Consumer Confidence Surveys: Do They Boost Forecasters' Confidence?

Every month, the two primary measures of U.S. consumer confidence, the University of Michigan’s Index of Consumer Sentiment and the Conference Board’s Consumer Confidence Index, are released with much media fanfare. The attention these indexes receive often centers on the potential information they contain regarding current and future economic conditions. That is, changes in the indexes are often described as foreshadowing changes in economic conditions more broadly. This article discusses what these indexes measure and why they receive so much attention, and also investigates whether the facts justify the interest.

What Is Consumer Confidence and How Is It Measured?

Consumer confidence is a catch-all phrase for the opinions and attitudes of consumers about the current and future strength of the economy. A psychological concept, consumer confidence is difficult to measure. The University of Michigan and Conference Board both measure consumer confidence by asking a random sample of consumers five questions about current economic conditions and expected future conditions (see below). Consumers also are asked to assess their personal financial situation.

After the surveys are conducted, the responses are aggregated into a single number, called an “index” of consumer confidence. Variation in this index is meant to measure variation in overall consumer confidence.

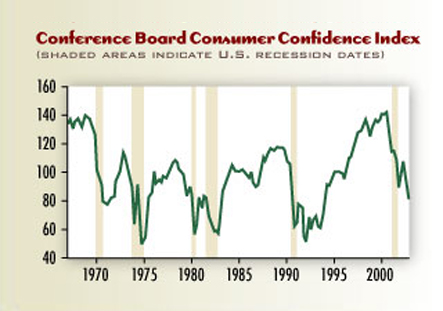

The figure shows the Conference Board’s Consumer Confidence Index along with shading that indicates the time periods during which the U.S. economy was in recession.1 Two things are of interest from the figure. First, consumer confidence appears to be correlated with the strength of the economy at the time of the survey. In particular, when the economy goes into a recession, consumer confidence generally falls sharply; and when the economy is in an expansion, consumer confidence is generally at high levels. Second, consumer confidence often peaks before the economy enters a recession. That is, variation in consumer confidence appears to be followed by similar variation in the overall economy.

Why Does Consumer Confidence Receive So Much Attention?

A primary reason why people pay attention to consumer confidence indexes is because they are thought to provide an early signal regarding the strength of the broad economy. There are at least two reasons why this might be the case. First, as is suggested by the figure, consumer confidence is correlated with current economic conditions. This might be because consumers accurately portray current economic conditions with their answers to the survey questions. It might also be if the way consumers feel about the economy and their personal financial situation affects their willingness to spend. Here, consumer confidence would be a causal force for the economy.

In any case, if consumer confidence indexes accurately reflect current economic conditions, they would provide an early indication of how the economy was performing simply because they are released very quickly; in most instances, far before other data measuring the strength of the economy. For example, the consumer confidence indexes for a given month are generally released toward the end of that month. By contrast, the personal consumption expenditure report, which measures what consumers actually did that month, is not available until the end of the following month. Thus, because consumer confidence is timely, it could be a useful early indicator of the economy’s performance.

The second reason why consumer confidence might provide useful early information is if consumers’ responses to the survey questions provide good forecasts of future economic activity. This would occur if consumer confidence has a causal influence on economic activity, but this influence takes several months before it is fully realized. It might also be that consumers are good at forecasting the economy. Consumer confidence serves as a convenient summary of the forecasts of many individuals based on a variety of different information. To the extent that these forecasts are useful for predicting economic activity, indexes of consumer confidence will be an important leading indicator of the economy’s strength.

Is the Infatuation Justified?

There are many research studies that attempt to determine if consumer confidence is a useful early signal of economic activity. Much of this research has investigated the relationship between consumer confidence and consumption spending, as this is the type of economic activity that one would think is most closely connected to consumer confidence.

What does this research conclude about whether consumer confidence is correlated with current economic conditions, providing an early indication of the economy’s strength because it is quickly available? Economist Phillip Howrey of the University of Michigan investigated this question. He tested whether predictions of current period consumption growth can be improved upon by using results from the Michigan confidence index from that period. For example, can the consumer confidence data for January, released at the end of the month, improve one’s guess about the strength of consumer expenditures in that same month? If so, this would give us an early signal regarding consumer expenditures in January, data for which is not released until the end of February. Howrey concluded that the Michigan index does provide some useful information for predicting the value of consumption growth. However, this improvement is generally very small.

What about the possibility that consumer confidence might predict future economic activity? Christopher Carroll, Jeffrey Fuhrer and David Wilcox investigated this in a 1994 article. These authors tested whether the value of the University of Michigan index from a month, say, January, was able to improve projections of February’s consumption growth. Carroll, Fuhrer and Wilcox concluded that when consumer confidence is used as the only variable, it can significantly improve these forecasts. However, they also showed that once other widely available data are taken into consideration, consumer confidence makes only a small improvement for forecasting purposes. That is, consumer confidence does not appear to have much additional, useful information beyond that contained in other common forecasting data.

Super-Powerful Data?

The research discussed above suggests that today’s consumer confidence does give a meaningful clue as to the economy’s strength, both in the present and the future. Thus, if an economic forecaster were trapped on a desert island with only data on consumer confidence, use of the consumer confidence measures to educate her guess about the economy’s strength more broadly would not be a bad idea. However, consumer confidence is not data with “super-forecasting” powers. Indeed, the ability of consumer confidence to improve forecasts of the economy is modest at best, especially when considered jointly with other forecasting information.

Endnotes

- The National Bureau of Economic Research, which is the official arbiter of business cycle dates, has not yet announced the end date of the recession that began in March 2001. The graph assumes that this recession ended in December 2001. [back to text]

- Source: University of Michigan Surveys of Consumers, www.sca.isr.umich.edu/main.php. [back to text]

References

Howrey, E. P. “The Predictive Power of the Index of Consumer Sentiment.” Brookings Papers on Economic Activity, 2001, 0, pp. 175-207.

Carroll, C.D.; Fuhrer, J.C.; and Wilcox, D.W. “Does Consumer Sentiment Forecast Household Spending? If So, Why?” American Economic Review, 1994, 84, pp. 1397-408.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us