Who Is Concealing Earnings and Still Collecting Unemployment Benefits?

The unemployment insurance program in the U.S. offers benefits to workers if they lose their jobs through no fault of their own. In 2011, this program cost $108 billion, of which nearly $3.3 billion was spent on overpayments due to fraud.1

Unemployment insurance fraud occurs when an ineligible individual collects benefits after intentionally misreporting his or her eligibility. Recent headlines have brought attention to extreme forms of fraud, such as the collection of unemployment benefits by prisoners.2 The dominant form of unemployment insurance fraud, however, is what's called concealed earnings fraud. This fraud occurs when individuals collect unemployment benefits while they are employed and are earning wages. The overpayments due to concealed earnings accounted for almost $2.2 billion in 2011, two-thirds of the total overpayments due to all categories of fraud.3

In this article, we document a few facts regarding concealed earnings fraud among various income groups. These facts may help focus efforts to deter fraud and to recover overpayments.

To begin, not everyone who is unemployed collects benefits: Some people are not eligible, and some choose not to collect. In 2011, the number of unemployed individuals collecting benefits was 3.7 million (only 27 percent of the unemployed individuals).4 The median of their earnings when they were last employed was $596 a week. Among those collecting unemployment benefits, 88,000 committed concealed earnings fraud; their (past) median earnings were $479.5

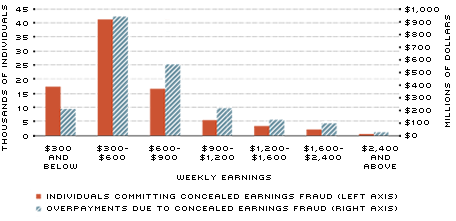

Individuals committing this type of fraud are not evenly distributed among various income groups. Figure 1 illustrates the number of individuals committing this fraud and the overpayments to the individuals in each income group.

Among those committing concealed earnings fraud, 18,000 (roughly 20 percent) earned less than $300 per week, and 12,000 (14 percent) earned more than $900 per week. Part of the reason for the uneven distribution across income groups could be that individuals collecting unemployment benefits are not evenly distributed across income groups. However, the numbers do not line up conveniently. For instance, 14 percent of those collecting benefits earned less than $300 per week, whereas almost 25 percent earned more than $900 per week.

Table 1 illustrates the percent of individuals in each income group. Those earning less than $300 per week accounted for 14 percent of the individuals collecting unemployment benefits but accounted for 20 percent of the individuals committing concealed earnings fraud. In contrast, those earning at least $900 per week accounted for 24 percent of the individuals collecting unemployment benefits but only 14 percent of the individuals committing concealed earnings fraud.

Fraud due to Concealed Earnings in 2011 by Income Group

SOURCES: Benefit Accuracy Measurement (BAM) program, U.S. Department of Labor; authors' calculations.

NOTES: To arrive at the number of individuals committing concealed earnings fraud (red), we first calculate the fraction of individuals in each income group (in the BAM sample) committing concealed earnings fraud. We then multiply this fraction by the total number of individuals collecting benefits in each group. We perform a similar calculation to find the overpayments due to this type of fraud (blue pattern). We calculate the concealed earnings fraud overpayments as a fraction of benefits for each earnings group (in the BAM sample) and multiply it by the total benefits received by each group.

Measured in terms of fraud dollars, however, the picture looks different. As Figure 1 illustrates, nearly half a billion dollars of the overpayment went to those earning more than $900 per week and only $210 million of the overpayment was accounted for by

the individuals whose weekly earnings were less than $300. That is, those earning more than $900 per week accounted for almost 22 percent of the overpayment, while the ones earning below $300 per week accounted for less than 10 percent.

One reason why the number of individuals committing fraud in each income group does not line up perfectly with the fraud overpayments in each income group is that the unemployment benefit dollars are not distributed according to the proportion of people in each income group. In fact, only 5.5 percent of the benefits distributed by the unemployment insurance program went to individuals who earned less than $300 per week, whereas 35.5 percent of the benefits went to individuals who earned more than $900 per week. (See Table 2.)

Roughly speaking, high earners receive larger unemployment checks than low earners. In the U.S. unemployment insurance system, each worker collects benefits equal to a percentage of his or her previous earnings. This percentage is referred to as the replacement rate.

The replacement rate for high earners is less than that for the low earners. In 2011, a person earning $300 per week had a replacement rate of almost 50 percent, a person earning $1,200 had a replacement rate of 33 percent and a person earning $2,400 had a rate of 15 percent.6 Despite the lower replacement rate, the high earners receive a higher unemployment benefit relative to the low earners. Consequently, concealed earnings fraud committed by an individual earning $2,400 per week accounts for more than twice as many dollars as the fraud by an individual earning $300 per week.

Table 2 illustrates the percent of the overpayments (due to this type of fraud) going to each income group. Fraud committed by a high earner involves more dollars relative to a low earner, and more of the overpayment amounts go to the high earners.

Fraud due to concealed earnings represents the largest source of fraud in the U.S. unemployment insurance system. Individuals with relatively low earnings constitute a larger fraction of those committing such fraud. High-earnings individuals, however, account for larger dollar amounts of this fraud. Given limited resources to deter fraud and to recover overpayments, the unemployment insurance system faces a trade-off between the number of individuals versus the dollar amounts.

Endnotes

- Fraud data are taken from the Benefit Accuracy Measurement (BAM) program run by the U.S. Department of Labor. See Fuller et al. 2012a. [back to text]

- See, for instance, www.azcentral.com/news/articles/2012/07/17/20120717des-targets-ill-gotten-arizona-benefits.html [back to text]

- See Fuller et al. 2012a. [back to text]

- See the U.S. Department of Labor, http://www.ows.doleta.gov/unemploy/chartbook.asp. More of the unemployed could have collected benefits in 2011. See Fuller et al. 2012b. [back to text]

- To calculate the number of individuals committing concealed earnings fraud, we calculate the fraction in the BAM sample and multiply by the total number of persons collecting benefits in 2011. We calculate weekly earnings in the BAM sample by dividing total reported earnings by number of weeks worked. [back to text]

- Replacement rates are calculated from the BAM sample. For each individual in the sample, we divide the weekly benefit amount by our estimate of weekly earnings. Replacement rates vary across states. We present the average replacement rate for each level of earnings. [back to text]

References

Fuller, David L.; Ravikumar, B.; and Zhang, Yuzhe. "Unemployment Insurance Fraud," Federal Reserve Bank of St. Louis' Economic Synopses, 2012a, No. 28. See http://research.stlouisfed.org/publications/es/article/9481 Fuller, David L.; Ravikumar, B.; and

Zhang, Yuzhe. "Unemployment Insurance: Payments, Overpayments and Unclaimed Benefits." Federal Reserve Bank of St. Louis' The Regional Economist, Vol. 20, No. 4, October 2012b, pp. 12-13.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us