Bullish on Banking: Thriving in the Information Age

Are banks going the way of the dinosaur? Will savers and borrowers bypass them altogether to make transactions and obtain loans in the new millennium? Over the past decade, questions about the future of banking have filled business periodicals and dominated banking policy debates on Capitol Hill and in state legislatures. Sagging profitability, declining market share and record bank failures in the1980s nursed this speculation. Recent data and banking theory suggest, however, that the industry is very much alive and kicking. While it's clear that banks will lose market share and the business of banking will change, it's also a sure bet that banks will continue to provide valuable services in 21st century financial markets.

Signs of Life

From the 1970s to the early 1990s, a number of gauges of the health of the banking sector indicated problems. First, bank earnings suffered. For example, return on equity (ROE)—defined as pretax net income divided by average equity—plunged from 18 percent in 1980 to 10 percent in 1990. Second, banks' share of total assets held by all private financial intermediaries dropped from 41 percent in 1971 to 33 percent in 1990. Third, bank failures soared. Between 1980 and 1990, 1,205 U.S. banks failed, compared with just 557 banks between 1935 and 1979. Fourth, the number of commercial banks and trust companies tumbled from 14,435 in 1980 to 12,342 in 1990—a 14 percent decline.1

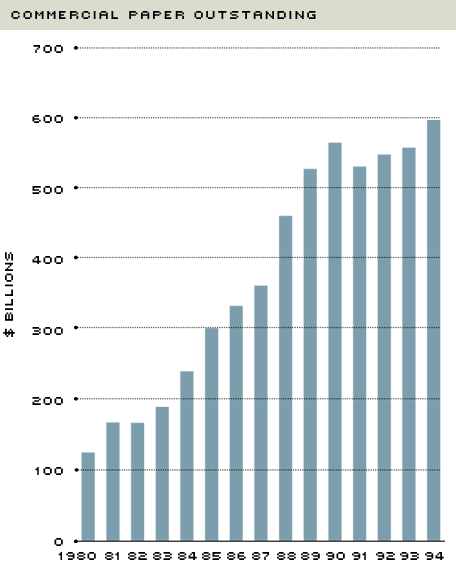

A careful examination of recent data, however, suggests that the problems of the 1980s may have been transitory, or even illusory. For starters, bank profits began improving in the late 1980s, reaching record levels in 1994. Also, banks' share of assets held by all intermediaries has proved to be a misleading indicator of total banking activity because it fails to include off-balance sheet (OBS) banking and U.S. lending by foreign banks, both of which have exploded in recent years (see Chart 1).

Banks' Share of Total Assets Held by Financial Intermediaries

NOTE: Failing to adjust for off-balance sheet banking and foreign bank loans indicates a steady decline in the percentage of total financial institution assets held by commercial banks. Adjusting for such activity significantly reduces the downward trend.

SOURCE: Adapted from Boyd and Getlier (1994).

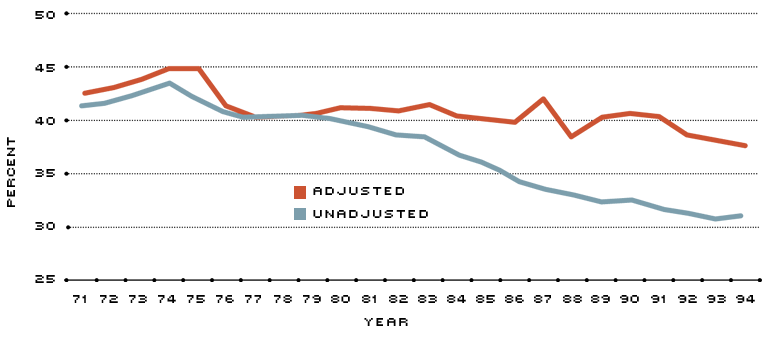

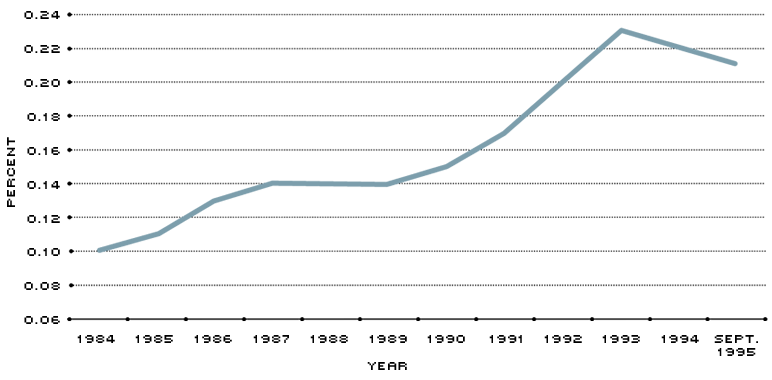

OBS banking generates income, but not necessarily corresponding assets and liabilities on a bank's books. One example is loan commitments, which give firms the right to borrow from a bank and appear on the bank's balance sheet only if the right to borrow is exercised.2 Derivative securities, which are assets that derive their payoffs from the prices of other securities, do not appear on the balance sheet, either. In the 1980s, OBS banking became attractive to banks, especially large regional and money center banks, as a tool for managing interest rate and credit risks, as well as sources of additional income and end-runs around capital requirements. OBS banking has also been good for the industry's bottom line (see Chart 2).

