Debt Crisis in Europe Is Easing, but Stability Remains a Long Way Off

Several historical examples show that financial crises generate large increases in private and public debt that take many years and sometimes drastic measures to be worked out. The recent global financial crisis was no different. In the wake of the crisis, which began in 2007, the public debt of the affected countries increased to levels not seen since the years after World War II. Also rising was the perceived risk of default on this debt.

The initial worries lay with four peripheral countries of the European Union (Greece, Ireland, Portugal and Spain, sometimes referred to by the acronym of GIPS or PIGS) but soon extended to Italy (thus becoming GIIPS or PIIGS) in the summer of 2011 and later to Cyprus, Slovenia and even France. As a consequence, financial markets and investors demanded higher yields to keep buying the debt issued by this group of countries; some countries, such as Portugal and Ireland, stopped issuing debt almost entirely and turned to borrowing from the European Union (EU) and the International Monetary Fund (IMF).[1]

Thanks to intervention by the European Central Bank (ECB), to fiscal packages in various countries and to the restructuring of the Greek debt, the yields of many of these countries' government debt started trending down in 2012, causing a softening of the debt crisis. That softening has continued to date but may heat up again in the near future.

In this article, we explain how the concepts of government debts and deficit are relevant in the Economic and Monetary Union (EMU) in Europe and how they evolved after the beginning of the financial crisis in a group of countries. Finally, we briefly discuss possible paths that countries can follow to adjust from the debt overhang.

EU and EMU

The process of European integration led to the creation of the EU when the Treaty of Maastricht came into force in 1993. The EU is an unusual political and economic partnership that resembles a confederation; it currently comprises 28 countries. Countries can join if they meet the so-called Copenhagen criteria. In 1999, a subset of 11 EU countries formed the EMU, also known as the euro zone or euro area. The EMU adopted a common currency, the euro, and its members relinquished monetary policy to the ECB, based in Frankfurt.

In order to access the EMU, countries must comply with a series of criteria, including two regarding fiscal positions. The Treaty of Maastricht requires that a member government's annual budget deficit not exceed 3 percent of its gross domestic product (GDP) and that the gross government debt to GDP not exceed 60 percent of the country's GDP. In exceptional circumstances, countries are allowed to exceed these limits temporarily, but such deviations are monitored under the EU's Stability and Growth Pact. As of this year, 18 countries belong to the EMU.

The Evolution of Debt and Deficit Ratios

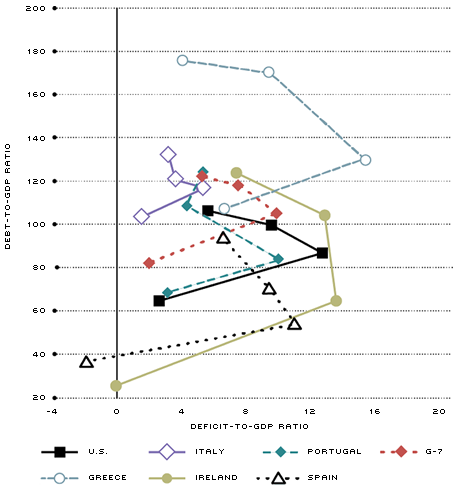

SOURCE: International Monetary Fund, World Economic Outlook, October 2013.

NOTE: The ratios are plotted four times on each country's line; each symbol along the line represents a year, starting on the bottom with 2007 and then moving along the line to 2009, 2011 and 2013. (Data for 2013 are projected.) For example, in Ireland in 2009, the deficit-to-GDP ratio was about 13 percent and the debt-to-GDP ratio was about 62 percent. The G-7 is composed of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

What Happened after the Financial Crisis?

The figure illustrates the ratios of debt and deficit to GDP for the GIIPS (and for the U.S. and the Group of 7 for comparison purposes) at four points in time: 2007, 2009, 2011 and 2013. (Only projections are available at this time for 2013.) The changes in the two ratios are more marked than what one would see in plain vanilla recessions that are not associated with financial crises.

During a recession, governments increase spending while tax revenue falls due to the contraction of GDP. The combination of these two forces increases deficits, which can potentially quickly raise the debt-to-GDP ratios.

This effect can be seen very clearly in the figure, not only for the GIIPS countries but for the U.S. and the Group of 7. From 2007 until 2009 (roughly, the recession period for most of these countries), both the deficit and debt ratios rose. As the recession ended, the deficit ratios started to decline because tax revenue grew and primary deficits (excluding interest) contracted. But the debt ratios kept rising, in part because primary balances are still negative and in part because the burden of interest is now larger.

