Economy Bounces Back from Hurricanes

(All data for this article are as of Dec. 1.)

Two major hurricanes hit the U.S. mainland in August (Harvey) and September (Irma).1 Given the population and economic significance of the impacted regions, most forecasters immediately downgraded prospects for the U.S. economy’s growth of real gross domestic product (GDP) in the third quarter.

Although the hurricanes reduced U.S. employment in September, employment subsequently recovered in October. Despite initial forecasts of a sharp slowdown in third-quarter real GDP growth, the pace of economic activity turned out to be stronger than expected.

Forecasters continue to see above-trend real GDP growth in the fourth quarter, bolstered by the burst in economic activity that normally occurs during the recovery and rebuilding phase after natural disasters.

Economic Effects of Natural Disasters

Typically, natural disasters disrupt activity in three key ways. First, disasters destroy lives, property and other factors of production. These are termed direct losses. These losses reduce the region’s and, if large enough, the nation’s wealth and tend to adversely affect productivity, income and profits in the short term.

Second, indirect losses occur as a result of the disaster’s direct losses. These indirect losses include disruptions to the supply chain, upending the efficient distribution of goods and services, as well as lost sales and increased costs for businesses. Some of these losses (e.g., restaurant meals or airline services) can never be made up.

Finally, natural disasters eventually trigger a rebound in economic activity, as structures, furniture, appliances and vehicles are repaired or replaced. For example, U.S. auto sales rose sharply in September and remained at a high level in October.

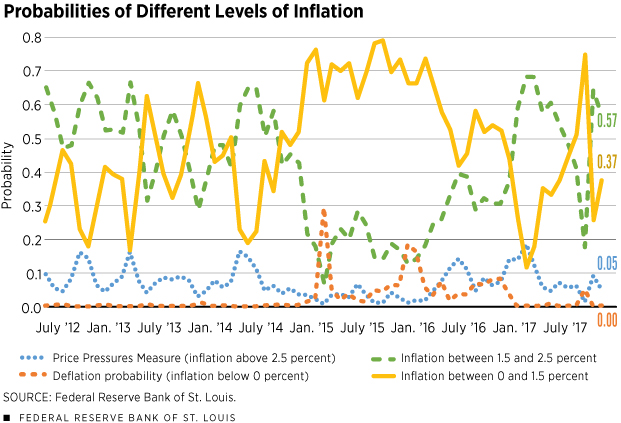

This chart plots the four St. Louis Fed Price Pressures Measures (PPM). Each series measures the probability that the personal consumption expenditures price index (PCEPI) inflation rate over the next 12 months will fall within a certain bucket. The four buckets are as follows: below 0 percent, between 0 and 1.5 percent, between 1.5 and 2.5 percent, and above 2.5 percent. For example, the probability for the above 2.5 percent bucket (“Price Pressures Measure”) is 0.05, which indicates there is a 5 percent probability inflation will exceed 2.5 percent over the next 12 months.

Developing Momentum

Despite the hurricane-spawned disruptions, U.S. real GDP accelerated at a 3.3 percent annual rate in the third quarter. The second estimate was modestly stronger than the advance estimate. The advance estimate of 3 percent was very close to the St. Louis Fed’s Economic News Index (ENI) estimate, which had predicted third-quarter growth of 2.9 percent.

With the hurricanes in the rearview mirror, the near-term outlook for the economy is brightening. Business surveys, such as the purchasing managers reports and the national homebuilders survey, indicated high levels of activity in September and October. Importantly, business-capital expenditures continue on an upward trajectory.

Likewise, consumer confidence continues to trend higher, reflecting record-high stock prices and healthy labor market conditions. Indeed, the unemployment rate fell to 4.1 percent in October, its lowest level since December 2000.

Wage gains have also picked up, albeit at a sluggish pace. Importantly, labor productivity growth is finally beginning to accelerate, which would be a catalyst for stronger wage and real GDP growth.

Another factor helping to bolster the U.S. economy is the improving global economic outlook, which has triggered an upswing in U.S. exports.

At the same time, the construction industry has slowed, mostly because of slowing in the multifamily and commercial segments. Housing sales have slowed, but homebuilders generally report that this reflects supply shortages (e.g., labor and lots) rather than a softening in demand.

The St. Louis Fed’s ENI predicted on Dec. 1 that real GDP will increase at a 3.1 percent rate in the fourth quarter.

Inflation Developments

The effects of Hurricane Harvey were notable because it affected the heart of the nation’s petrochemical industry on the Gulf Coast. As refineries, pipelines and chemical production facilities shut down, prices of gasoline, diesel fuel and petroleum-based products like resins and plastics rose appreciably; price increases were passed along to consumers and producers to varying degrees. However, as production returned to normal, these supply shortages abated and prices retreated accordingly.

Likewise, Hurricane Irma roared through Florida, disrupting its important tourism and agricultural industries. Food price increases were already on the upswing since fall 2016, and Irma may put additional upward pressure on them. The recent fires in northern California may be another source of additional pressures on food price inflation.

Despite the uptick in food and energy prices, the personal consumption expenditures price index was up in October by only 1.6 percent from a year earlier. Still, the rise in crude oil prices in October and November suggests that inflation could drift higher in the fourth quarter.

Nonetheless, inflation expectations remain stable, perhaps reflecting the expectation of further tightening actions by the Federal Open Market Committee in 2018, which would be expected to help stanch rising price pressures. As of late November, the St. Louis Fed’s inflation forecasting model continues to see a low probability of headline inflation exceeding 2.5 percent over the next 12 months.

Kevin L. Kliesen is an economist at the Federal Reserve Bank of St. Louis. Brian Levine, a research associate at the Bank, provided research assistance. See http://research.stlouisfed.org/econ/kliesen for more on Kliesen’s work.

Endnote

- A third major hurricane, Maria, ravaged Puerto Rico. Because U.S. GDP and employment data do not include economic activity from Puerto Rico, this article does not discuss the potential economic effects stemming from Maria on the U.S. economy. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us