The Dismal Science Tackles Happiness Data

At the heart of economic research is how economic policy affects personal well-being. Traditional economic measures of well-being, such as income per capita, assume that individuals are well off to the extent that they can satisfy their wants and needs. Under this assumption, income is generally regarded as a useful proxy for well-being because greater income allows for greater consumption.1 However, some critics point out that income does not fully capture the concept of well-being.

Nonmonetary factors, such as health, family and friends, also play a large role in determining individual welfare. Starting in the early 1970s, economists began studying broader notions of well-being by analyzing survey data that provide subjective individual assessments of happiness in place of conventional income or consumption-based measures of well-being. Subjective individual assessments of happiness have been used, for example, to study the link between income and well-being and to study the welfare effects of economic variables such as inflation and unemployment.

The Easterlin Paradox

Richard Easterlin was the first modern economist to examine the link between individual assessments of happiness and income. His 1974 study uncovered a puzzle that sparked further economic research on the link between income and well-being. Using happiness surveys from 19 countries, Easterlin observed that, within countries, an individual's income level closely matched self-reported happiness. Across countries and over time, however, there was little to no relationship between income per capita and average happiness. Additionally, Easterlin found that happiness in the United States had remained stagnant despite large increases in average real personal income. This pattern, in which wealthier individuals report greater happiness at any given time but average happiness does not increase with average income over time, is often called the Easterlin paradox.

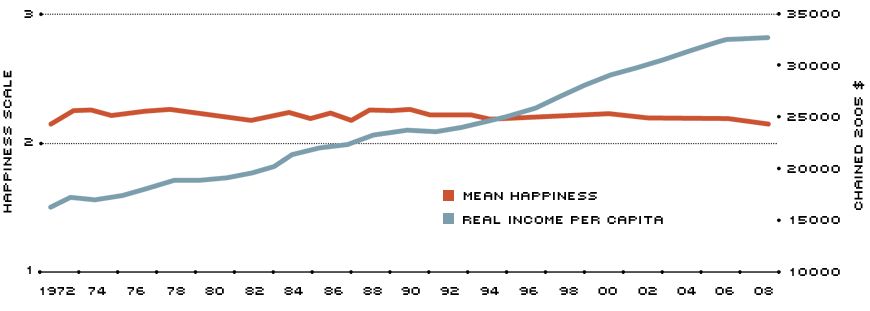

The figure shows that this puzzling observation persisted in the United States from 1972 to 2008. Real income per capita almost doubled over the period, while average happiness—as reported by respondents to the General Social Survey—changed very little.2

Happiness and Real Income per Capita in the United States

NOTE: Mean happiness (left scale) is the average reply from respondents to the U.S. General Social Survey. The survey question asks: "Taken all together, how would you say things are these days? Would you say that you are not too happy, pretty happy or very happy?" These values were coded as 1, 2 and 3, respectively.

SOURCE: General Social Survey data available at http://www.norc.org/GSS+Website. Real income per capita based on authors' calculation using data from the Bureau of Economic Analysis and the Census Bureau.

One of the most accepted explanations for this apparent puzzle is that individuals' happiness is not determined by their absolute level of income but by how their income compares with the income of others. According to this explanation, societies fail to get happier with economic progress because as economic conditions advance and average incomes rise, the reference standard that individuals use to judge their situation relative to others also rises.

At the time of Easterlin's study, the analysis of reported happiness was limited to developed countries because survey data from low-income countries was not available. More recently, the accumulation of reported happiness data across a lengthier time span and for a broader array of countries has allowed economists to more closely examine the link between income and well-being. One such study, conducted by economists Betsey Stevenson and Justin Wolfers, used data from

several surveys—most notably the Gallup World Poll—to investigate more countries than the original Easterlin study did. Stevenson and Wolfers, in contrast with Easterlin, found a positive association between income and average reported happiness across countries. They wrote that the correlation is similar to the one found within countries between personal income and individual happiness reports—that is, wealthy countries report higher average levels of happiness than poor countries. The authors also found that in several countries where time series were available, people tend to report being happier as countries get richer, although the correlation is not as strong. (The United States, as noted in the Easterlin survey, remains a notable exception.) Their findings suggest that relative income plays a smaller role and that absolute income plays a larger role in shaping happiness than previously thought.

