Modest Improvement in Economy Expected over Rest of the Year

After beginning 2015 on a weak note, the U.S. economy rebounded modestly in the middle part of the year. However, the economy then stumbled badly in the fourth quarter, eking out a meager 1.4 percent rate of increase in real gross domestic product (GDP). For the year, the U.S. economy grew by a modest 2.0 percent, a slowdown from 2014’s gain of 2.5 percent.1

As usual, the headline GDP estimate was a combination of some strengths and weaknesses during 2015. Bolstered by strong labor markets, low interest rates and falling energy prices, consumer spending continued to advance at a healthy pace. In particular, automotive sales registered their highest sales rate on record, and total housing sales—new and existing—registered their highest levels since 2007. Nonresidential construction activity also advanced at a brisk pace.

By contrast, business expenditures on capital goods (real business fixed investment) in 2015 grew at their slowest pace since 2009, while real U.S. goods and services exports declined for the first time since 2008. Businesses were dramatically scaling back planned expenditures because of a myriad of factors. These included the effects of lower oil prices (less drilling and exploration), an appreciation of the U.S. dollar and weakening foreign growth that reduced the foreign demand for manufactured goods.

Consumer prices, as measured by the personal consumption expenditures price index, rose by only 0.7 percent in 2015. Last year’s inflation rate, although similar to that of 2014 (0.8 percent), was the lowest since 2008. Low inflation over the past two years mostly reflected the plunge in oil prices, which began in late June 2014, although falling prices of nonpetroleum imported goods and non-energy commodity prices were also important factors. With inflation low and monetary policy still highly accommodative, nominal interest rates remain relatively low.

Evolving Trends in 2016

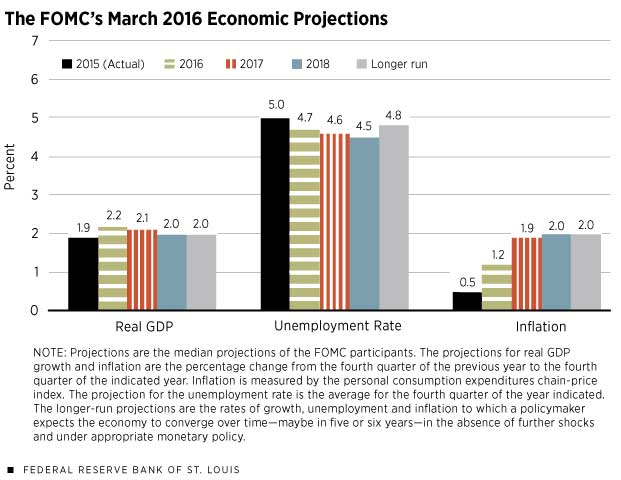

The consensus of professional forecasters is that real GDP growth and inflation in 2016 will be modestly stronger than last year’s and that the unemployment rate will fall modestly further. Despite a sell-off in stock prices early in 2016 that spawned fears of a recession and helped to elevate economic uncertainty, available data over the first three months of the year mostly support the consensus of professional forecasters. Importantly, job gains were stronger than expected in March and averaged 209,000 over the first three months of the year. Also in the first quarter, the unemployment rate averaged 4.9 percent. Somewhat unexpectedly, the labor force participation rate has rebounded over the past several months. If this trend continues over the near term, then the unemployment rate might not fall as much as forecasters are expecting.

Importantly, two of the economy’s sources of strength—consumer spending and housing—still look solid. Consumer spending was stronger than expected in January, as was residential and nonresidential construction. Strong growth of real after-tax incomes, healthy labor markets and ready access to credit should continue to bolster the confidence of both homebuilders and consumers.

Indeed, many housing industry analysts and forecasters remain optimistic. Still, some have pointed to a lack of qualified workers, a shortage of lots and disruptions in the permit-approval process as impediments to faster construction activity. Others have pointed to rapid rates of increases in housing prices in some areas that have reduced housing affordability and, thus, the pace of home sales.

Therefore, improving data signal a healthy rebound in real GDP growth in the first quarter of 2016. In response, financial markets have stabilized, recession fears have faded and oil prices have rebounded modestly as of early April.

Typically, rising oil prices are seen as a net negative for the U.S. economy. But this is not so clear-cut in an era when the United States is a major crude oil producer. Moreover, financial markets seem to believe that the decline in oil prices is an indicator of slowing global real GDP growth (less demand for oil). In this view, then, higher oil prices reflect improved prospects for global growth (and less uncertainty); therefore, a recovery in U.S. oil production should lift business fixed investment, exports and, thus, manufacturing activity.

But with the growth of the global oil supply still projected to outpace oil demand growth well into 2017, the recent uptick in oil prices may be temporary. If not, then inflation is likely to increase by more than most forecasters expect in 2016. For now, though, most forecasters and the Federal Open Market Committee (see the chart) do not see higher inflation and weaker growth as the most likely outcomes in 2016.

Endnote

- Unless otherwise noted, this article follows Federal Reserve convention in terms of defining yearly percentage changes. Thus, for quarterly series like GDP, the percent changes are from the fourth quarter of one year to the fourth quarter of the following year. Similarly, yearly changes using monthly data are the percentage change from December of one year to December of the following year. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us