Metro Profile: A Familiar Name with an Economy Facing Familiar Challenges

Springfield, Mo., as well as the area around it, has the air of Americana, with it being the birthplace of the legendary Route 66 and sharing a name with other medium-sized cities that seem to reflect the heartland of the country. While the origin of the city's name is contested, some presume it resulted from early settlers' remembrances of distant Springfields.

The city of Springfield, Mo., is the largest of the eight cities that share the Springfield name.1 It is also the second-largest of the four metropolitan statistical areas (MSAs) sharing the name, having about three-quarters the population of Springfield, Mass., almost twice as many residents as Springfield, Ill., and three times as many as Springfield, Ohio.

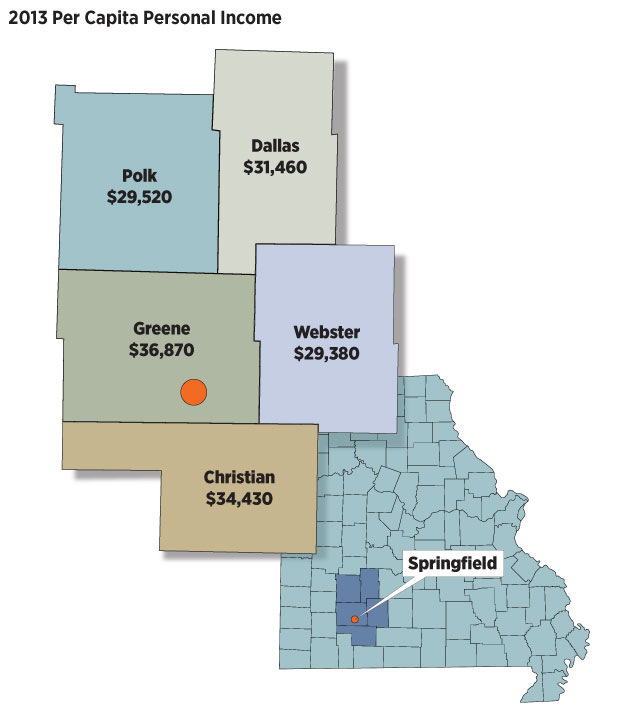

The Springfield, Mo., MSA extends across five counties in southwestern Missouri: Christian, Dallas, Greene, Polk and Webster. Robust population growth over the past few decades reflects the region's relative prosperity. Since 1970, annual growth has averaged over 1.8 percent, about three times the state average (0.6 percent) and higher than the national rate (1 percent).

The area's educational attainment closely aligns with the state's. In the MSA, 87.8 percent of the 2009-2013 population had at least a high school diploma and 26 percent held a bachelor's degree or higher. Springfield's percentage of those with a high school diploma is slightly higher than the national percentage (86 percent), and the college-educated population share is slightly below the U.S. average (28.8 percent).

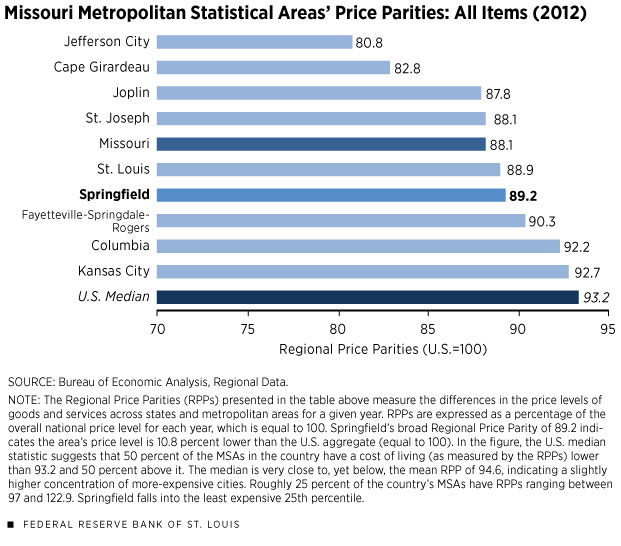

Springfield's real gross domestic product (real GDP) growth has been modest during the postcrisis recovery period, averaging 1 percent between 2010 and 2013. Based on a survey we conducted among local businesses, Springfield's low cost of living is perceived as one of the region's strengths. In 2012, Springfield's price level was 10.8 percent lower than the U.S. average. Its relative affordability is most pronounced in terms of the cost of housing. As of 2012, Springfield's rents were 31.3 percent lower than the U.S. average, 5.4 percent lower than the state average and approximately 14.6 percent lower than the average in nearby metropolitan areas, such as St. Louis. Springfield, Mo., also has the lowest cost of living of the four Springfield MSAs in the country.

