The Fixation on International Competitiveness

"To continue our success in the global economy we must remain—and continue to become—increasingly competitive."

— Ronald H. Brown Secretary, U.S. Department of Commerce

"The growing obsession in most advanced nations with international competitiveness should be seen, not as a well-founded concern, but as a view held in the face of overwhelming contrary evidence."

— Paul Krugman, Stanford University

Every four years, the nations of the world engage in a spirited athletic competition known as the Olympics. As with most athletic competition, when the dust settles, there are winners and losers.

Many observers use the same analogy when talking about the global economy and the U.S. position in it. If the Japanese or Europeans sell more cars, computers or financial services than we do, won't we inevitably suffer from higher unemployment, lower wages and a reduced standard of living? Indeed, this idea underpinned much of the debate over the recent passage of the General Agreement on Tariffs and Trade (GATT) treaty. Unfortunately, despite its intuitive appeal, the idea of countries competing with one another on the economic battlefield is a dubious concept.

Competition And Competitiveness: Two Peas In A Pod?

In economics, competition (as opposed to competitiveness) is a well-defined concept, generally referring to a market in which firms may or may not be distinguishable from one another in terms of what they produce. Illinois and Missouri soybean farmers, for example, produce an identical product—soybeans. Processors who buy soybeans to make soy sauce thus do not care where their soybeans come from; they can buy all they want at the prevailing price in the soybean market regardless of who produced the soybeans. But more important, is the Missouri farmer still in direct competition with the Illinois farmer, and if so, how is this measured?

The reality is that, in this particular market, both farmers are competitive only to the extent that they can efficiently transform their land, labor, machinery, seed and other inputs into a reasonable profit. If they can't, they will go out of business. In other words, because both can sell all the soybeans they can produce at the prevailing market price, each farmer's profit is not influenced at all by how well or how poorly the other does. Rather, competitiveness in this market is productivity-driven, meaning that each farmer is in competition only with himself to produce a quality crop at the least possible cost.

In other industries, competition between firms is fierce, and how well a firm's competitor does has a direct bearing on its bottom line. One example is the auto industry, where Ford, General Motors and Chrysler, like the soybean farmer, also have a product to sell. The market structure for autos differs in two important respects from the soybean market, however. First, automakers do not produce a homogeneous product: Their cars and trucks vary in price, size, style and other features. Second, because they cannot sell all the cars and trucks they want at a given price, each firm uses marketing strategies to influence consumer perception of their product.

But competitiveness in the auto market does not depend solely on slick ads or generous rebates. As before, competitiveness in this industry also depends on the firm's efficiency (productivity) as an auto producer and thus, inevitably, the sustainability of its market share. If GM's workers are not as productive as Ford's or Chrysler's, and its labor, steel and marketing costs are higher than its competitors, then GM will not be as competitive as Ford or Chrysler. We should eventually see GM's profits and market share falling relative to Ford's or Chrysler's.

Competitiveness, then, depends significantly on factors that the firm controls: It does not matter whether the firm is a farm or Ford Motor Company. Does this concept extend to the international arena where hundreds of thousands of different kinds of goods and services are traded among countries?

Competitiveness at the International Level: Rhetoric or Reality?

According to the World Competitiveness Report, issued annually by the International Institute for Management and Development, the U.S. economy was the world's most competitive in 1994, followed closely behind by Singapore, Japan, Hong Kong, Germany and Switzerland. Defining competitiveness as "the ability of a country or a company to, proportionally, generate more wealth than its competitors in world markets," the question for policymakers is whether such studies are relevant in comparing economic performance across countries.

To some people, a country's international competitiveness should be measured in such a manner as if it were a large firm, such as Japan Inc. or U.S. Inc., where losses can be measured in terms of trade deficits and profits translate into trade surpluses.1 Using this analogy, countries that run trade deficits should be noncompetitive internationally, with declining manufacturing employment and lower real wages; just the opposite should occur in countries that run trade surpluses. Competitiveness, according to this view, thus depends on our ability to export more than we import. Is this true?

Are Countries Just One Big Company?

