National and District Overview: Economists Expect Solid Economic Growth This Year

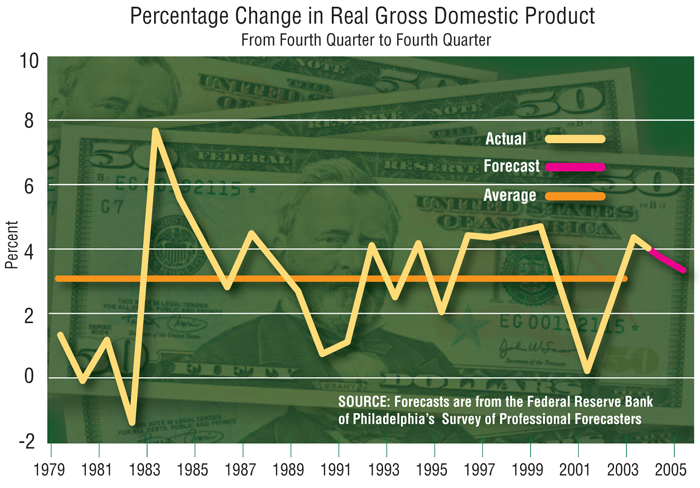

Although bruised a bit from recent spikes in oil prices that have boosted inflation and elevated business uncertainty, the U.S. economy was on course to end 2004 on an upbeat note. Absent a major terrorist attack, further sharp increases in energy prices or an acceleration in inflation, the U.S. economy appears poised to grow by between 3.5 and 4 percent in 2005 (percentage increase between the fourth quarter of 2004 and the fourth quarter of 2005). Such a rate of growth would probably lead to a modest further decline in the unemployment rate (5.4 percent in November 2004) over the course of the year.

Recapping 2004

According to the Blue Chip Consensus and the Philadelphia Fed's Survey of Professional Forecasters, real GDP will probably grow at about a 3.75 percent annual rate in the fourth quarter. If realized, real GDP will have increased by 3.9 percent in 2004, modestly less than the 4.4 percent gain seen in 2003.

Relative to what Blue Chip forecasters had expected in December 2003, the first three quarters of 2004 saw stronger-than-expected increases in residential construction and household purchases of durable goods such as motor vehicles. Amazingly, sales of new, single-family homes in 2004 will probably reach an all-time high for the fourth straight year. In part, this spending behavior by households reflects continued low interest rates and strong increases in their net worth over the past year and a half. But it also reflects a marked decline in the personal saving rate (the percent of after-tax income not spent). During the third quarter of 2004, the personal saving rate fell to 0.5 percent, matching its record low.

Business investment was another bright spot in 2004. Although activity in the manufacturing sector tapered off somewhat over the second half of 2004, capital spending by businesses, particularly for equipment and software, remained robust. In addition to low capital costs, relatively strong economic growth and a healthy profit environment, business investment has been boosted by the temporary tax incentive enacted in 2002. (This incentive was extended in 2003 but expired at the end of 2004.)

Rising energy costs probably acted as a drag on economic growth in 2004. According to Federal Reserve Gov. Ben Bernanke, rising real oil prices may have reduced real GDP growth by between 0.5 and 0.75 percentage points in 2004. Indeed, growth of real consumer spending on nondurable goods and services through the first three quarters of 2004 was weaker than forecasters had anticipated, which may help explain why firms were accumulating inventories by more than forecasters had expected. The modest downshift in the pace of growth in 2004 also stemmed from a weaker-than-expected upturn in the growth of real U.S. exports.

Inflation pressures have been relatively mild despite accommodative monetary policy and a sharp increase in energy prices. For instance, the core personal consumption expenditures (PCE) price index rose at a 0.7 percent annual rate in the third quarter, which was the smallest increase in nearly 42 years. Through the first 10 months of 2004, core PCE inflation (1.4 percent) was running a bit higher than 2003's increase (1.1 percent). When food and energy prices are included, PCE inflation had increased at a 2.6 percent annual rate over the same period, surpassing the 1.6 percent increase seen in 2003.

The Outlook for 2005

According to the November 2004 Survey of Professional Forecasters, real GDP is expected to increase by about 3.5 percent in 2005 (Q4/Q4), roughly equal to its long-run rate of growth. Forecasters expect continued healthy gains in business fixed investment and steady growth in consumer spending. Monthly gains in nonfarm employment are expected to average about 200,000 per month over the first half of 2005 and then slow to about 175,000 per month over the second half of the year. Forecasters expect that a lower trajectory of oil prices in 2005 will reverse some of the increases in inflation seen in 2004-a development that appeared to get under way in December 2004. However, continued declines in the trade-weighted value of the dollar (which, all else equal, boosts the dollar-price of imports) may work in the opposite direction. For the moment, monetary policy-makers remain heartened that long-run CPI inflation expectations have been anchored at 2.5 percent since 1997. In all likelihood, then, the FOMC's federal funds target rate will continue to move to a level thought consistent with long-run sustainable, noninflationary growth at a "measured" pace.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us