After Years of Decline, Yields on U.S. Treasuries Rise

After almost eight years of declining yields, the second half of 2016 marked a turning point for the U.S. bond market, with yields on 10-year and 30-year Treasuries substantially increasing, especially during the last two months of the year. In this article, we describe several domestic and international factors that have affected demand for U.S. Treasuries and have potentially helped push yields higher.

Demand from Foreign Holders

Central banks have been one of the most reliable sources of demand for U.S. Treasuries since 2008. Between 2008 and 2013, the Federal Reserve’s custody holdings of U.S. Treasuries for foreign central banks and other international institutions more than doubled, reaching about $3 trillion.1 At the peak in September 2015, foreign official institutions held a total of $4.15 trillion in U.S. Treasuries (including the $3 trillion held in custody at the Fed). In the year to September 2016, however, their Treasury holdings declined by $245.8 billion, and those in custody at the Fed declined by $185.4 billion.

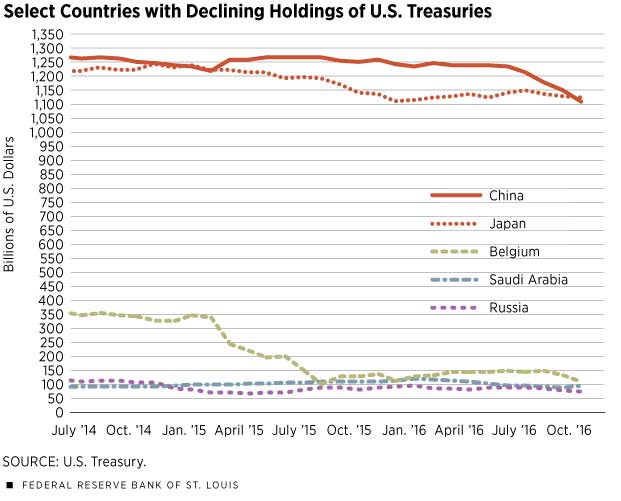

China and Japan, the top two foreign holders of U.S. debt, together account for 37 percent of foreign-held Treasuries, while Belgium, Saudi Arabia and Russia account for an additional 5 percent. All of these countries have recently reduced their exposure to U.S. Treasuries (Figure 1), with their combined holdings declining by $170 billion in the year to September 2016.

Each country has pulled back for a different reason. China has been selling U.S. Treasuries to defend its yuan in the face of capital outflows due to slower growth. Japan has been swapping Treasuries for cash and T-bills because its prolonged negative interest rates have increased the demand for U.S. dollars. Saudi Arabia has been selling to cover its budget deficit after the long decline in oil prices. And Belgium is home to Euroclear Bank SA, which holds securities on behalf of other countries; some people have speculated that in the case of U.S. Treasuries, it was acting on behalf of China.2

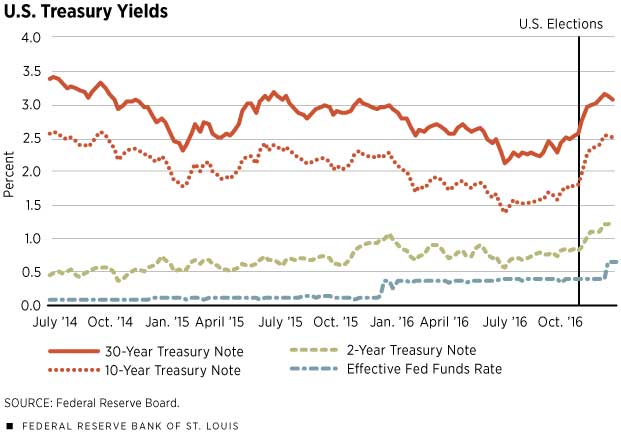

Although holdings by foreign official institutions have steadily declined since mid-2015, U.S. Treasury yields had remained more or less stable until the latter half of 2016. In the face of larger sell-offs, the yields on the 2-year, 10-year and 30-year Treasuries increased by 24, 44 and 45 basis points, respectively, between their lowest point on the week ending July 6, 2016, and the week ending Nov. 2, 2016 (Figure 2).

