National Overview: Weather Throws a Cold Blanket on the U.S. Economy

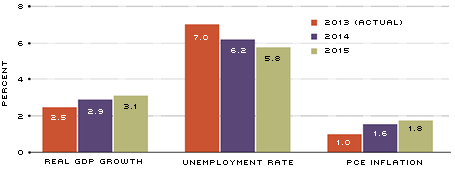

The FOMC's March 2014 Economic Projections for 2014-15

NOTE: Projections are the mid-points of the central tendencies. The projections for real GDP growth and inflation are the percentage change from the fourth quarter of the previous year to the fourth quarter of the indicated year. Inflation is measured by the personal consumption expenditures chain-price index. The projection for the unemployment rate is the average for the fourth quarter of the year indicated.

The U.S. economy exhibited considerable strength over the second half of 2013. After increasing at a 1.8 percent annual rate over the first half, the advanced estimate showed that real gross domestic product (GDP) increased at a brisk 3.7 percent annual rate over the second half. In response, nonfarm payrolls rose by an average of 204,500 per month from June to November, and the unemployment rate dropped from 7.5 percent to 7 percent. Meanwhile, inflation and inflation expectations remained relatively low and stable and below the 2-percent long-run inflation target of the Federal Open Market Committee (FOMC). Given the spate of good news over the second half of 2013, most private-sector forecasters and FOMC policymakers began to raise their expectations for the economy's performance in 2014.

Well, the U.S. economy's sprint toward a gold medal in 2014 suddenly looks rather shaky. First, a significant percentage of the data measuring economic activity in December 2013 and January 2014 has been unexpectedly soft. Foremost among them, nonfarm payrolls saw an average gain of only about 106,000 in December and January—about half as much as market expectations. Next, many of the major housing reports were markedly weaker than expected. Although construction spending inched up in January, housing starts and permits plunged that month, and sales of existing homes in January were at their lowest level since July 2012. Retailers and manufacturers also experienced significant weakness in January: Retail sales posted their largest decline since June 2012, while output at manufacturers registered its largest percentage decline since May 2009.

Weaker-than-expected data flows resulted in a marked downward revision to real GDP growth in the fourth quarter of 2013, from an annual rate of 3.2 percent to a 2.6 percent rate. Less momentum heading into 2014, compounded by some softer data in January and February, has spurred professional forecasters to mark down their estimates for growth of real GDP in the first quarter of 2014. The February 2014 Survey of Professional Forecasters now projects that real GDP will increase at a 2 percent annual rate in the first quarter, 0.5 percentage points less than three months earlier.

What's going on out there?! Is the U.S. economic expansion in the early stages of its demise, or is this merely a lull related to the harsh winter weather that gripped a significant portion of the nation in December, January and early February?

Weather or ... Not?

At this point, the evidence suggests that weather considerations may be responsible for much of the emerging weakness in the first quarter. This tentative conclusion is based on the following factors. First, many of the economic data releases—for example, those issued by the government, the Federal Reserve and private organizations—have specifically mentioned that adverse weather affected the statistics reported in the release. In particular, the Fed's Beige Book noted that severe weather contributed to weaker-than-expected economic conditions in many areas in January and early February. Compounding this problem is that many key monthly data series, such as retail sales and factory orders, tend to be highly volatile from month to month. Second, other key data do not indicate a looming demise of the business expansion. Important in this regard are the continued low levels of weekly initial claims for state unemployment insurance benefits. Initial claims data tend to be very sensitive to the state of the economy, particularly near peaks and troughs of the business cycle. The larger-than-expected rebound in payroll employment and manufacturing production in February was heartening in this regard, providing further evidence of the temporary nature of the first-quarter lull in activity. Third, financial markets—which are also sensitive to changes in economic data and expectations of future growth—show few signs of stress, and stock prices continue to increase. Fourth, the FOMC and the majority of professional forecasters continue to expect that the economy will perform solidly this year: real GDP growth of about 3 percent, further declines in the unemployment rate and an inflation rate modestly less than 2 percent.

A point of caution is in order, though: It is often extremely difficult to gauge the underlying strength of the economy even in the best of times; so, we'll just have to wait and see if the emerging slowdown in the first quarter was a weather-related short-lived economic disturbance, a worrisome return to the pattern of slower-than-normal growth seen during this expansion or something worse.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us