District Overview: Rock Solid in Little Rock?

Compared with some other parts of Arkansas, employment in the Little Rock-North Little Rock metro area has been slow to recover from the 2001 national recession.1 For example, from March 2001 through December 2005 (more than four years after the recession officially ended), private nonfarm payroll employment in the Little Rock area increased by 1.2 percent, compared with 17 percent in the Fayetteville-Springdale-Rogers metro area, in northwestern Arkansas. After returning to pre-recession levels in June 2004, there has been virtually no change in Little Rock's employment. Yet there are reasons to be optimistic about Arkansas' capital: above-average income growth and modest population growth.

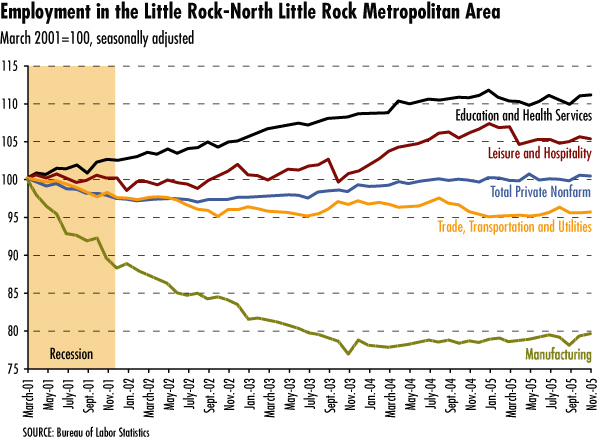

Reflecting its role as a regional center serving a large and mostly rural hinterland, Little Rock has a diverse industry mix that emphasizes health care, construction and transportation. An important economic engine for Little Rock is the education and health services sector, which accounts for 16 percent of the regional economy. As shown in the figure, this sector has outperformed others, growing by 11 percent since the beginning of the 2001 recession. However, job growth was offset by weaknesses in the trade, transportation and utilities (TTU) sector, which since March 2001 has declined by 5 percent, an equivalent of 1,200 jobs. Given the relative importance of TTU in the regional economy (more than a quarter of the region's labor force), it is not surprising that total employment growth has been stagnant.

Meanwhile, manufacturing in Little Rock stabilized during 2004 and 2005 after a long period of steady job losses (more than 20 percent since March 2001). The impact of declining manufacturing on the Little Rock economy is mitigated since the sector accounts for only 10 percent of employment, compared with 17 percent for Arkansas as a whole. The down side, however, is the loss of high-technology employment in industries such as aerospace manufacturing; this loss may have detrimental impacts on the region's future.

Other sectors such as construction and leisure and hospitality have enjoyed steady, though not stellar, growth in recent years.2 From March 2001 through December 2005, the natural resources, mining and construction sector grew by 1.2 percent and the leisure and hospitality sector by 4.8 percent. Despite some signs that the housing market is cooling in other parts of the United States, residential construction showed no sign of slowing during 2005 in Little Rock. This may be partly due to the emerging wave of housing in downtown in response to local revitalization efforts. In addition, the November 2004 opening of the Clinton Presidential Library in downtown Little Rock should not be discounted as a positive economic force; it is likely associated with increased nonresidential construction, as well as job creation in the leisure and hospitality sectors as tourists drive and fly to Little Rock.

Although Little Rock's overall job growth has lagged behind that in other parts of Arkansas in the past few years, its unemployment rate of 4.5 percent (12-month average for 2005) is below the average for the state (5 percent) and the country (5 percent). In addition, per capita income has been growing faster than the national average. For example, during 2000-2003, nominal per capita income for Little Rock increased by 11 percent compared with 5.5 percent nationally. After adjusting for inflation, Little Rock per capita income increased by 3.9 percent while U.S. per capita income actually declined.3 This may suggest that local productivity growth is running at a faster pace in Little Rock than for the nation as a whole.

Further, Little Rock has experienced slow population growth compared with booming northwestern Arkansas. For example, the population in Pulaski County, where the city of Little Rock lies, increased by 1.2 percent between 2000 and 2004, while Fayetteville County, the core county of the Fayetteville-Springdale-Rogers metro area, grew by more than 10 percent.4 However, one recent Brookings Institution study ranked Little Rock the No. 12 "Wealth Builder" among the 100 largest metropolitan areas. 5 (A "Wealth Builder" is defined as a region that can raise incomes without fast population growth.)

Endnotes

- The Little Rock-North Little Rock metropolitan area, referred to as simply Little Rock elsewhere in this article, includes Faulkner, Grant, Lonoke, Perry, Pulaski and Saline counties, all in the state of Arkansas. [back to text]

- The leisure and hospitality sector is made up of the arts, entertainment and recreation sector and the accommodation and food services sector. [back to text]

- "2005 Economic Review and Outlook," December 2005. See www.metroplan.org/datacenter/Econ2005.pdf. [back to text]

- "2005 Demographic Review and Outlook," June 2005. See www.metroplan.org/datacenter/2005DemR&O.pdf. [back to text]

- "Growth Without Growth: An Alternative Economic Development Goal for Metropolitan Areas," by Paul Gottlieb, February 2002. See www.brookings.edu/metro/publications/gottliebexsum.htm. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us