Youth Unemployment Notably High in Southern Europe

In a recession, the youth unemployment rate often rises more sharply and recovers more slowly than the average unemployment rate. The recent recessions in Europe and North America were especially damaging to workers between the ages of 15 and 25. Unemployment among this group rose in nearly all countries, but some countries experienced a more severe spike than others. The differences in the severity of youth unemployment from country to country are the result of differing long-run trends, initial conditions and labor market structures.

The unemployment rate is the number of unemployed individuals divided by the total labor force. Movements in the unemployment rate can result from changes in either or both statistics. If an individual without a job is not actively searching for employment, he or she is neither unemployed nor in the labor force. Because those younger than 25 frequently move into and out of the labor force, often in response to economic pressures, youth unemployment figures may understate the impact of a recession: Young people dropping out of the labor force during bad times will dampen the increase in the youth unemployment rate.[1]

The youth labor force participation rate did fall somewhat in both the United States and in Europe during the Great Recession, although youth participation had been falling in both areas for some time. In the U.S., it fell from 66 percent in January 2000 to 59 percent at the start of the Great Recession (December 2007) and then on to 55 percent in March 2013. Corresponding figures in the EU were 65 percent, 62 percent and 59 percent.

In the United States, the youth unemployment rate rose from 11.5 percent in early 2008 to a high of 19 percent in late 2009 and then began a steady decline.[2] Canada had a similar experience, with a peak of 15.8 percent in late 2009. In contrast, many nations in Europe continue to face crisis levels of youth unemployment. Most had higher youth unemployment rates to begin with. Italy, for instance, began 2008 with a youth unemployment rate of 20 percent. By the end of 2013, that rate had more than doubled, to 42 percent. Spain's experience has been even more extreme, with youth unemployment rising from 21 percent to 55 percent over the same period. Other nations in Europe, such as Germany and Sweden, have had much milder experiences.

Europe

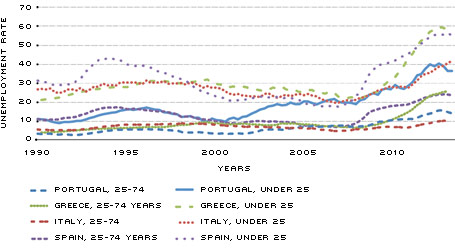

Nowhere in Europe is the youth unemployment situation more dire than in Greece, Italy, Portugal and Spain. While these Southern European countries have very high unemployment rates for the general population, their youth unemployment rates are unprecedentedly severe.

In the figure, we can see the rapid and continued rise in youth unemployment rates in these four countries. The spike in Greece has been the most pronounced, increasing from 22 percent at the start of 2008 to 36 percent at the end of 2010 and continuing to rise through 2013 to nearly 60 percent. As the unemployment rate for prime-aged workers in Greece neared levels seen in the American Great Depression, the youth unemployment rate in Greece exceeded twice that rate. Spain has had a similarly severe jump in youth unemployment. While youth unemployment is relatively less extreme in Italy, it is even more disproportionate: At the end of 2013, the youth unemployment rate there was nearly four times greater than the non-youth rate. Portugal's youth unemployment rate was lower than the other three in late 2013, but the rate is notable for its longer-run trend: Youth unemployment in Spain, Greece and Italy was stable or falling in the first half of the decade, but in Portugal youth unemployment has been trending upward since 2000.

These countries are all marked by "rigid" labor markets, which contribute to their high unemployment rates. In a rigid labor market, employers are reluctant to hire a relatively risky young worker because of high hiring costs or difficulty in firing. Rigidity can result from such labor market features as high rates of unionization or universal statutory severance payments. For instance, 35 percent of workers in Italy are unionized, as are 25 percent in Greece, 20 percent in Portugal and 15 percent in Spain, whereas only 11 percent are in the United States and 17 percent are in the 34-member Organization for Economic Cooperation and Development as a whole.[3] Regarding severance, Spain and Greece required payment of 52 and 24 weeks of salary in 2008 after 20 years of employment, while Portugal required 87 weeks.[4] In contrast, the U.S. has no universal statutory severance requirement for any tenure of employment.

