Advanced Manufacturing Is Vital across Nation, Including Eighth District

Manufacturing has been one of the nation’s largest and most productive sectors dating back to the Industrial Revolution, and that remains true today despite a long-term decline in employment.1

As technological progress continues to alter the landscape of the economy, a subset of manufacturing industries known as “advanced manufacturing” serves as a critical source of growth as these products drive productivity gains throughout the economy.

In some sense, all manufacturing is “advanced” because it requires specific knowledge and use of modern technology. However, we refer specifically to the advanced manufacturing sector as industries in which research and development spending exceeds $450 per worker and at least 21 percent of jobs require a high degree of technical knowledge.2 These two metrics quantify the high level of development, design and technical work that is needed to initially develop advanced products.

Thirty-five manufacturing industries outlined in the North American Industry Classification System (NAICS) qualify as advanced. Among the largest U.S. advanced manufacturers are companies that produce electronics, motor vehicles and fuel. The table displays the largest advanced manufacturing firms, based on revenue, in the nation and the Eighth Federal Reserve District.3

Largest Advanced Manufacturing Firms by Revenue

| National | Eighth District | |

| 1 | Apple (3342) | Emerson Electric (335) (St. Louis, Mo.) |

| 2 | Johnson & Johnson (3254) | MilliporeSigma (3254) (St. Louis, Mo.) |

| 3 | Gilead Sciences (3254) | Energizer Holdings (3359) (St. Louis, Mo.) |

| 4 | Intel (3344) | Hillenbrand (3339) (Batesville, Ind.) |

| 5 | Cisco Systems (3342) | American Railcar Industries (3365) (St. Charles, Mo.) |

| 6 | General Motors (3361) | Esco Technologies (3345) (St. Louis, Mo.) |

| 7 | General Electric (335) | FutureFuel (3251) (Clayton, Mo.) |

| 8 | Amgen (3254) | Kimball Electronics (3344) (Jasper, Ind.) |

| 9 | Pfizer (3254) | Escalade (3399) (Evansville, Ind.) |

| 10 | Exxon Mobil (3241) | Sypris Solutions (3363) (Louisville, Ky.) |

SOURCE: Compustat.

NOTE: Firm location is based on the location of the headquarters, which is self-reported by the corporation. Company NAICS code in parentheses. All data are from December 2016 unless otherwise noted. MilliporeSigma data are from Sigma-Aldrich in December 2014; since then, Sigma-Aldrich has been bought out and merged into MilliporeSigma.

A company is classified as a manufacturing firm if its main business purpose is to produce goods, regardless of how much it engages in the actual production of those goods. Consider Apple: Its purpose is to produce electronics, so it is a manufacturing firm even though it contracts production to other suppliers and has many employees developing software. Similarly, there are two types of manufacturing employees: production workers, who physically make the goods, and nonproduction workers, who work in other occupations that include administrative, professional, technical and management positions.

We restrict our analysis to advanced manufacturing for two reasons. First, these industries are more productive than the rest of manufacturing. Although they historically have employed only about 45 percent of manufacturing employees, their output makes up to 53 percent of manufacturing output.

Second, there exists a wage premium for advanced manufacturing employees. The average employee in these industries earns about 40 to 50 percent more than the average private sector worker, depending on the data source. As of 2016, the wage premium for nonproduction workers compared with private sector workers is 72 percent, and the premium for production workers is 7 percent.4 In contrast, workers in non-advanced manufacturing sectors earn essentially the same wage as other private sector workers.

In this article, we will examine advanced manufacturing’s long-term shifts, its current state and its impact on the Eighth District economy.