The most dramatic jump in debt- and deficit-to-GDP ratios in our sample of countries is certainly Ireland. In addition to the cyclical factors affecting these ratios, Ireland witnessed the failure and subsequent bailout by the government of the country's large banks. The deficit-to-GDP ratio jumped to about 13.8 percent in 2009, before retreating to about 13.1 percent in 2011 and then to an estimated 7.6 percent in 2013. While Ireland entered the financial crisis with an overall surplus and small debt-to-GDP ratio, it faced a debt-to-GDP ratio of more than 123 percent in 2013, clearly beyond the limit set in the Treaty of Maastricht.

How do these debt increases compare with historical experiences? Economists Carmen M. Reinhart and Kenneth S. Rogoff, well-known for their 2009 book "This Time Is Different: Eight Centuries of Financial Folly," looked at a large sample of crises before 2007. They found that real public debt increased by 86.3 percent on average within three years of the crisis.[2] Between 2007 and 2010, the U.S. initially had a relatively large debt-to-GDP ratio that increased by about 48 percent, while for the G-7 this increase was about 38 percent and for the GIIPS the increase averaged 86 percent. Between 2007 and 2012, these percentages were about 60 percent,

50 percent and 132 percent.

How Can Debt Overhangs Be Worked Out?

The monetary stance in many countries has kept interest rates at favorably low levels for the past few years and will perhaps do so for the near future. Thus, interest payments on debt are at a moderate level, particularly on new debt issued by each country. But how will these large debt-to-GDP ratios be worked out?

There are five ways in which large government debts, or debt overhangs, have been worked out historically: 1) Inflation surprises, i.e., realized inflation rates higher than those expected by consumers and firms (and therefore not built into existing contracts); high inflation rates can help reduce the real burden of repaying the principal of the outstanding debt; 2) GDP growth, which reduces the debt-to-GDP ratio (if it's larger than the growth rate of the debt outstanding) and increases tax revenue; 3) debt restructuring, which consists of partial or total default on outstanding debt; 4) fiscal consolidation, through a combination of higher taxes and lower spending, sometimes referred to as fiscal-adjustment austerity; and 5) financial repression, such as directed lending to governments by captive domestic audiences (for example, pension funds), explicit or implicit limits on interest rates, regulation of international capital movements, and similar measures.[3]

Recent data show that inflation and growth measures do not bode well for European countries. Inflation is trending downward, below the 2 percent target set by the ECB for the year-over-year harmonized index of consumer prices. The growth rate of GDP is projected to be very modest in the near future. In January 2014, the IMF forecast meager real GDP growth rates of 1 percent for the euro area as a whole.

Debt restructuring was experimented with in Greece in 2012. The Greek government and private holders of Greek government bonds struck an agreement in which private creditors accepted a haircut of 53.5 percent on the face value of Greek government bonds and could choose to swap their high-rate bonds with short maturity for low-rate bonds with long maturity. Although debt restructuring is generally shunned by European governments, more debt restructuring could occur in the coming years.

European countries are currently proceeding with a mix of fiscal austerity and financial repression, both of which lead to a very slow adjustment of debt-to-GDP ratios. While such ratios keep rising in Europe in the aftermath of the crisis, some countries are making slow progress in regaining their national debt sustainability. For example, Ireland and Portugal returned in 2013 to issuing treasury bonds and borrowing directly from financial markets.

Whichever route is taken by each government, the road to sounder fiscal stability will probably be long and difficult.

Endnotes

- For Portugal, the bailout loan was split among the European Financial Stability Mechanism (EFSM), the European Financial Stability Facility (EFSF) and the IMF. For Ireland, the bailout was from EFSM, EFSF, IMF, the National Pension Reserve Fund and bilateral loans from the United Kingdom, Denmark and Sweden. [back to text]

- See Reinhart and Rogoff (2009). [back to text]

- See Reinhart and Rogoff (2013). [back to text]

References

Contessi, Silvio. "An Application of Conventional Sovereign Debt Sustainability Analysis to the Current Debt Crises." Federal Reserve Bank of St. Louis Review, May/June 2012, Vol. 94, No. 3, pp. 197-220.

Reinhart, Carmen M.; and Rogoff, Kenneth S. "The Aftermath of Financial Crises." National Bureau of Economic Research Working Paper Series, No. 14656, 2009.

Reinhart, Carmen M.; and Rogoff, Kenneth S. "Financial and Sovereign Debt Crises: Some Lessons Learned and Those Forgotten." International Monetary Fund Working Paper, No. WP/13/266, 2013.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us