First-Time Homebuyers Appear to Be Younger, Less Creditworthy in Eighth District

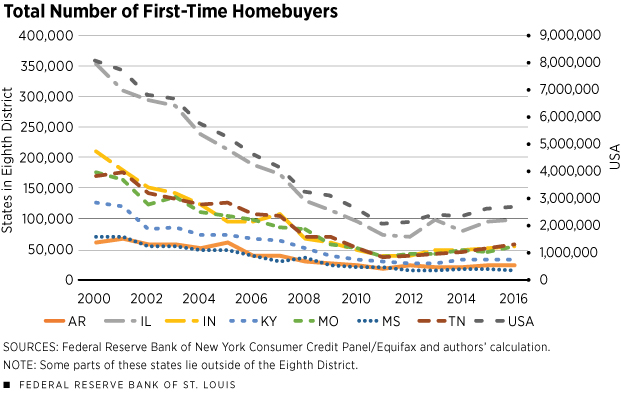

First-time homebuyers are essential to the dynamics of the housing market by allowing current homeowners to trade up. The number of first-time homebuyers decreased between 2000 and 2011, and then started slowly increasing again. (See Figure 1.) There are many possible reasons why this happened, such as rising rent and home prices, rising student debt and tightening credit standards.

Have there been fewer first-time homebuyers in the Eighth Federal Reserve District? In this article, we study the number and some characteristics of first-time homebuyers in the Eighth District1 and see how they compare to those at the national level.

We used the Federal Reserve Bank of New York Consumer Credit Panel/Equifax to estimate the number of first-time homebuyers. The FRBNY Consumer Credit Panel (CCP) consists of detailed credit-report data, updated quarterly, for a unique longitudinal panel of individuals and households beginning in 1999. It provides information on various forms of debt, including student loans, auto loans and mortgages.

The CCP is a nationally representative 5 percent random sample of individuals in the United States with a Social Security number and credit report.2

We took a 10 percent random sample of the CCP dataset, so we have a 0.5 percent nationally representative sample. In other words, we have 1,347,520 unique records for this sample in 2016, out of approximately 269,504,000 individuals in the U.S. with a Social Security number and a credit report.

A drawback of the CCP dataset is that it only includes homebuyers who finance their purchase with a mortgage; it excludes all cash purchases. However, it is likely that most first-time homebuyers finance their home.

Following work by Jessica Dill and Elora Raymond, we used the CCP to estimate the number of first-time homebuyers.3 We took the year of the oldest mortgage on file for individuals within the dataset to determine the first time they obtained a mortgage. This analysis does not consider individuals who transitioned back to renting and then purchased a home later on.4

Figure 1 is a plot of the total number of first-time homebuyers from 2000 to 2016 by each state in the Eighth District5 and the whole U.S. The number of first-time homebuyers decreased significantly since 2000. The decline bottomed out around 2011 and 2012 for the U.S. and most states in the District.

From 2000 to 2011, the rate of decline for these District states is similar to the 76 percent decline nationwide. Indiana and Illinois experienced the sharpest decline during this period, each falling about 80 percent, while Arkansas had the smallest decline, dropping about 70 percent.

The number of first-time homebuyers bottomed out in 2011 for the nation and most states in the Eighth District. Since 2011, the number of first-time buyers nationally has increased 34 percent. The growth rates since 2011 for Missouri and Tennessee exceeded the nation’s at 46 and 54 percent, respectively. The rates in Arkansas, Illinois and Indiana are in line with the nation’s. However, the rate remains flat in Kentucky, while the rate in Mississippi has actually declined 22 percent since 2011.

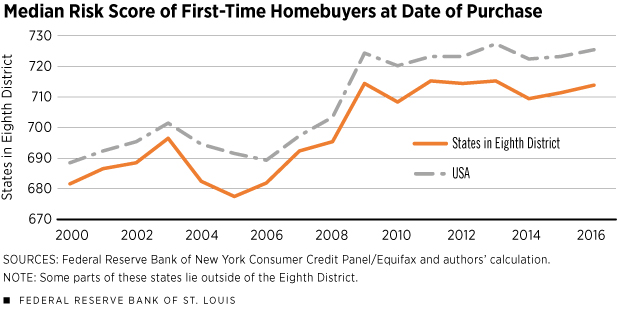

Figure 2 plots the median credit score of first-time homebuyers at the date of purchase. As we can see, credit worthiness appears to be of lesser importance in the states of our District throughout the whole period of 2000 to 2016; the combined credit score is lower than the national level.