Noninterest Income as a Proportion of Total Income

Breakdown of Banks' Noninterest Income—Sept. 30, 1995

| Banks by Asset Category | Service Charges as a Percent to Total Noninterest Income | Other Noninterest Income as a Percent of Total Noninterest Income |

|---|---|---|

| <$100 million | 44.6 | 55.4 |

| $100 million-$1 billion | 34.0 | 66.0 |

| >$1 billion | 17.8 | 82.2 |

| All banks | 20.6 | 79.4 |

NOTE: The rise in noninterest income as a percentage of total bank income illustrates the increasing importance of OBS banking in the past decade. Noninterest income includes all revenue that has not been generated from earning assets like loans and investment securities. Between 1984 and September of 1995, noninterest income rose from 10 percent to 21 percent of total bank income. Breaking noninterest income into its component parts—revenue from service charges on deposit accounts and "all other" noninterest income confirms the trend. The "all other" category captures the revenue from OBS banking and dominates total noninterest income, especially at larger U.S. banks. From 1984 through the third quarter of 1995, this component of total income rose from 7 percent to 17 percent.

SOURCE: FFIEC Reports of Condition and Income for Insured Commercial Banks, 1984-1995.

At the same time that U.S. banks were pursuing OBS banking, foreign banks were successfully wooing U.S. loan customers. In 1983, loans by foreign banks constituted just 19 percent of U.S. commercial and industrial (C&I) loans; by 1991, these loans had increased to 45 percent. The jump resulted both from a cost of capital advantage that allowed foreign banks to underprice U.S. banks on loans, as well as a superior ability to offer international banking services. Although foreign banks have not gobbled up market share in the 1990s at the rate they did in the 1980s, overall penetration of the U.S. C&I loan market remains high. Indeed, foreign market share has hovered just over 45 percent during the last few years.3

Adjusting for OBS banking and lending by foreign banks, then, wipes out most of the decreased share of financial intermediary assets held by banks.4 Moreover, as a percentage of nominal Gross Domestic Product (GDP), the adjusted measure of banking assets—that is, the measure including OBS banking and U.S. lending by foreign banks—has increased over the past decade, suggesting that banking is becoming more, not less, important to the economy.

Studies that focus on other measures of banking's health—like value-added and stock market returns—also counter the notion that banking is on the verge of becoming extinct. The value that the banking sector adds to the economy can be measured by the difference between the value of banking inputs and banking outputs. Far from declining, this measure reveals no clear downward trend in banking's share of total intermediation. Indeed, value-added as a percentage of GDP—a measure of banking's importance to the overall economy—actually rose from 1.9 percent in 1938 to 4 percent in 1989.5

The stock market tells a similar story. If banking were a declining industry, one would expect bank holding company stocks to underperform other stocks on a risk-adjusted basis. Yet, between 1986 and 1992, bank holding company stocks performed on par with other stocks.6 Hence, there is no reason to expect capital to exit the banking sector.

In short, the evidence does not conclusively point toward the end of banking as we know it. On the contrary, banking's profitability has rebounded, adjusted measures of banking's share of assets held by financial intermediaries have held steady, gauges of banking's importance to the economy have gone up, not down, and bank stocks have earned returns sufficient to keep investors happy. Collectively, this suggests that the record number of bank failures and the secular decline in the number of banks in the 1980s did not represent the last gasps of banking, but, rather, the impact of regional economic shocks and restructuring in the financial services industry as a whole.

This evidence does not, however, offer many clues about the future prospects for banking because it is backward-looking. Put another way, the evidence reveals only what has happened in the past and offers a guide to the future only if past trends continue. To find out what lies ahead for banking in the 21st century, it makes sense to look at the foothold it has carved in the past; that is, to identify the special services banks provide in financial markets and speculate about the extent to which banks will offer these services in the future.

A Breed Apart

In modern financial markets, banks earn profits by reducing transaction costs, which are the costs of buying and selling financial instruments like stocks and bonds. They include search costs and negotiation costs. Search costs are the costs to savers of identifying profitable lending or investing opportunities and the costs to borrowers of finding households or firms with money to lend. Negotiation costs include the costs of haggling over terms like the interest rate, loan size or loan maturity. As intermediaries, banks make money by bringing savers and borrowers together, thereby reducing search and negotiation costs for both parties.