The World Bank provides one way to quantify the rigidity of a labor market through its "rigidity of employment index," with higher scores indicating a more rigid market.[5] In 2008, the average for the developed countries in the OECD was 26. Portugal, Italy, Greece and Spain were all considerably more rigid, with index values of 43, 38, 47 and 49, respectively.

The economies of these four Southern European countries also feature "two-tier" labor markets, which can increase the likelihood that young workers will lose their jobs during bad times. In a two-tier labor market, some jobs have relatively flexible terms of employment, short contracts and low adjustment costs. Spain is most-often cited for its two-tier system, although Italy now has a similar environment after a spate of reforms in 2003.[6]

The U.S.

Although unemployment in the U.S. is far below the levels in Southern Europe, the Great Recession still brought the highest unemployment rates the U.S. has seen since 1981. This episode has been particularly severe not only because unemployment has remained high for so long, but also because young and less-educated workers have been hit so hard. Whereas the overall unemployment rate has fallen almost to its historic average, youth unemployment remains elevated at 14.2 percent, although the rate has been falling more quickly since the beginning of 2013.

Several factors may explain the steep rise and slow recovery in youth unemployment in the U.S. When the recovery began, the large pool of unemployed, experienced workers may have been more attractive to employers, crowding out the younger applicants. Workers younger than 25 also have less education than older workers, and less-educated workers have higher unemployment rates. Educated workers offer more general skills, which make them more valuable to a wider range of employers. In addition, young workers require more training, which makes them less attractive to hire. When per-worker profit margins are low, such as in a recession, the cost of training only makes those margins tighter. This is also consistent with the education gap: More-educated workers provide more general skills; so, the value of these workers to an employer comes relatively less from the specific training they get on the job. Before employers were sure of the recovery, they may have been reluctant to hire young workers who require more training.

Conclusion

Bad labor markets have repeatedly been shown to have long-lasting effects on youth in many different countries.[7] The postponed plans and stalled careers of millions of young workers are a national concern and should spur reflection on the institutions, policies and labor market structures that contribute to such different experiences across countries.

Unemployment in Southern Europe for Those Younger than 25 and for Those Older

SOURCE: Statistical Office of the European Communities/Haver Analytics.

Endnotes

- For example, consider a country with a youth labor force of 100, out of which 90 are employed and the remaining 10 are actively looking for work. Following the definition above, the youth unemployment rate is 10 percent. If one of the unemployed workers drops out of the labor force, the unemployment rate drops to 9.09 percent. [back to text]

- All unemployment statistics are based on harmonized quarterly averages taken from the Statistical Office of the European Communities, Statistics Canada and the Bureau of Labor Statistics. [back to text]

- These figures are averages (rounded) over the period 2008-12 from the OECD Stat Extracts. [back to text]

- Severance pay figures are furnished by the International Finance Corp. and the World Bank. See www.doingbusiness.org/data/exploretopics/employing-workers. [back to text]

- World Bank World Development Indicators series IC.LGL.EMPL.XQ. [back to text]

- See The Economist, www.economist.com/node/21547828, for a description of the system. [back to text]

- Many of these studies show immediate and persistent negative wage effects, as well as negative impacts on graduating and being unemployed in a recession. Others also show that worker's mobility is hampered, which can be a cause of this limited wage growth. See, e.g., Gregg and Tominey or Oreopoulos et al. [back to text]

References

Gregg, Paul; and Tominey, Emma. "The Wage Scar from Male Youth Unemployment." Labour Economics, February 2004, Vol. 12, No. 4, pp. 487-509.

Oreopoulos, Philip; von Wachter, Till; and Heisz, Andrew. "The Short- and Long-term Career Effects of Graduating in a Recession." American Economic Journal: Applied Economics, January 2012, Vol. 4, No. 1, pp. 1-29.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us