Metro Profile: After Stalling, Recovery Resumes in St. Louis

The St. Louis metropolitan statistical area (MSA) spans the Mississippi River, taking in parts of Missouri on the west and Illinois on the east. It is the largest MSA in Missouri and in the Federal Reserve's Eighth District. In 2012, the St. Louis MSA had a population of 2,795,794 and a labor force of 1,403,773. Per capita income was $44,625, roughly 2 percent above the national average. Gross metropolitan product (GMP) was $116.5 billion in 2012, equivalent to just over 50 percent of the gross state product (GSP) in Missouri.

French fur traders Pierre Laclede and Auguste Chouteau founded St. Louis 250 years ago, in February 1764. Their small trading village would soon blossom into a thriving metropolis. Following the Lewis and Clark exploration, entrepreneurs made fortunes in St. Louis, selling supplies to adventurers traveling west. Later in the 19th century, St. Louis became a major industrial center and home to the largest brewery in the U.S. The high volume of trade attracted many banks and financial firms. Financial services remain an important growth sector to this day. In the past several decades, St. Louis has emerged as a leader in the health care industry, too.

The MSA has struggled to retain population: During the 1970s and early 1980s, it lost an average of roughly 3,000 people per year. Since then, it has grown slower than the national average, although the population has increased every year since 1982. Between 2002 and 2012, the population increased by 95,673.

Population growth in Missouri and Illinois counties was roughly proportional to the size of their population; counties in Missouri accounted for 76 percent of the growth between 2002 and 2012, while those in Illinois accounted for 24 percent. The greatest percentage change in population occurred in three Missouri counties—St. Charles, Lincoln and Warren—all located in the northwestern portion of the MSA. At the other extreme, four counties lost population: St. Louis city (which is in Missouri and is considered legally a county unto itself), St. Louis County (Missouri), and Macoupin and Bond counties (Illinois).

Economic Drivers

The financial services sector has long been a major driver of the economy in the MSA. About 90,000 people (or 6.7 percent of the area's workers) are employed by financial services firms, much higher than the national average of 5.7 percent. Although the sector employs a relatively small share of workers, financial activities accounted for almost 20 percent of St. Louis' GMP in 2012.

St. Louis' health care sector employs just under 200,000 workers (about 15 percent of total employment), of which about 70,000 are employed by the region's hospitals. Three health care firms in the metro area—BJC HealthCare, SSM Health Care and Mercy—rank among the top 10 largest employers and, as of June 2013, collectively employed 47,883 workers. BJC is the largest employer in the area.

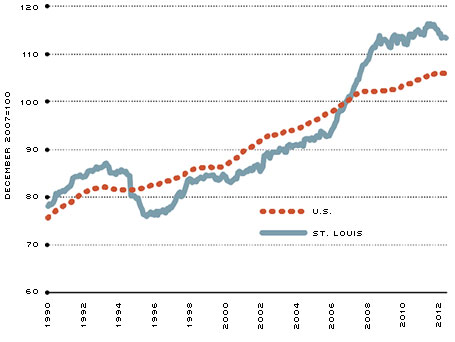

Hospital employment has been a bright spot for St. Louis. Over the past decade, regional hospital employment grew 13.9 percentage points faster than did such employment in the nation overall. Relative to national averages, the St. Louis MSA has about 14 percent more workers in the health care sector and 60 percent more hospital workers.[1] In 2012, output from the health care sector accounted for about 9 percent of St. Louis' GMP.[2]

Strong health care and financial services sectors have been key in helping the local economy through the Great Recession of 2007-09 and the recovery. During the recession, the metro area lost about 90,000 jobs; the health care sector added about 11,000 jobs. The local financial services sector lost about 1.5 percent of its workforce (1,200 jobs), which was only a quarter of the national rate.

The importance of these sectors for job growth after the recession has been even more pronounced. Combined, these two sectors have added almost 20,000 jobs, more than twice as many jobs as the rest of the local economy. Moreover, these sectors added jobs faster than the national rate, with financial services adding jobs five times as fast as the financial services sector did nationwide.

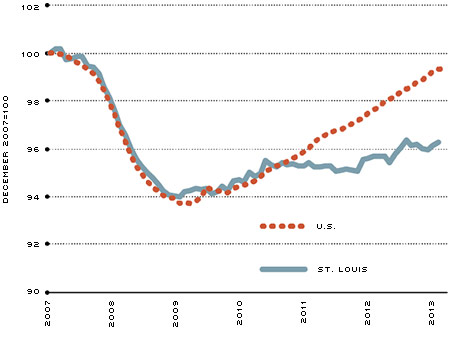

A Stalled Recovery

After the Great Recession ended in 2009, St. Louis firms began to hire workers at a pace that generally mimicked the national trend; the local economy added almost 20,000 jobs in the first 18 months of the recovery, and employment growth was positive in most industries. In the spring of 2011, however, the recovery in the MSA stalled.