Competitiveness enthusiasts believe that the United States competes with Japan or Germany in the same way that Ford competes with Chrysler or General Motors, with presidents and prime ministers playing the role of CEO and profits and losses being measured in terms of trade surpluses and deficits. By this standard, the United States, which has run a real trade deficit in goods and services for 31 of the past 35 years, should be a basket case economically, increasingly unable to sell its goods and services in world markets. Fortunately, the truth is quite the opposite. In 1993, the United States was the world's largest exporter of merchandise goods, with 12.4 percent of total world exports (up from 11.1 percent in 1980).2 Germany was the world's second largest exporter in 1993 with a 10.1 percent share, while Japan, further behind in third place, registered 9.7 percent.

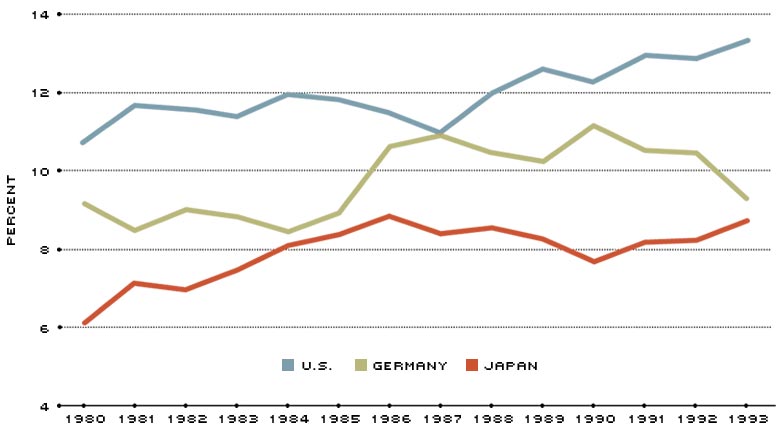

Merchandise exports, of course, are only one side of the story. Countries also earn income from the sale of engineering, financial and legal services and the use of communications satellites. When services exports are properly accounted for, the United States, as Chart 1 shows, is still by far the world's largest exporter of goods and services.

Setting the Pace in World Exports

The United States garnered more than 13 percent of the world's goods and services exports in 1993—outstripping Germany (9.3 percent) and Japan (8.7 percent). Moreover, the U.S. share of the world's exports of goods and services over this period has steadily risen, contrary to the conventional wisdom.

The prowess of the American economy is also demonstrated in the value of goods and services (output) produced per person. Measured on a purchasing power parity basis, which values goods and services consistently across countries, per capita U.S. output was $22,204 in 1991, 2.1 percent higher than Switzerland ($21,747), 13.9 percent higher than Japan ($19,107) and 12.2 percent higher than Germany ($19,500).

Some may correctly point out that, although per capita output (income) is highest in the United States, the growth rates of per capita output in many other industrialized countries (that is, the yearly increase in their standard of living) have exceeded that in the United States for several years. This is particularly true for Germany and Japan. This development is not, as some may think, the result of the United States becoming less competitive. It simply means that there is a natural tendency for living standards to equalize across industrialized economies over time. Those economies that start out relatively poor will initially grow faster than those countries that start out relatively well off, but at some point their economic growth will slow from unsustainably high rates. A good example of this is Japan after World War II. In 1950, Japan's per capita income was only one-sixth that of the United States. As Japan rebuilt its war-ravaged economy, its living standards improved so that today its income per capita is nearly 90 percent that of the United States; however, its economy is growing nowhere near the phenomenal rates experienced between 1950 and 1973 (about 9 percent per year).

Is the U.S. Deindustrializing?

A second claim made by the competitiveness gurus is that the persistent U.S. trade deficit has deindustrialized the U.S. economy.3 From cars to TV sets, the surge in imported manufactured goods into the United States, they say, has led to a decline in manufacturing employment and real wages.

