Boomers Have Played a Role in Changes in Productivity

In the 1970s, the U.S. economy experienced a prolonged period of low productivity growth. Nowadays, growth in productivity is once again slower than expected.

The causes of these slowdowns have been much debated. The 1970s’ slowdown has often been associated with, among other causes, high energy prices following the 1973 oil price shock, increased antipollution regulations and a decline in the quality of education.1 The current productivity slowdown is often associated with the 2007-08 financial crisis.

In this article, I hypothesize that the two slowdowns are related to a single, common factor: the baby boom, that period from 1946 to 1957 when the birth rate increased by 20 percent. This hypothesis is not to say that the baby boom was entirely responsible for these two episodes of low productivity growth. Rather, it is to point out the mechanism through which the baby boom contributed to both. Exactly how much did the baby boom contribute to these slowdowns? The answer to that question is beyond the scope of this article.

Productivity 101

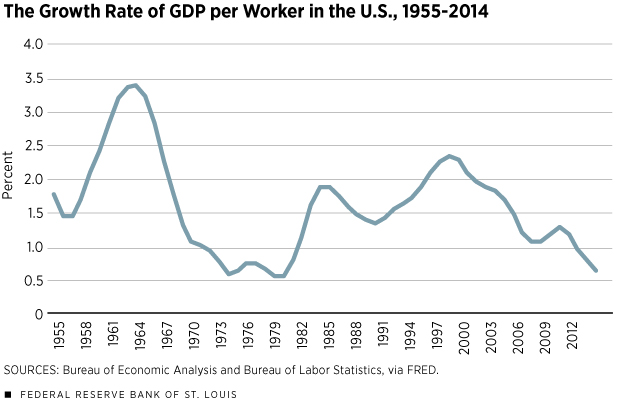

A typical measure of productivity is labor productivity, which is gross domestic product (GDP) per worker.2 Figure 1 shows that, in the 1970s, the growth rate of labor productivity was noticeably low.3 This slowdown started in the 1960s, when the growth rate of labor productivity started to decline. The growth rate of labor productivity accelerated between 1980 and 2000. Since 2000, another decline is noticeable. It is interesting to note that the current state of low labor productivity growth is comparable to that of the 1970s and that it results from a decline that started before the 2007 recession.

To understand how the baby boom may have contributed to both the 1970s slowdown and the current slowdown, it is worth taking a detour to think about what makes a worker productive.

Current thinking is that workers supply “human capital services” to their employer. Sometimes one can refer to “skills” or simply “productivity.” The exact terminology is not critical. What is critical is the theory that young workers have relatively low human capital and that, as they become older, they accumulate human capital.

The accumulation of human capital can be achieved in multiple ways. One is simply via experience: Older workers have more human capital, i.e., they know more just because they have done more and have experienced “learning by doing.” Another possibility is that workers go through periods of formal on-the-job training throughout their careers; so, they learn more as they grow older. Human capital is what makes a worker productive: The more human capital, the more output a worker produces in a day’s work.

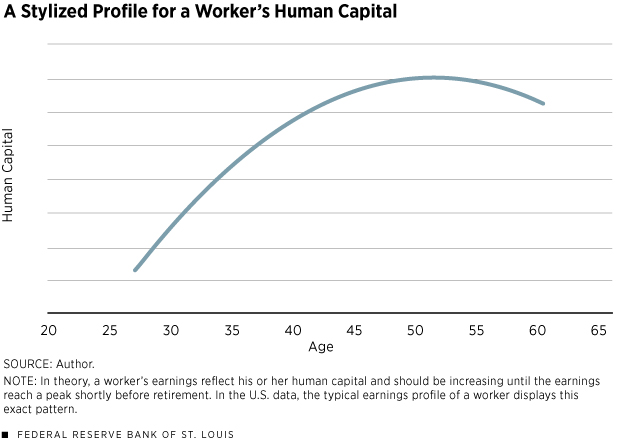

Picture, then, a typical worker’s human capital profile throughout life. A stylized representation of this profile is in Figure 2. In theory, such a human capital profile implies that a worker’s earnings profile should look very similar. This is because, in theory, workers are paid according to their productivity. Interestingly, this is exactly the case in the United States: The data show that the typical earnings profile throughout a worker’s life increases until it reaches a peak, usually a few years before retirement. What, then, does human capital theory tell us about U.S. productivity?

Who Is More Productive?

