A Look at Credit Default Swaps and Their Impact on the European Debt Crisis

Credit default swaps (CDS) are financial derivative contracts that are conceptually similar to insurance contracts. A CDS purchaser (the insured) pays fees to the seller (the insurer) and is compensated on the occurrence of a specified credit event. Typically, such a credit event is the default or bankruptcy of a corporate or sovereign borrower (also known as the reference entity). The difference between traditional insurance and CDS is that CDS purchasers need not have any financial stake in the reference entity. Therefore, buying a CDS can be analogous to an individual insuring his neighbor's car and getting paid if the neighbor is involved in a car accident. Just like in an insurance contract, the individual pays a periodic premium to a CDS seller in return for compensation should the credit event (accident) occur. Importantly, the individual is compensated even though he may have no financial stake in his neighbor's car.

The Origins of CDS

CDS were introduced in the mid-1990s as a means to hedge risk against a credit event. Initially, commercial banks used CDS to hedge the credit risk associated with large corporate loans. The attractiveness of a CDS contract emerges from the fact that these are made over the counter and generally adhere to the International Swaps and Derivatives Association's (ISDA) master agreement.1 As a result, they allow transacting parties to avoid regulatory requirements imposed by more-formal insurance arrangements. With the evolution of this market, CDS contracts were written on a variety of sovereign, corporate and municipal bonds, as well as on more-complex financial instruments, such as mortgage-backed securities and collateralized debt obligations. Unlike with insurance arrangements, sellers of CDS were not subject to significant regulation and were not required to hold reserves against CDS in case of default. It is widely believed that this exacerbated the recent financial crisis by allowing financial firms to sell insurance on various securities backed by residential mortgages and other assets.

How Do They Work?

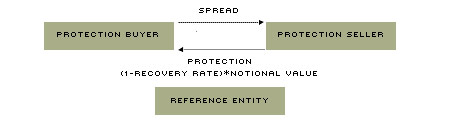

Typically, the CDS requires that the purchaser pay a spread (fee) quoted in percentage (basis points) of the amount insured. For example, the protection buyer of a CDS contract of an insured amount of $20 million and a premium of 100 basis points pays a (quarterly) premium of $50,000 to the CDS seller.2 The premiums continue until the contract expires or the credit event occurs. Higher premiums indicate a greater likelihood of the credit event.

Settlement occurs in one of two ways: physical or cash. Physical settlement requires that the buyer of the protection deliver the insured bond to the seller, who pays the buyer the face value of the loan. The occurrence of the credit event would generally imply that the asset is trading well below par. Conversely, in a cash settlement agreement, the seller of the CDS simply pays the difference between the par value and the market price of the obligation of the reference entity.3 Suppose that in our example, the recovery rate on the obligation of the reference entity is 40 percent on the occurrence of the credit event; then, the protection seller makes a one-time cash payment of $12 million to the protection buyer as shown in the diagram at the top of the next column.

CDS Spreads and the European Debt Crisis

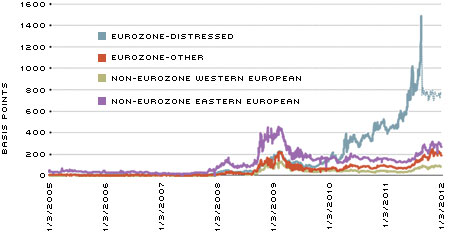

CDS spreads are an important metric of default risk—a higher spread on the CDS implies a greater risk of default by the reference entity. This feature can provide useful information as to how financial markets perceive the risk of default on corporate and sovereign debt. To illustrate this phenomenon, we study changes in the CDS spreads on the debt of European nations over the past few years. Figure 1 illustrates spreads on five-year CDS in Europe since 2005. Each series is an equally weighted index of country groupings where data are available—distressed countries in the eurozone (European Union members that use the euro as their currency), other countries in the eurozone, Western European countries that do not use the euro as currency and Eastern European countries that do not use the euro as currency.4 Prior to the crisis, CDS spreads were low for all of the reference countries, showing that investors placed low probabilities on these countries defaulting on their debts.

Five-Year Spreads on Credit Default Swaps

SOURCE: Bloomberg

NOTE: Greece data not available after September 2011, hence the dotted line and drop in spreads.

The onset of the financial crisis in 2008 raised the CDS spreads for all of the sampled groups of countries, especially for those in Eastern Europe. At the time, it was believed that Eastern European countries relied heavily on foreign capital flows to roll over their debt obligations. The Russian default in the late 1990s had made investors wary of the ability of these countries to service their debts in the face of a global downturn. In fact, many of the countries on the list solicited emergency loans from the International Monetary Fund.5

Since the crisis, it is clear that investors have become increasingly wary of the distressed eurozone countries. Their CDS spreads have continued to rise, reaching newer highs each quarter. These countries have relatively elevated debt levels, and investors have little faith in the countries' abilities to service their debt obligations. Although the CDS spread on these countries as a group was lower than that of their Eastern European peers initially, subsequent events have raised the spreads on the distressed countries' debt well beyond those for Eastern Europe.

Also notable is the fact that spreads on the nondistressed eurozone and Western European countries were initially elevated but then fell, reflecting that these countries were viewed after the crisis as fiscally sound. However, in the past few months, the fact that these spreads have continued to rise does not bode well for these countries in particular and the European region as a whole. More recently, although the spreads have receded from recent highs, investors' concerns about European debt continue to persist.

Endnotes

- This is an agreement of the participants in the market for over-the-counter derivatives. For more on this agreement, see http://www2.isda.org/ [back to text]

- Suppose the contract is for a notional amount of $20 million of Greek sovereign debt. Note that neither the protection buyer nor the seller of the CDS needs to have any exposure to Greek bonds in order to engage in this CDS contract. This is the important difference between CDS and insurance contracts. [back to text]

- The market price is often determined by an auction. See Helwege et al. for details. [back to text]

- See Table 1 for a list of the countries included in each country grouping. [back to text]

- See Oakley. [back to text]

References

Helwege, Jean; Maurer, Samuel; Sarkar, Asani; and Wang, Yuan. "Credit Default Swap

Auctions." Federal Reserve Bank of New York Staff Reports 372, May 2009.

Oakley, David. "CDS Report: European Credit Default Swaps Hit Record Wides." Financial Times Alphaville (blog), Oct. 23,2008. See http://ftalphaville.ft.com/blog/2008/10/23/17371/cds-report-european-credit-default-swaps-hit-record-wides

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us