Economic Hangover: Recovery Is Likely To Be Prolonged, Painful

The global financial crisis and the Great Recession of 2008-09 marked the end of a decade that seemed too good to be true for many Americans. After escaping the Asian financial crisis of 1997-98 relatively unscathed, the U.S. economy experienced historic booms in stock markets, housing markets and credit markets. Huge increases in households' wealth and borrowing, in turn, supported robust consumer-spending growth and housing investment despite moderate growth of income for most. To be sure, many Americans were excluded from the good times, but many broad-based measures of economic welfare—such as the unemployment rate, consumer-spending growth, access to credit and the homeownership rate—rivaled or attained their best levels ever.

This "dream world" of rising wealth and material well-being became a nightmare in 2008. The value of stocks, nonfederal bonds and houses plunged; credit became unavailable to many, while mortgage foreclosures soared; and the global economy sank into a deep recession. Meanwhile, most of an enormous increase in household debt accumulated during the free-spending decade remained in place, and government borrowing exploded.

Were the recent financial crisis and the ensuing severe recession merely "bad luck" that we might have avoided if we had, for example, cracked down on subprime mortgage lending much earlier? Or was the bursting of stock-market, housing and credit bubbles inevitable, sooner or later? The answers to these questions are important for gauging the future of the U.S. economy. If we simply were sidetracked by the financial crisis and recession, then we can expect eventually to resume many of the trends and features of the pre-2007 economy. If, on the other hand, the 1998-2007 decade itself was an anomaly, the crisis may, in fact, signal a necessary transition—albeit a painful one—to a less free-spending but more sustainable trajectory for the U.S. economy.

This article is divided into two main parts. The first takes a look back at the decade preceding the financial crisis to understand why the downturn was so severe. In retrospect, it appears that some sort of "course correction" was inevitable. The U.S. economy had become dangerously dependent on consumer borrowing and spending, which, in turn, depended to a large degree on rapidly rising house prices. At the same time, many other countries had developed their own dependence on exporting to the United States. To keep export growth high, these nations increasingly relied on a type of vendor financing—that is, they lent us the money to buy their exports. The financial crisis marked the end of this uneasy equilibrium. When house prices stopped rising, millions of American households no longer could support the debt they had taken on that allowed them to spend more than their incomes on housing, services and durable goods—a large portion of which came from overseas. The second part of the article looks forward. While it's always difficult to forecast the future, three possible scenarios for the economy are examined. Nothing about the future economy is certain, but we are likely to face a prolonged and painful period of adjustment.

Part I: The Past

A Decade of Credit-Fueled Growth in Household Spending

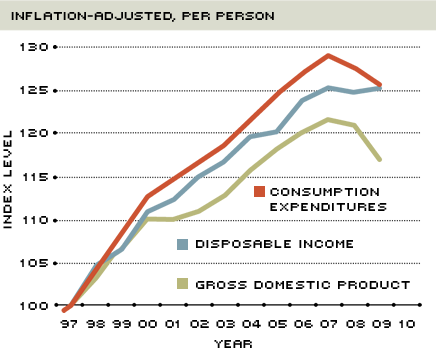

U.S. household spending grew considerably faster during the 1997-2007 decade than personal income. Figure 1 shows that per-person expenditures on goods and services grew about 29 percent in inflation-adjusted terms between 1997 and 2007, while per-person after-tax income grew only about 25 percent. Per-person inflation-adjusted gross domestic product (GDP) grew only about 22 percent.1

Spending Outpaces Income

NOTE: The average value of each series during 1997 is set equal to 100. Data are annual through 2009.

SOURCE: Bureau of Economic Analysis

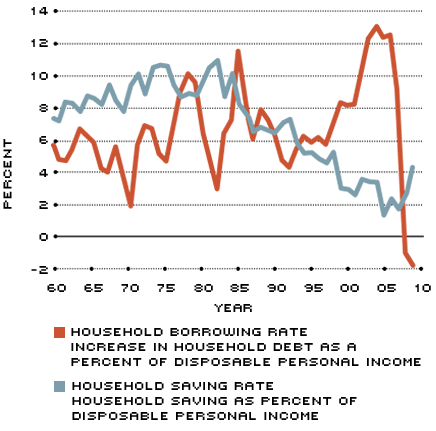

Borrowing and Saving

NOTE: Data are annual through 2009.

