National Overview: The U.S. Economy Should Strengthen As Year Goes By

The U.S. economy ended last year on a relatively strong note. Or did it? Although real GDP rose during the fourth quarter of 2011 at a 3 percent annual rate, which was the largest increase in a year and a half, nearly two percentage points of this growth stemmed from the production of final goods that were not sold—that is, the value of goods flowing into private nonfarm inventories (hereafter, inventory investment) rather than into the hands of households, businesses, the government or foreign purchasers.

Increases in inventory investment, particularly if unplanned, are sometimes viewed as a precursor to slower growth. If firms unwittingly produce too much relative to actual sales, they then have an incentive to curtail production until this excess inventory is eliminated. Indeed, forecasters expect firms to temper their production in the first quarter of 2012 to better match the demand for their product. Accordingly, the expected swing in the growth of real inventory investment from positive to negative from the fourth quarter of last year to the first quarter of this year is projected to account for about two-thirds of the expected slowing in real GDP growth in the first quarter (from a 3 percent rate to about a 2 percent rate).

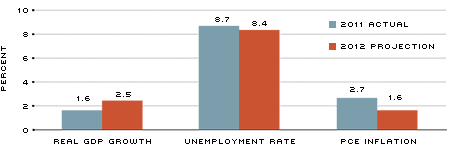

FOMC Economic Projections for 2012

SOURCE: Board of Governors of the Federal Reserve System

NOTE: Projections are the midpoints of the central tendencies. The actual and projected unemployment rates are for the fourth quarter of the indicated year. The growth of real GDP and PCE inflation (actual and projected) are percentage changes from the fourth quarter of the previous year to the fourth quarter of the indicated year. PCE is personal consumption expenditures.

The professional forecasting community believes that the economy will continue to grow at a relatively subdued pace beyond the first quarter of 2012. For example, the consensus of Blue Chip forecasters projects that real GDP growth will average 2.2 percent during the first half of this year and 2.5 percent during the second half. A similar survey, by the Federal Reserve Bank of Philadelphia (Survey of Professional Forecasters), shows slightly more optimism about the second half: 2.9 percent. (In comparison, real GDP growth for 2011 was 1.6 percent.)

Dueling Narratives

The consensus forecast is for continued modest, below-trend growth in 2012. (Although difficult to know for sure, many economists believe that the economy's trend rate of growth is about 2.75 percent.) The supporting narrative goes something like this: First, Europe's growth has slowed markedly in response to its sovereign debt and banking crisis; indeed, Europe might be in a recession today. The crisis has not only elevated volatility in U.S. financial markets, which often erodes investor and consumer confidence, but also will likely lead to weaker exports to Europe and countries elsewhere with important linkages to Europe. Second, the housing market remains relatively weak, foreclosures are high, and state and local governments are reducing their discretionary outlays in order to close budget deficits. Finally, with households apparently still determined to pay down debt and increase their saving rate, consumption spending—the largest component of real GDP—is likely to grow at exceedingly modest rates. With the unemployment rate expected to remain above 8 percent at the end of this year, inflation will slow to about 2 percent after measuring 3 percent last year.

There is a countervailing narrative, equally plausible, which points to stronger economic conditions this year than the consensus forecast. The first argument of this narrative is that the impact of any European recession on the U.S. has been overblown. This is because the volume of U.S. exports to Canada, Mexico and Asia is much larger than the volume of exports to Europe—and growth in those first three markets is much faster than in Europe. Also, U.S. banks and money market funds have greatly reduced their exposure to Europe's banking and financial system.

Second, the U.S. stock market is up strongly thus far in 2012, and measures of financial stress (e.g., the St. Louis Financial Stress Index) and economic uncertainty have fallen sharply. Third, the unemployment rate has fallen much faster than expected, and job growth is strengthening. From September 2011 to February 2012, private-sector job gains averaged nearly 215,000 per month. These developments, combined with a housing affordability index at record-high levels, should begin to trigger faster growth of home sales. Indeed, housing construction and homebuilder confidence are rebounding, and the declines in house prices have slowed. By some measures, house prices rose modestly over the second half of 2011.

The Shadow of Rising Energy Prices

Admittedly, the risks to the outlook, while receding, still appear higher than normal. In this vein, one threat is rising energy and gasoline prices, which usually exert a drag on economic activity and raise inflation rates. As yet, though, most forecasters and financial market participants see little prospect of accelerating inflation over the near-term—despite an extremely accommodative monetary policy and large federal budget deficits. The FOMC governors and presidents expect inflation to average a little less than 2 percent in 2012.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us