Measuring Labor Share in Developing Countries

KEY TAKEAWAYS

- Once considered a stable factor, labor’s share of GDP has fallen in developed countries. For developing nations, the evidence is mixed.

- The declining labor share can lead to stagnant incomes and lackluster wage growth.

- Alternative ways to measure labor share can help economists better understand a country’s growth.

Oftentimes economists think of income in terms of its factor components: labor and capital. The labor share is the fraction of labor income over gross domestic product (GDP), while the capital share is similarly the fraction of capital income over GDP. The labor share used to not draw much attention from researchers because it was long considered to be constant over time. However, it is now well-documented that the labor share in developed countries has, in fact, declined over the last few decades, but evidence remains mixed for developing countries.

A more complete understanding of the labor share can allow economists to better link the income at the macro-level (i.e., GDP) with the experience of individuals at the household level.1 For example, does an increase in GDP (national income) necessarily translate to higher income for all households or only a few?

A declining labor share can lead to stagnant incomes and lackluster wage growth. Because nominal wage growth signals future inflation, declining wages can lead to low inflation.2 Therefore, factoring in the labor share can help guide monetary policy. Also, a declining labor share is associated with increased inequality3 because capital owners are then receiving a greater share of income, but the number of capital owners is typically small relative to the general population.4

Gauging the Self-Employed

In this article, we look at the labor share and how it can be estimated in developing countries. If the labor share is declining in developing economies, this could hinder their future economic growth. However, it is more difficult to draw conclusions for developing and emerging economies because of data unavailability. One of the challenges of measuring a country’s labor share involves factoring in self-employed people, who can make up a larger share of the workforce in a developing country relative to the share in developed nations.

