Corporate Social Responsibility Can Be Profitable

Corporate social responsibility (CSR) is a doctrine that promotes expanded social stewardship by businesses and organizations. CSR suggests that corporations embrace responsibilities toward a broader group of stakeholders (customers, employees and the community at large) in addition to their customary financial obligations to stockholders. A few examples of CSR include charitable giving to community programs, commitment to environmental sustainability projects, and efforts to nurture a diverse and safe workplace.1

As more attention is being paid by outsiders to the social impact of businesses, corporations have acknowledged the need for transparency regarding their social efforts. In a recent survey, 74 percent of the top 100 U.S. companies by revenue published CSR reports last year, up from 37 percent in 2005. Globally, 80 percent of the world’s 250 largest companies issued CSR reports last year.2

Is CSR Socially Desirable?

Despite the apparent acceptance of CSR by businesses, many economists have taken a skeptical view of CSR and its viability in a competitive environment. Milton Friedman, in particular, doubted that CSR was socially desirable at all. He maintained that the only social responsibility of a business is to maximize profits (conducting business in open and free competition without fraud or deception).3 He argued that the corporate executive is the agent of the owners of the firm and said that any action by the executive toward a general social purpose amounts to spending someone else’s money, be it reducing returns to the stockholders, increasing the price to consumers or lowering the wages of some employees. Friedman pointed out that the stockholders, the customers or the employees could separately spend their own money on social activities if they wished to do so.

Friedman, however, also noted that there are many circumstances in which a firm’s manager may engage in actions that serve the long-run interest of the firms’ owners and that also have indirectly a positive social impact. Examples are: investments in the community that can improve the quality of potential employees, or contributions to charitable organizations to take advantage of tax deductions. Such actions are justified in terms of the firm’s self-interest, but they happen to generate corporate goodwill as a byproduct. Furthermore, this goodwill can serve to differentiate a company from its competitors, providing an opportunity to generate additional economic profits.

Friedman’s argument provoked economists to explore the conditions under which CSR can be economically justified. Economists Bryan Husted and José de Jesus Salazar, for example, recently examined an environment where it is possible for investment in CSR to be integrated into the operations of a profit-maximizing firm. The authors considered three types of motivation that firms consider before investing in social activities:

- altruistic, where the firm’s objective is to produce a desired level of CSR with no regard for maximizing its social profits, i.e., the net private benefits captured by the firm as a consequence of its involvement in social activities;

- egoistic, where the firm is coerced into CSR by outside entities scrutinizing its social impact; and

- strategic, where the firm identifies social activities that consumers, employees or investors value and integrates those activities into its profit-maximizing objectives.

In agreement with Friedman, Husted and Salazar conclude that the potential benefits to both the firm and society are greater in the strategic case: when the firm’s “socially responsible activities” are aligned with the firm’s self-interest.

Strategic CSR

Similarly, economists Donald Siegel and Donald Vitaliano examined the theory that firms strategically engage in profit-maximizing CSR. Their analysis highlights the specific attributes of business and types of CSR activities that make it more likely that “socially responsible” actions actually contribute to profit maximization. They conclude that high-profile CSR activities (e.g., voluntary efforts to reduce pollution or to improve working conditions for employees) are more likely undertaken when such activities can be more easily integrated into a firm’s differentiation strategy.

Siegel and Vitaliano studied a large sample of publicly traded firms and classified them using the North American Industry Classification System codes into five categories. The five categories were:

- search goods, whose quality can be readily evaluated before purchase, e.g., clothing, footwear and furniture;

- nondurable experience goods, whose quality is experienced over multiple uses and frequent purchases, e.g., food, health and beauty products;

- durable experience goods, which must be consumed before their true value can be determined, permit less learning from repeated purchases and require a longer period for the product’s characteristics to be fully known, e.g., automobiles and appliances; and finally

- experience services and credence services, which often involve strong information asymmetries between sellers and buyers, who may find it difficult to assess the service’s value even over a long period, e.g., banking, financial counseling, auto repairs and weight-loss programs.

Siegel and Vitaliano found, using an aggregate measure of CSR involvement, that firms selling experience goods and experience and credence services are more likely to engage in CSR than those selling search goods. The difference in the intensity of CSR involvement across types of goods, they argued, is explained by the consumers’ perception of a firm’s involvement in CSR (even when the firm’s product does not directly include a social component) as a valuable signal of the firm’s reliability and its commitment to quality and honesty.