National Advanced Manufacturing

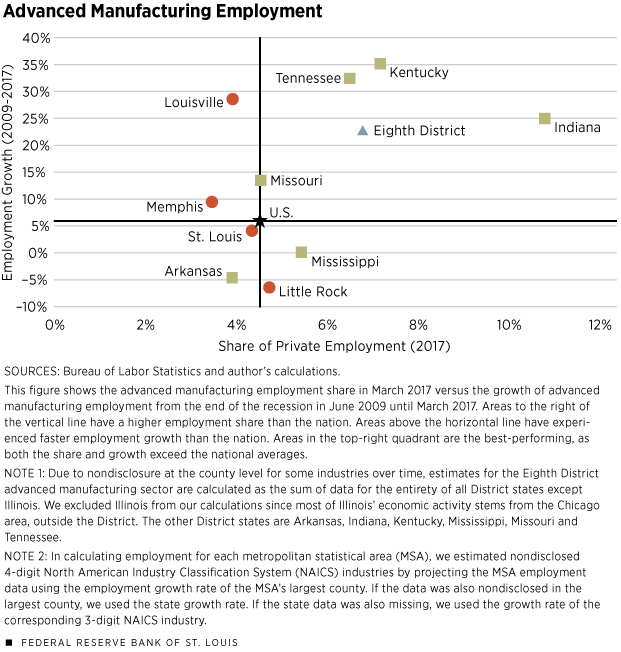

From January 1997 to the end of the Great Recession in June 2009, advanced manufacturing lost over 2 million employees. The biggest losses were in computer electronics manufacturing, which lost 720,000 jobs, and primary metals manufacturing, which lost 450,000. As a share of private employment, advanced manufacturing employment fell from 7.5 percent to 4.9 percent during this period. During the recovery from June 2009 to March 2017, advanced manufacturing employment increased 6 percent, but the share fell to 4.5 percent. (See Figure 1.)

Despite gains in recent years, employment in advanced manufacturing has fallen over 30 percent since 1997. Yet, that is not necessarily an indication of weakness in the sector. From 1997 to 2015, real output increased by over 50 percent due to gains in labor productivity. In 2015, advanced manufacturing was 40 percent more productive than the private sector as a whole.

Similarly, advanced manufacturing remains the largest U.S. exporter. In 2016, advanced manufacturing accounted for 60 percent of the dollar value of exports, down slightly from 68 percent in 1997, but up from 2014.

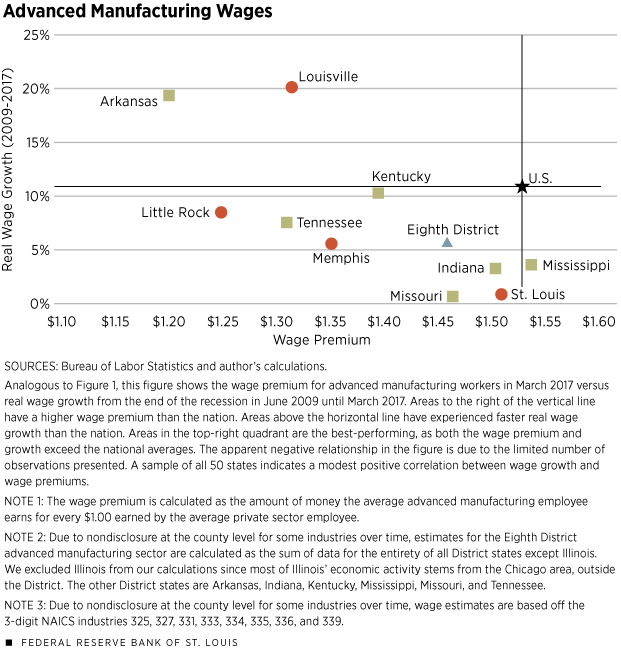

Moreover, wages in advanced manufacturing are high, with the average worker making over $1,600 per week. Wages are highest in computers and electronics manufacturing, at $2,300, and chemical manufacturing, at $1,900. Real (inflation-adjusted) wages have grown 11 percent since the recession, with the largest gains in computers and electronics manufacturing. Today, the average advanced manufacturer makes $1.53 for every $1 that the average private sector worker makes. (See Figure 2.)

Most advanced manufacturing jobs are in large metropolitan statistical areas (MSAs). Employment is highest in Los Angeles, which has 232,000 employees, followed by Chicago, with 143,000, and New York, with 132,000. These three MSAs account for 9 percent of advanced manufacturing employment nationwide. While the total number of employees is smaller, as a share of private employment, advanced manufacturing is most heavily concentrated in Midwestern MSAs. The share is highest in Battle Creek, Mich. (the main product being autos), followed by Wichita, Kan. (airplanes), and Columbus, Ind. (machinery).

Regional Employment

Advanced manufacturing is especially vital to the Eighth District economy: The sector employs 7 percent of private sector workers and generates 11 percent of private output.5 As Figure 1 shows, both the employment share and growth since the recession exceed the national averages. Among District states, the employment share is largest in Indiana, Kentucky and Tennessee. Among the District’s four largest MSAs (St. Louis, Mo.; Memphis, Tenn.; Louisville, Ky.; and Little Rock, Ark.), the employment share is highest in Little Rock.

Since the end of the recession, advanced manufacturing employment in the District states has grown 23 percent, outpacing the national rate considerably. That translates to 139,000 new jobs in the District states. Employment growth has been fastest in the eastern portion of the District: Kentucky, Tennessee and Indiana are growing substantially more rapidly than the rest of the District states. Among the MSAs, Louisville has experienced the fastest employment growth since 2009, at 29 percent, followed by Memphis, at 10 percent.