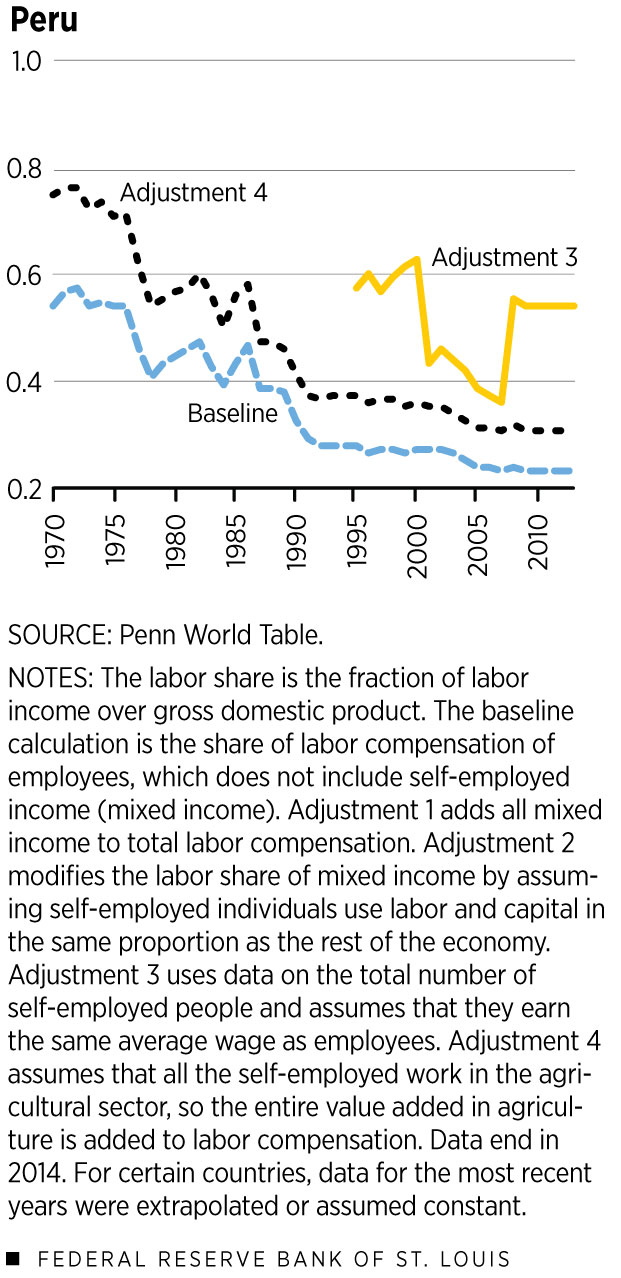

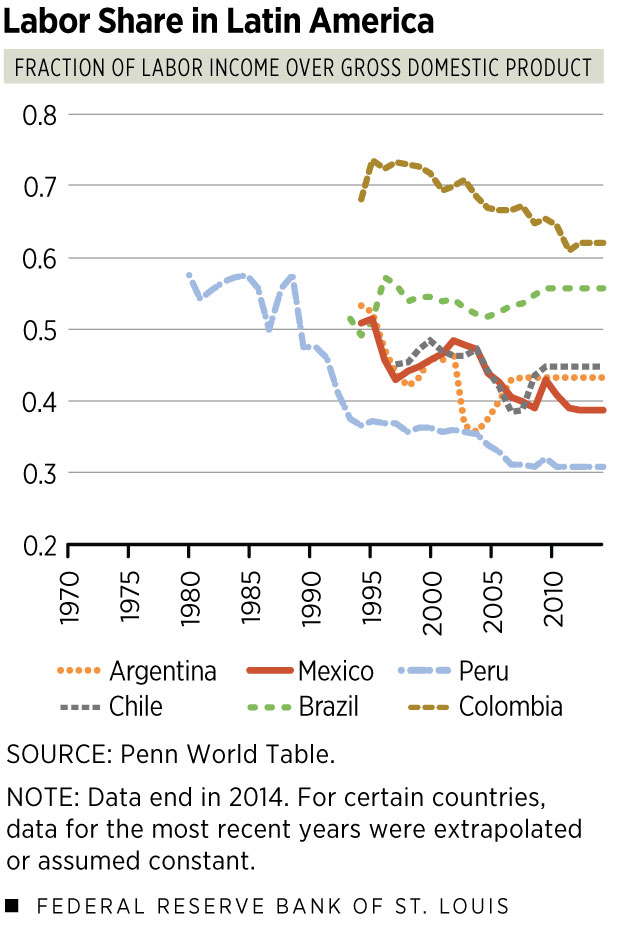

Figure 1 shows the labor share for Argentina, Brazil, Chile, Colombia, Mexico and Peru. Together these countries make up around 80 percent of GDP in Latin America.5

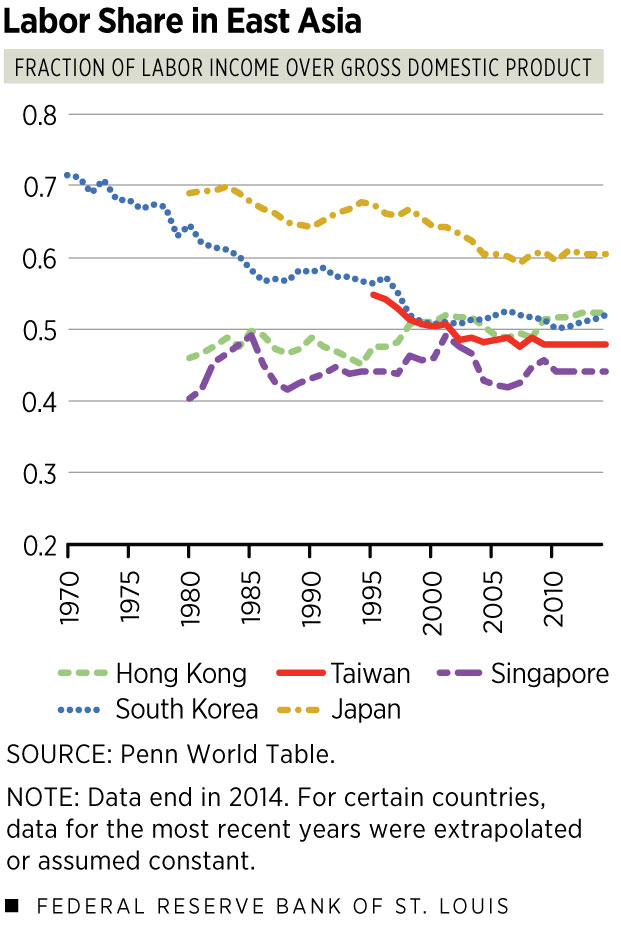

Figure 2 shows the labor share in Hong Kong, Japan, South Korea, Singapore and Taiwan.6 These economies experienced similar growth paths in the 20th century. These two groups were at similar stages in their economic development in the mid-20th century, but the East Asian economies grew more rapidly.