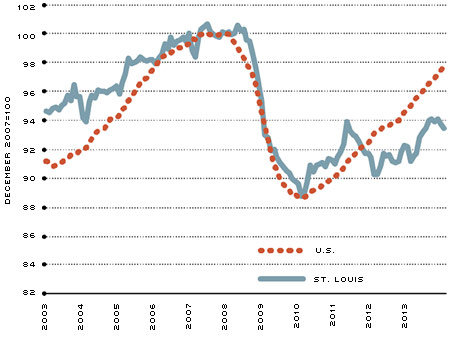

In the year that followed, the metro area lost about 4,000 jobs, while the national economy continued to add jobs at its previous pace. The job losses in the St. Louis area were not evenly distributed across industries or across the counties. Rather, the majority of the jobs were in sectors particularly sensitive to local conditions: construction, retail trade, and professional and business services. Geographically, the Illinois portion of the MSA appeared to have been most affected.

Continuing struggles in the local housing market are one potential factor of the stalled recovery in the MSA. Although housing prices did not fall locally as much as they did nationally, the recovery in the St. Louis area lagged the nation's gains. Year over year, housing prices in St. Louis continued to decline through the end of 2012, while prices nationally turned back up six months earlier. Moreover, the local construction industry lost almost 7,000 jobs between the spring of 2011 and 2012. This decline is in stark contrast with the national trend, where construction employment increased by almost 3 percent.

The stalled recovery is also evident in the local services sector, specifically professional and business services and retail, which together employ a quarter of the region's workforce. Professional and business services include accounting, law, waste management and security services, as well as other businesses typically driven by local demand. Between the spring of 2011 and 2012, the industry shed over 1,000 jobs, or 0.6 percent of its workforce. During the same period, the retail sector—which includes local grocers, small retailers and big-box stores—eliminated 1,400 jobs, almost 1 percent of its workforce. Nationally, the professional and business services sector and the retail sector increased their payrolls by 3.5 percent and 1.2 percent, respectively.

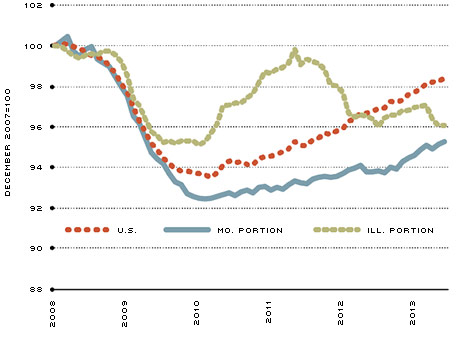

Across the region, the stalled recovery is most evident in Illinois. Labor department data indicate that the pace of hiring in Illinois was faster than in both Missouri and the nation before the spring of 2011. Between the spring of 2011 and 2012, firms on the Illinois side of the MSA reduced employment by 600 workers a month, resulting in an employment drop of 3.5 percent. In the Missouri counties of the MSA, employers continued to add about 350 workers per month. Since the spring of 2012, employment growth in Missouri outpaced growth in Illinois. The diverging trend continued in 2013. In the Illinois counties, employment declined by over 2,500 jobs in the first half of the year. In the Missouri counties, employment increased by more than 5,000 jobs. Both sides of the MSA have total employment levels about 4 percent below their prerecession peaks.

Changing Trends

Despite the temporary standstill, the current economic outlook in the MSA is somewhat encouraging: 2013 employment growth showed positive momentum, the financial services sector continued to add jobs faster than the national rate, and the professional and business services sector displayed strong growth. Moreover, some long-term population trends started to reverse. On the other hand, employment growth in the health care sector was relatively flat in 2013, and policy changes pose new challenges to that industry.

The retail sector showed signs of improvement: Two new outlet malls opened in the far western suburb of Chesterfield last summer, and one has already begun planning an expansion. Promising projects are on the horizon for the city of St. Louis: Ikea and Whole Foods have finalized plans to open new stores in the fall of 2015, for example. Recoveries in construction and other services sectors resulted in about 7,000 new jobs in 2013, up from 2,000 new jobs in 2012.

Growth of the health care industry showed signs of slowing in 2013. Over the past five years, the local health care sector added an average of 3,500 jobs per year. In 2013, the sector lost over 2,000 jobs.

Nonetheless, anecdotal information suggests the long-term outlook remains somewhat promising, with projects such as BJC's $1 billion campus renewal contributing to the turnaround of the construction industry. Many construction and contracting firms expect a growing portion of their revenue to come from these health care construction projects. Nationally, the outlook for the health care industry is also strong: Data from the Bureau of Labor Statistics project the health care industry to generate the largest job growth over the next 10 years.

