Improving Conditions Could Bode Well for Economic Recovery

KEY TAKEAWAYS

- The COVID-19 pandemic has caused precipitous swings in the U.S. economy, but improving economic indicators could signal a recovery ahead.

- U.S. real GDP and employment levels bounced back sharply in the third quarter, but they remain below their business expansion peaks.

- It will take time to return to pre-pandemic economic activity, though a viable COVID-19 vaccine could be a game changer.

The U.S. economy has been on a roller-coaster ride this year. First, real gross domestic product (GDP) and employment fell sharply over the first half of the year in response to the COVID-19 pandemic. Then, the record-setting decline in real GDP in the second quarter was followed by a record-setting increase in the third quarter. Improving economic and labor market conditions suggest the economy is transitioning out of recession and into recovery.

However, the levels of GDP and employment remain below their business expansion peak levels. Economic conditions should improve further in the fourth quarter of 2020 and into 2021. Through it all, with inflation still below 2%, the Federal Open Market Committee (FOMC) has continued to support financial markets by purchasing Treasury securities and mortgage-backed securities at a healthy pace.

Getting Off the Mat

The third-quarter surge in GDP reflected a snapback in economic activity that was postponed during the lockdowns earlier in the year. Although some activity can never be recouped, the surge in economic activity stemmed from large increases in consumer and business expenditures and from businesses’ restarting production and rehiring furloughed workers.

Given the depth of the recession, returning to the level of economic activity that prevailed before the pandemic will take time. In October, total nonfarm payrolls remained about 10 million below the February peak, and the unemployment rate—measuring 6.9% in October—was roughly double the 3.5% rate in February.

The economic rebound is evident by the sizable amount of forward momentum across key sectors and industries. For example, intermodal railroad traffic is rising rapidly. This development is a strong signal of a rebound in the industrial sector, because it measures the movement of goods from manufacturers and importers to firms such as auto dealers, and to store shelves and doorsteps via wholesalers and retail distribution facilities.

Increased intermodal traffic also reflects an improving global economy—especially in Asia—that has benefited the U.S. export sector. Importantly, rising imports of nonautomotive capital goods point to improving demand for capital goods by U.S. firms.

On the housing front, strong demand and lean inventories have boosted home sales and sale prices. In October, total home sales—combined sales of new and previously sold homes—were at an annual rate of 7.85 million, the strongest pace since March 2006. Certainly, record-low mortgage interest rates and continued purchases of mortgage-backed securities by the Federal Reserve have buoyed the housing market.

Rising home prices, in tandem with rising equity prices, have bolstered household wealth, which should support further gains in housing and discretionary household spending. One cautionary note: Lenders have been increasing terms and lending standards on residential real estate loans.

Risk and the Near-term Outlook

Although real GDP growth is expected to slow to around 4% in the fourth quarter of 2020, growth should remain between 3% and 4% in 2021. The economy will continue to benefit from the lagged effects of existing monetary and fiscal support and perhaps another round of fiscal support measures. Financial market conditions also remain highly supportive of continued solid growth in economic activity and real incomes.

A proven COVID-19 vaccine would be expected to boost growth of output and employment in the services industry, which has suffered because many consumers remain reluctant to travel and dine out, and business travel has been dramatically reduced. Strong growth in 2021 would continue to benefit the labor market and help those firms—particularly small and medium firms—return to profitability.

There are downside risks to the baseline forecast over the medium term. Most of these risks stem from unknowns associated with the pandemic and how policymakers respond to the current spike in infection rates.

For example, several states and localities have implemented some restrictions on economic activity, which appears to have triggered some layoffs. The longer these restrictions are in place, the greater the risk of weaker-than-expected growth. Adding to the worries for U.S. firms, measures of economic policy uncertainty remain higher than average, which tends to have a dampening effect on business investment and consumer expenditures on durable goods.

Temporary Burst of Inflation Is Possible

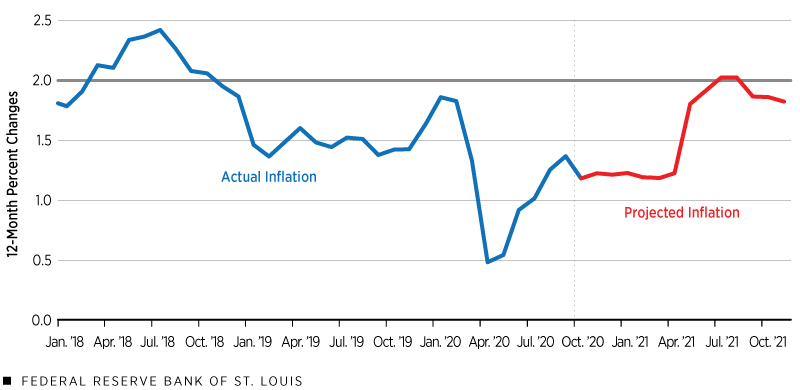

Inflation rates have moderated the past few months after rebounding sharply in May and June. For the 12 months ending in October 2020, the personal consumption expenditures price index (PCEPI) is up 1.2%.

The Federal Reserve Bank of St. Louis' inflation forecasting model predicts that the PCEPI inflation rate will remain at this rate over the first several months of 2021, but then briefly increase to 2% by summer. The model predicts that inflation will drift back down thereafter to around 1.75% by the end of 2021. See the figure below.

Personal Consumption Expenditures Price Inflation: Actual and Current Forecast

SOURCES: Bureau of Economic Analysis, Federal Reserve Bank of St. Louis and Haver Analytics.

Energy prices remain a wild card in the inflation outlook. COVID-19-related restrictions that weaken output growth and employment would tend to lower prices of oil and natural gas (less demand). However, the prospect of a proven vaccine would be expected to do the opposite. The recent rise in crude oil prices suggests markets are betting on the latter.

Large and increasing federal budget deficits and rising debt levels are occurring against the backdrop of the FOMC’s new strategy to countenance inflation temporarily above 2%. Thus, financial markets may become worried about higher inflation over the medium term, in view of aggressive actions by fiscal and monetary policymakers. However, market-based measures of inflation expectations over the next 10 years remain less than 2%.

Kathryn Bokun, a research associate at the Bank, provided research assistance for this article.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us