Inflation Remains Wild Card in U.S. GDP Outlook for 2022

KEY TAKEAWAYS

- During 2021, the U.S. economy rebounded strongly, but the rise in inflation surprised many.

- Headline and core inflation rates for the personal consumption expenditures price index will likely end 2021 at their highest in 30 years or more.

- The U.S. is expected to post strong GDP growth in 2022. If higher inflation persists and erodes household purchasing power further, that could put growth at risk.

The U.S. economy continues to recover from widespread disruptions in product and labor markets spawned by the pandemic. But the strong rebound in real gross domestic product (GDP) growth in 2021 has been accompanied by high inflation, which caught most forecasters and Federal Open Market Committee (FOMC) participants by surprise. With inflation on pace to be the highest in more than 30 years, the FOMC—the Fed’s main monetary policymaking body—signaled at its Dec. 14-15 meeting that it has accelerated the unwinding of its asset purchase program (“tapering”) that was announced at the beginning of the pandemic in March 2020. A new COVID-19 variant (omicron) poses a downside risk to the U.S. and global economic outlook in 2022. Another threat to the U.S. economy is the possibility that inflation will remain higher and more persistent than currently expected.

Inflation Nation

Consumer price inflation has surprised to the upside in 2021. For example, in February 2021, the Survey of Professional Forecasters projected that the headline and core personal consumption expenditures price indexes (PCEPI), which are the Fed’s preferred measure of prices, would increase by 2% and 1.8%, respectively, in 2021 (Q4/Q4). By mid-November, these inflation forecasts had risen to 4.9% and 4.1%, respectively. When all of the data are in, it is likely that the headline and core PCEPI inflation rate for 2021 will have been the highest in 30 years or more.

Higher inflation also helped to boost inflation expectations—by some measures, to levels not seen in many years. Rising inflation expectations are troubling because it could signal that households, firms and financial market participants expect high levels of inflation to persist for longer than Fed policymakers expect; this would be an unwelcome development.

Throughout the year, it became apparent that a change in the economy’s wage and price dynamics was triggering outsized inflation increases. Many firms across multiple industries were reporting that labor shortages and supply disruptions were hampering their ability to produce and sell the volume of goods and services demanded by consumers. To fill job openings and compete with other firms for scarce labor, many firms were forced to raise wage rates. When combined with material shortages that raised input costs, unit labor and nonlabor costs began accelerating. But firms were also reporting strong demand for goods and services, which enabled many to pass along their higher costs to customers. Thus, as the FOMC convened its final meeting of the year on Dec. 15, 2021, it continued to be confronted with a development not seen in decades: Firms willing and able to raise prices at jaw-dropping rates.

This was evident in the November consumer price index (CPI) report, as the headline CPI was up by almost 7% in November from a year earlier—the largest increase in more than 39 years. With an inflation rate exhibiting few signs of quickly returning to the FOMC’s 2% inflation target, the FOMC announced at its December meeting that it plans to end its asset purchases by mid-March 2022. Moreover, all 18 participants expect to raise the federal funds target rate at least once in 2022. By contrast, at its March 2021 meeting, only four of 18 participants believed that an increase in the federal funds target rate in 2022 was appropriate policy.

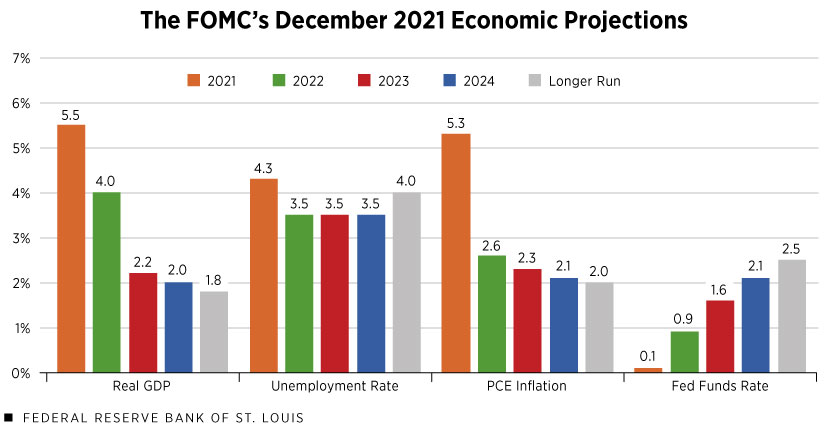

Most FOMC participants continue to project that 2021 will be the highwater mark for inflation going forward. (See the figure below.) Further improvements in supply chains that enable an increased supply of durable goods, such as new vehicles; vaccines and other therapeutics that spur more workers to rejoin the labor force; and the waning effects of the large monetary and fiscal economic policies implemented in 2020-21—which could slow the demand for goods and services—are some of the key factors that forecasters point to in helping to drive inflation lower over the medium term.

SOURCES: Summary of Economic Projections.

NOTES: Projections are the median projections of the Federal Open Market Committee (FOMC) participants. The projections for real gross domestic product (GDP) growth and inflation are the percentage change from the fourth quarter of the previous year to the fourth quarter of the indicated year. Inflation is measured by the personal consumption expenditures chain-price index. The projection for the unemployment rate is the average for the fourth quarter of year indicated. The federal funds rate is the projected appropriate path.

The Near-Term Outlook for the Economy and Labor Markets Is Good

The pace of economic activity slowed sharply in the third quarter after rising at an exceptionally brisk pace over the first half of 2021. However, improving economic and labor market conditions in October and November suggest that real GDP growth in the fourth quarter could be the strongest of the year—and growth for all of 2021 is expected to be the strongest since 1983. Supported by the expectation of continued healthy financial market conditions, increased production to restock lean inventories, further gains in the consumption of services as consumer and business travel picks up, and a resilient housing market, continued above-trend growth is likely in 2022. At this point, the most probable outcome is 3% to 4% real GDP growth.

Strong GDP growth will continue to be a boon for labor markets. The number of unemployed persons actively seeking employment is at a record low relative to the number of job openings. In addition, the number of people quitting their jobs as a share of employment, often to seek higher-paying jobs, remains near a record high. Strong demand for labor is likely to lower the unemployment rate to around 3% to 3.5% by the end of 2022 and generate continued strong growth in employee compensation. The latter will help mitigate the reduction in purchasing power from higher prices of goods and services. But if the reduction in household purchasing power from higher inflation persists, consumers will either need to reduce real spending or draw down their savings. Either development could pose a threat to consumer spending, and thus real GDP growth.

Devin Werner, a research associate at the Bank, provided research assistance.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us