A Closer Look: Assistance Programs in the Wake of the Crisis

During the financial crisis of 2007-2009, the Treasury, the Federal Reserve and the Federal Deposit Insurance Corp. (FDIC) extended unprecedented amounts of assistance to banks, government housing agencies, auto manufacturers, individual homeowners and others. Controversy surrounds such assistance. Opponents pejoratively refer to the assistance as "bailouts," arguing that billions of tax dollars were given to poorly managed but politically well-connected firms. They dismiss assertions that millions of jobs would have been lost for as long as a decade if certain large firms had ceased operation, believing that American entrepreneurs would have quickly started new businesses to employ such workers. Proponents argue the assistance was carefully structured, was provided primarily to viable firms whose principal sin was to be adversely affected by the financial crisis and, in cases of assistance to insolvent firms, was carefully collateralized so as to recover the maximum amounts after the crisis. Further, they argue, assistance in a panic (such as the autumn of 2008) is unquestionably the correct policy because a shallower recession and faster recovery benefit all American wage earners—and taxpayers. The truth, of course, is somewhere in between.

Are Bailouts Ever Wise?

A well-functioning (and well-regulated) financial system is essential in any economy that seeks to provide its citizens a high standard of living. Yet, inherent in financial systems is risk, including the risk of major financial panics. At such times, wisely administered government assistance is essential for both financial and nonfinancial firms.

Not all bailouts are wise. A firm that fails during normal economic times due to poor management, inadequate capital investment or excessive risk-taking should be allowed to fail (absent concerns regarding national security). To do otherwise is the equivalent of counseling managers and entrepreneurs that taxpayers stand ready to backstop their failures.

But failure during periods of extreme financial stress differs. The historical record suggests that judicious "bailouts" (we prefer the term "assistance") during periods of financial stress are economically efficient and can benefit both employees and taxpayers.

Critics of assistance argue that prudent managers of both financial and nonfinancial firms should maintain adequate liquidity at all times so as to survive any adverse shock—if not, then failure is their proper Darwinian fate, and the economy is strengthened by their demise. For modern economies, this argument is naïve—and false. The simplest argument is the most powerful: Virtually all businesses depend on borrowing capital against collateral, but in times of financial stress it often is impossible to determine prices for such collateral. This observation underlies Walter Bagehot's dictum in his 1873 book Lombard Street that in times of financial crisis a central bank must lend against any and all collateral, even if its value may be questionable.1 Assistance is wise until such time as cooler heads, in less tumult, can sort through the problem.

Often overlooked by these same critics is the alternative: an even more-heavily regulated economy, so battened-down against all perils that it fails to provide the maximum standard of living for its citizens. Yes, assistance programs of the past couple of years have placed large sums of taxpayer money at risk—but it must be remembered that these firms employ taxpayers, buy products and services from other taxpayers, and are owned by taxpayers.

Assistance programs, even in financial crises, should be judicious, transparent and granted at arm's length as much as possible. Legitimate questions can be asked whether terms of the 2007-2009 assistance were sufficiently onerous to ward off moral hazard. We believe they were. In many cases, firms' owners (the shareholders) were wiped out and senior managers were replaced. Admittedly, in other cases (and especially cases where banks borrowed from the Federal Reserve), senior managers and stockholders remain whole, or nearly so.

How Costly Are Bailouts?

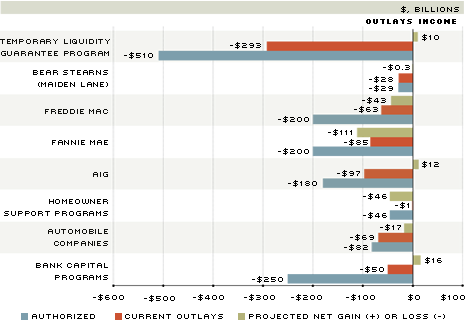

A person who receives his information primarily from news broadcasts might be forgiven for believing that "trillions of dollars" of taxpayer funds have been lost in bailouts. In fact, the assistance programs of the Federal Reserve and FDIC have earned significant profits, and the Treasury's programs—except for those related directly to the housing markets—are projected to incur no more than small losses. Significant losses, as we discuss later, are confined to the federal housing government-sponsored enterprises (Fannie Mae and Freddie Mac) and to the efforts to assist individual mortgage holders threatened with foreclosure.