SOURCES: Federal Reserve Board and Bureau of Economic Analysis

The result of spending growth exceeding income growth is a falling saving rate, whether for an individual family or for the nation as a whole. Figure 2 shows that the U.S. household saving rate fell from about 5 percent during 1997-98 (already a historically low level) to about 2 percent during 2005-07. The figure also shows that the U.S. household borrowing rate—defined as the annual increase in the amount of household debt outstanding as a percent of disposable income—was very high during the decade.

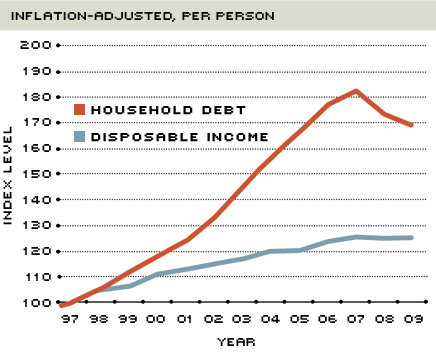

The period 1997-2007, thus, was a decade of rising household debt. Figure 3 shows the increase in household indebtedness after 1997 relative to the increase in household income. Inflation-adjusted per-person debt increased more than 80 percent between 1997 and 2007, the largest increase over a 10-year span since the 1960s. The lion's share of household borrowing during the decade was secured against owner-occupied housing—that is, in the form of mortgage debt. The amount of inflation-adjusted mortgage debt outstanding per person nearly doubled between 1997 and 2007, while the value of household real estate grew a bit less than 90 percent through 2007.

Debt and Income

NOTE: Data are annual through 2009. Average level in 1997 equals 100.

SOURCE: Federal Reserve Board and Bureau of Economic Analysis

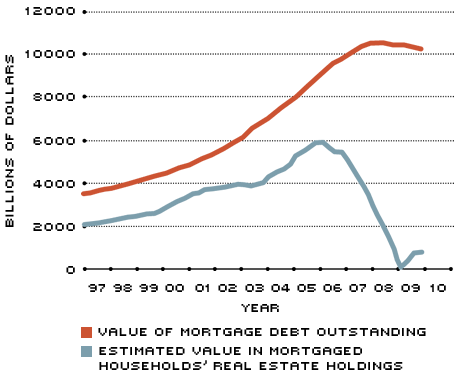

Mortgage Debt and Homeowners' Equity

NOTE: Data are quarterly through Q4.2009.

SOURCES: Federal Reserve Board and author's estimates.

Aggressive mortgage borrowing might have seemed like a good idea as long as housing and other asset values were rising. Now that housing values have declined sharply in many parts of the country, the inherent risk of leverage has been exposed. Debt magnifies both the gains and losses on the asset being financed. The 65 percent of U.S. home-owning households that have any mortgage debt together appear to have lost virtually all of their homeowners' equity between early 2006 and early 2009, almost $6 trillion (Figure 4). Compounded by rising unemployment, the loss of homeowners' equity has been a major factor driving mortgage-foreclosure rates to historic highs.2

A Growing but Unbalanced U.S. Economy

Although overall U.S. economic growth during the decade through 2007 averaged about 3 percent annually, just as it had during the previous 10 years, the composition and financing of U.S. growth were quite different across the two decades. The economy after 1997 became dominated by consumer and government spending at the expense of business investment and exports, while the domestic investment that took place was skewed toward residential building and increasingly relied on funds provided by foreign investors in the U.S.

The Composition of U.S. GDP Growth

While consumer spending accounted for about 65 percent of economic growth during the 1988-1997 decade, it constituted 82.5 percent of growth during the 1998-2007 decade (Table 1). Government spending on goods and services contributed a further 14 percent to economic growth during the later decade, compared with only 7 percent during the earlier decade. Thus, consumer and government spending together accounted for 72 percent of GDP growth during the 1988-97 decade, but 96 percent during the 1998-2007 decade.

Compared with the longer U.S. post-World War II history, the composition of GDP growth during 1998-2007 also was unusual. Consumer and government spending together constituted about 81 percent of GDP growth during the 1950-87 period, while business investment and net exports together accounted for about 11 percent. The corresponding figures of 96 and 3 percent, respectively, for the 1998-2007 period betray a significant shift toward consumer and government spending at the expense of business investment and net exports.

