National Overview: Forecasters Expect Solid Growth, Low Inflation in 2011

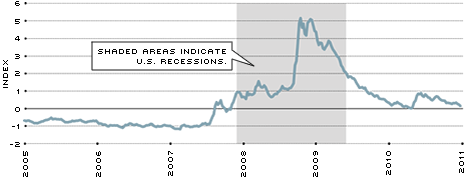

St. Louis Financial Stress Index

SOURCE: The St. Louis financial stress index, as of Dec. 24, 2010. Updates can be

seen on the St. Louis Fed's FRED (Federal Reserve Economic Data) web site.

See http://research.stlouisfed.org/fred2/

The U.S. economy's recovery from the 2007-2009 recession is lethargic by historical standards. Job gains remain disappointingly weak, and most forecasters expect to see only a grudgingly slow decline in the unemployment rate over the next year or two. Moreover, many in the business and financial community have regularly cited uncertainty about the economic and political landscape as a reason for their reluctance to hire, invest and lend.

That said, business conditions are on the mend and economic activity is expanding at a modest pace. Eventually, uncertainty will ebb, paving the way for rising levels of employment and real incomes. This dynamic will be assisted importantly by the economy's natural recuperative forces, improvements in financial market conditions and an expansion of the global economy.

On balance, the U.S. economy should surpass its long-run growth rate sometime

in 2011, with continued low and stable inflation. But there are risks. These include the possibility of spending cuts and higher taxes to reduce yawning budget deficits at the federal, state and local levels. In addition, because of the size of the Fed's balance sheet and rising commodity prices, there is an unusually large amount of disagreement among forecasters about the direction of inflation over the next few years.

Hurdles Become Lower

Construction remains the economy's soft spot. In a typical economic recovery, housing construction is a key driver of growth. Because of the housing bust and the large number of foreclosures, there is a sizable inventory of houses for sale, limiting the need for new construction. This supply also helps put downward pressure on house prices. Recently, however, home sales and new housing starts have stabilized at a low level, which is the first step toward recovery.

Meanwhile, vacancy rates on commercial and industrial properties are quite high because there was also a boom and bust in commercial construction. There is, thus, no pressing need today for the speculative building in commercial real estate that typically occurs during a recovery.

Other aspects of the economy look markedly better. Consumer spending in the third quarter of 2010 advanced at about a 2.75 percent annual rate, and early indications suggest continued solid gains in the fourth quarter. Likewise, business spending on equipment and software was quite vibrant going into the end of 2010, providing a boost to the manufacturing sector. Business capital spending has been bolstered by continued solid growth in exports, healthy profits and a relatively low cost of capital.

Financial conditions have also improved significantly over the past year, according

to the St. Louis Fed's financial stress index. Yields on long-term Treasury securities and mortgages are down appreciably from a year earlier, while stock prices have risen sharply. As yet, though, bank lending remains relatively weak. Part of the weakness in demand for consumer loans reflects a renewed preference among households for saving and debt retirement. Business lending remains weak, in part, because many nonfinancial firms remain flush with cash. Also, there appears to be a general unwillingness among consumers and businesses to borrow aggressively in the face of a weak economy and lackluster employment growth.

Inflation Remains Tame

Inflation was on a downward track in 2010. For the 12 months ending in November 2010, the consumer price index (CPI) increased by about 1 percent; core CPI (excluding food and energy prices) increased by 0.7 percent. The pronounced slowing in the core inflation rate worries some Federal Reserve officials since it conjures up parallels with Japan's long bout with deflation. Accordingly, with the economy growing at a subpar rate, the Federal Open Market Committee announced Nov. 3 that it intends to buy up to $600 billion of U.S. Treasury securities by June 30, 2011.

Most Fed officials believe that the potential growth-enhancing benefits of this decision outweigh the possibility of a rise in inflation and inflation expectations. In general, though, the consensus of most forecasters is that this new round of Treasury purchases will have, at best, only a modest effect on economic activity. The consensus of the forecasters is that CPI inflation will continue to be relatively low and stable (about 1.5 to 2 percent) this year. However, there is considerably more disagreement about the direction of inflation over the next 2-5 years. This is yet another layer of uncertainty that the U.S. economy must overcome.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us