At their core, assistance programs are of value to firms (and the economy) because they buy risk (that is, bear risk) at prices that the free-market, during times of financial crisis, is unwilling to pay. (An assistance program that places no taxpayer funds at risk is useless to the economy.) Measured by the aggregate number of dollars initially set aside, Treasury, Federal Reserve and FDIC assistance programs risked nearly $3 trillion. Federal Reserve short-term collateralized lending to banks comprised approximately half. The Treasury operated 13 programs of varying sizes, all funded by the $700 billion Troubled Asset Relief Program (TARP) funds authorized by Congress in late September 2008.

The Federal Reserve operated two broad categories of programs: lending to depository institutions and extraordinary lending to nondepository financial institutions. Fed lending to depository institutions was at market interest rates and fully collateralized. In a recent study, the Congressional Budget Office concluded that these programs provided no subsidy to banks because the interest rate was set in an open auction.2 Some critics have argued that Fed lending "bailed out" imprudent banks, whose managers had over-invested in high-yielding but illiquid assets. It may be true for a few banks, but there is no evidence that it is true for many.

The FDIC initiated its principal program, the Temporary Liquidity Guarantee Program, on Oct. 14, 2008. One part of that program provided unlimited deposit insurance for certain noninterest-bearing accounts, usually held by businesses. Its intent was to calm fears that depositors might move deposits from smaller to larger banks (perceiving these as less likely to be allowed to fail) or might move deposits from banks into money market mutual funds after the regulators had provided de facto unlimited insurance to these funds. The second feature of the FDIC program was to allow banks that found debt markets inhospitable to roll maturing senior debt into new issues fully guaranteed by the FDIC.3

Figure 1 summarizes into eight categories the assistance programs of the Federal Reserve, Treasury and FDIC.4 For each category, the blue bar measures the total funds authorized, the red bar shows current outlays and the green bar shows the projected net gain (positive values) or loss (negative values). In most categories, the net outlay (taxpayer cost) is small relative to initial program size.

Outlays and Projected Gains or Losses on Selected Programs

NOTES and SOURCES: Current outlays are cumulative outlays minus repayments, interest, fees and dividends. The values reported in the chart are from the following government reports: Temporary Liquidity Guarantee Program, Congressional Oversight Panel (2010, Figure 40); Bear Stearns (Maiden Lane), FRB H.4.1 Table 1; Freddie Mac/Fannie Mae, FHFA (2010, Figure 6); AIG, U.S. Treasury (2010b); Homeowner Support Programs, SIGTARP (2010, p. 49); Automobile Companies, SIGTARP (2010, Table 2.35) U.S. Treasury (2010a, Figure 2-B); Bank Capital Programs, U.S. Treasury (2010a, pp. 22-29).

Assistance to Banks

Assistance to banks was in three parts. First, the Treasury advanced $205 billion between October 2008 and December 2009 to 707 financial institutions in 48 states, in amounts ranging from $300,000 to $25 million, and at interest rates between 5 and 7.7 percent (increasing to 9 to 13.8 percent after five years). Each advance was secured by preferred stock or debt securities, plus warrants that permitted the Treasury to buy common shares. As of Sept. 30, 2010, three-quarters ($152 billion) had been repaid, plus an additional $21 billion had been received in dividends and interest and from the sale of warrants; $3 billion had been written off due to failed companies.5

The second part of Treasury assistance came in January 2009, when the Treasury advanced $20 billion each to Citibank and Bank of America. These loans were short-

lived: Both were repaid in full by December 2009. (In addition, the Treasury received

$3 billion in interest.6)