Start with a simple example. Suppose that there are only young and old workers. Each young worker produces one unit of a good, while each old worker produces two units since the old worker has more human capital ( Figure 2). Suppose now that there are 50 young and 50 old workers. The total number of goods produced is 150 and, therefore, labor productivity is 150/100=1.5.

But what if there were a larger proportion of young workers? Suppose that there are 75 young and 25 old. The total production would be 125 and, therefore, labor productivity would be 1.25. Thus, the increased proportion of young workers reduces labor productivity as we measure it via output per worker.4

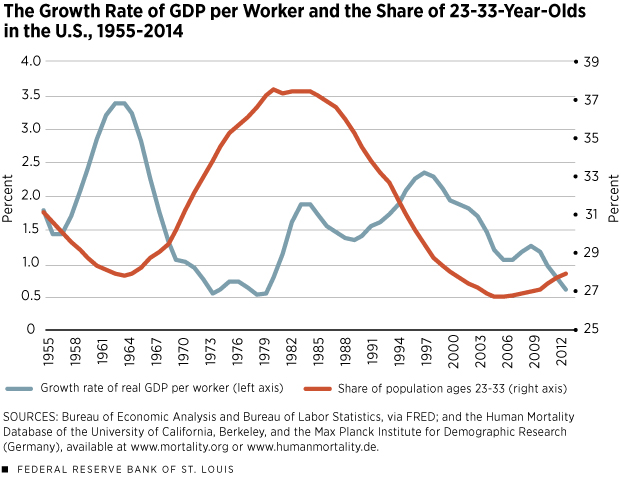

The mechanism just described is exactly how the baby boom may have affected the growth rate of U.S. labor productivity. Look at Figure 3. The blue line represents the growth rate of labor productivity, as in Figure 1. The red line represents the share of people between the ages of 23 and 33 (relative to the population between the ages of 23 and 63).5 An increase in the red line means that the 23-33 population represents a larger share of the U.S. population. The peak circa 1980 is the direct consequence of the baby boom: The U.S. birth rate peaked circa 1960, implying a large share of people in their 20s circa 1980. Note in Figure 3 that the two lines move mostly in opposite directions except during the 2000s. The correlation between the two lines is, indeed, –37 percent.

Note also that the share of 23-33 year-olds is increasing since the late 2000s. This can also be viewed as a result of the baby boom: The baby boomers are slowly leaving the 23-63 population, tilting the scale toward the younger population once again. This trend is noticeably less pronounced, however, during the 2000s than it was during the 1970s. Thus, the mechanism discussed here is likely to be a stronger contributor to the 1970s slowdown than to the current one.

Is There a Problem to Be Fixed?

What do these observations mean for productivity measurement?

It is important to realize that, should the theory proposed here be correct, there exists a sense in which the productivity slowdowns (especially in the 1970s) are statistical artifacts, that is, it may be that the productivity of individual workers did not change at all during the 1970s, but that the change in the composition of the labor force caused the slowdown in labor productivity. In a way, therefore, there is nothing to be fixed via government programs. Productivity slows down because of the changing composition of the labor force, and that results from births that took place at least 20 years before.

If we knew exactly how much human capital each worker has, better measures of productivity could be constructed. This, however, is a difficult endeavor since human capital is not directly observable.

The literature devoted to the measurement of human capital is large. Significant progress has been made, but much remains to be learned.

Guillaume Vandenbroucke is an economist at the Federal Reserve Bank of St. Louis. For more on his work, see https://research.stlouisfed.org/econ/vandenbroucke. Heting Zhu, a research associate at the Bank, provided research assistance.

Endnotes

- See Cullison. [back to text]

- Another measure of productivity is total factor productivity, also called multifactor productivity, which gauges the joint contribution of labor and capital to output, instead of the contribution of labor only, as does labor productivity. [back to text]

- The growth rate of productivity in Figure 1 was smoothed to remove frequent variations and to focus on secular changes. [back to text]

- The total number of workers is kept constant in this example, but that does not matter. Suppose there were 10 times more workers: 750 young and 250 old. Labor productivity would still be 1.25. [back to text]

- The share of people between ages 23 and 33 is a proxy for the share of young people. This does not imply that the old are all the people older than 33. [back to text]

Reference

Cullison, W.E. The U.S. Productivity Slowdown: What the Experts Say. Economic Review, Federal Reserve Bank of Richmond, July/August 1989, pp. 10-21.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us