Auto Manufacturing in the District

Auto manufacturing has a significant presence regionally, employing 39 percent of advanced manufacturing workers, and has driven the bulk of advanced manufacturing’s growth. On net, 90 percent of new advanced manufacturing jobs since 2009 are automotive.

Among District states, auto manufacturing employment as a share of advanced manufacturing employment is largest in Indiana, Kentucky and Tennessee. Among the MSAs, the auto employment share is largest in Louisville, at 37 percent, and Memphis, at 15 percent. Recall from Figure 1 that these areas also experienced the fastest growth in advanced manufacturing employment.

The Regional Impact

District productivity in the sector mirrors the nation. Advanced manufacturing in 2015 was 36 percent more productive than the overall private sector, with the most productive subsector being transportation equipment manufacturing. Advanced manufactures are a larger component of trade for the District than nationally. They make up 70 percent of the dollar value of District state exports to the world, above the 1997 share of 64 percent.

Average weekly advanced manufacturing wages in the District are generally below the U.S. average. However, nominal wages are lower throughout the private sector in the Eighth District, mostly because of the District’s lower cost of living.6 Figure 2 shows that the District’s wage premium, which accounts for differences in cost of living, also tends to fall below the U.S. average. This result is largely due to the fact that nonproduction workers, who garner higher wages than production workers, constitute a smaller proportion of the sector’s workforce in the District compared to the nation. Of the District MSAs and states, only Mississippi’s wage premium of 54 percent exceeds the national average. Among the four MSAs, the premium is highest in St. Louis, at 51 percent.

Likewise, real wage growth in the District, while positive, is slow. Of the states, only Arkansas real wages are growing more quickly than the national average. Among the MSAs, real wages are growing fastest in Louisville and Little Rock, at 20 percent and 9 percent, respectively.

Sector Still Significant

Advanced manufacturing employment as a share of private employment has steadily declined over the years, but the sector remains a significant cog in the U.S. economy. Advanced manufacturing accounts for 7 percent of private output and 60 percent of the dollar value of U.S. exports.

In the Eighth District, advanced manufacturing has a relatively large presence, mostly due to a high concentration of automotive manufacturing employment. However, the wage premium for advanced manufacturing employees, while significant, is smaller regionally than nationally. Likewise, though real wages are growing positively in the Eighth District, the pace of growth lags behind the national average.

Charles Gascon is a regional economist, and Andrew Spewak is a senior research associate, both at the Federal Reserve Bank of St. Louis. For more on Gascon’s work, see https://research.stlouisfed.org/econ/gascon.

Endnotes

- See Kliesen and Tatom. [back to text]

- See Muro et al. [back to text]

- Headquartered in St. Louis, the Eighth Federal Reserve District includes all of Arkansas and parts of Illinois, Indiana, Kentucky, Mississippi, Missouri and Tennessee. In our analysis we exclude Illinois; see endnote 5 for more information. [back to text]

- The Quarterly Census of Employment and Wages (QCEW) and Occupational Employment Statistics (OES), both from the Bureau of Labor Statistics, report industry-level wages. The advanced manufacturing wage premium is estimated to be 53 percent (QCEW) and 42 percent (OES). The OES provides estimates for both nonproduction and production occupations. Throughout the rest of the article, we will use QCEW data, as they are better suited for time series and regional analysis. When available, we have tested the robustness of our results using the OES data. [back to text]

- Due to nondisclosure at the county level for some industries over time, estimates for the District’s advanced manufacturing sector are calculated as the sum of data for the entirety of all District states except Illinois. We excluded Illinois from our calculations since most of that state’s economic activity stems from the Chicago area, which is outside the District. [back to text]

- See Coughlin, Gascon and Kliesen for more information on the relationship between cost of living and income. [back to text]

References

Coughlin, Cletus; Gascon, Charles; and Kliesen, Kevin. Living Standards in St. Louis and the Eighth Federal Reserve District: Let’s Get Real. Federal Reserve Bank of St. Louis Review, Fourth Quarter 2017, Vol. 99, No. 4, pp. 377-94.

Kliesen, Kevin; and Tatom, John. U.S. Manufacturing and the Importance of International Trade: It’s Not What You Think. Federal Reserve Bank of St. Louis Review, January/February 2013, Vol. 95, No. 1, pp. 27-49.

Muro, Mark; Rothwell, Jonathan; Andes, Scott; Fikri, Kenan; and Kulkarni, Siddharth. America’s Advanced Industries: What They Are, Where They Are, and Why They Matter. The Brookings Institution, February 2015.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us