The Effects of Inflation and Unemployment

In contrast to policy research in other social sciences, economists traditionally have been reluctant to use self-reports of well-being because of the subjective nature of those reports. Instead, economists prefer to infer individual preferences from observed consumption patterns—an approach known as the revealed-preference principle. However, in some situations where revealed preferences are unable to fully assess the welfare impact of policies or institutional features of an economy, self-reports of happiness may be a useful tool in evaluating economic policy. One particular policy issue on which subjective reports of happiness have been used to shed light is the trade-off between inflation and unemployment in terms of personal well-being.

Economists Rafael Di Tella, Robert MacCulloch and Andrew Oswald examined reported happiness data from the United States and Europe and found that inflation and unemployment both reduce happiness, but unemployment costs more than inflation in terms of happiness. What is notable about their research is that the authors account not only for the cost of unemployment on average well-being—what they call "fear of unemployment"—but also for the direct cost of individuals who actually become unemployed. According to these economists' estimates, individuals would prefer to take on a 1.66-percentage-point increase in inflation rather than a one-percentage-point increase in unemployment.

Additional Studies of Happiness Data

A recent study by economists Néstor Gandelman and Rubén Hernández-Murillo that used data for 75 countries from the Gallup World Poll took a novel approach in analyzing reported happiness. The authors used the responses to several unique survey questions in the Gallup World Poll to construct measures of well-being that are more comprehensive.

In the Gallup survey, respondents were asked to provide a personal assessment of their own happiness as well as a personal assessment of their country's well-being as a whole. The survey also asked respondents to evaluate not only current individual happiness and country well-being, but also assessments of happiness and national well-being five years ago and their expectations five years from now.

Gandelman and Hernández-Murillo used the responses to these questions to construct measures of past, present and future personal and country well-being. Their study revealed two interesting details in happiness data. First, individuals tend to evaluate their personal well-being as being better than their country's. Second, individuals tend to expect that their future well-being will improve.

Although Gandelman and Hernández-Murillo did not find any significant differences in the effects of inflation and unemployment on reported happiness, they found that both inflation and unemployment negatively affect past and present personal evaluations of individual and country well-being and also evaluations of present well-being relative to the future.

Comments

Research into the economics of happiness has come a long way since Easterlin's study and has gained increasing acceptance among mainstream economists as a complement to standard utility theory. Easterlin's paradox remains a controversial and unresolved issue, but the analysis of subjective well-being data continues to spread into various problems traditionally studied in economics, shedding new light on such issues as the determination of labor supply, the effects of taxation and democracy, and the degree of risk-aversion in individual preferences and its impact on savings behavior.

Endnotes

- In standard utility theory, utility is derived from the consumption of goods and services. [back to text]

- The General Social Survey is a national survey sponsored by the National Opinion Research Center at the University of Chicago. The survey gathers socio-demographic characteristics of respondents and polls them on a variety of social issues. [back to text]

References

Di Tella, Rafael; MacCulloch, Robert J.; and Oswald, Andrew J. "Preferences over Inflation and Unemployment: Evidence from Surveys of Happiness." American Economic Review, 2001, Vol. 91, No. 1, pp. 335-41.

Di Tella, Rafael; and MacCulloch, Robert J. "Some Uses of Happiness Data in Economics." Journal of Economic Perspectives, 2006, Vol. 20, No. 1, pp. 25-46.

Esterlin, Richard. "Does Economic Growth Improve the Human Lot? Some Empirical Evidence," in Paul A. David and M.W. Reder, eds., Nations and Households in Economic Growth: Essays in Honour of Moses Abramovitz. London: Academic Press, 1974, pp. 98-125.

Gandelman, Néstor; and Hernández-Murillo, Rubén. "The Impact of Inflation and Unemployment on Subjective Personal and Country Evaluations." Federal Reserve Bank of St. Louis Review, 2009, Vol. 91, No. 3, pp. 107-26.

Stevenson, Betsey; and Wolfers, Justin. "Economic Growth and Subjective Well-Being: Reassessing the Easterlin Paradox." Brookings Paper on Economic Activity, 2008, No. 2, pp. 1-87.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us