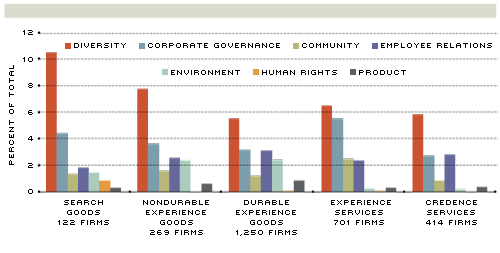

Using the same classification of firms as Siegel and Vitaliano did, the accompanying chart shows the proportion of firms in each classification that demonstrated relative strength in seven different social issues related to CSR as rated in 2007 by Kinder, Lyndenberg and Domini (KLD), an independent research firm that rates the social performance of corporations.4 The chart reveals that the level of relative strength in the seven individual areas of CSR rated by KLD varies among the five classifications of firms.5 In other words, firms choose to invest in different types of CSR when catering to different groups of stakeholders.

A greater proportion of goods-producing firms showed strength in the environment issue areas. This result is perhaps not surprising. Stakeholders in service firms are not likely to value CSR efforts related to the environment, since services probably have lower perceived environmental impact than manufacturing firms do.

In the community issue area—where strengths include giving programs, volunteer programs and support for local organizations—firms providing experience services performed quite well. Devoting resources to CSR activities in community relations can bolster reputation, on which firms that are classified in the experience services category typically rely as a form of brand differentiation. Banks, which constitute a large portion of the firms in the experience services category, can also excel in this area of CSR by committing a portion of their commercial loan portfolio to community development initiatives.

In the human rights issue area, the five categories of businesses have few, if any, firms that demonstrated relative strength. The only category with a sizeable proportion of firms was the search goods category. This is also understandable, as firms in this category face higher pressures from activists concerned about the working conditions of unskilled labor employed (usually in developing countries) in the production process.

Being Responsible … and Profitable

Modern theoretical and empirical analyses indicate that firms can strategically engage in socially responsible activities to increase private profits. Given that the firm’s stakeholders may value the firm’s social efforts, the firm can obtain additional benefits from these activities, including: enhancing the firm’s reputation and the ability to generate profits by differentiating its product, the ability to attract more highly qualified personnel or the ability to extract a premium for its products.

Figure 1

Proportion of the 3,000 Largest Publicly Traded U.S. Firms Demonstrating Strength in Social Issue Areas

SOURCE: KLD STATS 2008

Endnotes

- See General Mills Inc. for detailed examples of corporate CSR efforts. [back to text]

- See KPMG. [back to text]

- See Friedman (1962, 1970). [back to text]

- A firm is considered to have a relative strength in an issue area when the fraction of strengths identified divided by the number of strengths considered exceeds the fraction of areas of concern identified divided by the number of concerns considered. [back to text]

- The ratings in the seven social issue areas are provided by Kinder, Lyndenberg and Domini (KLD) from the 2008 KLD STATS database. KLD rates the largest 3,000 publicly traded U.S. companies in several categories of strengths and concerns in each issue area. The classification of firms by product or service provided used a listing of primary industry (NAICS) codes provided by the Center for Research in Security Prices (CRSP) database. Since some firms received no ratings from KLD or did not have a primary NAICS code listed in the CRSP database, the total number of firms considered is slightly fewer than 3,000. [back to text]

References

Friedman, Milton. Capitalism and Freedom. Chicago: University of Chicago Press, 1962.

Friedman, Milton. “The Social Responsibility of Business Is To Increase Its Profits,” The New York Times Magazine, Sept. 13, 1970, No. 33, pp. 122-26.

General Mills Inc. Corporate Social Responsibility Report, 2008.

Husted, Bryan W.; and Salazar, José de Jesus. “Taking Friedman Seriously: Maximizing Profits and Social Performance.” Journal of Management Studies, January 2006, Vol. 43, No. 1, pp. 75-91.

KPMG, International Survey of Corporate Responsibility Reporting of 2008, October 2008.

Siegel, Donald S.; and Vitaliano, Donald F. “An Empirical Analysis of the Strategic Use of Corporate Social Responsibility.” Journal of Economics and Management Strategy, Fall 2007, Vol. 16, No. 3, pp. 773-92.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us