Another notable shift over the past few years has been the relative convergence of population growth rates: The rates of the MSA's counties are converging, and the population growth of the MSA itself is converging with that of the nation.

Over the past decade, the Missouri counties of St. Charles, Warren and Lincoln led the region's population growth, averaging upward of 3 percent growth per year during the early 2000s. At the same time, the city of St. Louis and St. Louis County reported population losses, with declines of 1.2 percent and 0.2 percent, respectively. Over the past few years, these growth rates have converged, with the outlying counties' growth slowing to 1 percent or less per year. Population growth in St. Louis city and county have moved in the opposite direction, both reporting virtually no change in population during 2012.[3]

The region's population growth has also converged with the national rate. In the 1970s and '80s, the St. Louis metro population grew roughly 1 percent slower than the national rate. In recent years, the difference in population growth has declined to about 0.5 percent. Albeit below the national rate as a whole, the Missouri counties in the MSA have converged with national trends, while the Illinois counties still have about a 1 percent gap between the 2012 population growth rates and national averages.

Hospital Employment

SOURCE: Bureau of Labor Statistics

NOTE: Data are easily accessible in the St. Louis Fed's economic database, FRED, using these series IDs: St. Louis (SMU29411806562200001SA) and U.S. (CES6562200001).

Professional Business Services, Logging, Mining, Retail, Construction Employment

SOURCE: Bureau of Labor Statistics.

NOTE: Data are easily accessible in the St. Louis Fed's economic database, FRED, using these series IDs: St. Louis Professional and Business Services (STLPBSV), St. Louis Construction, Mining, and Logging (STLNRMN), St. Louis Retail Trade (SMU29411804

200000001SA), U.S. Professional and Business Services (USPBS), U.S. Construction (USCONS), U.S. Mining and Logging (USMINE), and U.S. Retail Trade (USTRADE)

Nonfarm Payroll Employment

SOURCE: Bureau of Labor Statistics

NOTE: Data are easily accessible in the St. Louis Fed's economic database, FRED, using these series IDs: St. Louis (STLNA) and U.S. (PAYEMS).

St. Louis Metro Employment by State

SOURCE: Bureau of Labor Statistics

NOTE: Data from the BLS' Quarterly Census of Employment and Wages cover 98 percent of all nonfarm payroll jobs. Illinois data were adjusted to account for a spike in January 2011 employment due to reclassification of workers.

MSA Snapshot

St. Louis, Mo.

| POPULATION |

2,795,794

|

| LABOR FORCE |

1,403,773

|

| UNEMPLOYMENT RATE |

6.9%

|

| PERSONAL INCOME (PER CAPITA) |

$44,625

|

| GROSS METROPOLITAN PRODUCT |

$116.5 BILLION

|

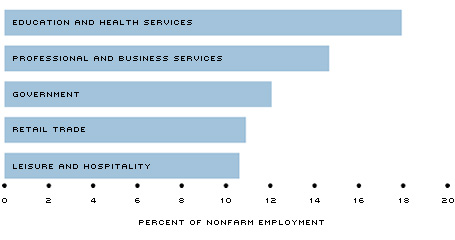

Largest Sectors by Employment

Largest Local Employers

1. BJC HEALTHCARE

2. BOEING DEFENSE, SPACE & SECURITY

3. WASHINGTON UNIVERSITY IN ST. LOUIS

4. SCOTT AIR FORCE BASE

5. SSM HEALTH CARE

St. Louis MSA Population Growth (Percent) by County 2002-2012

NOTES: Population, employment, personal income per capita and gross metropolitan product data are from the Census Bureau, Bureau of Labor Statistics and Bureau of Economic Analysis. These MSA-level data series are easily accessible in the St. Louis Fed's economic database, FRED (Federal Reserve Economic Data), which can be accessed at http://research.stlouisfed.org/fred2. For the panels and maps, see these FRED series (IDs in parentheses): population (STLPOP); labor force (STLLF); unemployment rate (STLUR); personal income (STLPCPI); leisure and hospitality (STLLEIH); retail trade (SMU29411804200000001SA); government (STLGOVT); professional and business services (STLPBSV); and education and health (STLEDUH).

Endnotes

- About 13 percent of the nation's workforce is employed in the health care sector and 3.5 percent in hospitals. Of St. Louis' workforce, 14.8 percent is employed in the health care sector and 5.5 percent in hospitals. Hospital employment is included in health care figures. [back to text]

- Health care sector output is not available for the MSA, only "health and education" is. Missouri sector-level GSP was used to decompose the data. [back to text]

- St. Louis city (–0.12%), St. Louis County (+0.11%). [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us