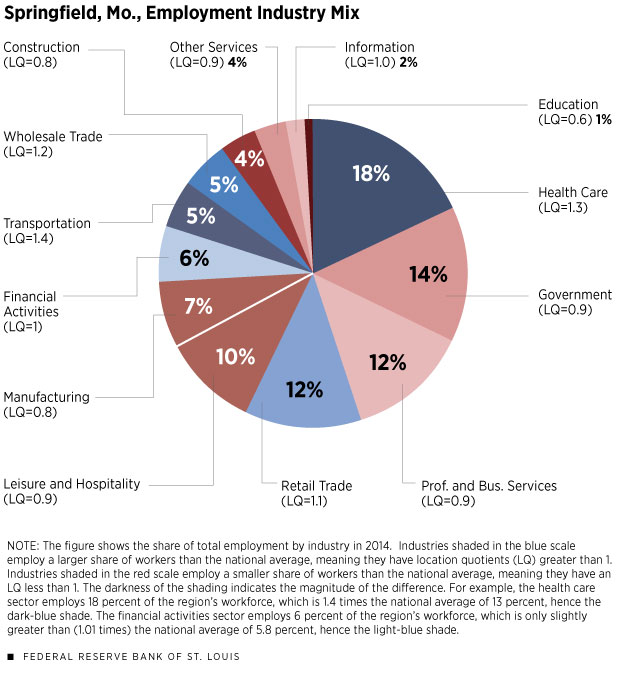

In many ways, the region's distribution of workers among different sectors mirrors ongoing national trends. Seventy-five percent of the MSA's workers are employed in the private service sector, slightly higher than the national average (70 percent). The MSA's service sector workers tend to be employed in the health care, transportation and retail sectors.

The diverse industry mix, coupled with a strong base of health care employment, has afforded the region strong job growth over the past few decades. The area was relatively stable economically even during the Great Recession and financial crisis.

The Role of Health Care

More than 17 percent (about 34,000) of the region's workforce is employed in health care. Almost half of these workers are employed by the region's two largest employers: Mercy Health (9,004) and Cox Health Systems (7,891). Relative to the national average, this represents about 1.3 times as many workers in the health care sector. The strong health care presence helped buffer job losses during the Great Recession; while the other sectors lost about 12,000 jobs between 2007 and 2009, the local health care sector added 2,600 jobs. As one of the fastest-growing sectors nationally, this has been a boon for the region since the recession ended: Almost a quarter of the MSA's employment growth during this period has come from the health care sector.

The sector is thought to employ relatively high-paid people; almost 14,000 workers are employed in "practitioner and technical" occupations, earning an average of $58,000 per year, about 60 percent above the MSA average wage across all industries, which is about $37,000. On the other hand, Springfield also has about 7,200 workers in health care support occupations; these workers earn an average wage of about $24,000.

Beyond health care, Springfield is headquarters for two major national retailers: Bass Pro Shops and O'Reilly Auto Parts, employing 2,600 people and 1,500, respectively. While not headquartered in the MSA, Wal-Mart is also a major employer in the region, employing 3,567 people. These firms, along with many other retailers in the region, employ close to 25,000 people or 12 percent of the total MSA workforce. Still, the retail sector has not, thus far, reached its prerecession peak.

Unlike many Midwestern cities that have relied heavily on manufacturing, Springfield has actually employed a smaller share of workers in manufacturing than both Missouri and the nation since the 1980s. At the same time, the region has closely followed the nationwide prolonged decline in manufacturing jobs: While in 1980, roughly 16 percent of the MSA's workforce was employed in manufacturing (21 percent nationally), by 2013, only 7 percent of the MSA's workforce was employed in the sector (9 percent nationally).