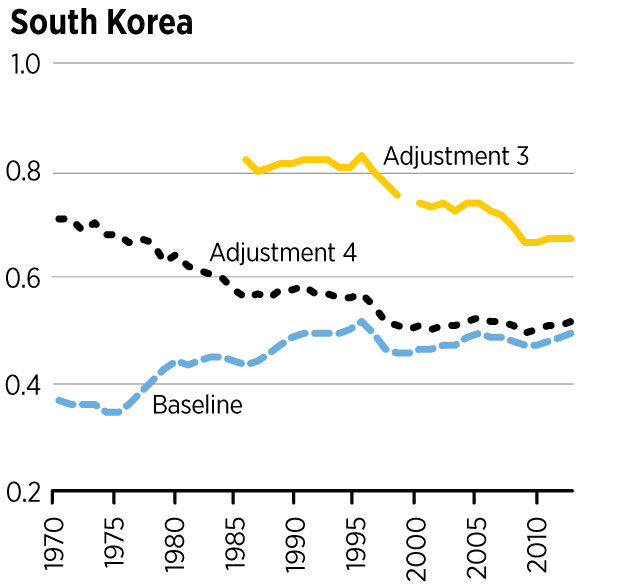

As Figures 1 and 2 show, the labor share varies widely among these economies, and for some, it also shows considerable differences over time. In Latin America, we see that the labor share has declined since 1995 for all countries except Brazil. The labor share has shockingly declined nearly 50 percent in Peru since 1980. In East Asia, the labor share has declined overall for Japan, South Korea and Taiwan but has actually increased in Hong Kong. The labor share remains fairly constant in Singapore. However, estimating the labor share accurately can be challenging, and the results will vary depending on what assumptions are made.

Assumptions for Estimating Labor Share

To have a good estimate of the labor share, it is crucial to have good data on labor compensation. Labor income is widely observable for employed individuals that work in formal firms. The challenge lies in estimating the labor income of self-employed individuals because their income contains contributions from both labor and capital.

The Penn World Table (PWT) has data for several estimates of the labor share.7 Figure 1 and 2 report what PWT considers the best measure based on several criteria.

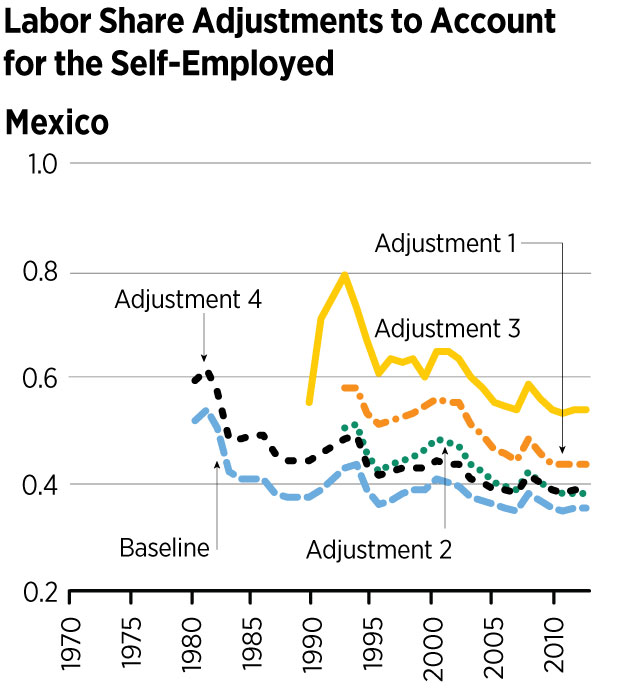

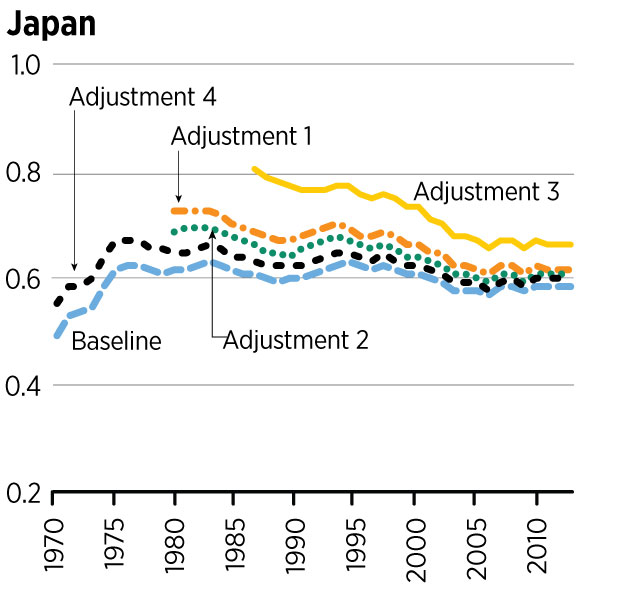

However, the labor share varies significantly for each country based on what assumptions are made and the quality of data. We graph these different measurements for a subset of countries in Figure 3.

The baseline calculation is the share of labor compensation of employees. Since it does not include self-employed income, it serves as a lower bound for the estimate of the labor share.

The first adjustment that can be done to the baseline calculation involves using mixed-income data. Some countries report mixed-income data, which is total self-employed income. For the countries that report mixed-income data, this adjustment adds all mixed income to total labor compensation, and this adjustment then serves as a reasonable upper bound to the labor share for countries that report mixed income. (See Adjustment 1 in Figure 3.) However, since self-employed income contains both labor and capital income, it overestimates the labor share.