The Financing of U.S. Investment

Another way to look at the economy is to see how its investment is financed. Any nation has two sources of funds for investment—domestic saving and borrowing from abroad. Because the household sector is such a large part of the U.S. economy, it should come as no surprise that the declining household saving rate during the 1997-2007 decade was echoed by a shift toward foreign borrowing by the nation as a whole. As shown in Table 1, the U.S. trade deficit increased sharply after 1997. This implies, as a matter of accounting, that the U.S. greatly increased its borrowing from foreigners. U.S. net borrowing from abroad exceeded 4 percent of GDP each year from 2000 through 2008 (with the exception of 2001, at 3.9 percent), a level not previously exceeded since the early part of the 20th century.

Composition of U.S. GDP Growth

| Average annual real GDP growth (% change from previous year) | Contribution of personal consumption expenditures (PCE; % of GDP growth) | Contribution of government spending (G; % of GDP growth) | |

|---|---|---|---|

| 1950-1987 | 3.72 | 63.4 | 18.8 |

| 1988-1997 | 3.05 | 64.9 | 7.4 |

| 1998-2007 | 3.02 | 82.5 | 13.9 |

| Sum of contributions of PCE and G (% of GDP growth) | Contribution of business investment (I; % of GDP growth) | Contribution of net exports (NX; % of GDP growth | Sum of contributions of I and NX (% of GDP growth) | |

|---|---|---|---|---|

| 1950-1987 | 81.2 | 13.0 | –2.1 | 10.9 |

| 1988-1997 | 72.3 | 20.1 | 3.3 | 23.4 |

| 1998-2007 | 96.4 | 18.1 | –15.5 | 2.6 |

SOURCE: Bureau of Economic Analysis

Is Unbalanced Growth Better than No Growth at All?

While the trends just described were visible at the time, many commentators dismissed them as harmless or, indeed, beneficial aspects of an increasingly globalized world economy. Their argument was seductively simple: Just as individuals and nations specialize in activities they do best and trade with others to increase the welfare of all, perhaps the globalization of goods, services and capital markets would allow the United States to concentrate on what it did best and then trade with others that specialized differently.

The obvious flaw in this argument is that what the U.S. appeared to do best on a large scale—consumer spending, homebuilding, borrowing and the provision of sophisticated financial services, such as mortgage securitization—did not result in a stable, let alone balanced, international trade position or a stable saving rate. In fact, the U.S. trade deficit—more precisely, the current-account deficit—doubled as a percent of GDP between 1997 and 1999, then nearly doubled again by 2006. Had this trend continued, financing our burgeoning trade deficit would have become increasingly difficult. At the same time, the household (and national) saving rate was falling persistently—which it could not do forever. It now appears that, by 1997 or 1998 at the latest, the U.S. economy had embarked on a path of unbalanced growth. Sooner or later, a major course correction was inevitable.

As it turned out, some of the rebalancing had begun before the financial crisis and recession hit. In particular, house prices stopped rising in about 2006. Increasing numbers of households defaulted on their unsupportable debts, a fate merely postponed by rising house prices during the preceding years. As mortgage defaults and market-value losses on mortgage-backed securities rippled through the financial system, the economy itself began to slow sharply. The severe financial and economic shocks of 2008 and 2009 were the ultimate result and have accelerated the reversal of the trends in place for a decade.

Global Imbalances—Part of the Solution or the Problem?

Just as the U.S. economy evolved in an unbalanced and historically unusual way after the Asian crisis of 1997-98, unusual international developments were taking place. Average rates of U.S. and world economic growth were healthy during the 1997-2007 decade, but individual economies diverged markedly in how they grew. Consumer spending, housing investment and government spending took on increasing importance in the United States and in some other high-income countries like the United Kingdom, while business investment and exports lagged. At the same time, many other countries—including both high-income and developing countries—were virtual mirror images of the U.S., increasing business investment and exports faster than consumer or government spending. The U.S. personal and national saving rates declined to historic lows, while these "mirror-image" countries experienced sharply higher saving rates.

To secure a more even pattern of investment around the world, the countries with a surplus of savings together lent hundreds of billions of dollars each year to the countries generating insufficient domestic savings to fund desired investment. By accounting necessity, these growing international capital flows were associated with offsetting imbalances in the trade accounts of the respective countries.

