Market Concentration and Its Impact on Community Banks

KEY TAKEAWAYS

- Market concentration rules can limit the ability of local banks to merge when they operate in a “highly concentrated” market.

- Most rural markets are highly concentrated, so those markets are “stuck” in terms of mergers among local community banks.

- For many markets, the only eligible merger partners will be out-of-market banks that may not be familiar with the community.

This article explores the effect that market concentration has on the ability of community banks to expand in their small markets, especially rural ones. For small banking markets, a community bank is often prevented from selling to a crosstown rival because of market concentration regulations, even if it might be in the best interest of consumers for other reasons. For example, compared to an in-market community bank, a large out-of-market bank holding company may have less interest in local institutions and less knowledge about market conditions and the reputation and quality of local businesses.

The U.S. Department of Justice (DOJ) and the Federal Reserve System have long adhered to a mathematical formula to determine a market’s competitiveness. A market can be considered “stuck” when it exceeds that threshold because its within-market merger activity is severely limited unless there are extenuating circumstances.

The number of such stuck markets had been on the decline for years but has started to climb back up in the last decade. This article does not take a policy position, but rather seeks to explain the regulation and some of the economic and social consequences stemming from it.

Determining a Market’s “Concentration”

In the early 1960s, the U.S. Supreme Court ruled that all bank mergers that result in a decrease in market competition—as measured by bank deposit shares in the affected markets—be subject to review and approval by the DOJ and the Federal Reserve.1 This ruling stemmed from the belief that banking is predominantly a local enterprise and that banks should not be able to monopolize access to credit and banking services in any market.

To implement these court rulings, several amendments were made to the Bank Holding Company Act in 1966. These amendments placed specific restrictions on the Fed’s approval of any acquisition or merger that attempted to “monopolize the business of banking” or “would be in restraint of trade.”

The act stipulates, however, that the Federal Reserve may allow the merger if “it finds that the anticompetitive effects of the proposed transaction are clearly outweighed in the public interest by the probable effect of the transaction in meeting the convenience and needs of the community to be served.”2

In response to the Supreme Court rulings and the 1966 Bank Holding Company Act amendments, the federal regulatory agencies began conducting antitrust analyses as part of their review of merger applications received by banking organizations. Specifically, the federal regulatory agencies began to follow DOJ-developed antitrust standards to identify which types of mergers would be viewed as anti-competitive and therefore disallowed in the absence of any additional mitigating circumstances.

To determine market concentration and to identify mergers as potentially anti-competitive, the DOJ and the Fed use a common measure of market concentration that is employed in other industries: the Herfindahl-Hirschman Index (HHI).

For banking markets, the HHI is calculated by summing the squares of banks’ shares of deposits in a given market. For example, if there are five banks in a market, and each bank has 20 percent market share, the resulting HHI would be 202 + 202 + 202 + 202 + 202 = 2,000. Under this definition, an extremely competitive market would have an HHI approaching zero, while a pure monopoly would have an HHI of 10,000 (1002).

The DOJ guidelines separate HHIs into the following ranges and market classifications:

- Less than 1,000—not concentrated

- 1,000 to 1,800—moderately concentrated

- Greater than 1,800—highly concentrated3

Mergers that would result in an increase in a market’s HHI by 200 points or more and result in the market’s HHI exceeding 1,800 generally require analysts to conduct additional, customized analysis to identify potential mitigating factors before a determination can be made regarding the permissibility of the merger.

A merger that would result in a bank having a 35 percent or higher share of deposits in a given market would also generally trigger the requirement that a more customized analysis be conducted to determine whether there are any mitigating circumstances that would indicate the merger is in the best interest of consumers in that market, despite the fact that it results, mathematically, in a less competitive market. Customized analysis conducted as part of the analysis of a merger application generally includes an assessment of the local banking market affected by the merger to better understand where customers find it practical to conduct their banking business. Factors such as commuting and shopping patterns and geographic features that make travel difficult, such as mountains and rivers, are considered.

The presence of other depository institutions—such as thrifts that offer a wide slate of banking services, and credit unions that have fairly open membership criteria and that also offer consumers a wide range of products and services—can be factored into the analysis. Further, when the merger application is in response to a failing bank, the regulatory agencies may decide that allowing a merger that triggers potential antitrust concerns is preferable to allowing the bank to fail and leaving consumers in that market with fewer banking options.

It is important to note that neither the Supreme Court rulings nor the Bank Holding Company Act requires the regulators to define a banking market for each bank in the United States prior to a merger request. As a result, banking markets can be defined on a case-by-case basis, triggered by a proposed bank merger or acquisition. This makes banking market definitions subject to change, and it also means that some banking markets are currently “undefined.”

Because market definitions continually change over time, a historical record of markets is difficult to construct. We therefore needed to develop a banking market proxy to enable historical comparisons of banking markets and changes in competitiveness over time. For most analyses, the baseline assumption is that a banking market is an individual county. That market is then expanded, if a customized analysis is needed, to include other counties—such as those comprising a metropolitan statistical area (MSA)—and other factors, such as geographic and political boundaries.

Once banking markets are defined, the HHI for each market is computed by using the deposits reported to the Federal Deposit Insurance Corp. (FDIC) during its annual Summary of Deposits (SOD) survey of branch office deposits for all FDIC-insured institutions. The data in the SOD are as of June 30 of the most recent year.4

For the purposes of this investigation, we decided to define a banking market either as an individual county or as the collection of counties that constitute a particular MSA as defined by the U.S. Census Bureau. Keeping these definitions of rural and urban consistent allows us to better understand how market power affects banks operating in these two types of markets. Constructing our banking market proxy in this way gave us a consistent set of banking markets over our 24-year study period.