Qualitatively, however, the District and national trends behave the same. Credit requirements eased from 2003 to 2006, corresponding to the time of the housing bubble. When the housing bubble burst, credit significantly tightened as lenders increased credit worthiness requirements. As we mentioned, credit scores in the District follow a similar trajectory but began to increase a year earlier than the national trend. After the sharp increase, the District and national trends flattened out in 2009.

Although increasing over the last several years, the number of first-time homebuyers is still much lower than the pre-2007 level, suggesting that tightened lending standards have been a headwind for first-time homebuyers.

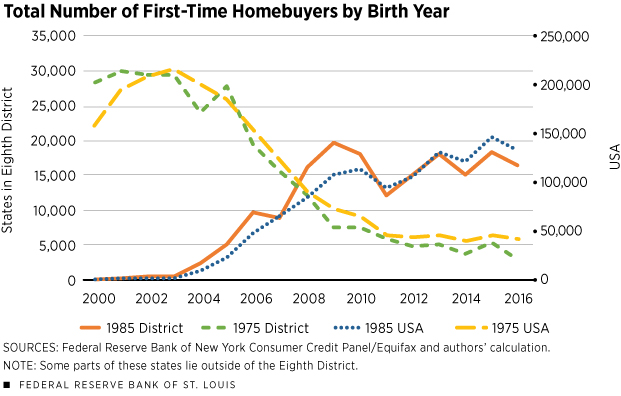

Did this decline affect age groups differently? Figure 3 shows the total number of first-time homebuyers who were born in 1975 and 1985 for the U.S. and the District, from 2000 to 2016. The number of first-time homebuyers for those born in 1975 peaked in the early 2000s, when they were in their late 20s, while the number of first-time homebuyers for those born in 1985 has remained more constant since 2010.

For those born in 1975, the total number of first-time homebuyers fell precipitously after age 30, while the number for those born in 1985 remained fairly constant after 2010. These results suggest that demand by first-time buyers is more spread out for later generations.

From these data, we can conclude that the number of first-time homebuyers in the District states has a trend which is very similar to the national level and that credit requirements are somewhat looser in the District.

Paulina Restrepo-Echavarria is an economist, and Brian Reinbold is a research associate, both at the Federal Reserve Bank of St. Louis. For more on Restrepo-Echavarria’s work, see https://research.stlouisfed.org/econ/restrepo-echavarria.

Endnotes

- Headquartered in St. Louis, the Eighth District includes all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. [back to text]

- See van der Klaauw and Lee. [back to text]

- See Dill. [back to text]

- According to the U.S. Department of Housing and Urban Development, a first-time home buyer is “an individual who has no ownership in a principal residence during the 3-year period ending on the date of purchase of the property.” Therefore, an individual who buys their first home, then becomes a renter and finally purchases a home three or more years later would be considered a first-time home buyer again. See HUD. [back to text]

- The sample includes individuals from the entire state, not just those from the parts of the state that belong to the District. [back to text]

References

Dill, Jessica; and Raymond, Elora. Are Millennials Responsible for the Decline in First-Time Home Purchases? Federal Reserve Bank of Atlanta: Real Estate Blog, May 20, 2015. See http://realestateresearch.frbatlanta.org/rer/2015/05/are-millennials-responsible-for-the-decline-in-first-time-home-purchases.html.

Dill, Jessica; and Raymond, Elora. Are Millennials Responsible for the Decline in First-Time Home Purchases? Part 2. Federal Reserve Bank of Atlanta: Real Estate Blog, July 1, 2015. See http://realestateresearch.frbatlanta.org/rer/2015/07/are-millennials-responsible-for-the-decline-in-first-time-home-purchases-part-2.html.

U.S. Department of Housing and Urban Development. HUD HOC Reference Guide, Nov. 7, 2012. See https://archives.hud.gov/offices/hsg/sfh/ref/sfhp3-02.cfm.

van der Klaauw, Wilbert; and Lee, Donghoon. An Introduction to the FRBNY Consumer Credit Panel. Federal Reserve Bank of New York, Staff Report No. 479, November 2010.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us