Low Interest Rates Have Yet To Spur Job Growth

The Federal Reserve set the target range for the federal funds rate at 0 to 25 basis points in December 2008. It has remained there because the recovery in output and jobs has been so slow. The rate was set so low to stimulate aggregate demand and job growth (by lowering borrowing costs for consumers and firms). With low interest rates, consumers are more likely to increase spending now rather than wait to consume later. Low interest rates also drop the cost of borrowing to invest in productive capital. The increased demand for consumption and investment then leads to higher demand for labor. But of late, the low interest rates do not seem to be having much of the intended effect, either on spending or on job growth.

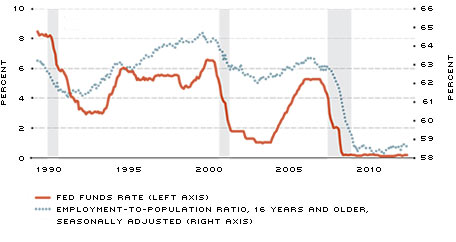

The Federal Funds Rate and the Employment-to-Population Ratio

SOURCES: Federal Reserve Board, Bureau of Labor Statistics/Haver Analytics.

NOTE: The shaded areas indicate recessions.

One way to gauge job activity is to look at the ratio of employed people to the civilian population. The employment-to-population ratio falls whenever people quit their jobs and leave the labor force. It also falls when workers are laid off and counted among the unemployed. The figure shows this ratio from 1990 through 2012. The shaded areas represent recessions. As can be seen, the employment-to-population ratio dips to a trough early in each recovery, but the most recent recovery is distinguished by the failure of this ratio to rebound from the post-recession low.

The figure also shows the federal funds rate over the same period. A cursory glance reveals positive comovement between the employment-to-population ratio and the Federal Reserve's policy rate.

Obstacles to Low Interest Rate Policy

Recognizing that the economy is a complex system subject to many shifts in taste and shocks to productive activity, it is also important to consider the economic mechanisms that work against low interest rate policy. The effect of low interest rates on the supply of labor is subtle but not so hard to understand.

Interest rates represent the return we get for waiting to consume. Low interest rates encourage more spending today, which the Fed intends, and more leisure today, which the Fed does not intend. Labor participation rates decline for many reasons, but low interest rates work in the direction of discouraging labor market participation.1

This effect of interest rates is not large and is usually ignored in academic studies of factors that affect labor supply.

The business demand for labor, however, is widely thought to be the main determinant of job growth. The effect of low interest rates on labor demand works through the impact of interest rates on the marginal product of capital. To understand how this can discourage job growth, it might help to review the basic economic principles surrounding the ways that lower interest rates affect investment decisions.

Consider a simple world in which a firm uses just two factors to produce output: capital and labor. The marginal product of capital refers to the increase in the value of output that occurs when a firm invests in one more unit of capital while keeping the employment level fixed.

For example, consider an automobile plant that produces cars with capital (assembly lines) and labor which can vary depending on the demand for cars and the cost of hiring workers. If demand goes up, the firm may hire more employees to produce more cars with the same capital. Adding workers will increase the marginal product of the physical plant (the capital), but it will lower the marginal product of the last worker hired. Now suppose that the cost of capital falls and the firm decides to add another assembly line. In this case, the firm will move some of the workers from the other line and hire more workers. For a variety of reasons, the second assembly line will produce fewer cars than the first line operating alone would. One reason is simply that demand fluctuates and the two lines together will operate below capacity more often than one line alone would. The increase in capital will lead to a decline in its marginal product, but investment can be justified if the cost of capital is low enough.

The marginal product of capital depends on how much capital one uses, but it also depends on how much labor is employed.

If interest rates fall, the marginal product of capital will also fall if the firm adds more capital or if it dismisses some workers. If interest rates fall because demand is projected to be weak, then the firm may decide to lay off a shift of workers, leaving the existing assembly lines idle more often and resulting, overall, in a lower marginal product of capital that is compatible with the lower interest rate on bonds.

