Homebuyers Bear ARMs in the Mortgage Market

Just one year ago, the choice between a fixed rate and an adjustable rate mortgage (ARM) was a slam dunk for most homebuyers: With rates on 30-year fixed mortgages hovering around 7 percent, the lowest in 20 years, most homebuyers opted for certainty over risk. Today, the calculus has changed. Increasing numbers of U.S. and Eighth District homebuyers are "ARMing" themselves as long-term interest rates continue to move up. What makes the ARM market tick? To answer that, let's look at the market from the perspective of the lender and the borrower.

Adjusting to Higher Rates

Until recently, prospective homebuyers and home refinancers had little choice in mortgage products. The 30-year fixed rate, fully amortizing mortgage (FRM) had been the standard among lenders since the 1930s. Adjustable rate mortgages—those whose interest costs rise and fall with market interest rates—developed in the early 1980s, largely in response to severe problems in the thrift industry, the traditional extenders of mortgage credit in the United States.

Historically high and volatile interest rates in the late 1970s and early 1980s put thrifts in dire financial straits. The problem was a fundamental mismatch between the industry's assets and liabilities: The bulk of thrifts' assets consisted of 30-year FRMs, but their liabilities were largely shorter-term deposits and purchased funds that paid market interest rates, which were on the way up in response to the lifting of deposit rate ceilings. The combination of more frequent rate adjustments on liabilities than on assets and unanticipated increases in interest rates put thrifts in a pressure cooker.

This type of situation is an example of interest rate risk, a risk all financial intermediaries are subject to in some form. At the time, financial institutions and their regulators reasoned that if lenders were allowed to offer mortgages with variable rates, much of this interest rate risk could be mitigated, because these loans could be repriced at frequencies closer to deposit repricing frequencies.1 And so the ARM was born.

ARMs Equip Lenders and Borrowers

The ARM's benefits for lenders are clear: Some of the interest rate risk inherent in mortgage lending is shifted to the borrower.2 But borrowers also benefit from ARMs. First, ARM borrowers are generally compensated for taking on some of that risk by receiving a lower average interest rate than the rate charged on a corresponding FRM. In addition, they are generally protected from large increases in interest rates because most ARMs feature periodic and lifetime caps on rate adjustments (see glossary below for definitions of other ARM terms).

Second, ARM borrowers can avoid the costs of refinancing mortgages, since monthly payments tend to fall when interest rates fall. Third, and most significant for first-time homebuyers, ARMs allow many people who wouldn't ordinarily qualify for a mortgage to obtain one. Because of the prevalence of low initial, or teaser, rates on ARMs, and because lenders often base their decisions on the ratio of the initial mortgage payment to current income, ARMs increase the borrowing power of low and middle-income households. Most households can also qualify for a larger mortgage with an ARM than they can with an FRM.

For borrowers expecting to be in a house for only a short period of time, the savings of an ARM with a teaser rate over an FRM can be substantial. And ARMs are particularly useful for homebuyers who must pay private mortgage insurance (PMI). Because ARMs tend to have lower initial interest rates, ARM borrowers generally pay off principal earlier than borrowers with FRMs. Thus, ARM borrowers reach 20 percent equity sooner, at which point PMI can be dropped. Finally, continued innovations in ARMs, like low or no prepayment penalties, convertibility features and extended adjustment periods (for example, one type of ARM, the 10/1, has a fixed rate for 10 years and then adjusts yearly), continue to enhance ARMs' appeal to homebuyers.

The downside with ARMs, of course, is that large increases in monthly payments may not coincide with increases in income. Caps can limit the extent of these increases, but can lead to a situation in which total borrower payments over the life of the loan are larger than the initial loan plus contractual interest (see negative amortization in glossary). The other major problem with ARMs, as far as consumers are concerned, is their complexity and sheer variety; hundreds of variations—in caps, adjustment periods and discounts—on the basic ARM make comparison shopping daunting.