Banks also earn profits by reducing the information costs associated with transferring funds from savers to borrowers.7 One source of such information costs is moral hazard, which refers to the difficulties associated with monitoring people in positions to take advantage of third parties. A number of markets—especially insurance—have inherent moral hazard problems. For example, an insurance company could offer to indemnify a customer for 100 percent of his losses from theft, regardless of the value of the items stolen. In this case, the customer would have no incentive to guard against theft; indeed, he might even choose to "steal" his own property. Monitoring myriad property insurance claims to reduce fraud, for example, would quickly eat up profits, which is why insurance companies insist on deductibles on theft claims.

Moral hazard is present in lending because only borrowers know the outcomes of investment projects. After obtaining funds from savers, a borrower could, for example, renege on a loan by falsely claiming that the project lost money. To prevent such duplicity, savers would have to commit additional resources to monitor actual project outcomes—a burden that would likely be unattractive to them. Banks lower the costs of moral hazard by serving as delegated monitors for savers by lending their deposits to borrowers and then monitoring the performance of the loans or investments for them. In contrast to a given saver, banks have strong incentives to monitor these investments because of their large stake in the borrowers to whom they lend. Moreover, by serving as delegated monitors, banks also reduce economy-wide monitoring costs.

Banks are in an ideal position to serve as monitors because of the economies of scope that exist in writing loans and offering checking accounts, and the cost advantages they enjoy from prior lending relationships. Economies of scope exist if the cost of providing two services is lower than the cost of providing each service separately. In banking, for example, handling a firm's checking account yields financial information that reduces the costs of originating and monitoring loans, especially if the firm is small and has only one checking account. The long history of banks as lenders gives them an advantage over other intermediaries that do not have established customer relationships.

Another costly type of information problem that banks are adept at solving is adverse selection, which occurs when one party in a transaction has difficulty assessing product quality. As a result, the transaction either breaks down or takes place on unfavorable terms. A good example is used cars. Sellers know the quality and, hence, the value of the cars they offer, but buyers can only guess. Consequently, a used car will often be priced below its true value (called a "lemon's discount") in case the car is of low quality. If the discount is large enough, the market will collapse because sellers of high-quality cars will not want to deal at such a low price.

In financial markets, adverse selection problems interfere with individual savers' attempts to obtain both high liquidity and high returns from investments. Individuals generally like to hold some cash for emergencies; however, because cash doesn't pay interest, they must part with liquidity and invest in real financial assets to obtain a positive return. Suppose, however, an insurance company could assess the probability that an individual would find himself short of ready cash; if this were the case, the insurer could offer "liquidity" insurance. That is, it could write a policy that would deliver liquidity if some unforeseen event left the individual cash-strapped. This would give the individual saver the high returns from real financial assets, without the worry of becoming short of cash. Unfortunately, however, only an individual knows the likelihood he will suffer a cash shortfall, making it impossible for an insurance company to sort good and bad risks. Hence, the adverse selection problem.

Banks solve the problem by offering transaction deposits that are highly liquid. In turn, they invest in illiquid assets, like loans, that offer high returns. Banks also keep ample cash on hand to meet routine withdrawal needs. What is considered ample is pegged to past withdrawals.8 Individual savers find bank deposits more attractive than other liquid assets because banks can pass along some of the higher returns from illiquid assets in the form of more services or higher interest.

Adverse selection also makes it more expensive for firms to raise capital by directly issuing securities because the capital market has trouble distinguishing firms with good prospects from those with poor prospects. Managers of firms possess inside information that cannot be credibly communicated to the market. In other words, every manager has an incentive to boast of rosy future prospects, even if such boasting is untrue. Because this incentive taints all firms, those with good prospects find their stocks undervalued.

Banks help solve this undervaluation problem through their lending decisions. For example, research indicates that a firm's stock price rises when the market learns that a bank has renewed a loan to that firm. If a bank is willing to renew the loan, the firm's prospects must be good. That the market perceives a loan renewal as good news implies that banks gather valuable information—information that even security analysts cannot obtain—about a firm's prospects in the course of a normal banking relationship. This information enables banks to certify a firm's quality to financial markets, making it easier for firms to market debt and equity (see below).

Decisions, Decisions

Banks earn profits by reducing transaction and information costs. Consequently, predicting the future of banking involves evaluating the extent to which banks will reduce these costs in 21st century financial markets. Such an evaluation suggests that banks will probably lose market share in the future. For example, even now, banks are not the only financial intermediaries that reduce transaction costs for borrowers and savers; brokerage firms and mutual funds offer the same services. In addition, regulatory reform may further erode the role of the banking sector in transferring funds from savers to borrowers. Future advances in telecommunications and technology will also undoubtedly threaten banking's competitive position by significantly reducing the costs of directly issuing securities.