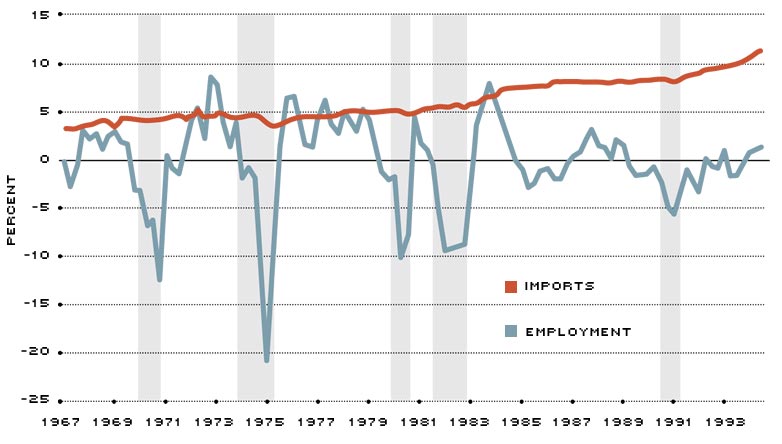

There is no getting around the fact that imports of manufactured goods have surged in recent years. Currently, the sum of imported capital goods (machinery) and automotive products is about 37 percent of total imports, more than triple the 11 percent share that prevailed in 1965. Has this rising quantity of imported manufactured goods deindustrialized the United States, as some maintain? Not according to the evidence (see Chart 2).

Does Manufacturing Employment Drop as U.S. Imports Rise?

Vertical bars represent periods of business recession.

The chart above, which plots real merchandise nonpetroleum imports as a share of GDP against the percentage change (annualized) in manufacturing employment, indicates that there is little apparent relationship between the modest rise in imports and the growth of manufacturing employment. Manufacturing employment growth is influenced to a large degree by domestic factors such as the business cycle—it tends to fall during recessions and rise during recoveries—with international factors contributing only a minor part.*

*To test this hypothesis, a simple regression was estimated to examine the relationship. The results, not printed here, show an extremely weak causal relationship.

Nevertheless, those who push the deindustrialization hypothesis are entirely correct on one point: The growth of manufacturing employment has been weak in recent years. What few realize is that manufacturing employment as a share of total employment has been declining for decades, reflecting the relatively faster growth of productivity in the goods-producing sector, especially in agriculture and somewhat less so in manufacturing. Currently, the share of the nonfarm workforce engaged in manufacturing is about 16 percent vs. 34 percent before World War II. As a result, employment in the service-producing sector has been steadily growing in importance—from an estimated 24 percent of total employment in 1870 to its current share of nearly 80 percent.4 At the same time, manufacturing output as a share of total output (real GDP), although both cyclical and influenced by wartime build-ups and peacetime reductions, has stayed roughly constant, measuring approximately 20 to 22 percent of GDP.

This development is not unique to the United States. Other industrialized economies have also become more service-oriented over time. In Japan, the share of employment devoted to manufacturing is just under 24 percent, down from 27.6 percent in 1974, while in Germany manufacturing employment is slightly more than 31 percent, down from almost 40 percent in 1970. Larger declines have occurred in Canada, Australia and the United Kingdom, to name a few.

In some European countries, particularly Germany, a concerted effort has been made by the government to remain as manufacturing-intensive as possible—usually to the detriment of the rest of the economy—by imposing onerous regulations on sectors like financial services and retail trade. Given their persistently high unemployment rates, some of these countries are now trying to phase them out, realizing that they are an impediment to economic growth. Accordingly, we should expect to see a continued increase in the share of workers employed in the service industries in these countries.

Many advocates of the competitiveness school buttress their argument by claiming that one way to boost U.S. competitiveness is for the government to take an increasingly active role in allocating society's resources. Among their prescriptions: (1) shifting to a value-added tax system; (2) increasing government funding for education and worker training programs; and (3) increasing cooperation between government and the private sector, such as the Partnership for a New Generation of Vehicles. Many of these recommendations smack of industrial policy, which economists typically view with a jaundiced eye.5 Nevertheless, many have become official economic policy of the Clinton administration.6

Critiquing The Competitiveness School

In a provocative article, Stanford University professor Paul Krugman summarily dismisses the competitiveness view as both "wrong and dangerous."7

Krugman makes two important points. The first, touched on earlier, is that countries are not like firms. If a firm consistently incurs a loss, it will go out of business; if a country persistently runs a goods and services trade deficit—as the United States has recently—it will not go out of business. As Krugman points out, a trade deficit may simply reflect other factors, such as a need to acquire foreign exchange to pay foreign creditors; more important, it may just be the result of a growing economy, reflecting an increase in the demand for all goods, both domestically produced and foreign produced (imports). For example, the United States ran a real balance-of-trade surplus (or slight deficit) when economic growth was slowing or negative (in 1974-75, 1980-82 and 1990-91), and a large trade deficit during periods of rapid growth (the late 1950s and mid-1980s).