ARM Trends

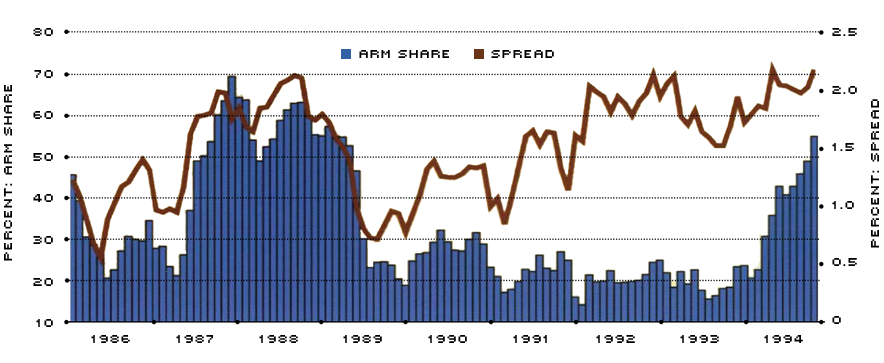

Since their inception, ARMs have waxed and waned in popularity with the interest rate cycle and the introduction of new features.3 Since January 1985, the ARM share of monthly conventional mortgage originations has ranged from 15 percent (in February 1992) to 69 percent (in December 1987), according to the Federal Housing Finance Board. Though numerous factors go into a homebuyer's decision to take out an ARM, the level of the 30-year FRM rate and the spread between this rate and the rate on ARMs seem to be the dominant ones. Because the rates charged on ARMs are typically less than those on FRMs, the ARM share of mortgage originations tends to go up when rates on FRMs go up (see figure).

Both of these factors—the level of the FRM rate and the spread—help explain mortgage choice over the last several years, a boom period for housing in the United States. In late 1992 and 1993, when long-term FRM rates were in the 7-to-8.5-percent range and the spread was declining, the ARM share of mortgage originations was relatively small; in 1994, as long-term rates inched toward 10 percent and the spread widened, the ARM share more than doubled. In November 1994, 55 percent of mortgage loans closed carried adjustable rates.

Another influence on ARM purchases is the level of home prices. Because ARMs generally allow borrowers to take out larger mortgages, the share of ARM originations tends to be higher wherever housing is more expensive. For example, the ARM share in metropolitan areas in the Eighth District, where housing is extremely affordable, is usually significantly below the ARM share of higher-priced areas like California and Hawaii.4 In the fourth quarter of 1993, when 30-year interest rates hit bottom in this most recent cycle, ARMs accounted for just 10 percent of mortgage originations in Louisville and 11 percent in St. Louis, compared with 48 percent in Los Angeles, 60 percent in San Francisco and 74 percent in Honolulu.5

After a decade and a half of existence, ARMs have proved to be legitimate competitors for the long time standard, the 30-year fixed-rate mortgage. Over that period, market forces continually adjusted and fine tuned the ARM, resulting in a product that provides clear benefits to lenders and borrowers. By ARMing themselves, more former renters are realizing the American Dream today than ever before.

Endnotes

- See Peek (1990) for more detail on the history of and rationale for ARMs. [back to text]

- Though lenders' interest rate risk is reduced with ARMs, credit risk often increases. Large increases in monthly payments from rate adjustments make these loans more prone to default than standard FRMs. [back to text]

- For example, convertible ARMS—which allow borrowers to switch to a FRM at little or no cost—became available on a large scale in mid-1987. [back to text]

- See Clark (1994) for background on housing affordability in the Eighth District. [back to text]

- Data are from a monthly survey conducted by the Federal Housing Finance Board. Regional variations in ARM originations exist of various types of financial institutions. For example, ARM shares tend to be relatively larger in California because the state is home to some of the nation's largest thrifts, which are the dominant ARM lenders. See Nothaft and Wang (1992) for a discussion of other determinants. [back to text]

References

Clark, Michelle A. "Home Sweet Home in the Eighth District," Federal Reserve Bank of St. Louis The Regional Economist (April 1994), pp. 12-13.

Federal Housing Finance Board. Rates and Terms on Conventional Home Mortgages: Annual Summary (1993).

Goodman, John L., and Charles A. Luckett. "Adjustable-Rate Financing in Mortgage and Consumer Credit Markets," Federal Reserve Bulletin (November 1985), pp. 823-35.

Nothaft, Frank E., and George H. K. Wang. "Determinants of the ARM Share of National and Regional Lending," Journal of Real Estate Finance and Economics (No. 5, 1992), pp. 219-34.

Peek, Joe. "A Call to ARMs: Adjustable Rate Mortgages in the 1980s," Federal Reserve Bank of Boston New England Economic Review (March/April 1990), pp. 47-61.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us