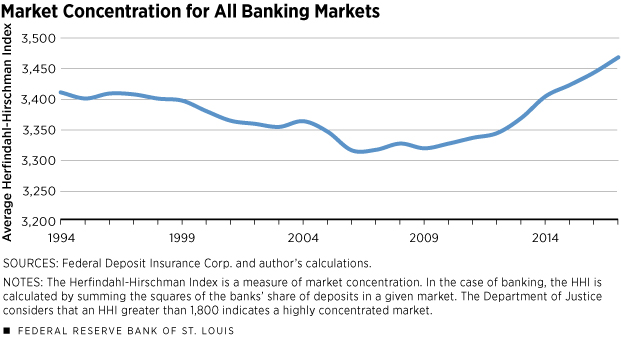

As shown in Figure 1, the mean HHI for all U.S. banking markets is quite high; it goes from 3,411 in 1994 to a low of 3,316 in 2006 and then back up to 3,468 by 2017. The gradual decline in average HHI after 1994 may have been the result of larger banks being able to put branches in markets that were previously only served by local banks, while the slow upward trend that we see starting after 2008 is the result of post-crisis consolidation and a decreased willingness of large banks to acquire branches in rural areas that were still recovering from the recession.

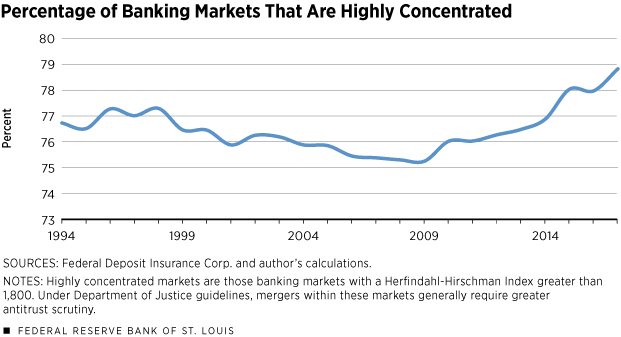

We can see essentially the same trends by looking at the percentage of banking markets that were above the DOJ’s 1,800 HHI threshold. (See Figure 2.) This measure gives us a better sense of the number of stuck markets, as defined above. For all U.S. markets, the percentage was 76.7 percent in 1994. It bottomed out at 75.3 percent in 2009 and it climbed back up to 78.8 percent in 2017.

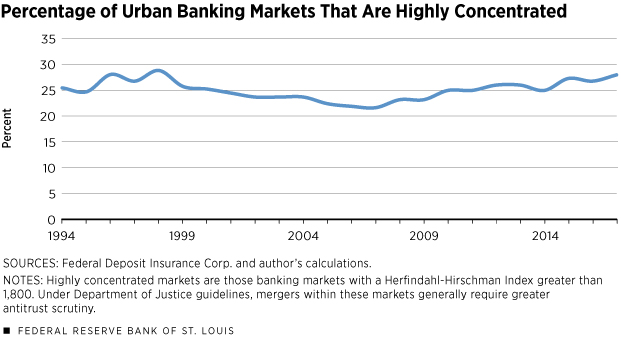

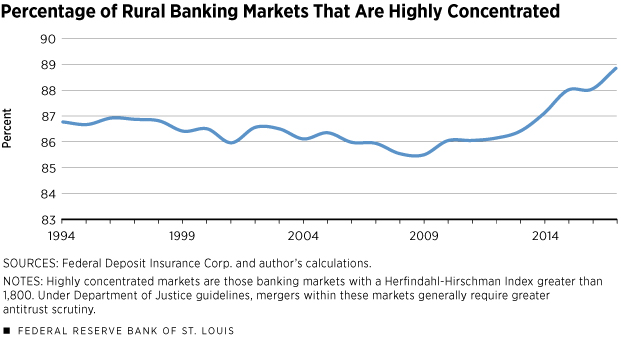

When we separate the urban banking markets from the rural banking markets, we see large differences in the competitive landscape. In Figure 3, we see that urban markets are much more competitive than rural markets, with the number of stuck urban markets never exceeding 29 percent. Conversely, by 2017, fully 88.8 percent of rural markets are considered stuck. (See Figure 4.)

In short, more than three-quarters of all banking markets in the United States (and almost 89 percent of rural markets) are considered uncompetitive in this framework. An important caveat is that the rural markets tend to have sparse populations, so these statistics overstate the percentage of the U.S. population living in uncompetitive markets. Still, this condition places restrictions on merger activities that any of the in-market banks can conduct, especially if the bank exceeds the 35 percent deposit threshold in that market.

Conclusion

While the purpose of this article is not to argue for or against greater flexibility in the ability of small community banks to merge, it is clear that a complete lack of flexibility will result in few within-market mergers for smaller markets. Put another way, for many markets, the only eligible buyers will be out-of-market institutions. These out-of-market buyers may not be well-versed in the intricacies of the new market. They also may not have as much of a vested interest in the health of the community as a truly local bank with close ties to the population. The fact that the number of stuck markets is so high warrants further research and policy analysis.

Endnotes

- See United States v. Philadelphia National Bank, 374 U.S. 321 (1963) and United States v. First National Bank and Trust of Lexington, 376 U.S. 665 (1964). [back to text]

- See 12 U.S. Code, Section 1842. [back to text]

- See Horizontal Merger Guidelines, U.S. Department of Justice and the Federal Trade Commission, Aug. 19, 2010. www.justice.gov/atr/public/guidelines/hmg-2010.html. [back to text]

- See FDIC Summary of Deposits, www.fdic.gov/regulations/resources/call/sod.html. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us