In the third part, also in January 2009, the Treasury, Federal Reserve and FDIC jointly guaranteed losses on $118 billion and $301 billion of shaky assets held, respectively, by Bank of America and Citicorp. Again, the assistance was short-lived: Bank of America terminated the agreement six months later, paying the Treasury a $425 million termination fee despite never having received any funds from the Treasury. Citicorp's guarantee line remains open. At inception, to secure the guarantee, Citicorp paid the Treasury $7.1 billion in preferred stock (with an 8 percent dividend), plus warrants for 66.5 million common shares. Through Sept. 30, 2010, the Treasury had received $440 million in stock dividends from Citicorp, despite Citicorp not requesting any funds from the Treasury, and the sale of the common shares is expected to bring a profit of $12 billion.7

The Federal Reserve's largest lending program was the Term Auction Facility (TAF), which auctioned to banks each week the right to borrow funds from the Federal Reserve. All borrowing was fully collateralized, the Fed incurred no risk and suffered no losses, and there were no expenditures except administrative costs—hence, the TAF is not included in Figure 1. The TAF began December 2007 and ended April 2010.

Perhaps the Fed's most controversial program was Maiden Lane I (ML I), created March 14, 2008, to assist the acquisition by J.P. Morgan Chase (JPMC) of the failed Bear Stearns and Co. Regulators believed that financial markets would be harmed grievously if Bear Stearns' primary businesses (collateral and market-clearing services, particularly for Far East customers) were unavailable on that Monday morning. Some $30 billion of Bear Stearns' shakiest assets were placed into ML I, funded by a loan from the Federal Reserve Bank of New York. It was agreed that JPMC would absorb the first $1 billion of losses on these assets, with the Fed absorbing the excess. Valued at market prices as of Nov. 17, the value of the assets is more than sufficient to repay 100 percent of its loan to the New York Fed and 94 percent to JPMC.

Assistance to Insurance Companies

The Treasury and the Federal Reserve assisted a number of insurance companies

—most visibly AIG. Assistance to firms other than AIG consisted largely of the

Federal Reserve strengthening market confidence in the firms by approving their applications to become bank holding companies. For AIG, assistance began in September 2008 with a collateralized Federal Reserve loan of $85 billion. On Nov. 25, 2008, the Treasury bought $40 billion of newly issued AIG preferred stock, the proceeds used to repay a portion of the Federal Reserve loan. On April 17, 2009, the Treasury created a $29.8 billion equity capital facility for AIG, of which the firm has drawn one-quarter. As of Sept. 30, 2010, the Treasury's assistance to AIG was $69.8 billion. In exchange, Treasury held a 79 percent ownership stake and had announced its intention to increase its stake to 92 percent through a conversion of debt and preferred shares to common equity.

The Federal Reserve also assisted AIG during the autumn of 2008 via the creation of the special purpose firms Maiden Lane II and III. Using $70 billion borrowed from the Federal Reserve Bank of New York, these firms strengthened AIG by buying certain shaky AIG liabilities. (ML II assumed the remainder of the September 2008 loan; ML III bought certain AIG liabilities in the open market.) As of November 2010, both Maiden Lane II and III showed profits on their investments due to increased market prices of the purchased assets.

Analysts differ widely regarding the Treasury's likely recovery of its assistance to AIG; how much is recovered depends on projections for AIG's earnings and stock price. If the Treasury sells eventually its common equity at the current market price of AIG common stock (approximately $40 a share), the net loss might be as small as $5 billion. More-pessimistic projections are a loss of $25 billion.

Was assistance to AIG wise? Assistance shielded customers, including thousands

of households and both large and small businesses (many U.S. taxpayers), from

disruption and loss. Assuming the Treasury converts its debt to equity, AIG's extant shareholders will hold only 8 percent. Senior management has resigned. AIG's bondholders, however, certainly benefited from the firm's avoidance of bankruptcy.

Assistance to Fannie, Freddie

The Treasury's most expensive program to date is assistance to Fannie Mae and Freddie Mac, which were placed into conservatorship Sept. 7, 2008, after losses overwhelmed their small capital bases. The Treasury has injected capital by buying newly issued senior preferred stock. As of June 30, 2010, the Treasury had invested $148 billion, roughly equal to the firms' losses.8 Recent best- and worst-case projections, respectively, are for additional Treasury purchases of between $73 billion and $215 billion, with a net loss to the Treasury through 2013 of between $135 billion and $259 billion.