The Role of Bond and Capital Markets

Low interest rates affect investment through the interaction between bond and capital markets. If bond rates are held lower by policy, then the return to capital will fall until investors are indifferent between investing in bonds or capital. In the happy scenario, funds shift from bond markets toward investment in more capital until the risk-adjusted net marginal product of capital falls enough to equal the policy-induced low return on bonds. In the perverse scenario, firms lay off workers until the marginal product of capital falls enough to be consistent with the lower interest rate. For the employment-to-population ratio, it matters whether the marginal product of capital is lowered by adding capital (more investment) or by laying off workers.

We are in new territory with interest rates being held at zero. In policy statements from recent meetings, the Federal Open Market Committee (FOMC), the monetary policy arm of the Federal Reserve System, promised to continue adding $85 billion a month to its balance sheet, and it pledged to keep the target rate unchanged until the unemployment rate falls to 6.5 percent or inflation projections rise to 2.5 percent.

According to the most recent FOMC forecasts, neither is expected to occur before 2015.

Forecasting is always a problem, but especially so today because we have very little data from economic history with which to predict how the economy will behave when the interest rate is pegged at zero. A few theoretical studies use New Keynesian macroeconomic models to analyze monetary policy when interest rates are near zero.

In these models, if there is a positive shock to productivity that would normally occur during a recovery, it is expected to have perverse effects if the interest rate is pegged at zero. The perverse effects include subpar expansion and downward shifts in both the supply and demand for labor.2 In these models, raising nominal interest rates (lifting off the zero lower bound) can lead to higher wages and to higher rates of return in both bond and capital markets. Firms would have an incentive to add workers because doing so would lead to an increase in the marginal product of capital.

People would have an incentive to re-enter the work force because the return to saving would increase.

Although these are only models, they are widely used in analyzing monetary policy. After more than four years of low interest rates and stagnating growth around the world, a better understanding of low interest rate policies is needed.

Endnotes

- Mulligan argues that changes in government policy, especially the 2009 American Recovery and Reinvestment Act, substantially increased the marginal benefit of not working relative to the situation in 2007. He argues that the distortions reducing labor supply are a major reason for slow investment and job growth during the past four years. [back to text]

- As Krugman notes, these perverse effects were also associated with liquidity traps in analysis of the Great Depression. Fernández-Villaverde et al. and Gavin et al. examine the effect of positive technology shocks when interest rates are constrained at the zero lower bound. For more on economic dynamics at the zero lower bound, see Eggertsson

and Woodford; Christiano, Eichenbaum and Rebelo; Braun, Körber and Waki; and Schmitt-Grohé and Uribe.[back to text]

References

Braun, R. Anton; Körber, Lena Mareen; and Waki, Yuichiro. "Some Unpleasant Properties of Log-Linearized Solutions When the Nominal Rate Is Zero." Federal Reserve Bank of Atlanta, Working Paper 5, 2012.

Christiano, Lawrence; Eichenbaum, Martin; and Rebelo, Sergio. "When Is the Government Spending Multiplier Large?" Journal of Political Economy, 2011, Vol. 19, No. 1, pp. 78-121.

Eggertsson, Gauti B.; and Woodford, Michael. "Zero Bound on Interest Rates and Optimal Monetary Policy." Brookings Papers on Economic Activity, 2003, No. 1, pp. 139-233.

Fernández-Villaverde, Jesús; Gordon, Grey; Guerrón-Quintana, Pablo A.; and Rubio-Ramírez, Juan. "Nonlinear Adventures at the Zero Lower Bound." National Bureau of Economic Research (NBER) Working Paper, No. 18058, 2012.

Gavin, William T.; Keen, Benjamin D.; Richter, Alexander; and Throckmorton, Nathaniel. "Global Dynamics at the Zero Lower Bound." Federal Reserve Bank of St. Louis, Working Paper 2013-007A.

Krugman, Paul R.; Dominquez, Kathryn M.; and Rogoff, Kenneth. "It's Baaack: Japan's Slump and the Return of the Liquidity Trap." Brookings Papers on Economic Activity, 1998, No. 2, pp. 137-205.

Mulligan, Casey B. "The Redistribution Recession: How Labor Market Distortions Contracted the Economy." Oxford University Press, 2013.

Schmitt-Grohé, Stephanie; and Uribe, Martín. "The Making of a Great Contraction with a Liquidity Trap and a Jobless Recovery." NBER Working Paper No. 18544, 2012.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us