Nor do banks monopolize the role of delegated monitor. Other intermediaries—like pension funds, life insurance, finance and brokerage companies—can and do reduce the costs of containing moral hazard in lending. Although banks now possess an edge as delegated monitors because of their history as lenders, they will likely lose that edge overtime as rival intermediaries build customer relationships.

The role of banks as liquidity insurance providers is also threatened. Any intermediary that invests the proceeds from transaction deposits in a portfolio containing illiquid and liquid assets can easily perform the same function. For example, Merrill Lynch's cash management accounts compete directly with bank transaction deposits. Although banks' access to deposit insurance gives them an edge in the market for deposits, reform of the Glass-Steagall Act—legislation that maintains walls between commercial and investment banking—could make deposit insurance available to other intermediaries. This would enable nonbank intermediaries to make further inroads into the market for transaction deposits.9

In fact, the only arena in which banks may continue to have a clear advantage is in lending to small firms. Informational economies of scope between checking and lending will continue to give banks a competitive edge in originating and monitoring loans for firms small enough to need only one bank for their checking services. Of course, economies of scope exist among a number of financial services besides checking and lending. Some versions of Glass-Steagall reform would strengthen banks by allowing them to evolve into warehouses of financial services, like the universal banks in Germany. In this scenario, banking would flourish, but in an environment analogous to the supermarket, bundling commercial banking, investment banking, insurance and brokerage services to capture economies of scope in financial services.

Secure for Now

After a period of sluggishness, the U.S. banking industry is again enjoying robust profits. Bank stocks continue to earn returns that compare favorably to other stocks. Banking activity—whether measured by value-added or by assets adjusted for OBS banking and lending by foreign banks—has remained high as a percentage of total intermediation. It has also grown as a percentage of overall economic output. The industry may be restructuring, but borrowers and savers still apparently value banking services.

Banking's future is also secured in large part by its past. Banks historically have earned profits by reducing transaction and information costs for borrowers and savers. Although technological advances and regulatory changes will no doubt enable other intermediaries to attract some customers away from banks, or enable other customers to by pass intermediaries altogether, banks will continue to thrive as long as information problems plague markets.

Endnotes

- Although bank failures have decreased since the 1980s—only 13 banks failed in 1994—mergers have continued apace. Hence, the number of banks has still continued to fall. As of Sept. 30, 1995, the number of banks and trusts stood at 10,054—a 30 percent decline since 1980. [back to text]

- See Saunders (1994). [back to text]

- See McCauley and Seth (1992) and Nolle (1994). [back to text]

- See Boyd and Gertler (1994) and Kaufman and Mote (1994). [back to text]

- See Kaufman and Mote (1994). [back to text]

- See Levonian (1994). [back to text]

- See Hubbard (1994). [back to text]

- Banks do not need to assess the probability that a household will need cash because they can rely on estimates of average cash withdrawals. [back to text]

- See Clark (1995). [back to text]

- For more details on the commercial paper market, see Hahn (1993). [back to text]

References

Boyd, John H., and Mark Gertler. "Are Banks Dead? Or Are the Reports Greatly Exaggerated?" Federal Reserve Bank of Minneapolis Quarterly Review (Summer 1994), pp. 2-23.

Clark, Michelle A. "Commercial & Investment Banking: Should This Divorce Be Saved?" The Regional Economist (April 1995), pp. 4-9.

Hahn, Thomas K. "Commercial Paper," in Instruments of the Money Market (Seventh Edition), Timothy Q. Cook and Robert K. LaRoche, ed. Federal Reserve Bank of Richmond (1993).

Hubbard, R. Glenn. Money, the Financial System, and the Economy (Addison-Wesley, 1994).

Kaufman, George G., and Larry R. Mote. "Is Banking a Declining Industry? A Historical Perspective," Federal Reserve Bank of Chicago Economic Perspectives (May/June 1994), pp. 2-21.

Levonian, Mark E. "Will Banking be Profitable in the Long Run?" in The Declining Role of Banking: Proceedings of a Conference on Bank Structure and Competition. Federal Reserve Bank of Chicago (1994), pp. 118-29.

McCauley, Robert N., and Rama Seth. "Foreign Bank Credit to U.S. Corporations: The Implications of Offshore Loans," Federal Reserve Bank of New York Quarterly Review (Spring 1992), pp. 52-65.

Nolle, Daniel E. "Are Foreign Banks Out-Competing U.S. Banks in the U.S. Market?" Office of the Comptroller of the Currency, Economic & Policy Analysis Working Paper 94-5 (May 1994).

Saunders, Anthony. Financial Institutions Management: A Modern Perspective (Irwin, 1994).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us