National Overview: Signs Point to Stronger Growth in GDP This Year

The U.S. economy ended 2012 on a down note. Although real gross domestic product (GDP) rose at an annual rate of only 0.4 percent in the fourth quarter, several of the key underlying components registered solid growth. In particular, consumer outlays for durable goods remained exceptionally strong, as did construction of new residential structures. Likewise, business spending on equipment and software rebounded impressively after falling unexpectedly in the third quarter. Outlays for imports are another measure of the willingness of consumers and firms to spend. Together, these components registered about a 3.7 percent annual rate of growth in the fourth quarter of 2012.1

So, what accounted for real GDP's flat performance in the fourth quarter? The Bureau of Economic Analysis provided an explanation. First, firms cut back on their inventory stocking in the fourth quarter; this reduced overall real GDP growth by 1.5 percentage points. Second, federal government expenditures on national defense fell at their fastest rate in a little more than 40 years; this plunge reduced real GDP growth by an additional 1.3 percentage points. Finally, exports of goods and services declined for the first time in nearly four years; this drop reduced real GDP growth by 0.4 percentage points. In all likelihood, these developments are one-off factors and not likely to persist.

As for the components of real GDP that posted healthy growth in the fourth quarter, there are plausible reasons to believe that those factors supporting growth in this area will remain in place in 2013. Thus, it is likely that real GDP growth this year will exceed its 1.6 percent growth rate registered in 2012, which was the weakest growth in three years.

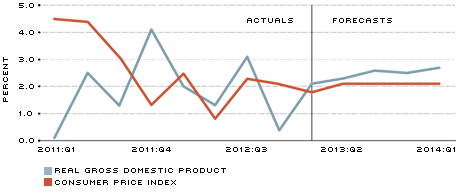

What Are Professional Forecasters Predicting for Real GDP Growth and CPI Inflation?

SOURCE: Survey of Professional Forecasters, Federal Reserve Bank of Philadelphia, February 2013.

Hope on the Horizon

Several developments have weighed on financial markets, consumers and businesses over the past two years. These developments have included Europe's sovereign debt and banking crises, the debates in the United States over the debt-ceiling extension and over the expiration of the 2001-2003 tax cuts, the sharp rise in oil prices from May 2010 to April 2011, the Japanese earthquake and tsunami in 2011, and Hurricane Sandy in October 2012. Fortunately, the headwinds emanating from these shocks are abating or have abated entirely. As evidence, the St. Louis Fed's Financial Stress Index in February indicated lower than normal financial stresses. All else equal, lower than normal financial stresses tend to be associated with improving economic conditions.

A bottom-up approach to analyzing the economy provides further support for steadily improving prospects in 2013. Last year, auto sales registered their highest level since 2007, housing starts posted their highest level since 2008 and business capital spending finished on a strong note. Thus, continued low interest rates, rising values of financial assets like stocks and bonds, an improving labor market, and increased lending activity should continue to benefit sales of autos, houses and other durable goods this year. Rising stock prices, elevated profit margins and healthy cash flows also augur for continued improvement in business capital spending and increased hiring in 2013. Finally, most forecasters expect continued modest inflation pressures in 2013. Importantly, the U.S. Energy Information Administration is forecasting a modest decline in crude oil prices.

Risks to the Outlook

Any forecast contains the risk that growth and inflation could turn out to be weaker or stronger than forecasters had expected. In this vein, four recent developments stand out. First, fiscal policy will be restrictive in 2013—chiefly through higher taxes. Higher taxes could have a significant drag on consumption spending. Second, the decision to raise the federal debt ceiling was postponed until May. As in the summer of 2011, another rancorous political debate could raise uncertainty, elevate financial stresses, and dent the confidence of consumers and businesses. Third, gasoline prices have risen by more than expected thus far in 2013. Finally, labor productivity growth has weakened considerably over the past two years. In response, the growth of unit labor costs has accelerated. If businesses are increasingly able to pass along these increased costs to consumers, then that could be another avenue for higher inflation in 2013. At this point, though, forecasters and financial market participants see inflation of about 2 percent this year.

Endnotes

- This percentage is derived from Table 2 of the March 28, 2013, GDP report from the Bureau of Economic Analysis. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us