New Technology May Cause Stock Volatility

The fact that the market value of firms traded in U.S. stock markets displays considerable fluctuations over short time periods is very well-known and receives a great deal of attention in the press. From the perspective of economic theory, this elevated level of short-run volatility in the stock market is very challenging to understand because fundamentals—i.e., variables that one would consider key determinants of market values, such as profits, dividends or output growth—do not fluctuate nearly as much.

Should Investors Focus on the Long Run?

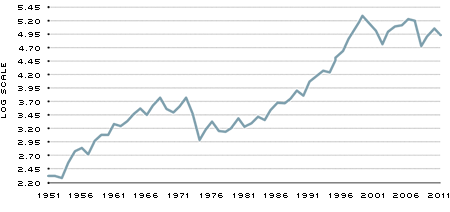

From a macroeconomic perspective, if stock market volatility were confined to short-term horizons, then it would not be of great concern because the volatility would wash out in the long run. However, the stock market displays pronounced movements that are also long-lived. The relevant data are summarized in the figure.

Market Value of U.S. Corporations

Market value of U.S. corporations in real terms and in log scale. Each decimal point on the log scale represents approximately a 10 percent change.

SOURCE: Table L213 of the Flow of Funds of the U.S. (shares at market value) divided by the GDP deflator taken from the U.S. National Income and Product Accounts.

The stock market value of all publicly traded U.S. corporations increased at a very fast pace during the 1950s. During the 1960s, it slowed down substantially. Stock market values declined by 57 percent from their peak in 1972 to 1974 and did not start growing until the 1980s. From the mid-1980s to 2000, equity values rose steadily, more than tripling. From 2000 to 2010, in spite of large year-to-year fluctuations, equity values did not display any particular trend.

The welfare implications of such strong changes in market valuations may be profound. An individual considering retirement in early 1974, for example, would have seen her stock market wealth go down by 50 percent in that year. More important, the stock market did not recover from this negative shock until well into the 1990s. Retirement prospects would look very different for somebody considering retirement in about 1990. By then, the stock market had recovered, and a twofold increase in valuations would take place during the following decade.

The Role of Technology

One of the possible explanations for the observed changes in the long-term trends in the stock market is changes in technology.1 The production structure of the U.S. economy has been transformed at its most fundamental levels during the past four decades, and these changes are reflected in asset valuations.

First, the U.S. economy slowed down substantially about the mid-1970s as productivity growth was cut in half and stagnated for the next two decades. This is the famous productivity slowdown, which might also have signaled that existing technologies and production methods could no longer continue to be the engines of growth.2 Historically, firms that are traded in the stock market tend to be well-established firms that are, therefore, more likely to use established technologies. As a result, the slowdown in productivity might have affected, in a particularly strong fashion, publicly traded firms and their market valuation.

Interestingly enough, some small, incipient sectors of the economy were experiencing a productivity boom simultaneous with the productivity slowdown of the mid-1970s.3 The 1970s, and most certainly the 1980s, signaled the beginning of the information technology (IT) revolution. Many of the major economic players of the 1990s, and even of today, were born in the middle of this revolution. However, most of the firms employing these new technologies would not go public until the late 1980s or early 1990s, and only then would stock markets start to recover.

Using Theory to Account for the Facts

To better understand how the aforementioned technological shocks might translate into stock market fluctuations, it is useful to recall some basic economic principles. A key complication behind stock market valuations is that they are forward-looking by nature. Ownership of a share of equity entitles the holder to a fraction of the stream of future dividends distributed by the firm and to the expected capital gains (or losses) that may result from selling such a share. The value of shares must, therefore, equal the expected discounted value of dividends plus expected capital gains.

Using this basic theory, think about the possible impact of the mid-1970s slowdown in existing technologies. Since the stock market had reached a period of relative stability during the 1960s, people might have thought that dividends would grow at a relatively stable rate for years to come. As a back-of-the-envelope calculation, consider a fictitious firm that pays an initial dividend distribution of $100 and that the expected dividend growth rate is 3 percent per year (which corresponds to the average growth rate of the U.S. economy during the 1960s). If the interest rate is 5 percent (the average during the relevant period), then this firm is worth $5,250.4

The productivity slowdown can be thought of as a sudden decline in the expected growth rate of the economy, from 3 percent to 1.5 percent. Let's further assume that this slowdown is perceived to be long-lasting. According to the theory, the value of the firm is now updated to $3,000.

These numbers imply that a sudden slowdown in the expected growth rate of the economy may translate into a drop in the stock market! It is important to notice that dividends do not have to fall for the stock market to fall. The perception of a slowdown in the expected growth rate of dividends is enough to generate large changes in stock market prices.

Hence, basic economic theory seems to be useful to understand the stock market crash of the mid-1970s. What about its subsequent stagnation and eventual recovery? Microsoft, Cisco, Yahoo and the like are products of the information technology revolution. But IT firms did not start trading in the stock market immediately. Indeed, data show that firms take 20 years on average to go from main initial innovation to actual listing in the stock market.5

IT-producing firms were important forces driving the recovery of the stock market of the 1990s. But to move the stock market overall, it is necessary that a large number of firms and sectors recover in value. And this is another reason for the stagnation in the 1970s. New firms have the comparative advantage in adopting new technologies, and adoption of new technologies takes time. The recovery in the stock market, therefore, was delayed because the firms and technologies that would bring growth back did not enter in full force until decades later.

Endnotes

- These ideas are explored in a fully blown general equilibrium model in Peralta-Alva. [back to text]

- See Griliches for a survey of the productivity slowdown literature. [back to text]

- Productivity decompositions by sector, with an emphasis on measuring the productivity of the information technology sector, can be found in Jorgenson. [back to text]

- The present value of a flow that starts at value X and grows at rate g discounted at rate r is (1+r)X/(r–g). [back to text]

- See Jovanovic and Rousseau. [back to text]

References

Griliches, Zvi. "Productivity Puzzles and R & D: Another Nonexplanation." Journal of Economic Perspectives, Vol. 2, No. 4, 1988, pp. 9-21.

Jorgenson, Dale W. "Information Technology and the U.S. Economy." American Economic Review, Vol. 91, No. 1, 2001, pp. 1-32.

Jovanovic, Boyan; and Rousseau, Peter L. "Why Wait? A Century of Life before IPO." American Economic Review, Vol. 91, No. 2, 2001, pp. 336-41.

Peralta-Alva, Adrian. "The Information Technology Revolution and the Puzzling Trends in Tobin's Average Q." International Economic Review, Vol. 48, No. 3, 2007, pp. 929-51.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us