Countries in the first group incurred increasing deficits on their international current accounts, while countries in the second group accumulated large surpluses. The deficit countries—including the U.S., the U.K., Spain and a few others—had in common relatively sophisticated financial systems and relaxed attitudes toward borrowing. Surplus countries—including China, a number of other emerging-market countries, Japan, Germany and several oil-exporting countries—typically had less well-developed financial sectors and a less borrower-friendly climate. Some surplus countries also appeared to follow an "export-led growth strategy," defined by the International Monetary Fund (IMF) to include an undervalued exchange rate together with measures to compress domestic spending.3 The result of these policies was to increase the country's trade surplus and, at the same time, increase its financial-account deficit (lending abroad). The emergence of large global imbalances during the decade after the Asian crisis has been studied in great detail, while their interpretation remains open to debate.4

Part II: The Future

The Uncertain Outlook

Given the large role of household spending on goods, services and housing in the American and, indeed, the global economy during recent years, newly frugal consumers are likely to keep economic growth rates subdued for some time. In view of American households' historically high debt burden and the potential for negative feedback effects on income growth itself, a protracted, years-long period of painful adjustment appears likely.

Is there any escape from this scenario of growth-inhibiting household deleveraging? Perhaps, but it will require significant changes in consumer behavior and national economic policies. In broad outline, American consumers must durably raise their saving rates and the federal government must come much closer to balancing its budget on a consistent basis even in the face of looming deficits of unprecedented size. Other countries must stimulate domestic spending and reduce their large trade surpluses, which result in large capital exports to the United States and other countries.

The IMF and other analysts have outlined a number of scenarios for the world economy during the next few years.5 The possibilities range from very good—an internationally coordinated restructuring of key economies—to very bad—a retreat into short-sighted, protectionist policies leading to a renewed global economic slump. Which outcome ultimately occurs depends on how private and public actors behave during the next few, critical months and years. Here are three broad scenarios, together with the policy actions that would make them possible.

Scenario 1: Global Cooperation To Rebalance World Output and Demand

The most optimistic scenario entails widespread, simultaneous efforts by the leaders and ordinary citizens of many countries to refocus their economies on sustainable domestic production and consumption. In this context, sustainability refers to patterns of work, investment and spending that do not rely on persistent, large international transfers of economic and financial resources. Drawing an analogy to an individual household, the basic idea is that "profligate" consumers should plan to spend within their means without frequent recourse to borrowing, while "miserly" households should avoid accumulating excessive savings that are lent to others. At the national level, it implies that international trade and financial balances should not be far from zero in either direction over long periods of time.

Unfortunately, the U.S. has incurred very large trade deficits and corresponding financial surpluses (capital imports) for decades. Moreover, the imbalances grew sharply during the 1997-2007 decade. This pattern of increasingly unsustainable economic growth was an important contributor to the global economic and financial crisis that occurred because, ultimately, millions of American households buckled under excessive burdens of unsupported debt when house prices declined.

At the same time that many American households were digging themselves deeper into debt, there were offsetting imbalances building up in other countries. Given the interdependent nature of international trade and capital flows, it clearly would be best if coordinated behavior and policy changes could be undertaken in many or all of the affected countries.

A benign global rebalancing would see deficit countries, such as the United States, increase saving by households and the federal government, while increasing business investment and exports. At the same time, surplus countries such as China would expand social safety nets (to decrease households' need to save), improve corporate governance (to decrease hoarding of cash and wasteful overinvestment), and encourage consumer spending and imports. Other groups of surplus countries also could contribute meaningfully to global rebalancing. For example, oil-exporting countries could delink oil prices from the dollar, and the aging economies of Europe and Japan could take actions to raise their domestic growth potential.6

This benign-rebalancing scenario probably would be associated with weaker currency values in deficit countries and stronger currencies in surplus countries. Orderly exchange-rate changes can moderate the domestic adjustments needed in wages and prices to support changing trade patterns.

Scenario 2: Lack of Coordinated Policy Adjustments—Global Imbalances Return

Less-benign outcomes are possible, of course. Continued reliance on export-led

growth strategies in major emerging markets and some large, advanced countries could frustrate attempts by the U.S. to shift its economy away from excessive consumer and government borrowing and spending and toward business investment and exports. Conversely, our trading partners could take positive steps that our own indifference or policy gridlock negated.

