging markets, the relative shares of individual countries' FDI flows have remained fairly stable. China appears to play a prime role in both the inflow and outflow of FDI. Brazil appears to be a major destination for FDI inflows, whereas Russia appears to be a major source of FDI outflows. Third, during 1993-1997, emerging markets accounted for over 20 percent of the share of global FDI inflows. The financial crisis in East Asia and the Russian Federation in 1998 saw a collapse in this share. This has been followed by a steady recovery since 2000. The share of FDI inflows into emerging markets now stands near the precrisis peak of the mid-1990s.

Other trends of global FDI flows have gained significant attention in recent years. Historically, the direction of capital flows has been from the developed nations to emerging markets. In the mid-1990s, while the share of FDI into emerging markets was in excess of 20 percent of global FDI inflows, the share of FDI outflows from emerging markets was less than 5 percent. Moreover, this share witnessed a decline in the aftermath of the Asian crisis. In contrast, from 2001 through 2010, emerging markets increased their global outward investment share from about 1 percent to about 14 percent. Advanced economies were not the only recipients of these investments: Low-income countries saw increased capital flows due to the emerging economies' presence in global capital markets.4 It is important to note that the increase in the global percentage metric is due, in part, to the significant decrease in the outward FDI from OECD countries after the financial crisis of 2007-2008.

Volatility

Because of their direct links to factors of production, FDI is generally presumed to be less volatile in comparison with FPI. By taking a direct and controlling stake, FDI allows the investor to overcome information and control problems between managers and owners. On the other hand, FPI is viewed at times as "ownership without control." Although this feature may not reduce the information and control problems of the FPI investor, it has important implications for the resale of the investment. Should the need arise to resell the investment, a well-informed FDI investor faces a classic lemons problem in attracting potential buyers. In contrast, the FPI stakes are relatively easier to sell—a rationale for their high volatility.5

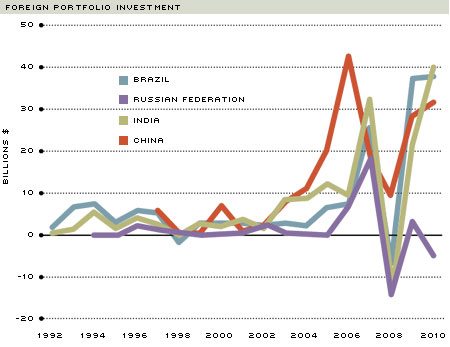

As evidence of higher volatility, we look at the trends of inflows of FDI and FPI in four prominent emerging markets from 1992 through 2010. These are Brazil, Russia, India and China, popularly denoted by the acronym BRIC. (See Figure 3.) Noticeably, both FDI and FPI have witnessed strong growth since 2000 in BRIC countries. Clearly, flows of FDI slowed considerably after the U.S. financial crisis of 2007-2008, largely due to a reduction in growth projections. Importantly, a sharp reversal of FPI resulted in the aftermath of the global financial crisis. Although the FPI flows have returned once again to their precrisis levels, Figure 3 shows why it is not difficult to see why FPI is considered the more volatile segment of capital flows.

Capital flows both into and out of emerging markets are playing a larger role in the global marketplace. As these economies continue to grow at a rapid pace, it will be interesting to see the course charted by inflows and outflows of FDI and FPI as capital markets continue to evolve.

Endnotes

- See IMF. [back to text]

- We distinguish the following countries as emerging markets: Brazil, China, Egypt, India, Indonesia, the Philippines, Russia, South Africa, Turkey, Thailand, Poland, Peru and Malaysia. Many vendors, such as S&P, Dow Jones and FTSE, keep country lists according to their definition of emerging markets. Our choice of countries is derived from such lists by including countries that are common to most lists. Details of this selection procedure are available on request. [back to text]

- See Goldstein and Razin. [back to text]

- See Dabla-Norris et al. [back to text]

- See Goldstein and Razin. [back to text]

References

Dabla-Norris, Era; Honda, Jiro; Lahrech, Amina; and Verdier, Genevieve. "FDI Flows to Low-Income Countries: Global Drivers and Growth Implications." IMF working paper, June 2010.

Goldstein, Itay; and Razin, Assaf. "An Information-Based Trade off Between Foreign Direct Investment and Foreign Portfolio Investment." Journal of International Economics, Vol. 70, No. 1, 2006, pp. 271-95.

International Monetary Fund. "Global Development Horizons: Multipolarity: The New Global Economy." 2011.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us