Despite this steady decline and the smaller share of employment, manufacturing remains an important sector in the region, accounting for 12 percent of the region's output in 2013. Multiple contacts we surveyed expressed the desire for more manufacturing jobs because of the higher wages associated with the industry. In Springfield, manufacturing jobs pay, on average, close to $42,000, which is almost 20 percent above the average pay for workers in the MSA.

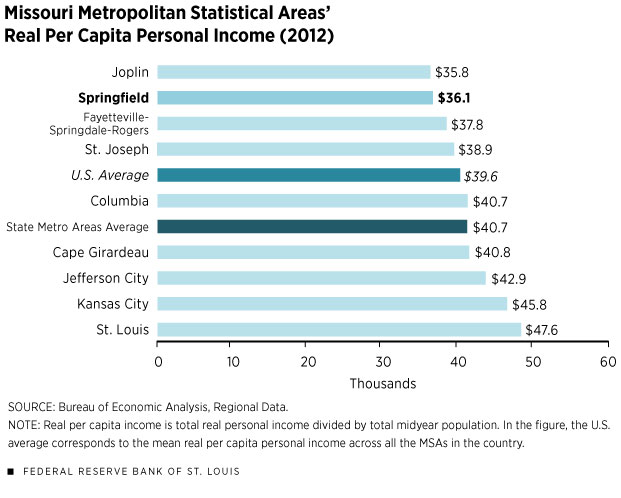

Few higher-paying manufacturing jobs may explain some of the lower-wage bias in the region. Wages across all major occupational groups are relatively low when compared with those of other MSAs in Missouri. In St. Louis, where the cost of living is nearly the same (a fact that may surprise many), average wages (across all industries) are 35 percent higher, or $47,800 per year. While Springfield's low wages can be seen as a comparative advantage relative to what is being paid in other MSAs, they are not without a hitch. While contacts noted that the relatively low wages in the Springfield area were important in driving job growth, regional poverty is a concern, as well, since almost 19 percent of the MSA population lives below the poverty level, higher than the national rate of 14.5 percent. The poverty rate is even more pronounced in counties such as Dallas and Polk, where it is over 20 percent.

While many factors can fuel wage discrepancies among MSAs, these discrepancies can be most directly accounted for by city-specific differences in labor productivity.4 For example, in 2013, an average worker in Springfield produced about $79,000 worth of output, while the average value of output per worker in St. Louis was $103,800, approximately 30 percent more. Differences in labor productivity, in turn, depend on multiple factors; these include workers' skill levels, often measured by educational attainment, and prior work experience. In Springfield, nearly 26 percent of the population has at least a bachelor's degree and 8.6 percent has a graduate degree or higher, compared with 31 percent and 12 percent, respectively, in St. Louis. Similarly, researchers have found a positive relationship between wages and city size—a 1 percent increase in wages for each additional 100,000 people.5 Based on this relationship alone, one would expect wages in St. Louis to be about 24 percent higher than in Springfield.

Current Economic Conditions

Much like the nation, Springfield has enjoyed steady job growth and a falling unemployment rate. As of December 2014, the unemployment rate stood at 4.6 percent, about a percentage point below the national average and well below the state average of 5.4 percent. The local housing market has shown signs of improvement. As of the fourth quarter in 2014, home prices were up 2.4 percent from one year ago, the number of building permits had increased slightly and anecdotes have been generally upbeat.

Early indicators, including our survey results, suggest that growth has continued into the first part of 2015. Almost 60 percent of the businesses surveyed noted that January sales met or exceeded their expectations. However, many contacts said they did not expect a short-term uptick in business to change their hiring plans. For example, one contact noted that his company has held off hiring for the past couple of years to ensure the stability of the recovery, reiterating that hires will be made only for long-term growth.

Looking Ahead

According to our survey results, the perceived economic outlook for Springfield is positive. With several national employers in the area, the region is expected to benefit from strong national growth. Seventy percent of contacts surveyed expect the local economy to be better or somewhat better during the next 12 months, and fewer than 10 percent of contacts expect conditions to worsen. Respondents also carefully follow policies that might have an impact on the region. As expected, contacts mentioned a wide range of policy issues; the most important factors influencing their outlook include changes in interest rates, the Affordable Care Act and state funding for highway projects and for other municipal programs.