Domestic Factors Affecting Demand

Two key events that contributed to the rapid increase in U.S. Treasury yields were the results of the U.S. national elections and the agreement by major oil-producing countries to cut oil production in order to reduce the oversupply of crude and lift its market price.

The election results in early November delivered a positive shock to U.S. financial markets overall, despite also triggering a sharp correction in the Treasury market. Expectations shifted with the anticipation of aggressive fiscal policy changes, including higher infrastructure spending, financial deregulation and a major tax overhaul. In theory, if these policy changes materialize, they could lead to higher growth rates and a quicker pace of inflation. But these policy changes would also lead to higher-than-anticipated levels of U.S. government debt and a growing deficit,3 and, together with the deal to cut crude production, would reinforce expectations of higher inflation.

These fears drove investors worldwide to sell a massive amount of U.S., German and Japanese bonds, along with other fixed-income securities, causing yields to spike.4 In the weeks between Nov. 2 and Dec. 7, yields on the 2-year, 10-year and 30-year Treasuries increased by 30, 58 and 50 basis points, respectively (Figure 2).

As for recent changes in monetary policy, the Federal Open Market Committee (FOMC) decided at its December meeting to raise the target range for the federal funds rate by 25 basis points, moving in line with the markets and also expecting economic activity to expand gradually. In its press release, the FOMC cited further improvements in labor market conditions and expected inflation in the coming months as the factors behind its decision.5 The committee’s move boosted short-term interest rates further and stalled the rise in longer-dated yields, as investors moved from short-term to long-term securities.

Implications Ahead

Softer demand for long-term U.S. Treasuries—demand from central banks or investors worldwide—will keep yields trending upward faster than previously anticipated and could lead to higher borrowing costs in the near future. Though central banks’ actions have been mainly in response to their unique circumstances, the global market’s response has mainly focused on expectations of higher inflation and fiscal policy changes in the U.S. that may or may not materialize. Meanwhile, the FOMC has signaled that monetary policy is likely to gradually tighten according to the evolution of economic conditions.

Will demand from foreign central banks and investors pick up again? Will the cut in oil production hold, helping oil prices rise and pushing broader prices higher? Will a stronger dollar keep inflation at bay, or will rising inflation expectations push investors further from short-term to long-term Treasuries? Answers to these questions will also shed light on the future path of monetary policy.

Paulina Restrepo-Echavarria is an economist, and Maria Arias is a senior research associate, both at the Federal Reserve Bank of St. Louis. For more on Restrepo-Echavarria’s work, see https://research.stlouisfed.org/econ/restrepo-echavarria.

Endnotes

- Custody holdings are securities kept on behalf of some client, such as a foreign government or central bank. [back to text]

- See Kim. [back to text]

- An August 2016 Congressional Budget Office report projected public debt would be $14 trillion at the end of 2016 and $23 trillion at the end of 2026 (76.6 percent and 85.5 percent of gross domestic product [GDP], respectively). [back to text]

- See Leong, as well as Faucon, Hodge and Said. [back to text]

- See the FOMC’s December press release at www.federalreserve.gov/newsevents/press/monetary/20161214a.htm. [back to text]

References

Congressional Budget Office. “An Update to the Budget and Economic Outlook: 2016 to 2026.” August 2016. See www.co.gov/publication/51908.

Faucon, Benoit; Hodge, Nathan; and Said, Summer. “Oil-Producing Countries Agree to Cut Output Along with OPEC.” The Wall Street Journal. Dec. 10, 2016. Accessed Dec. 13, 2016. See www.wsj.com/articles/opec-russia-upbeat-about-securing-oil-output-deal-as-meeting-begins-1481362580.

Kim, Kyoungwha. “China Hides Treasury Buys in Belgium: Chart of the Day.” Bloomberg. July 27, 2014. Accessed Oct.18, 2016. See www.bloomberg.com/news/articles/2014-07-27/china-hides-treasury-buys-in-belgium-chart-of-the-day.

Leong, Richard. “Foreign Bids at U.S. Treasury Supply Weak after Election.” Reuters. Nov. 22, 2016. Accessed Dec. 1, 2016. See www.reuters.com/article/usa-auction-foreign-idUSL1N1DN1QH.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us