Treasury's assistance did not bail out the firms' owners. Shareholders' $36 billion in equity held at the time of conservatorship is now worthless; the primary losers are smaller commercial banks and retirement/pension funds. No losses were imposed, however, on holders of the firms' debt ($1.8 billion) and guaranteed mortgage-backed securities ($3.8 billion); these owners include households, state and local governments, banks, security brokers, insurance companies, and pension and mutual funds.

Assistance to the Auto Industry9

The Treasury assisted both General Motors and Chrysler during 2008. Critics of assistance argued that these firms were ill-managed and should cease operation. Supporters argued that up to 3 million jobs would be lost if the firms closed and that a decade might pass before these workers would become re-employed. For GM, the Treasury lent $49.5 billion in exchange for $6.7 billion in debt (now repaid), $2.1 billion in preferred stock and a 61 percent common equity stake. For Chrysler, the Treasury lent $12.5 billion and received a 9.9 percent common equity stake.

The Treasury also assisted auto-lending firms GMAC (now Ally Financial) and Chrysler Financial. The Treasury lent GMAC $17.2 billion in exchange for a 56.3 percent common equity stake, $2.7 billion in trust preferred securities and $11.4 billion in preferred shares. The Treasury lent $1.5 billion to Chrysler Financial, which was fully repaid in July 2009.

The Treasury's assistance did not bail out the owners—all shareholders' equity in the old GM and Chrysler was extinguished in bankruptcy. Owners of bonds—individuals and institutions—also suffered losses in bankruptcy, averaging approximately 70 percent of their investments.

In total, the Treasury assisted the industry with $81.7 billion, of which $11.2 billion had been repaid and $2.9 billion had been received in dividends, interest and fees as of Sept. 30. The Treasury recouped an additional $14 billion from GM's public stock offering in November. The projected eventual loss on auto industry assistance is $17 billion. Although a profit on GM is possible, this depends on the stock's price at the time of sale. The Treasury's break-even price, relative to the assistance provided, is roughly $57 per share.

Assistance to Homeowners

Potentially the Treasury's second most expensive programs (after Fannie Mae and Freddie Mac) are the homeowner support programs, for which the Treasury has pledged $45.6 billion to foreclosure mitigation.10 As of Sept. 30, 2010, some 207,000 permanent loan modifications had been completed at a cost of $540 million. Although individual mortgage borrowers are the program's most visible beneficiaries, perhaps equally important are the holders of the related mortgage-backed securities: They risk losses as high as 70 percent if properties are foreclosed. Ironically, the largest single amount (more than $7.5 billion) has been pledged to Countrywide Home Loans Servicing and to Bank of America, both previously large subprime lenders.11 Because this program's funds assist borrowers to make permanent changes in their mortgages, the Treasury does not anticipate recovering the funds.

What Is the Bottom Line?

Both Federal Reserve and FDIC assistance programs have earned net profits. Small losses on some programs have been more than offset by earnings elsewhere, including Maiden Lane III and the interest received by the Fed on loans to banks. (We do not include Federal Reserve earnings beginning March 2009 on its quantitative easing.) The FDIC has received guarantee fees and increased insurance premiums on demand deposits, with minimal expenditures.

The Treasury anticipates small profits on some programs (see Figure 1), more than offset by losses on the government-sponsored enterprises (GSEs) and assistance to individual homeowners. Excluding housing-related programs, recent estimates are that the Treasury will likely recover 90 to 95 percent of assistance funds, the largest uncertainty being the sale price of its shares in GM and AIG.

Too Much or Too Little?

An evaluation of the role of government assistance must look beyond taxpayers' profits or losses. Large-scale assistance stirs debate regarding both moral hazard and the fundamental role of government, although at times, financial crisis seems forgotten. Disparate views are highlighted by U.S. Rep. Erik Paulsen, R-Minn., and former U.S. Sen. Robert Bennett, R-Utah. The first argued, "We would be much better-served if private institutions either fail or be successful on their own," while the senator argued, "[TARP] did save the world from a financial meltdown. ... Even if it did not all get paid back, it was still the [right] thing to do."