In addition to the survey respondents' widespread perception of Springfield's low labor costs, contacts noted that the unemployment rate is lower than in nearby areas and wondered how this may impact job growth and wages. Some mentioned facing difficulties in finding qualified workers, which ultimately affects their hiring strategies. Intuitively, the already low unemployment rate, paired with employers' difficulties in finding adequately skilled workers, could cause an uptick in wages. However, the relationship between wages and unemployment is not as direct. In fact, average hourly earnings (adjusted for inflation) in the region have been on a slow and steady decline. Some of this reflects long-term, nationwide changes in the country's wage structure, most of which started even prior to the 2007-09 Great Recession. Recent research has shown that improvements in labor market conditions are more likely to affect the bargaining power and wages of workers earning less than the median wage than those of higher earners.6 While this could mean good news for low-income earners in Springfield, the majority of businesses surveyed don't anticipate a significant increase in wages. Rather, most survey respondents expect wages to remain the same or increase only slightly. This is because firms typically adjust wages based on labor productivity growth, which has been weak, and inflation expectations, which have been lower recently. Should these factors improve, wage growth should pick up.

MSA Snapshot

Springfield, Mo.

| POPULATION |

448,744

|

| POPULATION GROWTH (2009-2013) |

3%

|

| POPULATION (AGE 25+) W/BACHELOR'S DEGREE OR HIGHER |

26%

|

| POPULATION IN POVERTY |

18.7%

|

| REAL PER CAPITA PERSONAL INCOME |

$36,121

|

| REAL PER CAPITA PERSONAL INCOME GROWTH (2009-2012) | 1.5% |

| COST OF LIVING | –10.8% |

| RENTS | –31.3% |

| UNEMPLOYMENT RATE | 4.6% |

| REAL GDP (2013) | $15.7 BILLION |

| REAL GDP GROWTH (2010-2013) | 1% |

NOTE: Population estimates come from the U.S. Census Bureau. Cost of living data come from the Bureau of Economic Analysis' Regional Price Parities series.

Largest Employers

| MERCY HEALTH SPRINGFIELD |

9,004

|

| COX HEALTH SYSTEMS |

7,891

|

| WAL-MART STORES |

3,567

|

| SPRINGFIELD PUBLIC SCHOOLS |

3,206

|

| MISSOURI STATE UNIVERSITY |

2,583

|

SOURCE: www.springfieldregion.com.

Endnotes

- According to the Census Bureau, cities named Springfield are in Florida, Illinois, Massachusetts, Michigan, Missouri, Ohio, Oregon and Tennessee. As of July 2013, Springfield, Mo., had a population of 164,122, about 10,000 more than Springfield, Mass. In addition to those eight cities, there are 12 smaller localities around the country sharing the Springfield name. [back to text]

- Anecdotal information in this report was obtained from a voluntary survey of business contacts in Springfield between Feb. 4 and Feb. 13. In total, 114 contacts completed the survey, conducted by the Federal Reserve Bank of St. Louis. The results should be interpreted with caution because the sample of respondents may not be fully representative of businesses in Springfield. Some quotes were lightly edited to improve readability. [back to text]

- About 9.7 percent of workers are employed in food preparation and serving-related occupations, just slightly above the national rate. [back to text]

- Measured by GDP per worker, adjusting for differences in average hours worked. [back to text]

- See Baum-Snow and Pavan. [back to text]

- See Eubanks and Wiczer. [back to text]

References

Baum-Snow, Nathaniel; and Pavan, Ronni. "Understanding the City Size Wage Gap." Review of Economic Studies, January 2012, Vol. 79, No. 1, pp. 88-127.

Eubanks, James D.; and Wiczer, David. "Where's the Wage Pressure?" Federal Reserve Bank of St. Louis The Regional Economist, January 2015, Vol. 23, No. 1, an online-only article. See www.stlouisfed.org/publications/regional-economist/january-2015/wage-pressure.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us