District Overview: Track Records for District, Nation Differ on Startups, Which Are an Important Driver of Job Growth

The creation of new businesses, the so-called startups, is important for job growth, as research has shown. Economists John Haltiwanger, Ron Jarmin and Javier Miranda, using data from the Census Bureau's Business Dynamics Statistics (BDS),1 showed that the annual job creation rate in the U.S. is 18 percent, that is, every year 18 percent of total employment stems from jobs created during that year.2 About a fifth to a third of that annual job creation happens at startups, they found.3 This high rate of creation is balanced with high job-destruction rates of about 16 percent of total employment per year, according to Haltiwanger, Jarmin and Miranda4; about a third of this job destruction happens at establishments that shut down. Using the same data, economist Tim Kane found that during recessions job creation at startups remains stable, while net job growth (job creation minus job destruction) at existing firms is highly sensitive to the business cycle.5

Studying the dynamics of establishments' births and deaths gives important information about labor market performance. We compare the dynamics of such flows in the states of the Eighth District (excluding Illinois6) relative to the nation since the early 1990s. BDS data measure establishment births and deaths, as well as the subsequent creation and destruction of jobs. Births and deaths of businesses do not include temporary shutdowns or seasonal reopenings. Thus, a business must be closed for a year to be considered as a death. This, in turn, restricts the availability of business death data up to the second quarter of 2013.

Dynamics during the Great Recession

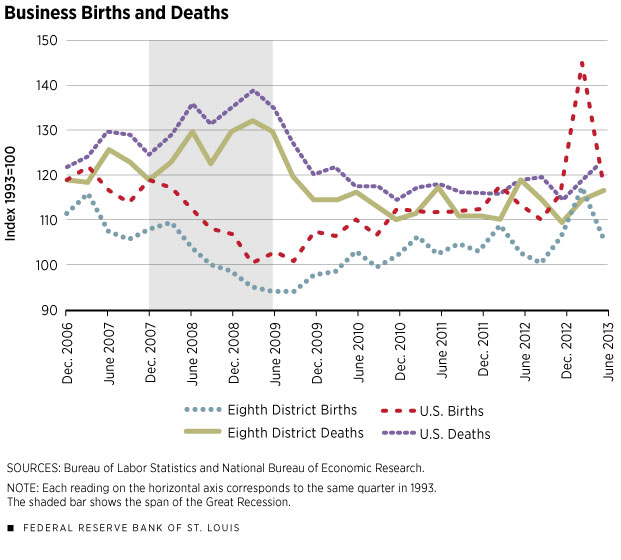

The chart shows establishments' births and deaths for the states in the Eighth District and the nation since late 2006. Births and deaths are normalized to 100 in each quarter of 1993; therefore, each index reflects establishments' births/deaths relative to the same quarter of 1993. New establishments (births) decreased significantly during the Great Recession for both the states in the Eighth District and the nation. In the fourth quarter of 2007, establishment births in the states of the Eighth District were 8.1 percentage points higher than in the fourth quarter of 1993, but these births decreased 13.9 percentage points by the third quarter of 2009, the first quarter after the recession officially ended. The pattern was similar for the nation: While establishment births were 19.2 percentage points higher in the fourth quarter of 2007 than in the fourth quarter of 1993, they decreased by 18.4 percentage points by the third quarter of 2009.

Establishment deaths, or shutdowns, increased significantly during the Great Recession. Shutdowns in the states of the Eighth District were 12.5 percentage points higher in the first quarter of 2009 relative to the fourth quarter of 2007. For the nation, shutdowns were 13.9 percentage points higher in the first quarter of 2009 relative to the fourth quarter of 2007.

Consistent with the findings in the 2013 study by Haltiwanger, Jarmin and Miranda, the decrease in establishments' births and the increase in establishments' deaths were accompanied by an increase in job losses and a sharp decrease in job creation. (See the table.) Job losses increased 15.15 percent for the Eighth District states and 9.85 percent for the nation between the fourth quarter of 2007 and the second quarter of 2009. Newly created jobs decreased 16.3 percent for the Eighth District states and 16.63 percent for the nation between the fourth quarter of 2007 and the second quarter of 2009. Therefore, the Eighth District states experienced more volatile employment dynamics during the Great Recession than did the nation as a whole. This higher variability in employment can be explained by a larger decrease in establishments' birth rates in the financial activities and "other services" sectors, combined with a larger increase in establishments' death rates in the manufacturing sector in the District, relative to the nation.

Dynamics in the Recovery

In the second quarter of 2013, four years after the Great Recession ended, employment gains in the U.S. were 12.71 percent higher than in the second quarter of 2009; in the District states, the gains were 8.09 percent higher. Total employment reflects lower employment losses in the District relative to the nation over the same period. (Employment losses in the second quarter of 2013 were 21.97 percentage points lower than in the same quarter of 2009 for the District, while they were 19.11 percentage points lower for the nation.)

Similar to what happened during the Great Recession, establishments' birth and death rates help explain these dissimilar employment dynamics. During the recovery from the Great Recession, establishments' births were significantly higher in the nation than in the District, which explains lower job-creation rates in the District. In the second quarter of 2013, business birth rates were 14.5 percentage points higher in the nation than in the same quarter of 2009, but birth rates were only 11.7 percentage points higher in the District. In the postrecession period, total birth rates in the District continued to be lower in the financial activities and "other services" sectors, as well as in the information, retail and transportation sectors, helping to explain lower job-creation rates in the District.7 Differences in establishments' deaths in the four years after the end of the Great Recession are not as significant (12.8 percentage points lower in the District and 11.9 percentage points lower in the nation).

Endnotes

- The Business Dynamics Statistics data series, published by the Census Bureau, decomposes the U.S. net employment change into gross job gains and gross job losses. The quarterly data series includes the number and percent of gross jobs gained by opening and expanding establishments, and the number and percent of gross jobs lost by closing and contracting establishments. The data also include the number and percent of establishments that are classified as openings, closings, expansions and contractions. [back to text]

- See Haltiwanger, Jarmin and Miranda (a) and (b). [back to text]

- The BDS calls a startup an establishment of age zero, and calls an existing firm an establishment that is at least 1 year old. [back to text]

- See Haltiwanger, Jarmin and Miranda (a). [back to text]

- See Kane. [back to text]

- Illinois is excluded because Chicago, where much of the state's economic activity takes places, is not part of the Eighth District. BDS data cannot be broken down for the Eighth District's portion of the state, the southern part. More details on the Eighth District region can be found at http://research.stlouisfed.org/regecon. [back to text]

- Some exceptions are observed in the professional services sector, in which birth rates have been increasing in Missouri since the first quarter of 2009; since the third quarter of 2011, these rates have been above prerecession levels. Startups in the education and health sector in Missouri also showed a significant spike in the first quarter of 2013. [back to text]

References

Haltiwanger, John; Jarmin, Ron; and Miranda, Javier (a). "Business Formation and Dynamics by Business Age: Results from the New Business Dynamics Statistics," CES working paper, May 2008. See http://www.census.gov/ces/pdf/BDS_Business_Formation_CAED_May2008.pdf.

Haltiwanger, John; Jarmin, Ron; and Miranda, Javier (b). "Who Creates Jobs? Small versus Large versus Young," Review of Economics and Statistics, May 2013, Vol. 95, No. 2, pp. 347-61.

Kane, Tim. "The Importance of Startups in Job Creation and Job Destruction," Kauffman Foundation Research Series: Firm Formation and Economic Growth, July 2010. See www.kauffman.org/~/media/kauffman_org/research%20reports%20and%20covers/2010/07/firm_formation_importance_of_startups.pdf.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us