Suppose the U.S. unilaterally made a number of politically difficult policy choices that would support economic restructuring and global rebalancing. These might include reducing tax incentives that favor excessive housing investment, mortgage borrowing and health-care expenditures, as well as implementing a broad-based consumption tax designed to encourage saving over consumer spending. But if our trading partners did not simultaneously increase their willingness and ability to buy our exports, the result could be disastrous. A very weak U.S. economy could be crippled by an even more depressed housing market and a shrinking health-care sector, while export sectors showed negligible improvement over their growth baselines. The political response likely would be to reverse the reforms and expand bailout efforts. A return to low household and national saving, unbalanced domestic growth and global imbalances probably would follow.

Scenario 3: No Policy Adjustments and Premature Withdrawal of Macroeconomic Support—Global Slump Returns

A third possibility is that no progress toward economic restructuring of any kind is made, while policymakers in the United States and elsewhere misjudge the strength of economic recovery. If government policies that have resulted in large budget deficits and near-zero short-term interest rates—which probably kept the global economy out of a depression—are reversed abruptly and if private-sector spending slows unexpectedly, economies around the world could fall back into a slump as bad as or worse than the downturn experienced during 2008 and 2009. Under these circumstances of a "double-dip" global recession, renewed policy interventions might need to be even more drastic than during the first downturn. Further long-lasting economic damage in the form of long-term unemployment and financial defaults would occur.

Conclusion

Paying the Piper

With the benefit of hindsight, one can say we should have seen the financial crisis coming. Although some analysts pointed to unbalanced U.S. economic growth and growing global financial imbalances, few anticipated how rapid, severe and global the downturn would turn out to be.

Americans almost certainly will save more, spend in closer proportion to their income and increase their borrowing more slowly, or decrease it outright in the coming

years. Said differently, a protracted period of household "deleveraging" appears likely. This will translate into relatively slow consumer spending and overall economic growth unless other sources of demand materialize. If economic growth remains weak, it will mean that house prices remain subdued, mortgage defaults remain high due to frequent instances of negative home-owners' equity and the average American household's financial situation improves only slowly.

One bitter lesson we have learned is that unbalanced growth, whether in one country or around the world, brings risks in its wake. Unless we are able to rebalance our own economy and, in cooperation with other major countries, do the same at the global level, we are likely to face a long period of slow and volatile economic recovery.

Endnotes

- Data from Bureau of Economic Analysis. An important reason why household after-tax

income grew faster than GDP was that tax rates were reduced in the early 2000s. Thus, part of the growth in disposable household income during the decade represented a redistribution of national income, rather than genuine increases in output. [back to text] - See Emmons. The aggregate value of home-owners' equity conceals a wide variety of individual situations. Many homeowners with mortgage debt have positive equity, while many others have negative equity. It is those with negative equity who are at greatest risk of default. [back to text]

- See Blanchard and Milesi-Ferretti. [back to text]

- See Bernanke and Blanchard and Milesi-Ferretti. [back to text]

- See Blanchard and Milesi-Ferretti. [back to text]

- Delinking oil prices from the dollar might divert some capital exports from oil exporting-nations into non-U.S. markets, resulting in less upward pressure on the dollar. Meanwhile, deregulating labor markets and service sectors in the aging nations of Europe and Japan could raise domestic growth potential and reduce trade surpluses. [back to text]

References

Bernanke. Ben S. "The Global Saving Glut and the Current Account Deficit." Homer Jones Lecture at the Federal Reserve Bank of St. Louis, April 14, 2005. See www.federalreserve.gov/boarddocs/speeches/2005/20050414/default.htm

Blanchard, Olivier; and Milesi-Ferretti, Gian-Maria. "Global Imbalances: In Midstream?" IMF Staff Position Note, Dec. 22, 2009, SPN/09/29.

Bucks, Brian K.; Kennickell, Arthur B.; Mach, Traci L.; and Moore, Kevin B. "Changes in U.S. Family Finances From 2004 to 2007: Evidence From the Survey of Consumer Finances." Federal Reserve Bulletin, February 2009, Vol. 95, No. 1, pp. A1-A55.

Emmons, William R. "Housing's Great Fall: Putting Household Balance Sheets Together Again." Federal Reserve Bank of St. Louis' The Regional Economist, October 2009, Vol. 17, No. 4, pp. 14-15.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us