President's Message: The Rise and Fall of Labor Force Participation in the U.S.

The labor force participation rate—a measure of the number of people actively involved in labor markets—has generally been a secondary concern in macroeconomics over the past several decades. However, the sharp declines in the participation rate that followed the financial crisis and recession of 2007-09 have put the topic front and center. In this column, I will offer my own perspectives on the issue.[1]

Labor market performance is at the heart of the debate over how to characterize the state of the U.S. economy. While unemployment hit 10 percent in the fall of 2009, it was down to 6.7 percent this past February. The unemployment rate has generally declined faster than many forecasters anticipated. In tandem with this rosy development, however, labor force participation (LFP) has declined substantially.

There are two main interpretations of these data. The "bad omen" view interprets the recent declines in LFP as suggestive of a very weak labor market and discounts the signal coming from recent faster-than-expected declines in unemployment. The "demographics" view interprets recent declines in LFP as more benign and takes the signal coming from recent faster-than-expected declines in unemployment at face value. Since the Federal Open Market Committee has explicitly tied monetary policy choices to labor market performance, it is of considerable importance which view is more nearly correct.

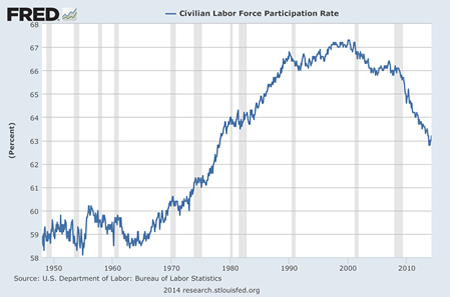

Some background on the LFP data is in order. Participation rose in the 1970s, 1980s and 1990s; it peaked in 2000 and has been in decline since. (See the chart.) Current projections from the Bureau of Labor Statistics suggest that this decline will continue over the coming decade. The rise in LFP is often attributed in part to the maturing of the baby boomers, as well as to the increase in the number of women in the workforce. The decline has often been attributed to the aging of the labor force.

A satisfactory model has to account for the rise and fall over many decades. A demographically based model—which assumes that certain demographic groups have a certain propensity to participate in market work—would seem to have a good chance of success in explaining these data. Based on some of the available literature on this topic, my view is that carefully constructed empirical models of the trend in the U.S. LFP rate indeed do a good job of explaining the data.[2] These models suggest that the current participation rate is not far from the predicted trend. This means, in turn, that the cyclical component in LFP is likely to be relatively small.

To the extent these models are correct, then, the observed unemployment rate remains as good an indicator of overall labor market health as it has been historically. In particular, the recent, relatively rapid declines in unemployment can be understood as representing an improving labor market. This is the judgment that should inform monetary policy going forward.

The literature is not completely satisfactory, however. Simply saying that people in certain demographic groups tend to make the participation decision one way or another does not do enough to analyze the incentives of household labor supply decisions. The more we know about the details of the household labor supply choices, the better we can predict the impact of policy on LFP. Furthermore, including more detailed household decision-making in economic models would allow us to better understand what motivates or deters participation in labor markets. I look forward to seeing future research pushing in this direction.

Endnotes

- This column is based on my speech on Feb. 19, 2014, and my article in the First Quarter 2014 issue of the Federal Reserve Bank of St. Louis Review. Links to both can be found at http://research.stlouisfed.org/econ/bullard/the-rise-and-fall-of-labor-force-participation-in-the-u-s/. [back to text]

- For details on the literature, see my related speech and Review article. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us