The ultimate judgment must come down to two factors:

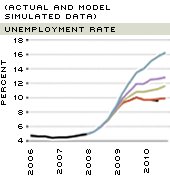

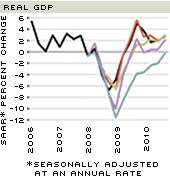

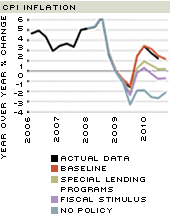

1) Did the assistance prevent a 1930s-scale collapse (see sidebar)? and

2) In complex financial markets, where taxpayers are employees, owners, customers and creditors of both firms and the GSEs, who is really being "bailed out"? Corporate "bailouts" benefited debt holders—for example, pension funds and 401(k)s; home-owner "bailouts" benefited investors who had bought risky mortgage-backed securities.

Although the jury is out on definitive answers to these questions, the consensus that emerges will determine the tools available to the government and Federal Reserve during the next financial crisis.

Endnotes

- Bagehot often is misquoted as arguing the opposite. See Anderson. [back to text]

- The exceptions are $21 billion, primarily from the TALF program, that provided general support to auto, student and small-business loan securitization markets. [back to text]

- The two programs are the Transaction Account Guarantee Program and Debt Guarantee Program, respectively. [back to text]

- Due to changing economic conditions and the restructuring of existing programs, there is margin for error around these projections. Moreover, the complexities in each program have led to varying methodologies and different results. Details can be obtained from the publicly available reports cited. [back to text]

- This program is the Capital Purchase Program. See U.S. Treasury (2010a). [back to text]

- This program is the Targeted Investment Program. See U.S. Treasury (2010a). [back to text]

- This program is the Asset Guarantee Program. See U.S. Treasury (2010a). [back to text]

- This is the Senior Preferred Stock Purchase Agreement. [back to text]

- This is the Automotive Industry Financing Program, which includes the Auto Supplier Support Program and the Auto Warranty Commitment Program. See U.S. Treasury (2010a). [back to text]

- A number of separate initiatives lie under this banner, including the Home Affordable Modification Program, the Second-Lien Modification Program, the Home Affordable Foreclosure Alternatives, the Home Affordable Unemployment Program and the Principal Reduction Alternative program. See Office of the Special Inspector General. [back to text]

- The predatory behavior of Countrywide Mortgage prior to June 2008 is well-documented. For example, on June 7, 2010, the Federal Trade Commission announced a $108 million settlement with Countrywide with respect to excessive fees charged to struggling homeowners and mishandling of loan documents. [back to text]

- See IMF. [back to text]

- See Blinder and Zandi. [back to text]

References

Anderson, Richard G. "Bagehot on the Financial Crises of 1825 ... and 2008." Economic Synopses, No. 7 (2009). See http://research.stlouisfed.org/publications/es/09/ES0907.pdf

Blinder, Alan S.; and Mark Zandi. "How the Great Recession Was Brought to an End." Moody's Analytics special report, July 27, 2010, p. 7.

Congressional Budget Office. The Budgetary Impact and Subsidy Costs of the Federal Reserve's Actions during the Financial Crisis, May 2010.

Congressional Oversight Panel. September Oversight Report: Assessing the TARP on the Eve of its Expiration, Sept. 16, 2010.

Federal Housing Finance Agency. Projections of the Enterprises' Financial Performance, October 2010.

International Monetary Fund, World Economic Outlook: Crisis and Recovery, April 2009.

Office of the Special Inspector General for the Troubled Asset Relief Program (SIGTARP). Quarterly Report to the Congress, Oct. 26, 2010.

U.S. Department of the Treasury, Office of Financial Stability. Troubled Asset Relief Program: Two Year Retrospective, October 2010a.

U.S. Department of the Treasury, "Treasury Update on AIG Investment Valuation," Press Release, November 2010b.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us