The second point—the crux of Krugman's critique—is that domestic considerations largely determine the extent of a country's economic health—especially over a longer horizon. Although foreign considerations can affect a nation's domestic output and employment growth in the short term, its living standards (and thus its economic competitiveness) are largely determined by such factors as productivity growth.

What Causes Economies to Grow and Prosper?

Let's take a closer look at exactly why productivity growth matters so much to a nation's standard of living. Workers generally increase their productivity in two ways. One way is by increasing their knowledge or skills. This comes about primarily through additional education, experience or, perhaps, apprenticeship programs. The second way is through technological advancements, such as more powerful computers, robots, fax machines or machine tools, which allow a worker to produce more output with less effort (input). When a worker increases his or her productivity, the result is higher real wages (increased living standards); when productivity growth wanes, real wage growth slows or becomes negative (decreased living standards).

Of course, this gain comes with some short-term pain: Those workers with a lower skill level may be forced into other industries. As an industry becomes increasingly computerized or relies more heavily on sophisticated electronics, those who lack the necessary skills will be forced into industries that do not put a premium on such skills.

The main idea is that the factors determining an economy's growth over a longer horizon have little to do with international considerations. Whether a country prospers does not depend on how much it imports or exports, but rather on how well it makes the goods that compete with its imports and with the goods that it exports. According to a recent study, over the past 100 years, Britain's productivity growth rate lagged that in the United States by an average of 1 percentage point per year. While seemingly trivial, it is estimated that this discrepancy, multiplied over time, "was sufficient to transform the United Kingdom from the world's undisputed industrial leader into the third-rate economy that it is today. It was also sufficient to cut real wages in the U.K. from about 1 and 1/2 times that in other leading European economies to about two-thirds of the real wages in those countries today."8

Europhoria or Eurosclerosis?

To bolster his case, Krugman discusses the problem of high European unemployment rates. From 1950 to 1974, the unemployment rate in the European Community (EC) averaged less than 5 percent of the work force—about the same as in the United States, although on average the unemployment rate in the United States was higher, particularly during the late 1950s and early 1960s. Since 1974, however, the EC unemployment rate has risen steadily, reaching 10.6 percent in 1993, and is projected to climb to nearly 12 percent by the end of 1995. While the U.S. unemployment rate also began to climb after 1974, it peaked in 1983 at 10.8 percent and has since declined to less than 6 percent. The obvious question is why.

Before attempting to answer this, we should point out that a nation's unemployment rate can be thought of as the sum of its cyclical component, usually a temporary phenomenon, and its structural component (sometimes referred to as the economy's natural unemployment rate). As economic growth slows, the output of goods and services wanes, leading firms to reduce employment. This is called cyclical unemployment (after the business cycle). The second component depends on the various structural impediments that are prevalent in the economy: the changing demographics or government policies that restrict growth—for example, increases in regulations that raise the cost of labor to business, causing firms to try to substitute relatively less expensive machines, restrict their hiring of new employees or make their existing employees work harder. Most mainstream economists and policymakers agree that the persistently high European unemployment rates are not due to cyclical factors or, as adherents of the competitiveness school might suggest, the result of Europe's inability to export its goods and services to the rest of the world. After all, Germany is not only the world's second-largest exporter, but its share of world exports also rose from 9.5 percent in 1980 to 10.1 percent in 1992, as did the world export shares of other European countries. Instead, the crux of Europe's competitiveness problem, as European leaders have termed it, is structural in nature.9

Recall that an individual's real wage will depend on how productive the worker is. This should be a positive relationship: The most productive workers in society are usually among the highest paid workers, while workers with a lower level of productivity are paid relatively less. Thus, couldn't it be that European workers have higher wages simply because they are more productive? Not necessarily. From 1977 to 1992, manufacturing productivity in the United States grew by 2 percent per year, slightly less than the 2.2 percent per year growth in Germany. At the same time, however, manufacturers' labor costs—that is, wages and salaries, fringe benefits and other mandated social costs—rose by 3.8 percent per year in the United States, but by 6.3 percent per year in Germany. Clearly, some factor besides productivity is driving wages higher in Germany relative to the United States. That factor, many economists have concluded, is the rise of the social welfare state. (For a summary of an alternative view, see the article "Are Economic Flexibility and Social Welfare Programs Incompatible?" by Adam Zaretsky in this issue.)