A second common assumption for adjusting the labor share of self-employed income is that self-employed individuals use labor and capital in the same proportion as the rest of the economy. (See Adjustment 2 in Figure 3.) This adjustment is considered the most reasonable estimate. However, Peru, Hong Kong, Singapore, South Korea and Taiwan do not report mixed income, so additional information is required.

A third adjustment uses information on the total number of self-employed people and assumes that they earn the same average wage as employees.8 (See Adjustment 3 in Figure 3.) This assumption is only reasonable if the earning ability of employees and the self-employed is similar. However, the self-employed are likely to make less than those employed in formal firms. Since the self-employed make up a large share of the workforce in developing countries, this discrepancy can overestimate the labor share for developing nations.

There is a fourth adjustment that can be made. A 2015 paper suggests another way to estimate labor income of self-employed individuals in poorer countries that may be superior to the third adjustment mentioned above.9 This fourth adjustment assumes that all the self-employed work in the agricultural sector, so the entire value added in agriculture is added to labor compensation. (See Adjustment 4 in Figure 3.)

This adjustment does not separate capital income from agriculture, which can inflate the estimate. However, in developing economies, agriculture is less capital-intensive than in developed economies, so this distortion may be insignificant. Also, self-employed labor income outside of agriculture is not counted, which lowers the estimate. All things considered, this adjustment is a reasonable approximation of the labor share for developing economies.

This adjustment is also reasonable in poorer nations because agriculture employs about half of the self-employed and uses little capital.10 This measure, therefore, gives a rough idea of the labor share in poorer countries, and this is the measure reported in Figure 1 and Figure 2 for Peru, Hong Kong, South Korea, Singapore and Taiwan. Adjustment 4 is nearly identical to the baseline measure for Singapore, Hong Kong and Taiwan. Adjustment 4 also seems reasonable for Argentina, Chile and Mexico.

However, it might not be very accurate for countries that are already in their second stage of their structural transformation. The number of workers in the agricultural sector declines as a country develops. Therefore, Adjustment 4 may simply capture a falling share in agriculture and not necessarily the entire labor share. This may be why we see a significant decline in labor share for Peru and South Korea.

In summary, estimates of the labor share can vary depending on data availability and what assumptions are made for measuring the share of labor income of the self-employed. This can make a huge difference for developing countries with a large number of self-employed individuals. Since Peru, Hong Kong, Singapore, South Korea and Taiwan do not report mixed income, drawing conclusions on the behavior of labor share in these economies is challenging. Ultimately, knowing the behavior of labor share can help economists better understand a country’s economic growth.

Endnotes

- See Atkinson. [back to text]

- See Barrow and Faberman. [back to text]

- See International Labor Organization and the Organization for Economic Cooperation and Development. [back to text]

- If labor share is declining, then capital share is increasing. This result follows from the accounting identity that national income is the sum of its factor components: labor and capital. [back to text]

- See Ohanian, Restrepo-Echavarria and Wright. [back to text]

- Although Japan is a developed economy, we can compare the other developing countries with a developed country. [back to text]

- See Feenstra, Inklaar and Timmer. [back to text]

- See Gollin. [back to text]

- See Feenstra, Inklaar and Timmer. [back to text]

- See Timmer. [back to text]

References

Atkinson, A.B. Factor Shares: The Principal Problem of Political Economy? Oxford Review of Economic Policy, Vol. 25, No. 1, 2009, pp. 3-16.

Barrow, Lisa; and Faberman, Jason. Wage Growth, Inflation and the Labor Share. Chicago Fed Letter, 2015, No. 349.

Feenstra, Robert C.; Inklaar, Robert; and Timmer, Marcel P. The Next Generation of the Penn World Table. American Economic Review, 2015, Vol. 105, No. 10, pp. 3150-82.

Gollin, Douglas. Getting Income Shares Right. Journal of Political Economy, 2002, Vol. 110, No. 2, pp. 458-74.

International Labor Organization and the Organization for Economic Cooperation and Development. The Labour Share in G20 Economies. Report prepared for the G-20 Employment Working Group, Antalya, Turkey, Feb. 26-27, 2015.

Ohanian, Lee E.; Restrepo-Echavarria, Paulina; and Wright, Mark L.J. Bad Investments and Missed Opportunities? Postwar Capital Flows to Asia and Latin America. Working Paper No. 2014-038C, Federal Reserve Bank of St. Louis, May 2017.

Timmer, Marcel, ed. The World Input-Output Database (WIOD): Contents, Sources and Methods. WIOD Working Paper No. 10, April 2012.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us