National Overview: Growth Is Modest in GDP but Strong in Labor Markets

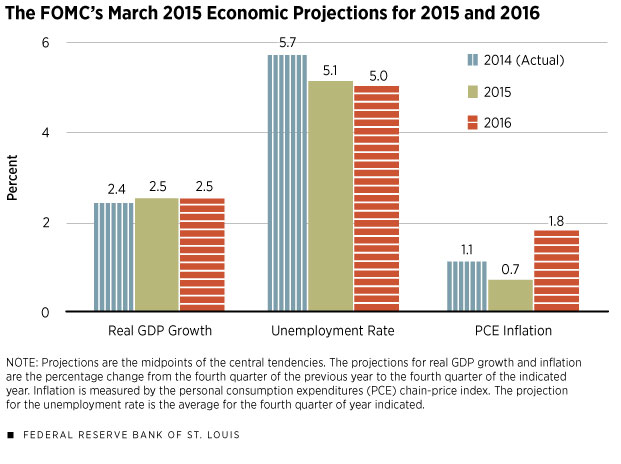

The U.S. economy appears to have lost some momentum during the winter months of 2014 and 2015. Although it is often difficult to gauge the underlying strength of the economy in real time, it appears that temporary factors have worked to slow the pace of economic activity in the first quarter. By contrast, U.S. labor market conditions remain strong despite a weaker-than-expected March employment report. Over the six months ending in March 2015, nonfarm payroll employment increased by about 1.6 million. Thus, with the slowdown viewed as temporary and inflation having been temporarily reduced because of the recent plunge in oil prices, the Federal Open Market Committee (FOMC) signaled at its March meeting that it remains on track to begin normalizing monetary policy this year.

The Pause That Refreshes

The U.S. economy lost a bit of momentum at the end of last year. According to the Bureau of Economic Analysis, real gross domestic product (real GDP) rose at a 2.2 percent annual rate in the fourth quarter of 2014 after increasing at about a 4.75 percent annual rate during the previous two quarters. Weaker growth in the fourth quarter of 2014 largely reflected sizable declines in businesses’ equipment expenditures and federal defense outlays.

By contrast, the growth of real personal consumption expenditures (PCE) remained vibrant over the second half of 2014. Households continued to benefit from the plunge in crude oil prices, spurring a noticeable increase in their real after-tax personal income.

Although the advance estimate for real GDP growth in the first quarter of 2015 will not be published until late April, forecasters have been modestly marking down their estimates because of weaker-than-expected data. In mid-March, the consensus of professional forecasters was that real GDP was likely to increase by a little less than 2.5 percent; however, some forecasters are predicting that real GDP growth will slow to 2 percent or less.

Adverse weather in January and February explains part of the slowing in the first quarter. For example, January and February retail sales were much weaker than expected; however, supportive of the weather story, online sales posted healthy gains during this period. Thus, despite some recent firming in gasoline prices in February and early March, the household sector remains a bright spot in the outlook—a sentiment noted in the March Beige Book.

Other temporary factors contributing to the expected first-quarter slowdown include a likely drop in business inventory investment, cutbacks in capital spending in the oil- exploration industry and the recent slowing in shipments from West Coast ports, a development that has hampered supply chains.

Despite modest growth in the overall economy, firms continue to add jobs at a brisk pace. Although nonfarm payrolls rose by only 126,000 in March, the unemployment remained at 5.5 percent. If the expected slowdown reflects temporary factors, then the economy should strengthen over the remainder of 2015. If job growth remains brisk, then it is likely that the unemployment rate will fall below 5 percent sometime during the second half of 2015.

The combination of robust labor market conditions and the prospect of continued low mortgage rates in 2015 should also benefit the housing industry. Industry forecasters expect that new home construction will increase by about 11 percent in 2015, although the consensus of professional forecasters is a bit less optimistic.

Business surveys suggest that optimism among large and small firms is on the rise. However, a sizable percentage of large firms are worried about the recent strengthening of the dollar and some softening of growth in Europe and Asia. Thus, while a strengthening domestic economy should help the manufacturing sector, the near-term outlook for business capital spending is more mixed.

Temporary Decline in Inflation

Headline inflation, as measured by the PCE price index, was about 0.75 percent in 2014, lower than 2013’s 1.25 percent increase. Inflation edged further downward in February, as the PCE price index was up by only 0.3 percent over the previous 12 months. Besides weaker oil prices, the recent strengthening of the trade-weighted dollar has intensified the downward pressure on prices of nonpetroleum imported goods. But with inflation excluding energy prices measuring 1.5 percent in February, it is highly likely that headline inflation rates (including food and energy) will rise modestly over the remainder of 2015 as oil prices begin to stabilize. Still, most forecasters expect that headline PCE price inflation will remain below 2 percent in 2015. That also is the consensus of the FOMC.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us