As Figure 1 shows, German employers pay a significantly larger amount on social welfare costs than U.S. employers do. To compensate for such nonlabor costs, European employers have had to increase their productivity—not only by reducing the size of their work force, but also by beginning to move production to the United States, where labor costs are considerably less and just as productive. Construction of manufacturing plants by Mercedes Benz in Alabama and BMW in South Carolina are two prominent examples. A survey conducted by the German Chamber of Industry and Trade found that 24 percent of companies had moved part of their facilities overseas between 1990 and 1993; another 30 percent plan to do so before 1997. The growing divergence between productivity and real wage growth in some European countries, Krugman and others argue, is the real reason why the prospects for U.S. economic growth are considerably brighter—despite our persistent trade deficit in goods and services.

The Higher Price of Employer Compensation Costs in Germany

For every $100 in wages a German worker earns, the worker's employer must pay another $84 in social costs such as health care and unemployment insurance, a Christmas bonus, sick leave, vacation, company retirement, workers' compensation and church and public holidays. The average U.S. employer's additional compensation costs are less than half that, totaling about $41.

SOURCE: Shlaes (1994) and U.S. Department of Labor

Conclusion

The United States is still the world's largest exporter of goods and services and, moreover, has been increasing its share continually since 1980. At the same time, it generally imports even more than it exports, with the resulting trade deficit setting off alarms about our competitiveness and causing angst among the population. What is often lost in this rancor, however, is that a country's long-term prospects depend on a climate that is conducive to job creation and productivity growth—not on the trade deficit. In this regard, the United States, which has fewer labor market distortions and restrictive regulations than other countries, gives us a distinct advantage.

Endnotes

- Two well-known advocates of this general approach are Robert Reich (1991) and Lester Thurow (1992). [back to text]

- World export data expressed in dollar terms come from the GATT organization based in Geneva, Switzerland. Though caution is always in order when using international data because of the differing ways in which countries report or measure imports and exports, this data is probably a good approximation of the reality. [back to text]

- See, among others, Prestowitz (1994). [back to text]

- The estimate for 1870 comes from Ott (1987). [back to text]

- See Clark (1993) for a critique of industrial policy. [back to text]

- See U.S. Department of Commerce (1994). [back to text]

- See Krugman (1994), p. 44. [back to text]

- See Baumol, et al (1989). [back to text]

- See, for example, several of the papers presented at a recent symposium on the problems of high European unemployment rates (Federal Reserve Bank of Kansas City). [back to text]

References

Baumol, William J., Sue Ann Batey Blackman, and Edward N. Wolff, ed., Productivity and American Leadership (MIT Press, 1989).

Clark, Michelle A. "The Pitfalls of Industrial Policy," The Regional Economist (April 1993), pp. 10-11.

Federal Reserve Bank of Kansas City. "Reducing Unemployment: Current Issues and Policy Options," a Symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, August 24-27, 1994.

International Institute for Management Development. The World Competitiveness Report 1994 (Lausanne, Switzerland, 1994).

Krugman, Paul. "Competitiveness: A Dangerous Obsession," Foreign Affairs (March/April 1994), pp. 28-44.

Ott, Mack. "The Growing Share of Services in the U.S. Economy—Degeneration or Evolution?" Review, Federal Reserve Bank of St. Louis (June/July 1987), pp. 5-22.

Prestowitz, Clyde V., Jr. "Playing to Win," Foreign Affairs (July/August 1994), pp. 186-89.

Reich, Robert B. The Work of Nations (Alfred A. Knopf, 1991).

Shlaes, Amity. "Germany's Chained Economy," Foreign Affairs (September/October 1994), pp. 109-24.

Thurow, Lester C. Head To Head: The Coming Economic Battle Among Japan, Europe, and America (William Morrow and Company, 1992).

United States Department of Commerce. Competing To Win In A Global Economy (Government Printing Office, September 1994).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us